Automated Accounts Receivable Solutions Boost Cash Flow and Increase Efficiency

- 12 min read

Accounts receivable automation software simplifies invoice processing, reduces the time accountants spend collecting payments from customers, and accelerates cash flow.

Learn how to find and select an automated accounts receivable solution to dramatically improve your business’s cash flow and efficiencies.

Cash flow is the lifeblood of any business: A lack of working capital—or slower access to it—can severely hamper a company’s ability to operate effectively, pay its bills, and invest in growth opportunities.

Without sufficient cash on hand, businesses can quickly find themselves unable to cover essential expenses such as payroll, rent, and supplier payments. Cash flow deficiencies create a domino effect, leading to operational disruptions, strained relationships with vendors and customers, and the risk of insolvency.

While various factors contribute to cash flow challenges, inefficiencies in the accounts receivable (AR) process are often the primary culprit. Without accounts receivable automation, even companies with a healthy invoice volume can face serious cash flow problems if they’re not collecting payments promptly.

Jump to a section of interest:

How accounts receivable inefficiencies hurt your cash flow →

What to look for in an automated accounts receivable solution →

How accounts receivable inefficiencies hurt your cash flow

The accounts receivable process is complex, encompassing various tasks from generating and delivering invoices to processing payments and reconciling accounts. Any bottlenecks from order to cash can impact a company's ability to collect payments.

Our research with Wakefield found that for a typical mid- to upper-mid sized company ($250 million or more in annual revenues), inefficient AR processes create extra manual work, forcing teams to manually resolve challenges on nearly $3.7 million worth of invoices monthly.

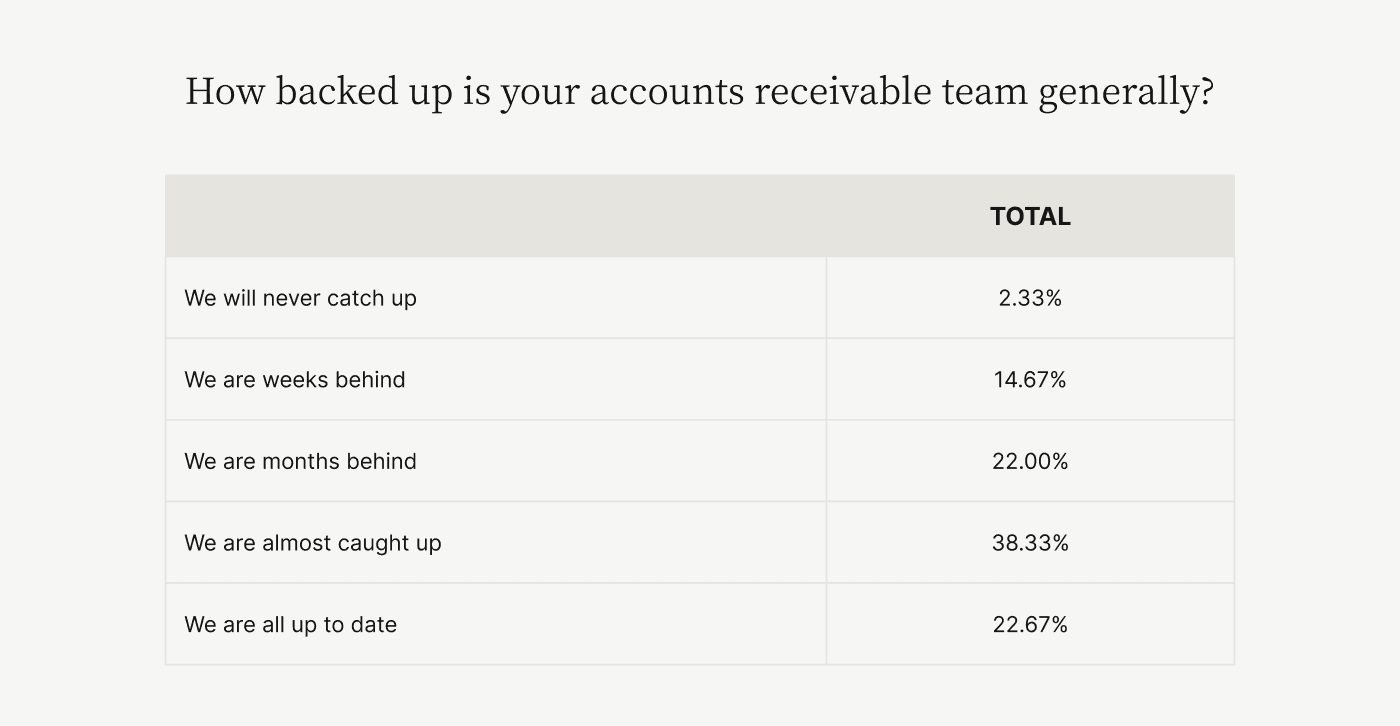

Because these inherent inefficiencies result in delays, miscommunication, and a lack of visibility into outstanding payments, 77% of AR teams find themselves consistently behind, unable to stay up to date with their invoices.

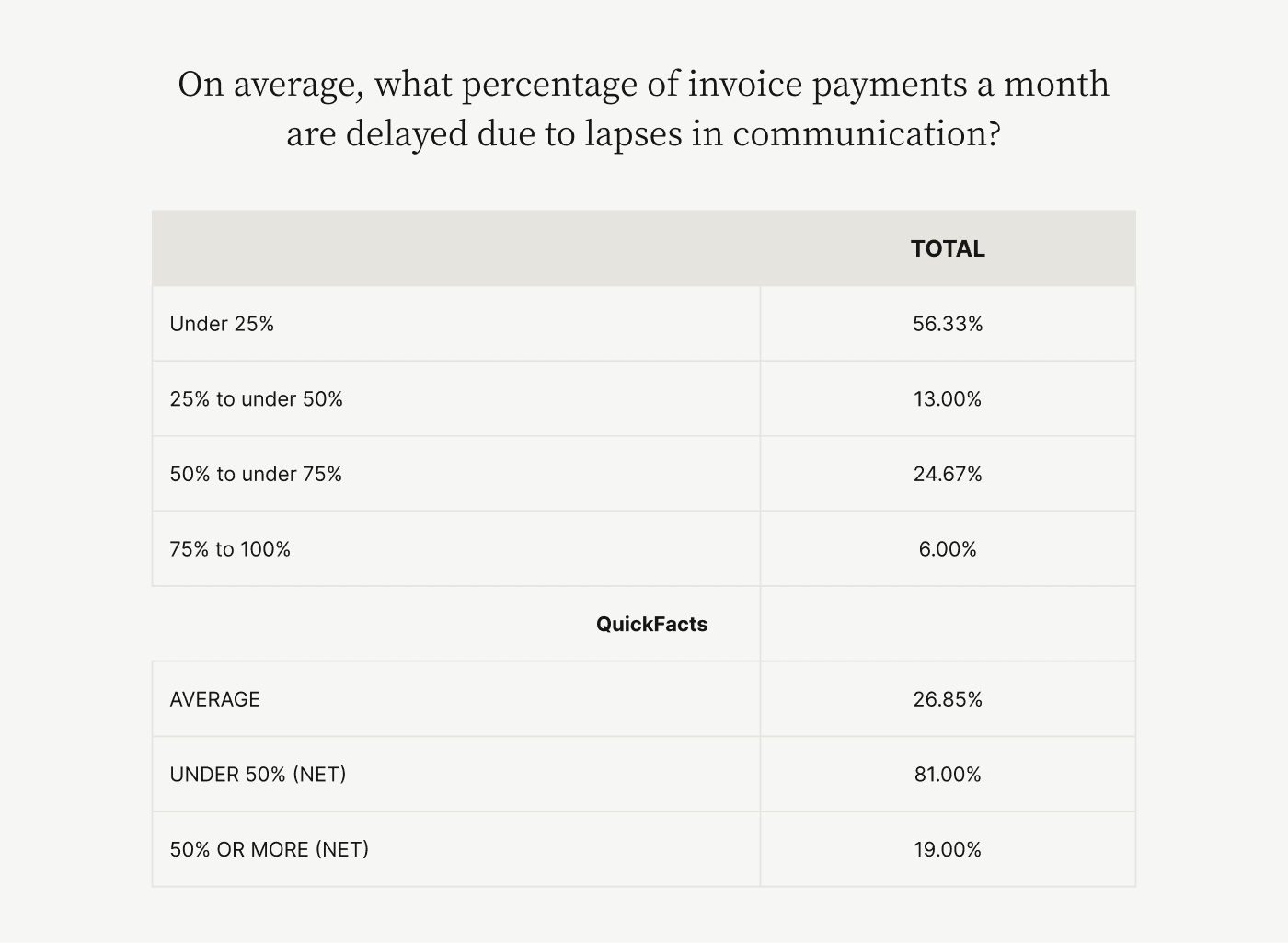

Communication breakdowns, both internally and with customers, are a major contributing factor. According to our research, 27% of all invoices face delays due to lapses in communication that lead to disputes. Resolving these disputes is labor-intensive and time-consuming, taking up more than half of each workday for over a third of AR teams.

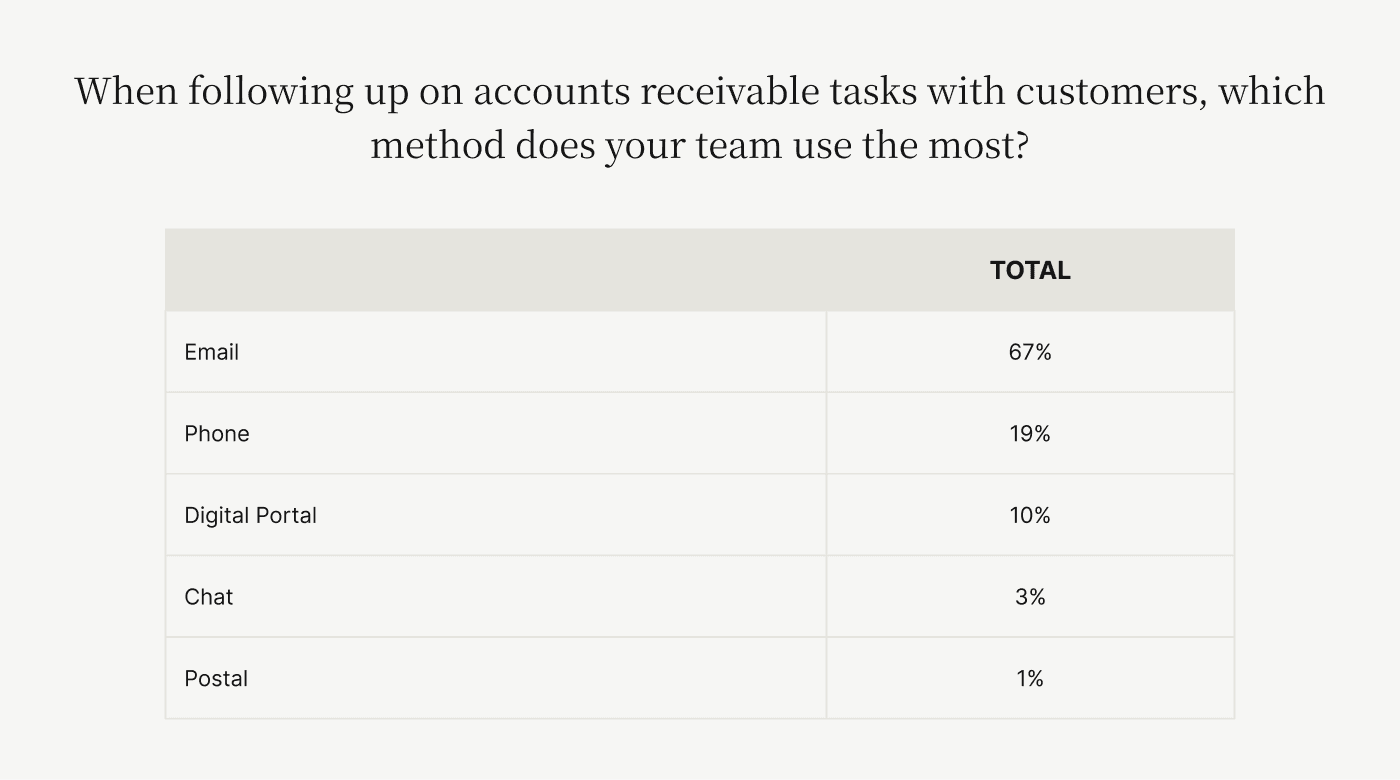

Traditional invoicing methods further exacerbate accounts receivable challenges. Outdated communication technologies like phone (used by 22% of CFOs in our study), email (43%), and re-printing/mailing invoices (21%) are prone to human error, lost documentation, and lengthy approval cycles that leave businesses hanging when it comes to collecting money that's rightfully theirs.

Companies looking to improve their cash flow recognize the critical need for massive efficiency gains. By addressing inefficiencies with an automated accounts receivable solution, companies can free their AR team from routine tasks, minimize disputes, unlock significant improvements in cash flow management and overall financial performance.

What an automated accounts receivable solution looks like

Recognizing the role that AR plays in maintaining healthy cash flow, many businesses are turning to automated accounts receivable solutions for efficiencies that accelerate payments and help their teams accomplish more with less. AR automation solutions streamline key processes within the accounts receivable cycle, such as:

Generating and delivering invoices

Accepting and processing payments other than checks

Matching and applying payments to open invoices

Facilitating collaboration and transparency

Ensuring financial reporting accuracy

Generating and delivering invoices

Accounts receivable software can automatically generate accurate invoices from your enterprise resource planning (ERP) system based on predefined rules and templates, ensuring consistency and compliance with billing requirements. These invoices can be delivered electronically to customers (or posted to cloud-based payment portals), eliminating delays associated with manual processing and postal delivery.

Accepting and processing payments other than checks

With accounts receivable automation, businesses can provide customers with a variety of secure and convenient payment options, such as eChecks and other Automated Clearing House (ACH) payments, credit cards, and virtual cards. These electronic options improve security, reduce the risk of human error, and accelerate cash application. Plus, they’re more convenient for customers.

Matching and applying payments to open invoices

One of the most time-consuming and error-prone tasks in the AR process is cash application. Accounts receivable automation software streamlines this process by automatically matching payments and remittance advice to open invoices based on predefined rules and customer information. Here’s a high-level primer on how you can improve the cash application process using automation software:

Facilitating collaboration and transparency

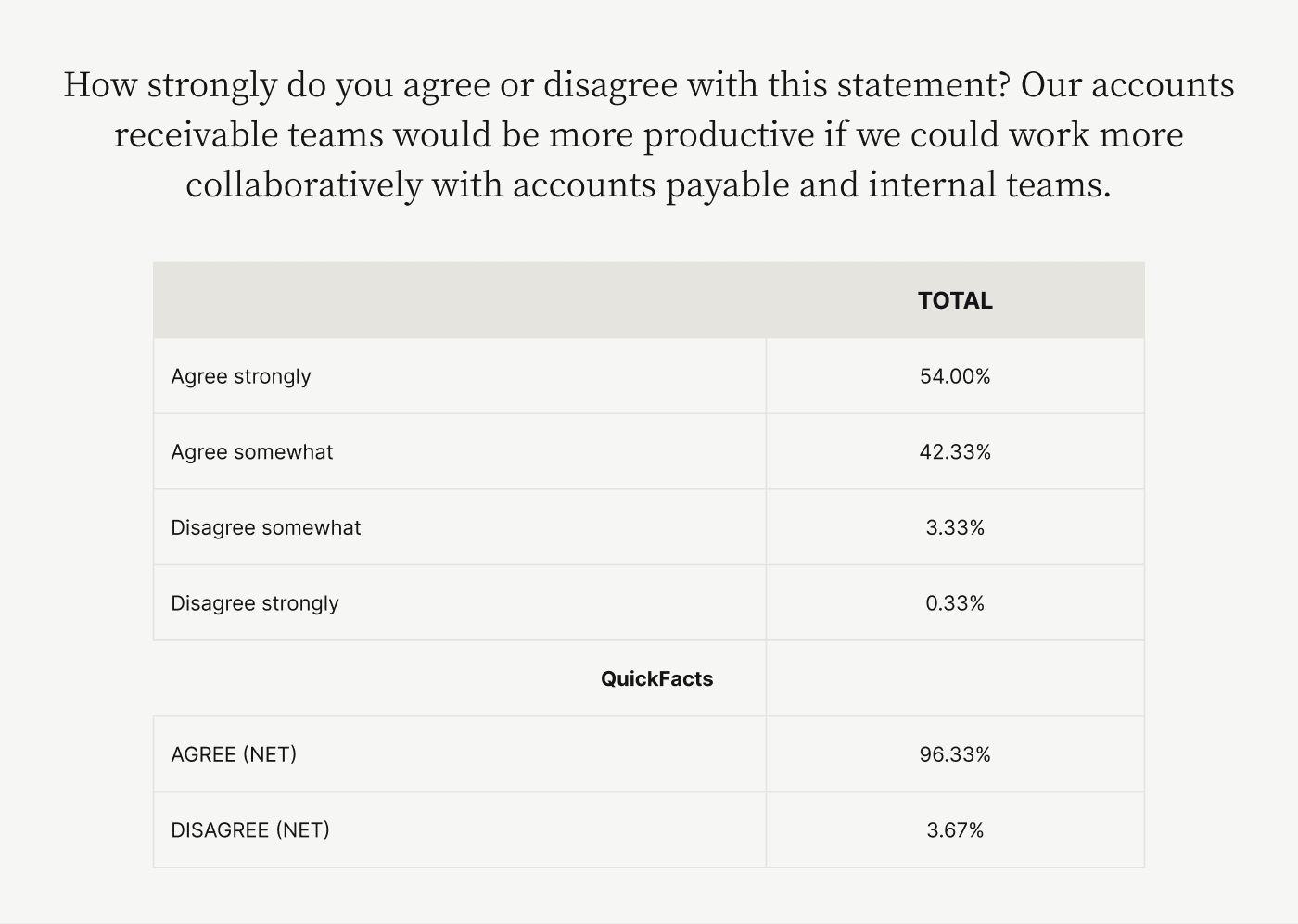

Open lines of communication between accounts receivable teams, customers, and internal stakeholders are crucial for reducing disputes and delivering exceptional customer experiences. However, our research shows that most companies struggle in this area. An overwhelming 96% of CFOs believe their AR teams could be significantly more productive if they had a better way to collaborate with their customers' accounts payable departments and other internal teams.

More than half (54%) of those surveyed strongly agree with this sentiment, highlighting how manual accounts receivable systems often hinder the level of transparency and alignment needed for smooth operations. By providing a centralized platform for documentation sharing, queries, and joint issue resolution, an automated accounts receivable solution can bridge these communication gaps, fostering productive partnerships and minimizing friction throughout the invoicing and payment cycle.

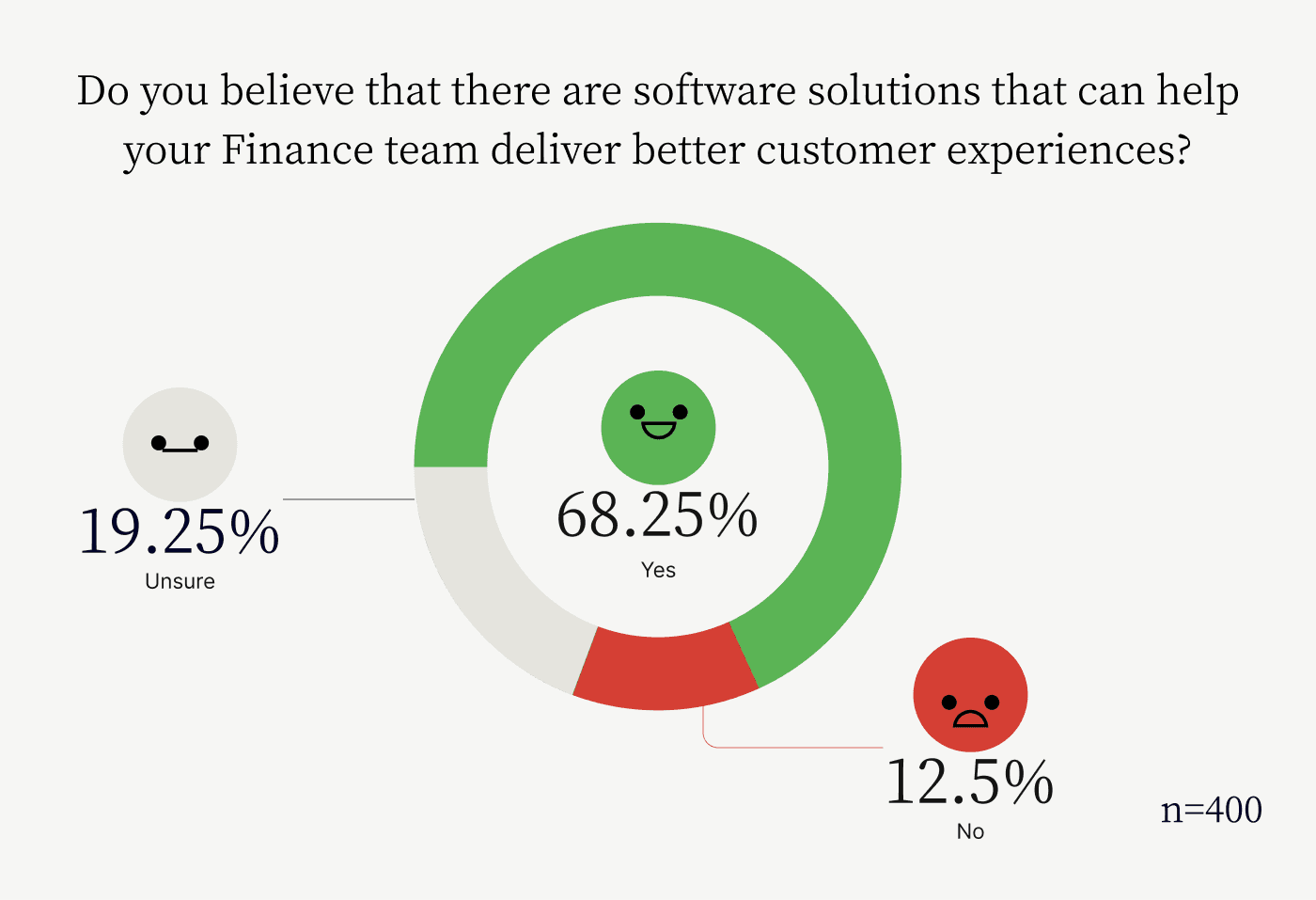

Collaboration can also help finance teams improve the customer experience, something not generally associated with collecting payments. In a study we conducted using the Gartner Peer Community platform, 76% of finance and business leaders agreed that finance teams need to contribute more to building better customer relationships. The study also revealed some good news: 68.25% know that there are software solutions out there that can help:

Ensuring financial reporting accuracy

Using accounts receivable automation software, businesses can maintain accurate and up-to-date financial records. By integrating with your ERP system or accounting software, automated accounts receivable solutions enable real-time updates and reduce the risk of discrepancies or errors. By leveraging AR automation, your business can reduce manual effort, minimize errors, and accelerate the entire accounts receivable cycle, ultimately improving cash flow and overall operational efficiency.

Benefits of an automated accounts receivable solution

Automated accounts receivable solutions offer numerous benefits that impact cash flow and operational efficiency. By automating and streamlining the AR process, businesses can unlock improvements in key areas and do more with less:

Reduced manual work

AR automation can lead to a 50% reduction in manual work related to invoice generation, payment processing, and account reconciliation. This reduction in manual effort allows your AR team to focus on higher-value tasks that are more impactful for the business, such as customer relationship management, strategic planning, and managing legitimate disputes.

Accelerated payment cycles

With automated invoicing, electronic payment options, and streamlined, collaborative processes, businesses can experience up to a 25% increase in payment speed. Faster payment cycles translate to improved cash flow, as funds are received and available for use more quickly.

Fewer past-due invoices and disputes

Automating payment reminders, payments, and collections processes reduces the number of past-due invoices by as much as 30%. This helps keep cash flow positive and improves overall cash flow management, as fewer outstanding invoices mean more predictable and timely receipt of funds. By building efficiency into your entire AR process, an automated accounts receivable solution can help your business get paid faster.

For a fuller exploration of the benefits of accounts receivable automation, check out this video:

What to look for in an automated accounts receivable solution

While the benefits of AR automation are clear, not all solutions are created equal. When evaluating automated accounts receivable solutions, it's essential to consider several key factors that can impact the success and long-term value of the investment:

Integration with existing systems

Scalability to accommodate business growth

Robust security and compliance features

Two-way communication and collaboration capabilities

Comprehensive reporting and analytics capabilities

Customer support and training resources

Integration with existing systems

To maximize efficiency and minimize disruption, your accounts receivable automation software should seamlessly integrate with existing systems, such as your ERP system or accounting software. Smooth integration ensures data integrity, eliminates the need for manual data entry, and provides a unified view of financial and customer information.

Scalability to accommodate business growth

As your business grows, your accounts receivable software should scale accordingly. Look for solutions that can handle increasing transaction volumes, support multiple currencies and languages, and adapt to changing organizational structures or processes.

Robust security and compliance features

Handling sensitive financial data requires robust security measures to protect against cyber threats and ensure compliance with relevant regulations, such as the Payment Card Industry Data Security Standard (PCI DSS).

Two-way communication and collaboration capabilities

Successful adoption and long-term use of accounts receivable automation software depend on easy-to-use, collaborative portals for accessing information and making payments.

However, other recent survey data reveals most companies currently lack such modern collaboration capabilities. Only 14% of CFOs report utilizing cloud-based tools designed to streamline communication around invoicing and payments. The remaining 87% find themselves relying on outdated, outmoded channels like phone calls, emails, and physical mail.

Without a clear path toward digitizing and centralizing AR collaboration, these businesses struggle to escape cumbersome manual processes that stifle productivity and impede cash flow.

Comprehensive reporting and analytics capabilities

Real-time visibility into key performance indicators (KPIs) and trends is crucial for effective cash flow management. Look for AR automation solutions that enable real-time, data-driven decision-making and continuous process improvement.

Customer support and training resources

Implementing accounts receivable automation can be a complex process. Reliable customer support and comprehensive training resources can help ensure a smooth transition and ongoing success. By carefully evaluating and selecting the right solution, your business can unlock significant efficiencies and gain greater control over your cash flow.

With streamlined processes and real-time visibility into your receivables, you can make more informed decisions, allocate resources more effectively, and become a strategic driver of long-term growth and profitability.

Start creating efficiencies and improving your cash flow today

If you're ready to make your accounts receivable process more efficient to boost your cash flow, talk with a Versapay expert today. Our industry-leading, collaborative accounts receivable automation platform can help you streamline operations, accelerate payments, and drive business growth.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.