Remittance Processing Automation: A Must-Have for Modern AR Operations

- 9 min read

Learn what remittance advice is, common remittance processing challenges, and how remittance processing automation can help accounts receivable teams accelerate cash flow, boost productivity, and deliver better customer experiences.

For most accounts receivable (AR) teams, having to manually process remittance advice is a constant headache. Each day brings a dizzying array of remittance documents that must be painstakingly matched to payments and open invoices—a time-consuming, error-prone process that hamstrings productivity and efficiency.

From deciphering hard-to-read remittance details to resolving discrepancies, the remittance rigamarole is a tangled knot that increasingly bogs down AR operations (to the tune of 200 unnecessary hours of additional work per week in some cases). Cash flow slows to a trickle as payments go unmatched and unapplied for days or weeks on end. And customer relationships fray when inaccuracies persist.

At the end of the day, accounts receivable teams shouldn't have to operate like detectives, endlessly hunting down remittance clues and matching payments to invoices. Traditional remittance processing is an outdated, labor-intensive workflow that no AR department should accept as its status quo.

In this article, we'll examine why an automated approach to processing remittance advice is the best remedy for the challenges described above. From accelerating cash flow to boosting productivity and customer satisfaction, cash application and payment automation holds the key to escaping the remittance rigamarole once and for all.

Jump to a section of interest:

Remittance advice’s role in payment processing and cash application →

Break free from remittance processing realities with automation →

Remittance advice’s role in payment processing and cash application

To appreciate the magnitude of challenges around remittance advice processing, it's crucial to understand the role remittance advice plays in accounts receivable. Remittance documents provide essential details about customer payments, specifying which invoices are being paid, payment amounts, deductions or adjustments, and more.

Without this data, incoming money can’t be accurately reconciled and applied to open receivables. Remittance is the linchpin for cash application, the critical AR workflow of matching payments to invoices and updating customer accounts.

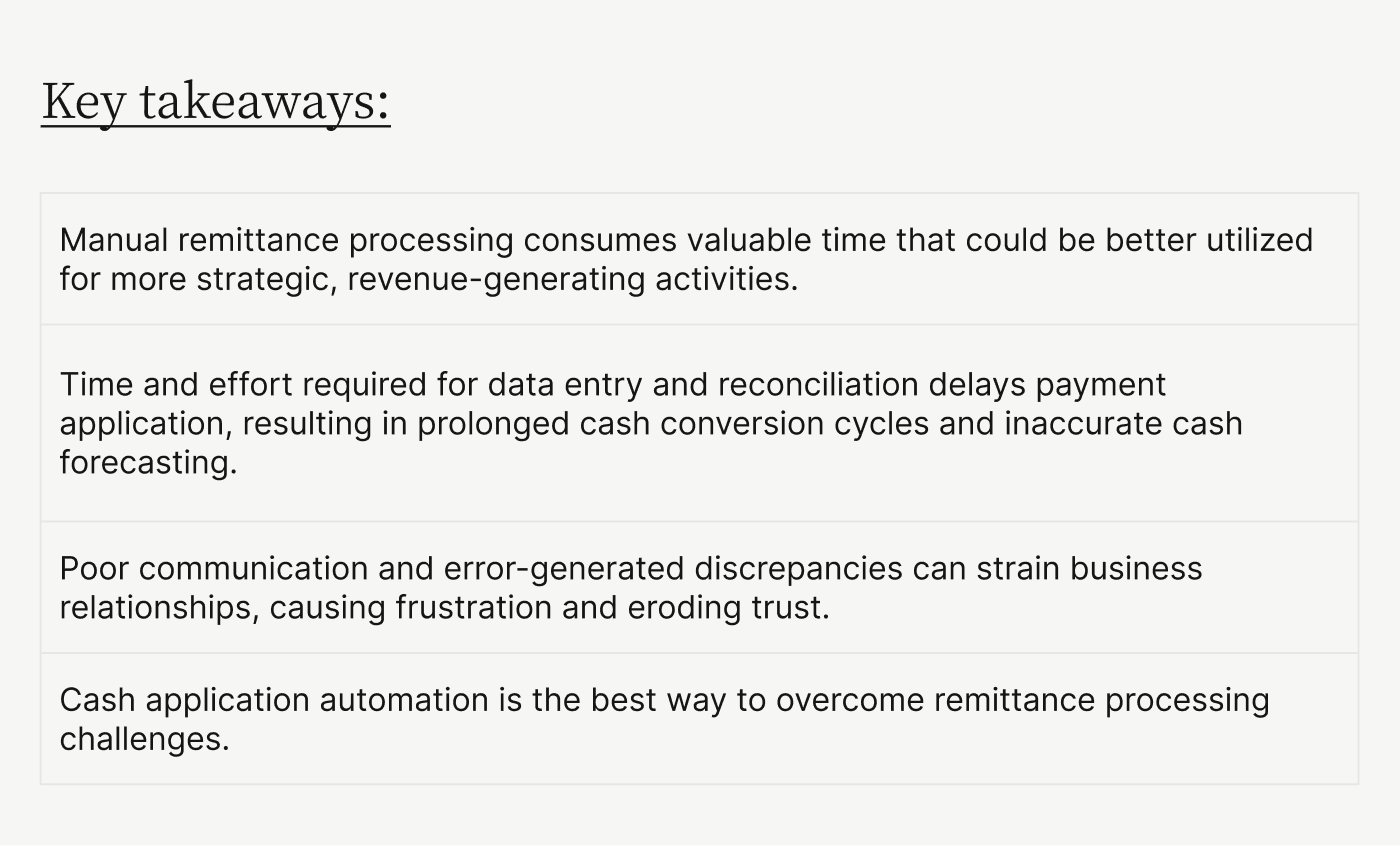

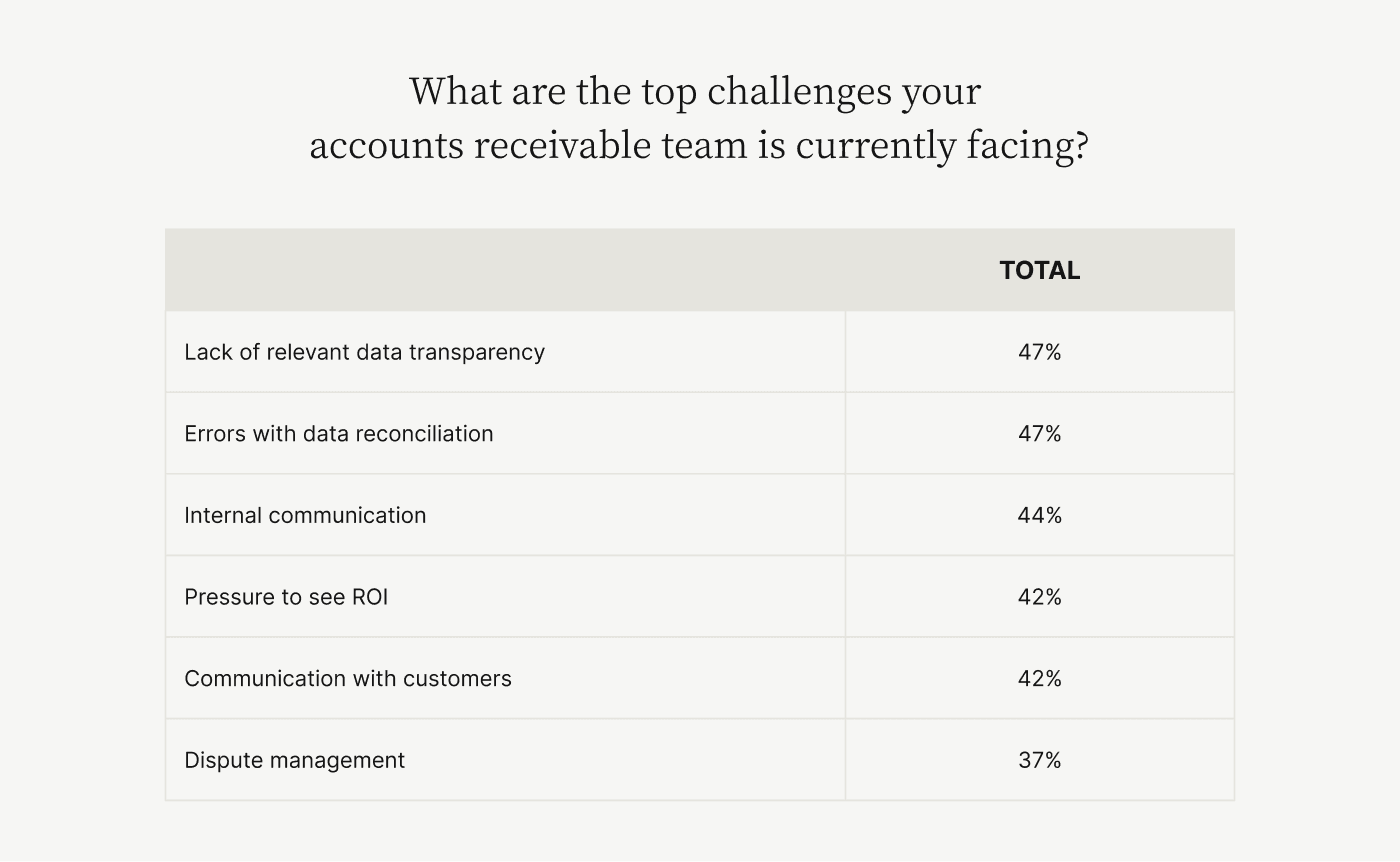

Handled manually, remittance processing represents one of the biggest bottlenecks and sources of errors in the cash application workflow. In a survey of 300 CFOs we conducted with Wakefield, for example, errors with data reconciliation topped the list of challenges faced by AR teams at 47%. At 37%, dispute management was another top challenge.

With cash application automation, these remittance processing-suffused challenges can be overcome. For example, customer payment exceptions like short payments or deductions can be quickly identified and routed to appropriate departments for resolution, increasing customer satisfaction.

Hitting reset on remittance: why outdated processes must go

Organizations grapple with a perfect storm of obstacles when it comes to remittance processing efficiency. Antiquated technology and manual processes create unnecessary busy work and open the door to human error—the number one cause of invoice disputes and a top driver of poor cash flow.

Payment data arrives in numerous, hard-to-decipher formats, from email attachments and web portal downloads to illegible paper documents. Matching these remittances to open invoices is a laborious and highly repetitive task for AR staff, and complicated account structures with diversified billing make reconciliation even more convoluted.

Below are just some of the specific challenges accounts receivable teams face when it comes to processing remittance advice—and how automation solutions can help you solve them:

Challenge 1: Obtaining remittance advice from multiple sources

Challenge 2: Receiving remittance advice in different formats

Challenge 3: Receiving remittance advice that’s decoupled from associated payments

Challenge 4: Receiving incomplete remittance advice, or none at all

Challenge 1: Obtaining remittance advice from multiple sources

When remittance advice arrives through a fragmented labyrinth of channels, such as email inboxes, fax machines, physical mail, and online vendor portals, AR teams waste precious time collecting and consolidating documents before processing can begin. Each source presents its own formatting quirks, compounding the complexity of matching payments to invoices accurately.

This scattered, multi-channel retrieval process is highly susceptible to errors and delays that disrupt cash flow and erode the customer experience. Lacking real-time remittance visibility, your receivables team may place credit holds on accounts or may request payments from customers that have already paid.

How automated remittance processing helps

Automated remittance solutions offer an escape from this tangled web. They consolidate remittance advice from all sources into a unified, digital stream, and intelligent capture functionality extracts key data regardless of format.

This channels remittance into a single, accessible location for streamlined processing, minimizing errors. Such centralization provides the payment transparency accounting teams need while expediting reconciliation and customer satisfaction.

Challenge 2: Receiving remittance advice in different formats

Remittance advice often arrives in a dizzying array of formats, including paper documents, CSV files and PDFs attached to emails, EDI files, and more. Because each format demands a unique and often inefficient processing workflow, the inherent inconsistency breeds errors, delays, and excess effort.

Analysts may be called upon to:

Use optical character recognition (OCR) to convert images into extractable text.

Scrutinize EDI files and digital payments for completeness, as character limits can often cut off valuable information.

Manually enter data from check stubs into spreadsheets, or post information from expensive lockbox key-in services into an enterprise resource planning (ERP) system.

Ask colleagues if they can decipher illegible handwritten advice, or follow up with customers to get clarity.

How automated remittance processing helps

Automated remittance solutions employ advanced data capture capabilities, such as intelligent character recognition and machine learning document classification. This drives high straight-through processing rates (in some cases, upwards of 90%) by automatically identifying and extracting remittance details regardless of formats.

Challenge 3: Receiving remittance advice that’s decoupled from associated payments

When remittance details arrive separate from their associated payments—which is often the case in lockbox banking—matching the two becomes an arduous task. This disconnect can lead to delayed or misapplied cash, slowing cash flow and straining customer relationships.

For remittance advice received before a payment, collections specialists risk inaccurately applying details before the money arrives, forcing a rework once payment lands. Conversely, receiving payment first means having to manually download bank statements to reconcile remittance after the fact.

In some industries, like insurance, remittance advice comes packaged as claims data from portals, so claims numbers must be matched with invoice numbers. In similar fashion, staffing, logistics, and other verticals use non-standard identifiers like consolidated freight invoices or timesheet details that must be manually mapped to payments, often requiring customer follow-up for proper details.

Even consolidated remittance advice covering multiple invoices forces specialists to apply arbitrary cash application rules, such as “oldest invoice first” or “highest amount first.” Remittance processing becomes a guessing game, with payments often allocated unevenly across invoices.

No matter the scenario, decoupled remittance advice universally translates to arduous logins across portals and systems and other painful processes for getting data in sync.

How automated remittance processing helps

Intelligent cash application automation solutions provide a lifeline for organizations battling decoupled remittance challenges. These advanced softwares deploy machine learning and AI to automatically identify, capture, and match remittance details to incoming payments. By ingesting remittance from documents, portals, claims and other sources via smart data capture, these platforms stitch everything together seamlessly behind the scenes.

—

🎥 Watch Versapay's cash application product demo to see how we automatically extract remittance data from multiple sources—including vendor portals, bank lockboxes, emails, and PDFs—using advanced image recognition and machine learning technology:

Challenge 4: Receiving incomplete remittance advice, or none at all

Discrepancies frequently arise when invoices are short paid, or when single payments cover multiple invoices. This kicks off a tedious investigation: scrutinizing the mismatch root cause, potentially calling the customer for clarification, and manually reconciling payments to the proper invoices. Such discrepancies consume considerable time and delay accurate cash application.

Incomplete or missing remittance information, which is a common complaint when it comes to automated clearing house (ACH) payments, compounds these challenges.

Receivables teams must collaborate with customers to collect missing details before payment posting can proceed. Similarly, incorrect remittance information forces back-and-forth queries to secure the proper amounts, invoice numbers, and more.

How automated remittance processing helps

Automation can deliver much-needed relief from the discrepancy dilemmas that plague manual remittance processes.

AI-powered cash application solutions apply machine learning to identify what payments are likely for, resolving remittance mismatches before they escalate into larger issues (or are ever birthed). Intelligent data capture extracts payment information from supporting documents (like invoices) and remittance sources, cross-referencing it against expected data points. And exceptions that cannot be automatically remedied are digitally routed to the appropriate people to resolve.

Break free from your remittance processing realities with automation

The remittance rigamarole plagues far too many accounts receivable teams. From deciphering cryptic data across fragmented formats and sources, to wrestling with discrepancies, missing details, and laborious data entry, the inefficiencies are endless. Each roadblock represents a delay in cash application, a drain on productivity, and a risk to the customer experience.

But it doesn't have to be this way. Cutting-edge cash application solutions powered by intelligent automation provide an escape route from your remittance processing realities. By consolidating payment information into a unified digital stream, automating data capture across formats, and driving straight-through processing with AI-enabled matching, these technologies eradicate the headaches associated with manual remittance processing.

The impacts are transformative: accelerated cash flow, increased efficiency and cost savings, optimized application of deductions and short payments, and improved transparency with real-time remittance visibility. What’s more, customers experience flawless AR service when payments are accurately applied on-time, every time.

To learn more about how Versapay can help, talk with an expert today. Or, get your free copy of our finance leaders’ guide to driving efficiencies with AI-powered cash application automation software:

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.