Accounts Receivable Roadblocks: How to Overcome the 4 Toughest Challenges

- 11 min read

By addressing the 4 root causes of accounts receivable roadblocks, you can improve cash flow, enhance customer relationships, and increase operational efficiency.

Here are some tactics, best practices, and strategic approaches to consider.

Imagine your accounts receivable (AR) department operating with great efficiency, ensuring the timely collection of payments while maintaining excellent customer service. Your team members have high morale and a great sense of satisfaction, knowing their efforts contribute to your company's growth.

If this is your experience, congratulations—you can stop reading now.

But, if you’re like most professionals in finance and AR, you’re probably facing accounts receivable challenges that make the ideal scenario seem impossible to attain. That’s why in this article, we'll explore how to overcome the four toughest roadblocks that hinder accounts receivable performance.

Resource constraints, system limitations, and inconsistent policies and procedures can all impact your team’s ability to operate at a level that approaches perfection. However, striving towards the ideal can help your organization optimize accounts receivable processes, maintain positive customer relationships, and generate healthy cash flow.

Jump to a section of interest:

The 4 root-cause accounts receivable roadblocks—and what they mean →

Overcome every roadblock with accounts receivable automation →

What perfect accounts receivable looks like

Knowing what an optimized accounts receivable process looks like can help provide a guiding vision for overcoming your roadblocks. Let's examine what comprises accounts receivable and how each function could operate in a perfect world:

1. Invoicing and billing process

Invoices are generated accurately and promptly, with clear payment terms and due dates.

Bills are delivered to customers through their preferred channels (e.g., email, mail, or online portal).

Your invoicing system integrates with other systems (like ERP or accounting) for seamless data flow and greater accuracy.

2. Customer communication

Two-way, open communication and collaboration between sellers and buyers is fostered through advanced tools, including well-timed, relevant, credible reminders.

Readily-available documentation minimizes questions, disputes, and other forms of communication that can strain a relationship.

3. Payment processing

Multiple payment options (e.g., electronic funds transfer, ACH, virtual credit cards) are available to accommodate customer preferences.

Payment processing integrates with your accounting system, reducing manual data entry and minimizing errors.

Cash application is accurate and prompt, ensuring that payments are reconciled to corresponding invoices with minimal human intervention.

4. Collections management

Past-due accounts are identified and prioritized based on predefined criteria, such as aging, amount owed, and customer history.

Collections are systematic and consistent, following well-defined processes and escalation procedures.

Proactive communication and relevant notifications clarify payment arrangements and minimizes disputes.

5. Reporting and analysis

Real-time reporting and dashboards provide visibility into key performance indicators (KPIs), such as days sales outstanding (DSO), cash flow, and aging analysis.

Data analytics are leveraged to identify patterns, score customer risk, and optimize deduction policies and collection strategies.

Regular reviews and audits ensure the accuracy of customer records.

The 4 root-cause accounts receivable roadblocks—and what they mean

The best way to optimize AR is to address the root causes of your accounts receivable challenges. Lots of people merely focus on symptoms, while ignoring the deeper reasons behind the manifestations of accounts receivable breakdowns.

At Versapay, we define four root-cause accounts receivable roadblocks across four broad categories:

1. Outdated processes that create errors and delay payments.

One major root cause of accounts receivable challenges is the reliance on outdated processes related to critical activities like payment processing, remittance processing, reconciliation, and deduction management. Many organizations still employ manual, paper-based methods or operate with legacy systems that aren’t integrated with other business applications.

Outdated processes are highly susceptible to human errors, data entry mistakes, and inefficiencies that negatively impact cash flow and working capital management.

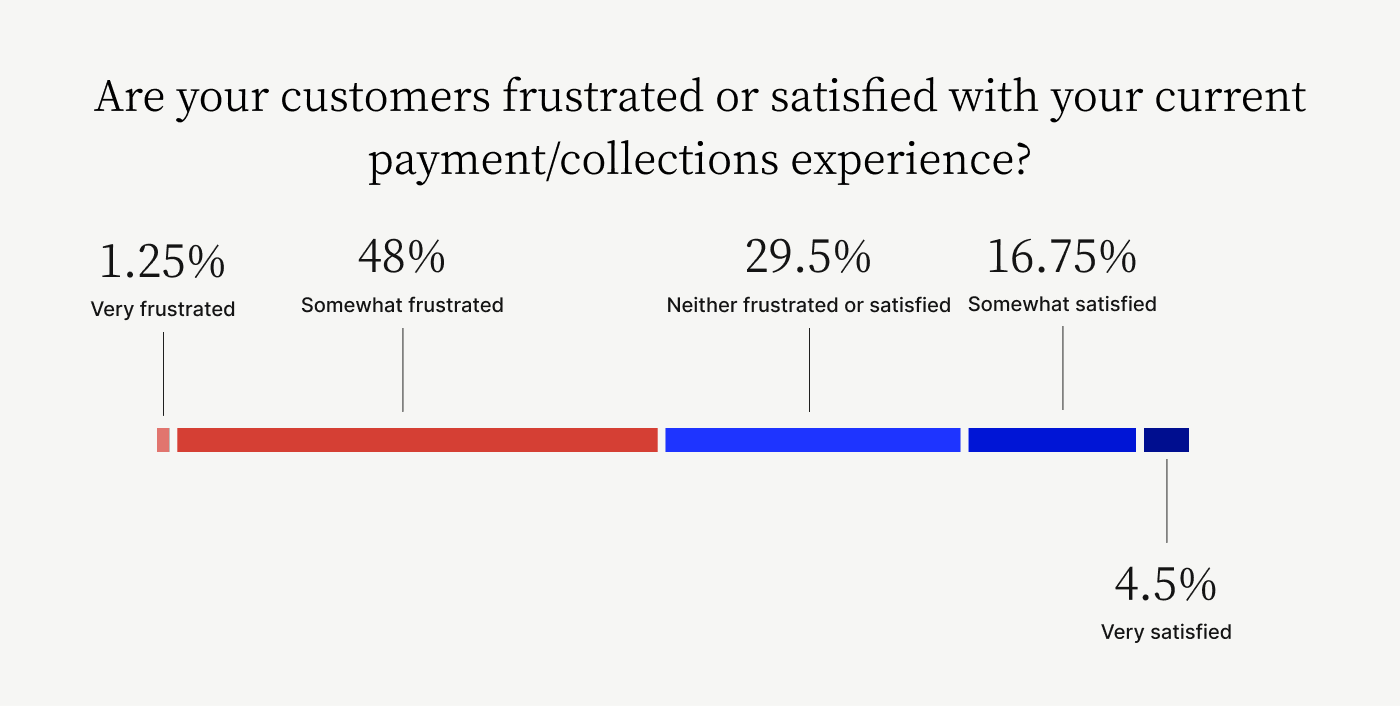

2. A lack of collaboration that creates inefficiencies and frustrates customers.

Ineffective communication channels and a lack of clear communication protocols can hinder the accounts receivable process. Customers may not receive invoices if they get lost in the mail or piled on their desks, for example, or they may struggle to get their inquiries addressed promptly.

3. Insufficient resources that create burnout and take people away from higher-value work.

With a significant accountant shortage affecting many industries, accounts receivable teams are often understaffed and overburdened. This often leads to:

Fragmented cash flow management — With increased workload, accounts receivable professionals have less time for more important activities, such as cash flow forecasting and analysis. They can also become less effective at identifying and resolving issues such as customer disputes, delayed payments, and cash application, leading to decreased visibility and inaccurate projections.

Customer dissatisfaction — Accounts receivable teams play a crucial role in delivering smooth payment and dispute-handling processes to enhance the customer experience. However, when overloaded with tasks, resolving complex customer disputes becomes difficult. This can result in customers feeling misunderstood and strain the important relationship between the company and the customer.

Employee resignation — Overworking employees in accounts receivable can lead to a talent exodus that exacerbates the aforementioned problems and make it harder to attract new talent in the future.

Accounts receivable automation can free your team members from repetitive, manual tasks and free them up for more strategic and fulfilling activities. Advanced technology can enhance the productivity of your current staff and build morale that keeps teams together.

4. Inconsistent policies that create misalignment across departments.

A lack of standardized policies and procedures for accounts receivable can lead to inconsistencies across different departments within an organization.

For example, your sales team may follow different discount and deduction policies, creating confusion for customers and friction in finance. Inconsistent policies can also hamper collaboration and data sharing among teams, leading to additional inefficiencies.

Removing accounts receivable roadblocks: tactics, best practices, and strategies you can use now

By addressing the four root causes of accounts receivable challenges, you can improve cash flow, enhance customer relationships, and increase operational efficiency. Here are some tactics, best practices, and strategic approaches to consider:

Modernize outdated processes

Tactics for modernizing outdated processes

Integrate your accounting system with other business applications (e.g., CRM, ERP) for seamless data flow

Implement technologies like optical character recognition (OCR) for automated data capture and quicker invoice processing

Offer customers digital payment options; support ACH and credit card payments and encourage customers to use autopay for recurring payments

Broader strategies for modernizing outdated processes

Adopt digital transformation initiatives, such as electronic invoicing and online customer portals

Migrate to a cloud-based accounts receivable software or solution

Leverage artificial intelligence (AI) and machine learning (ML) for intelligent invoice processing and predictive analytics

Improve communication

Tactics for improving communication

Update customer records with accurate contact information

Establish clear communication protocols and escalation procedures

Send payment reminders and prioritize follow-up

Provide regular training to customer-facing staff on effective communication and customer service

Broader strategies for improving communication

Implement a system for centralized, omnichannel communication, such as a collaborative accounts receivable payment portal

Leverage invoicing and payment solutions that enable invoice and/or line-item-level disputes and communications

Automate routine touch-points and payment reminders

Leverage conversational AI and chatbots for 24/7 customer support and inquiries

Overcome resource insufficiencies

Tactics for managing insufficient resources

Implement process automation to reduce manual workload

Cross-train team members to provide coverage and reduce bottlenecks

Broader strategies for managing insufficient resources

Invest in modern accounts receivable software and tools to improve efficiency

Outsource or leverage shared services for specific tasks, like collections or cash application

Make policies more consistent

Tactics for making policies more consistent

Establish standardized policies and procedures across all relevant departments and business units

Understand the risk profiles of customers and make adjustments to credit terms, if warranted

Conduct regular audits and compliance checks to ensure policy adherence

Provide comprehensive training and documentation for consistent policy implementation

Broader strategies for making policies more consistent

Leverage business process management (BPM) tools to automate policy-driven workflows

Adopt a governance framework to ensure integrity across systems

Overcome every roadblock with accounts receivable automation

Implementing individual tactics and best practices can provide incremental improvements and help you overcome your accounts receivable roadblocks. But if you want to truly transform your accounts receivable function, you should consider adopting an advanced automation platform that tackles all four roadblocks simultaneously.

An accounts receivable automation platform can reduce manual efforts, minimize errors, free up staff, and prevent burnout through features like intelligent data capture, automated invoice processing, and seamless integration with other business systems. Self-service customer portals and automated communication workflows can improve customer communication and satisfaction.

The long-term benefits of improved cash flow, enhanced customer relationships, and increased operational efficiency through automation provide a solid foundation for sustainable growth and competitive advantage.

To learn more, talk to an expert today. Or, take our 6-minute assessment to learn where you are in your digitization journey, how you stack up against peers, and how to set your AR team up for success.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.