How a Collaborative Order-to-Cash Process Eliminates Cash Flow Bottlenecks

- 11 min read

For a potent and efficient order-to-cash process, you need collaboration between all parties and during all stages—but especially within accounts receivable.

This blog explores some common root causes behind order-to-cash inefficiencies, how you can resolve those issues, and how you can ultimately (and sustainably) boost your profits.

Well-oiled order-to-cash processes (also called the O2C or OTC process) are central to a business’ ability to compete successfully. Why? Because numerous elements within the order-to-cash process have critical implications for your company's cash inflows and working capital structure. Even small efficiency gains in this process can have an outsized impact. (Likewise, lackluster processes that result in efficiency losses have equally outsized impacts, albethey negative.)

McKinsey and Company offers such an example. An industrial manufacturer discovered that inefficiencies in its O2C process, specifically granting excessive credit memos due to weak validation controls, amounted to revenues losses of three and five percent of Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA.)

There’s a good chance your O2C process lacks potency and efficacy, resulting in hidden credit management issues and inadequately satisfied customers. This article explores some common root causes behind order-to-cash inefficiencies, how you can resolve those issues, and how you can ultimately (and sustainably) boost your profits.

Jump to a section:

What is the order-to-cash process?

The order-to-cash process encompasses all customer-facing and internal workflows from the moment the customer places an order to when you record cash from that order in your books.

Here are a few business functions (and their primary responsibilities) involved in the order-to-cash cycle:

- Order management (OM): Ensures goods are available and arrive on time.

- Sales: Negotiates pricing and credit terms

- Accounts receivable (AR): Collects payments and handles order disputes.

- Accounting: Records cash in your company's books.

- Inventory management: Monitors inventory levels and communicates them to OM.

- Reporting and data management: Monitors trends and proposes improvements to the O2C process.

Why is the order-to-cash process important?

Having a well-optimized order-to-cash process is important for your organization because:

- It is central to accelerating collection times. You can collect cash faster when your teams communicate coherently with your customers, giving them a great experience and eliminating potential disputes.

- It helps you boost net margins. Increase efficiency at every stage of the process, and your net margins will rise thanks to the compounded cost savings.

- It is critical to building healthy customer relationships. An efficient O2C cycle helps you deliver products quickly, minimize customer disputes, and deliver a great customer experience.

The 8 steps in the order-to-cash process

Here are the order-to-cash process steps along with the teams that will execute each step:

Step 1. Receive your customer’s order

Your OM team receives an order, notifies sales, and enters order details on your order management system.

Step 2. Check your customer’s credit

Your OM team checks whether the customer qualifies for credit if they are not paying up front.

Step 3. Check your inventory

Your order fulfillment team checks whether goods are present in quantities requested.

Step 4. Ship goods to your customer

Your order fulfillment team coordinates with logistics partners to deliver goods to the customer. This team also updates your customer relationship management (CRM) and enterprise resource planning (ERP) systems with the relevant order and tracking information.

Step 5. Invoice your customer

Your order fulfillment team collaborates with accounts receivable to create invoices and deliver them per your customer's preferred method, whether through their dedicated accounts payable portal or via alternative channels—such as email, EDI, or customer portal.

Step 6. Collect cash from your customer

Your AR team monitors payment due dates, sends reminders, and collects cash. They also handle disputes that might arise by involving sales and OM teams in the process.

Step 7. Apply cash to your books

Your AR team recognizes the revenue for the payments you've received by applying them to the correct invoices and updating the accounts receivable ledger. This step concludes the O2C process.

Step 8. Analyze process data

Your OM, order fulfillment, AR, and sales teams review order-to-cash process data to pinpoint any gaps that cause revenue loss. You can improve your process efficiency using the insights they gather.

4 common bottlenecks in the O2C process

Here are 4 common order-to-cash process issues that affect your cash cycle.

1. Your AR team sends invoices with incorrect order details

Mismatches between invoice and customer orders are a common AR mistake due to a lack of cohesion between OM and AR systems caused by manual processes. For instance, an invoice might detail incorrect order quantities or prices.

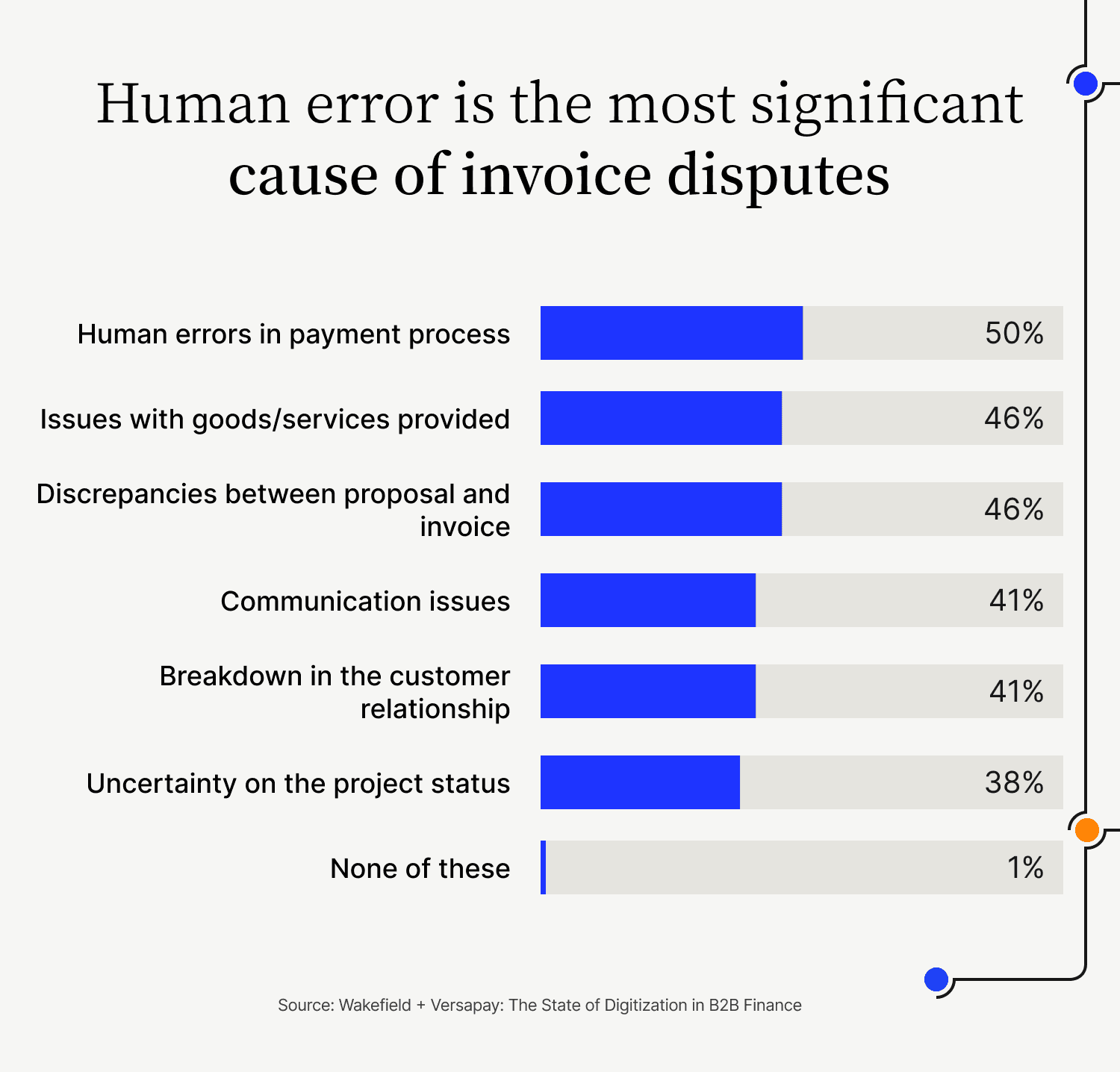

Versapay, in collaboration with Wakefield Research, discovered that human errors in the payment process account for half of all invoice disputes.

These highly avoidable errors increase customer disputes and lengthen your O2C process. The result is delayed cash application times and longer DSO.

2. Your teams don’t use O2C automation to execute routine tasks

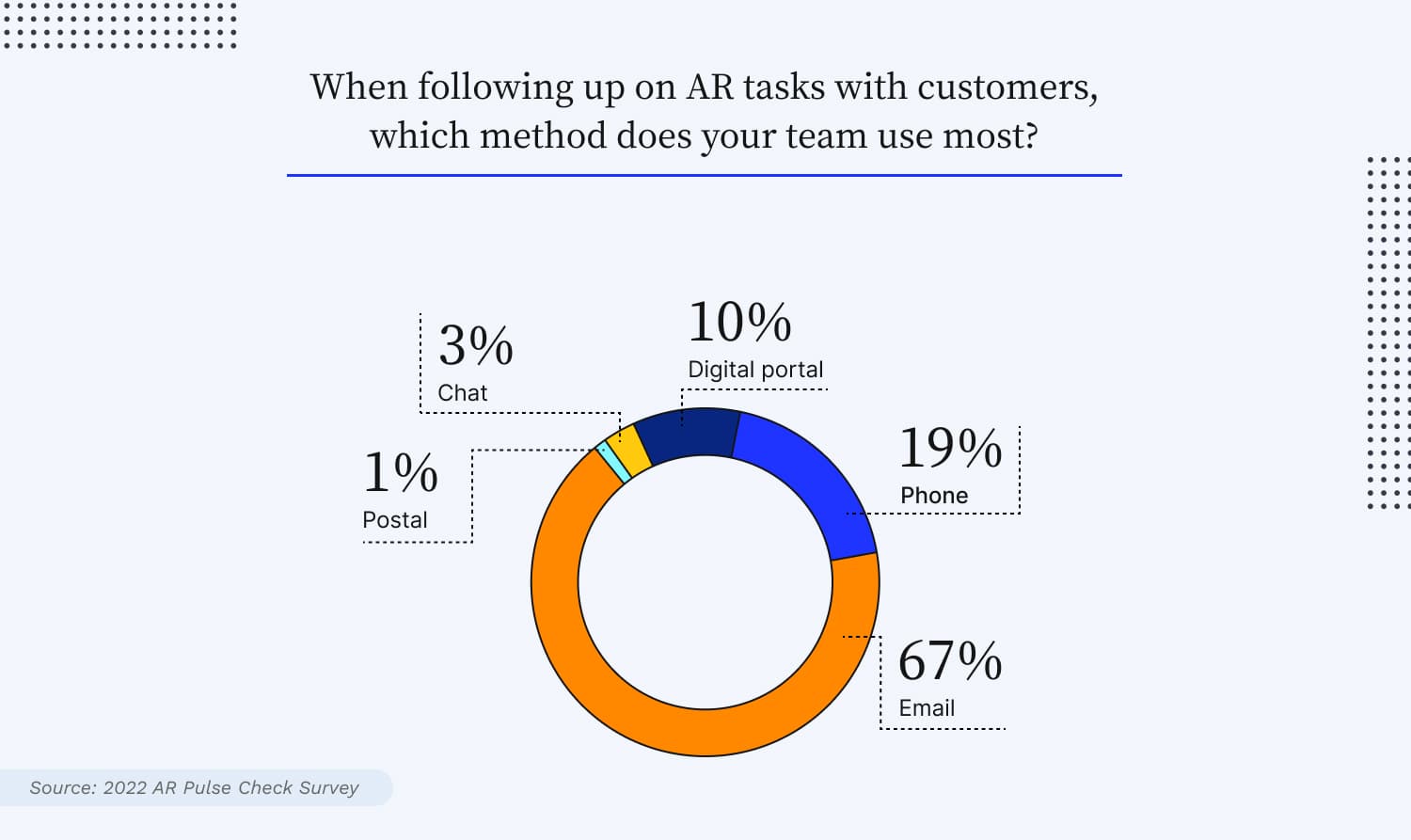

Despite a wave of digitization sweeping through most businesses, many companies rely on manual processes in the O2C cycle. For instance, Versapay’s AR Pulse Check Survey shows that 67 percent of AR departments send invoices and follow up on payment via quasi-manual methods such as email.

These manual processes increase the communication gap between your O2C teams. For example, your AR team might struggle to retrieve correct order information, having to scrounge for documents amongst disparate systems, leading to invoice errors and customer disputes.

The result is a slow O2C process that frustrates customers and lengthens your cash cycle.

3. Your order-to-cash cycle teams struggle to address disputes

Even the healthiest customer relationships experience disputes. If your teams lack visibility into the causes of disputes, they will struggle to resolve customer issues. Communication breakdowns caused by a lack of O2C process cohesion—including those that are over-reliant on antiquated communication channels, like email and phone—have an outsized impact on your revenues.

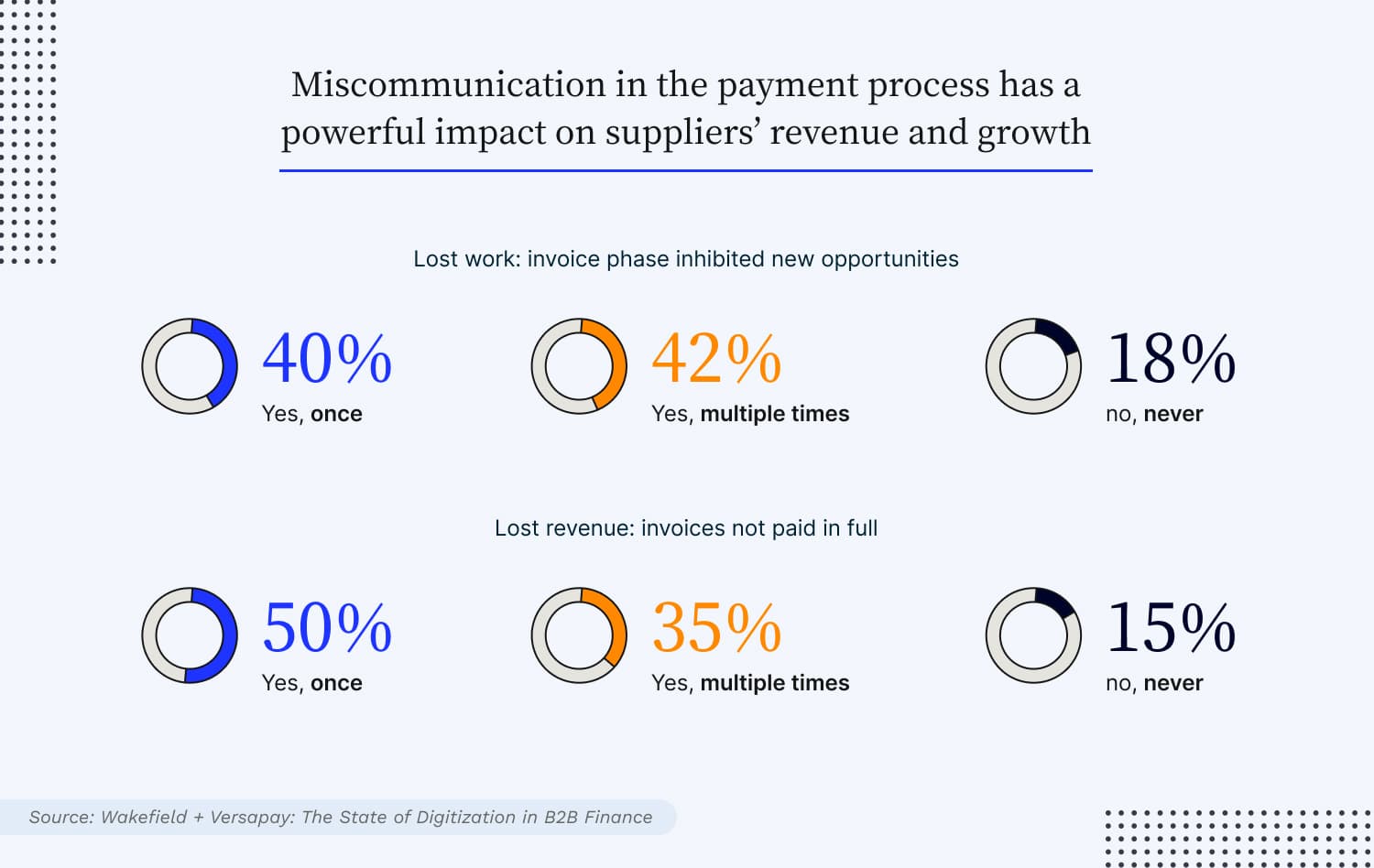

For example, in Versapay and Wakefield Research’s State of Digitization in B2B Finance Report, 85 percent of executives reported collecting partial invoice amounts due to AR communication breakdowns.

The result is that your customers never have visibility into what they owe and receive uncoordinated communication from your teams. They perceive a lack of transparency in your O2C process, resulting in more disputes and delayed payments.

4. Your customers do not have convenient payment channel options

Prioritizing the payment options that are easiest for your behind-the-scenes processes could mean you’re overlooking customers’ experience. Neglecting to offer convenient payment options can lead to an influx of outstanding invoices, because customers find the payment experience difficult.

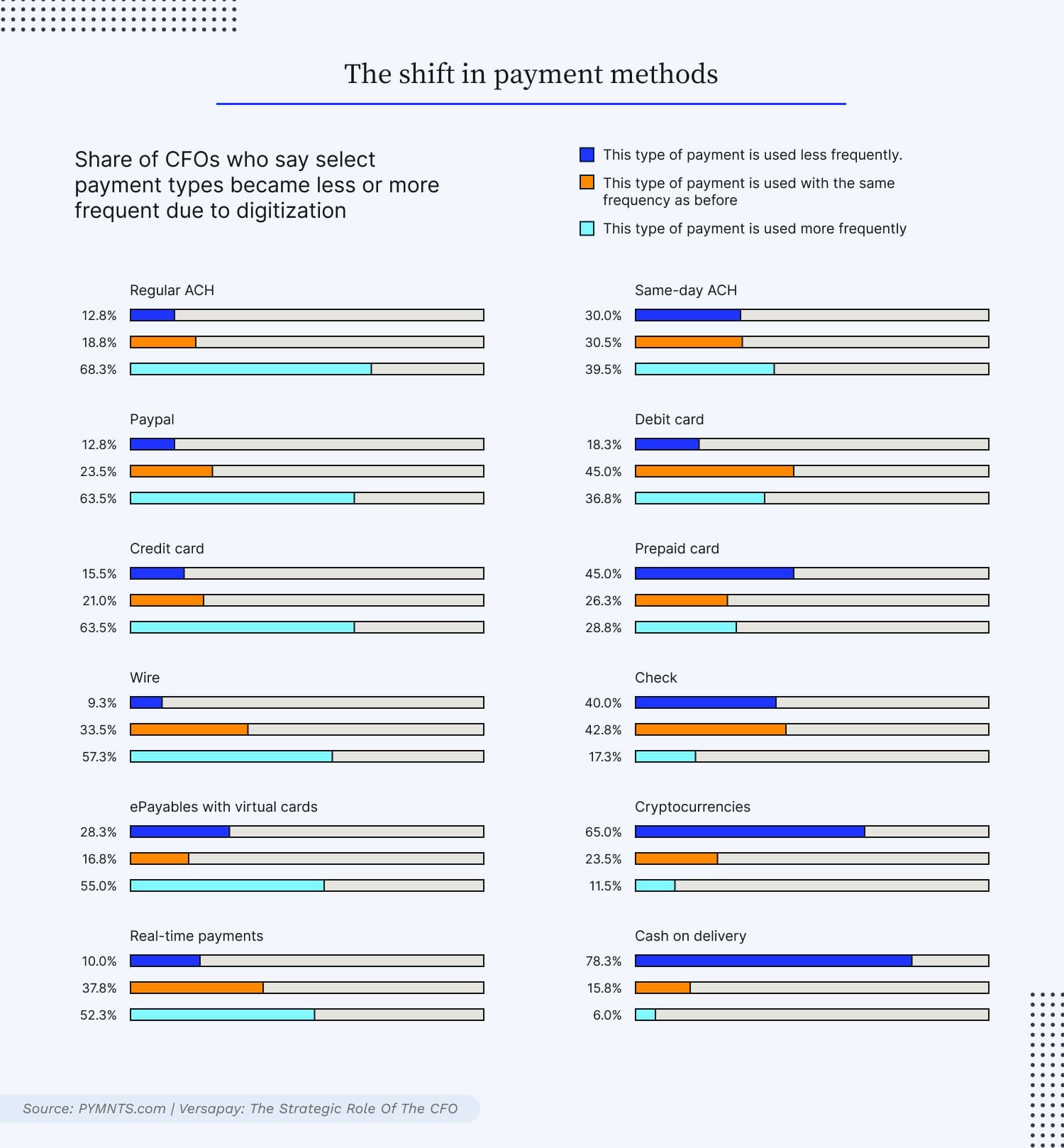

For example, you might find bank transfers easiest to reconcile, but your customers might find them inconvenient, leading to delayed payments. Luckily, digitization is helping firms accelerate their use of digital payments, including real-time payments, while also allowing them to reduce reliance on paper checks.

Versapay’s research reveals the frequency with which companies use different payment options thanks to digitization.

Failure to offer your customers convenient payment options leads to increases in your average collection times, decreases in your collection effectiveness, and poorer overall customer experiences. The result is a long order-to-cash process that you could have avoided.

—

🚨 Many of these bottlenecks stem from inefficient—yet easily fixable—AR processes. Take our six-minute assessment and get personalized recommendations for how to transform your accounts receivable and eliminate these bottlenecks.

How better collaboration throughout the O2C process eliminates these challenges and accelerates cash flow

Your order-to-cash process involves multiple internal and external teams. As such, several common O2C hiccups occur due to a lack of communication between these teams, as well as between your teams and your customers. Collaboration at multiple stages of the O2C process can remove these challenges in the following ways:

1. Fewer invoice errors

Collaboration brings your internal teams closer and helps them align more efficiently. For instance, throughout the order-to-cash process, OM and AR teams must work with sales to understand customer invoicing needs and order terms. An emphasis on collaboration will see these teams interact with greater frequency, and mitigate the consequences of poor communication—like discrepancies between proposals and invoices.

The result is a greater customer experience and a more cohesive organizational voice when dealing with customer queries.

2. Fewer order fulfillment errors

Delivery errors, delays, and poor product conditions are some of the most common OM mistakes that prolong your O2C cycle. An OM team that prioritizes collaboration with sales, order fulfillment, and AR teams can flag issues quickly, coordinate with logistics partners, and offer customers clearer communication about their order statuses.

Your sales department can further mitigate order fulfillment errors by managing customer expectations, thanks to being on the same page as your OM team. This is how collaboration reduces the impact of potential order fulfillment issues and prevents customer disputes.

3. Better dispute handling

Most companies view disputes as problems. However, a collaborative approach to dispute handling turns disputes into opportunities for you to enhance customer experience (CX). Your teams can deliver great CX by working together to quickly resolve any issues.

Also, collaboration extends beyond your internal teams. With the right technologies, you can work in lockstep with your customers to quickly resolve disputes (such as invoice errors or misaligned expectations).

For instance, your accounts receivable department can work with your customer to offer self-service access to shared, cloud-based payment portals where they can view their invoices and supporting documents in real-time. Here, they can resolve invoicing disputes in aggregate or at the line-item levels and communicate via chat-like tools with your AR team to expedite resolutions.

Collaboration of this kind is far more efficient than traditional email follow ups or phone calls. You can offer your customers transparency and preempt any invoicing or order-to-cash related questions.

Collaboration throughout the O2C cycle, especially between your AR teams and your customers, can dramatically increase your processes’ efficiency.

Improve order-to-cash efficiency with Versapay

Introducing collaborative processes within your AR processes goes a long way towards seeing order-to-cash process improvement. Also, backing collaborative processes with Collaborative AR automation solutions significantly boosts your profitability.

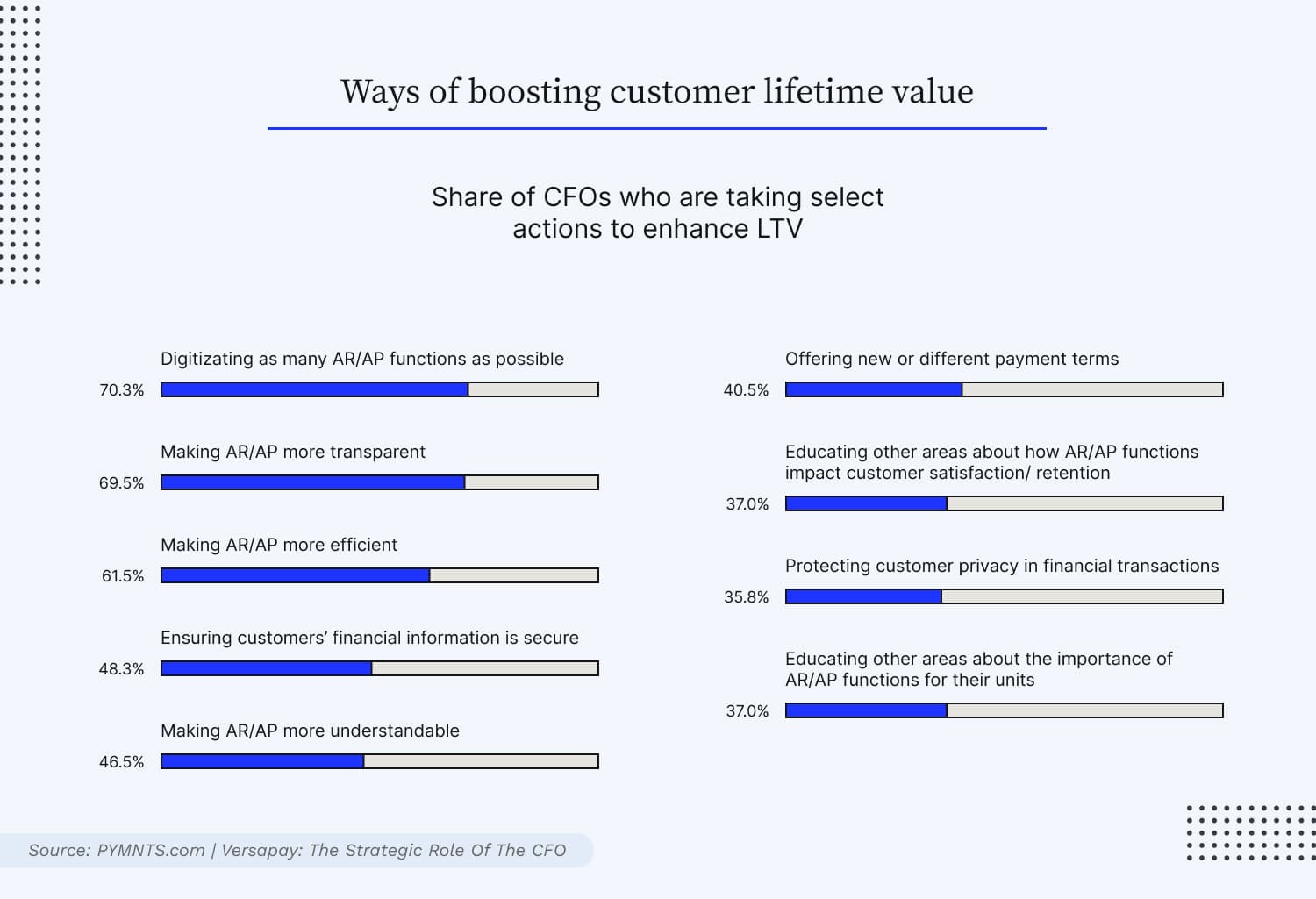

Versapay's The Strategic Role of the CFO report revealed that 70 percent of CFOs are boosting customer lifetime values by digitizing as many AR/AP functions as possible.

Collaborative AR automation software helps you automate several accounts receivable activities in the O2C process while prioritizing customer experience. This software also erases communication hurdles between these O2C stakeholders, removing many common O2C roadblocks.

Here are five ways Versapay's Collaborative AR platform boosts order-to-cash efficiency:

1. Automated invoice generation

Manual invoice creation adds precious time to O2C processes. Automating invoice creation helps you pull data from OM and sales systems—like your ERP—while complying with any invoicing needs your customers have.

For instance, you can dynamically list PO numbers or regions on your invoices depending on your customer's preferred format. The result is speedy invoice creation and minimal errors.

2. Automated payment collections reminders

Order-to-cash cycles increase because AR teams spend significant time chasing payments. Automated collection reminders help them step back and prioritize participating in more strategic initiatives, like evaluating your cash flow position.

By removing this tedious task from their workflows, your AR team can work on preventing late payments in the future, reducing your O2C cycles in the process.

3. Customer self-service portal

You can make your O2C processes more efficient by offering your customers full transparency into the status of their account. Versapay's shared, cloud-based customer and supplier self-service portals bring all stakeholders together on the same page by hosting documents related to an invoice in one place, which is accessible by all, at any time.

Customers can view and discuss line item level issues with your AR and sales teams. The result is less back-and-forth and speedy dispute resolution.

4. Seamless integration with ERP systems

Integrating your financial systems will give your O2C teams full visibility over essential data, reducing cycle times. Versapay integrates with ERP systems like NetSuite, Microsoft Dynamics, and Intacct. You can import and export data seamlessly from your AR systems to smooth accounting processes.

You can also create invoices within your ERP and post them to Versapay’s platform, giving customers access in real-time.

5. AI-powered cash application

Cash application issues increase the duration of the O2C cycle and compromise sales when customers are unable to purchase more due to credit holds. Some companies hire more people to manually clear cash application backlogs. However, this is an expensive choice.

Versapay is capable of increasing efficiency by 75% using its AI-powered cash application solution. Through machine learning and AI, Versapay enables you to match any payment type with open receivables, capture and reconcile payment data, eliminate entry errors, significantly reduce manual effort, and speed up cash flow.

It also recognizes unstructured remittance data and helps you categorize payments quickly, reducing time spent processing collections.

—

Your order-to-cash cycle offers handy insights into your overall efficiency as a company. In the current macroeconomic environment, you must decrease cash collection times to bolster your working capital position. Optimizing the order-to-cash process will help you achieve this goal.

A collaborative approach throughout your order-to-cash processes, especially within your AR workflows, will decrease O2C cycle times and eliminate common bottlenecks. You can increase your organization’s customer-orientation and give your teams the order-to-cash tools they need to deliver great experiences.

Versapay can improve your order-to-cash process by connecting your AR team and customers over the cloud. Take our 6-minute assessment and get your personalized accounts receivable transformation roadmap. Learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.