The State of Virtual Credit Card Acceptance in B2B

- 10 min read

In this article, we unpack our findings from a survey of 400 finance leaders on the value they see in B2B virtual cards and the virtual credit card acceptance. We’ll explore:

How virtual cards benefit sellers and buyers

Challenges faced in accepting virtual card payments

Why businesses are motivated to embrace virtual cards

And more

Virtual credit cards are skyrocketing in popularity, with the global value of virtual card transactions expected to rise nearly 260% percent, from $1.9 trillion in 2021 to $6.8 trillion in 2026.

A virtual credit card is a digital payment method intended for online and card-not present transactions. It’s an automatically generated 16-digit card number used in place of the physical credit card number it’s associated with.

It’s time for business-to-business (B2B) companies to acknowledge virtual credit cards as a strategic lever—and to start accepting virtual credit card payments—to make sure they don’t miss out on potential revenue and market share growth, particularly with inflation showing little signs of slowing down.

B2B sellers have more difficulty accepting virtual credit card payments than buyers do in using them, so sellers are at most risk of foregoing business if they don’t get the right tools in place to accept this payment method. (Here are the pros and cons of B2B virtual cards.)

And with 55% of CFOs now saying that their teams are more frequently making payments with virtual cards—as a result of digitization trends—it’s clear that buyers are racing forward to adopt this technology.

✍️ Sellers should take note: It’s a good time to focus on getting set up to take these payments.

To learn more about the value companies see in using and accepting virtual credit cards, we surveyed 400 finance leaders. The data helped us understand how virtual cards can benefit sellers as well as buyers, the challenges sellers face in accepting these transactions, and why sellers and buyers alike are increasingly motivated to increase virtual credit usage and acceptance in the immediate term.

Jump to a section of interest:

Key findings: virtual credit cards no longer only benefit buyers

The data first confirmed what is already widely experienced by financial teams: The benefits of virtual credit cards skew heavily towards buyers, with B2B virtual cards more convenient for accounts payable teams than for sellers. To emphasize this, nearly all respondents (98%) recognize that buyers stand to reap significant benefits from making invoice payments using virtual credit cards.

Yet here’s where things veer from the expected…

In this current economic environment, businesses are feeling pressure to secure payments quickly and efficiently, to extend their liquidity runway. This sudden urgency is leading executives to prioritize digital tools that focus on providing better customer experiences (CX) as a means of accelerating cash flow.

Virtual credit cards—and virtual card payment processing platforms—are one such instrument now entering sellers’ scopes. This payment method is increasingly seen as highly valuable, and many sellers are now aware that they should begin accepting them as soon as possible.

Business buyers are increasingly turning to virtual cards to make faster, more efficient payments while giving them flexibility and better cash-flow management. Suppliers are benefiting from these faster payments; however, the increasing volume of these transactions is making automating the receivables even more essential.

Here are three findings that further prove why B2B virtual cards will benefit buyers and sellers:

1. Virtual credit cards boost customer experience

The potential for improved customer experience (CX) is a major benefit that sellers identify in accepting B2B virtual card payments:

- More than a quarter (26%) of respondents were enthusiastic about virtual credit cards’ ability to provide better customer experiences

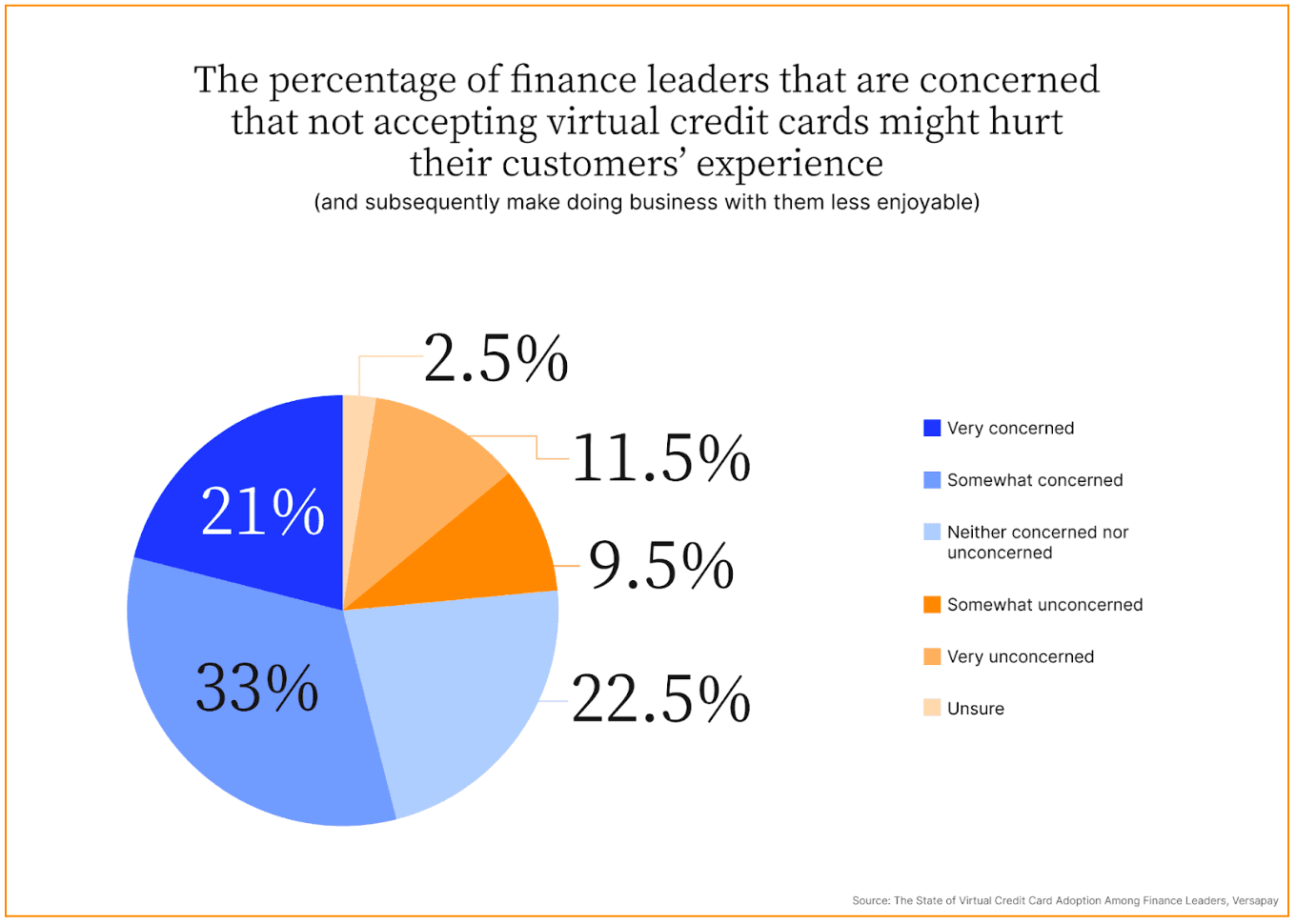

- Conversely, 54% reported being at least somewhat concerned that not accepting these payments would mar their customers’ experiences.

It should come as no surprise that businesses not accepting virtual credit card payments are less likely to provide good customer experiences than those that do. Unfortunately, many businesses are ill-equipped to meet their buyers’ preferences and it’s showing in their interactions:

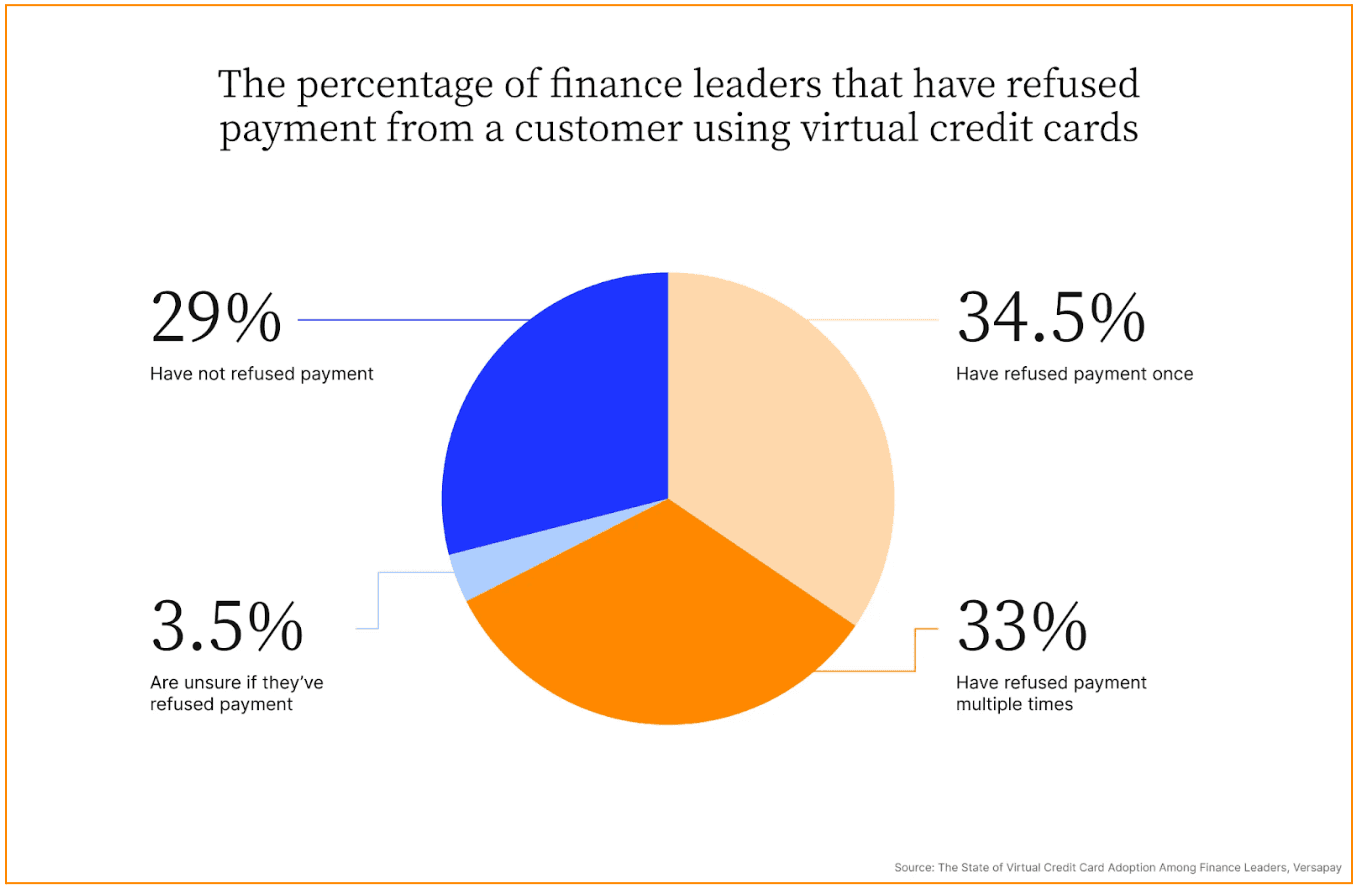

- More than two-thirds (67.5%) of respondents have had to refuse virtual credit card payments, with a third of respondents having done so multiple times. The customers who were trying to make those purchases certainly didn’t walk away happy.

2. B2B virtual cards offer sellers various benefits

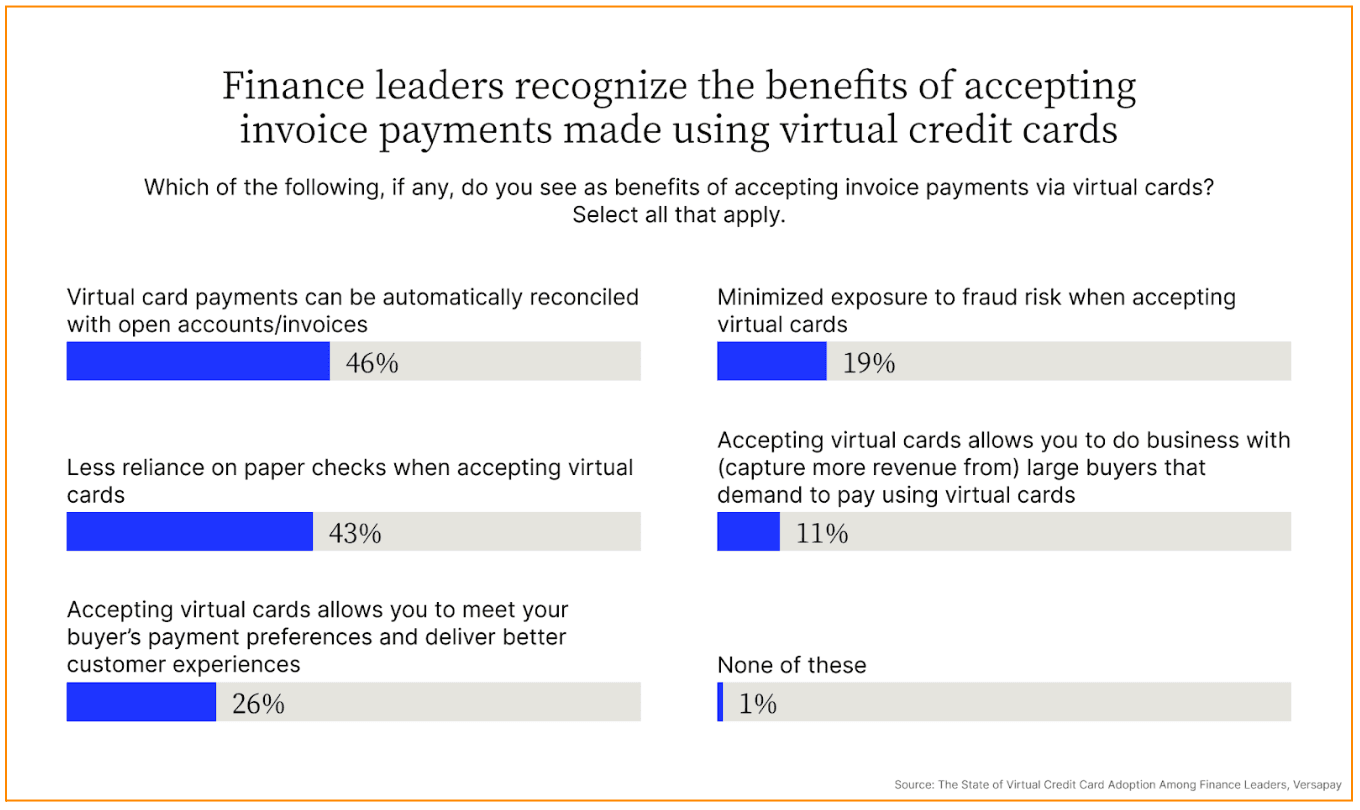

The data from our virtual cards report indicates that sellers perceive virtual credit cards to offer a variety of benefits beyond offering customers excellent experiences. Here are some other positives they identify:

- Reduced risk—With better security options than checks and credit cards, virtual credit cards reduce the risk of fraud. Cutting credit card fraud also reduces associated chargebacks and other fees. Almost one-fifth (19%) of survey respondents said that the security benefits of accepting virtual credit card payments are particularly appealing.

- Better customer retention—Buyers are adopting virtual cards faster than sellers, so it’s likely that some buyers will look to do business elsewhere if their preferred providers aren’t accepting this payment option. Losing buyers will impact revenue and growth.

- Streamlined workflows—For sellers, B2B virtual card payments are appealing because of the potential for these payments to be automatically reconciled with open accounts and invoices. Nearly half (46%) of survey respondents said that ability is so beneficial that it becomes a major reason to accept virtual card payments.

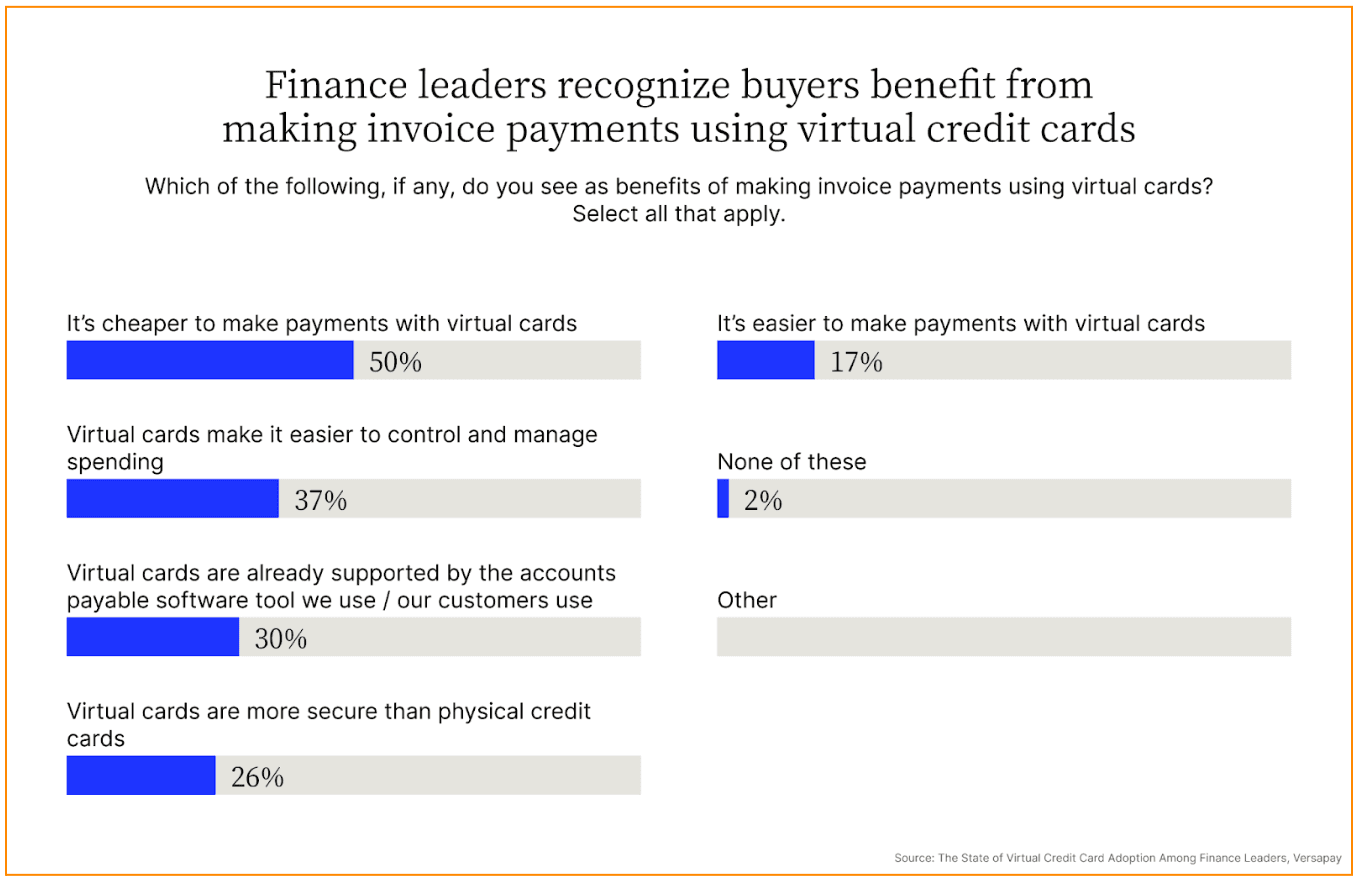

3. Accepting virtual credit card payments offers immense value to buyers

Buyers, of course, see benefits of using virtual cards as well. Our virtual cards report surfaced some of the most helpful benefits.

- Controlled spending—Survey respondents are most enthusiastic about the enhanced control over spending that virtual credit cards afford them, with 37% saying they appreciate that functionality. AP teams can set parameters for each transaction with a virtual credit card, which limits how staff can use company funds and improves finance managers’ ability to budget.

- Supported software integration—Respondents are enthusiastic about virtual cards’ capability of being supported by their—or their customers’—existing accounts payable software tools. Thirty percent of respondents see this potential integration as valuable and likely to expand buyers’ use of virtual credit cards.

- Boosted security—More than a quarter (26%) of survey respondents appreciate virtual credit cards’ security profile. B2B virtual cards can be programmed to block unauthorized usage, and they are often only used for a single transaction. Both features make them less appealing to hackers and thieves. And sellers need not be responsible for storing their customers’ banking data.

- More convenience—Buyers can transact with virtual credit cards instantaneously, a far more convenient option for buyers than using physical checks. And virtual cards can easily be canceled without the involvement of third parties, making them easier to manage than physical credit cards.

- Greater affordability—In comparison to checks—among numerous other B2B payment methods—virtual credit cards are a cheaper way to pay invoices, as issuers charge little for services and nothing to create card numbers. Meanwhile, issuing a check can cost as much as $20.

The future of virtual card acceptance: It’s time for sellers (despite obstacles)

Unfortunately, challenges have kept sellers from accepting virtual credit card payments.

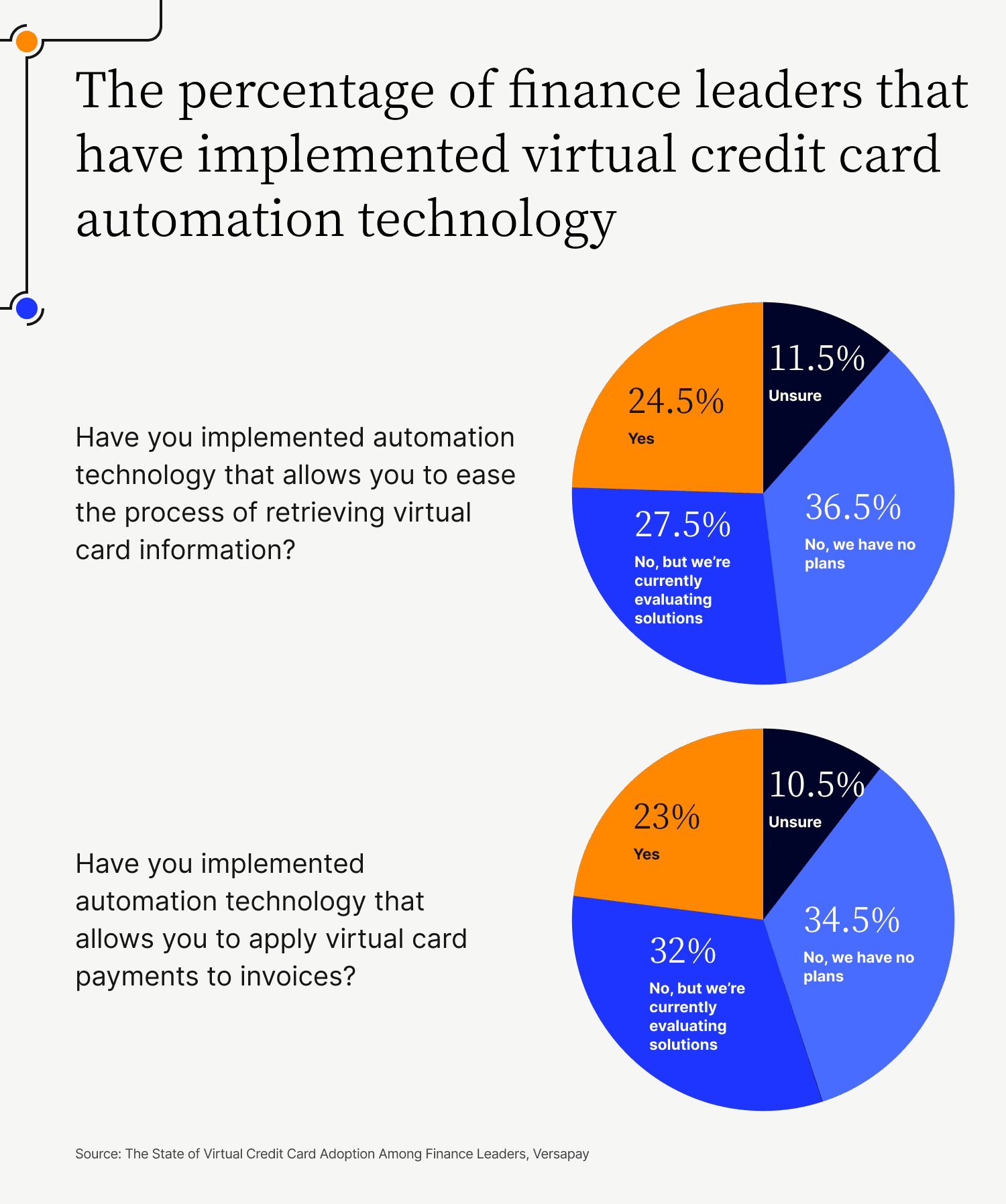

Despite all these benefits of accepting virtual cards, only a quarter (24.5%) of respondents have implemented automation technology—or virtual card payment processing technology—that allows them to ease the process of retrieving virtual card information; and fewer than that (23%) have implemented automation technology that allows them to apply B2B virtual card payments to invoices.

Sellers’ progress in accepting virtual credit card payments is slowed by a number of challenges:

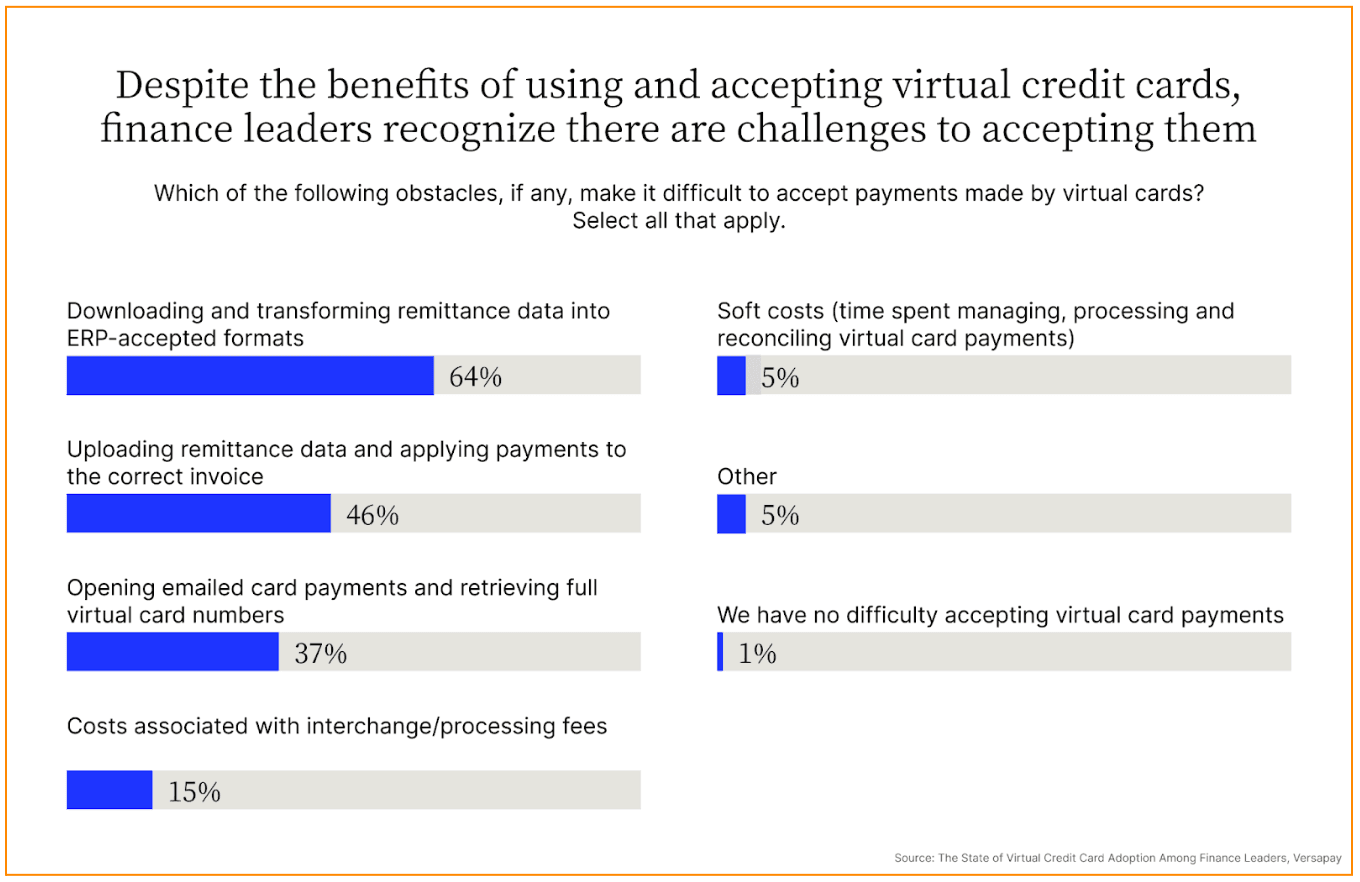

Nearly all respondents (99%) report facing challenges accepting and applying payments made using virtual credit cards.

Just under two-thirds of respondents (64%) said that downloading and transforming remittance data into ERP-accepted formats is the biggest impediment to virtual credit card acceptance. They find the process cumbersome and time-consuming.

And nearly half (46%) have had difficulty applying virtual credit card payments to the correct invoices.

Additionally, CFOs identify numerous reasons for slow uptake of digitization in general, with the lack of an in-house expert and difficulty in finding the right company to work with topping the list. Other factors include not having a fully integrated ERP system and concerns about cost, among other issues.

Despite these obstacles, the detrimental effect of not accepting virtual credit card payments can be so pronounced that sellers are moving quickly to become equipped to accept this payment method.

Virtual cards report reveals a dire need for greater virtual credit card acceptance

As virtual card usage continues to expand, we’re seeing increasingly sophisticated options—and virtual credit card platforms—that companies can access to help digitize and streamline virtual card payment processing. Accounts receivable automation vendors like Versapay, for example, can help sellers set up automatic reconciliation and get them up and running quickly.

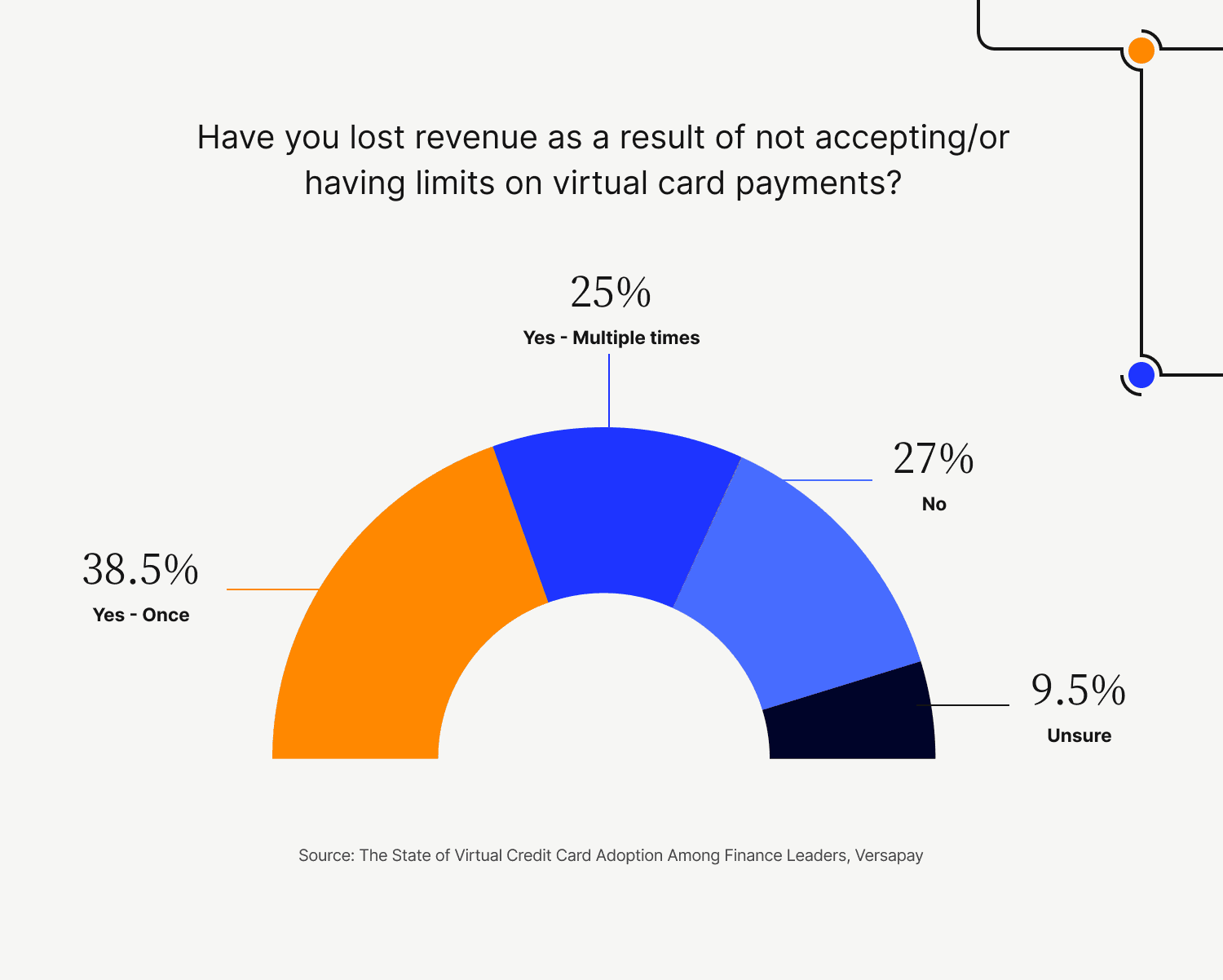

Getting set up to accept virtual credit card payments as quickly as possible will boost business outcomes for sellers in 2023. Not accepting virtual credit cards can put a dent in revenue: 63.5% of respondents to our survey report having lost business because of an inability to accept virtual credit card payments, and a quarter of respondents have lost business multiple times.

Such losses will only become more common as the portion of buyers who want to use B2B virtual cards to pay their invoices continues to outpace the number of sellers who accept them as a form of payment.

Technology is enabling virtual credit card acceptance

Tech tools are available to ease virtual card acceptance—a boon to businesses. In fact, this technology makes virtual card acceptance as seamless as virtual card issuance, vastly reducing the time it takes to accept virtual card payments.

This digital facilitation can have a great impact. Accepting virtual credit card payments allows businesses to make more sales and pull in more revenue, build better relationships with buyers, and tighten security to reduce risk and fraud.

Businesses should get ready: 2023 and beyond will be a time of fast change in the area of virtual credit card payment and acceptance. Businesses that want to build better relationships with customers and capture a greater share of revenue from a rapidly growing payment channel should work with a technology provider that can make sure they’re poised to take advantage of this exciting change.

Read our report that unpacks our survey results to learn more about how businesses are approaching—and benefiting from—using virtual credit cards.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.