What Is an Invoice? Examples, Best Practices, and Tips

- 13 min read

Invoicing is a critical aspect of almost every business. While it may seem simple, there are a lot of factors that business owners and accounting teams need to think about.

This blog outlines everything you need to know to start invoicing your customers.

So, what is an invoice?

A formal invoice is a legal document issued by a seller to a buyer. It itemizes the details of a transaction, indicating the products provided or services rendered and at what price. An invoice will also include information regarding when a payment is due—the payment terms—and how payments can be made—the available methods of payment.

Issuing an invoice is the first step a seller will take to collect payment. Invoices establish an obligation on behalf of the buyer to pay their supplier and serve as proof of debt owed.

In this article, we’ll cover everything you need to know about invoices, including:

- The reasons why businesses send invoices

- The different types and parts of invoices

- The difference between invoices, bills, and receipts

- What an invoice should look like and examples of invoices

- How to send an invoice: 12 steps

- Invoicing best practices

- How to streamline the invoicing process with accounting software

3 reasons for issuing invoices

Invoices for payment are commonly issued when transactions are paid on credit (meaning the payment is due at a later date). When businesses make the decision to offer credit terms, they’re taking on risk by allowing payment to be deferred.

Issuing invoices not only helps businesses establish a formal request for payment, but it also helps with the following:

1. Legal protection

Invoices are not legal proof of a commitment made between seller and buyer. They leave too much room for manipulation to serve as such. But, they are still helpful in protecting businesses from fraudulent lawsuits and do still encourage timely payments. If you plan on pledging your invoice as collateral, you must make a documented attempt to collect on it.

2. Payment tracking

Invoices help both the seller and buyer keep track of payments and debts owed. When your invoicing volumes eclipse a certain threshold, however, keeping track of the status of each invoice can be daunting.

Without adequate follow-up, payments will quickly become past due, meaning AR staff will have to spend time sending multiple emails, mailing dunning letters, and calling customers directly to confirm invoice statuses. Online invoicing portals are great solutions for remedying this issue, as they inform customers of payments owed in real-time.

3. Record maintenance

A company invoice offers proof of sale. They ensure a clean audit trail for both sellers and buyers. Invoices ensure either party can easily confirm when goods or services were sold, who purchased them, and to who they were sold.

Clean audit trails are important for finance teams, especially for tax filing purposes. Having a record of all invoices issued and collected makes it easier for businesses to report their income. Dedicated invoicing software can help you keep a record of all your invoices.

6 different types of invoices

There are several different types of B2B customer invoices, each serving unique purposes. These types and invoice examples include:

1. Past-due invoice

All invoices are accompanied by payment terms (net 30, 60, 90, etc.). When those dates have come and gone and a payment is considered late, the original invoice is recognized as a past-due invoice. In other words, a past-due invoice is simply a common sales invoice that’s labeled according to its status.

It’s important to note that a past-due invoice is not the same as an outstanding invoice—despite the terms being commonly used interchangeably. An outstanding invoice is one that’s yet to be paid, but the invoice date has not yet passed. An outstanding invoice will become a past-due invoice once the payment terms have come and gone.

2. Pro forma invoice

Pro forma invoices are used when providing a quote for jobs or services before the work is completed. You can think of them as a preliminary bill or advance invoice that details the projected costs of a product or service. Pro forma means expected, so, unlike a traditional sales invoice, the pro forma is a commitment for goods and services yet to be delivered.

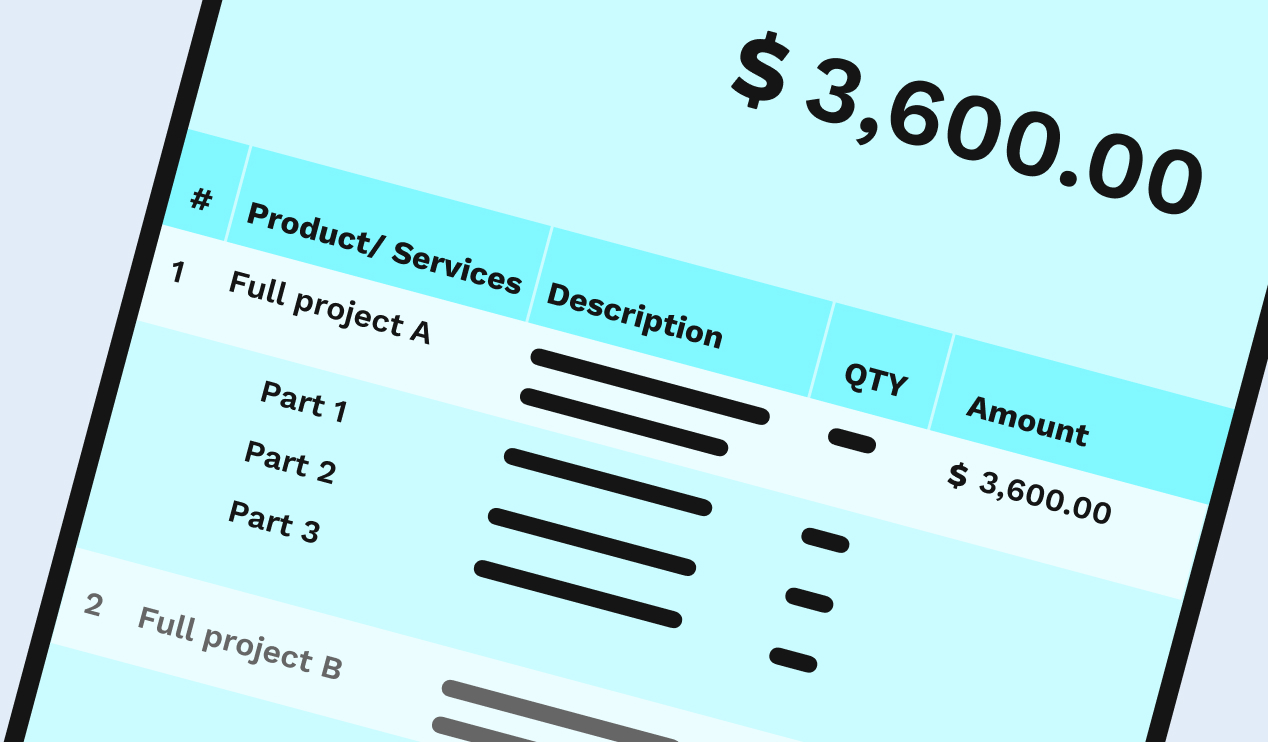

3. Interim invoice

Interim invoices might also be referenced as progress invoices or progress bills. This is an accounting method where the business invoices its customer in regular increments—typically for a large project. They’ll bill for a percentage of the project—often what’s been completed up to that point.

A supplier will send interim invoices throughout the duration of the project—either on a weekly, monthly, quarterly, or another recurring basis. Interim invoices are based on an initial project estimate that the customer will have already agreed to.

4. Recurring invoice

Recurring invoices are sent to customers at regular, repeating intervals. These are most associated with repeat transactions, such as subscription fees. Cloud-based invoicing and billing software makes it easy for AR staff to send recurring invoices—and for their customers to set up recurring payments.

5. Credit invoice

Credit invoices are issued when a customer must be provided with a discount or refund. This is commonly performed when correcting prior invoicing errors. The credit invoice will always include a negative total number. For example, if you were to provide a customer with a credit invoice detailing a $1250.00 refund, the credit invoice would total negative $1250.00.

You might hear credit invoices referred to as credit memos or credit notes. The purpose remains the same. These documents are issued frequently when goods are returned due to damages or mistakes.

6. Debit invoice

On the flip side, a debit invoice—which can also be called a debit memo or note—is issued when payment owed must be increased. If an invoice was issued incorrectly—meaning the dollar value was too small—the debit invoice will account for the adjustments needed.

What’s an invoice? Key differences between an invoice, a bill, and a receipt

Invoices are often referred to as bills or receipts—and vice versa. Despite their similarities, however, it’s important to note that these three documents are all different and each serves a different purpose.

Invoices

Invoices are highly descriptive and serve as a formal request for customers to pay a debt. Invoices include information about the seller and buyer and are not only used for requesting payment, but also for record-keeping and payment instruction.

Bills

The difference between a bill and an invoice is that bills generally do not contain customer information and are more generic. Buyers will typically receive bills without an invoice. One example is a bill that is tendered when shopping at a retail store or when dining at a restaurant. The expectation with a bill is that payment will be made immediately, rather than at a future date.

Receipts

Receipts are an acknowledgment that the supplier—or seller—has received payment from the buyer. Alternatively, it’s an acknowledgment—from the buyer’s perspective—that payment was received. For customers, a receipt is proof of payment as well as proof of ownership of goods or services received.

In short, invoices are specific types of bills, but not all bills are invoices. Much like a Honda is a type of car, but not all cars are Hondas.

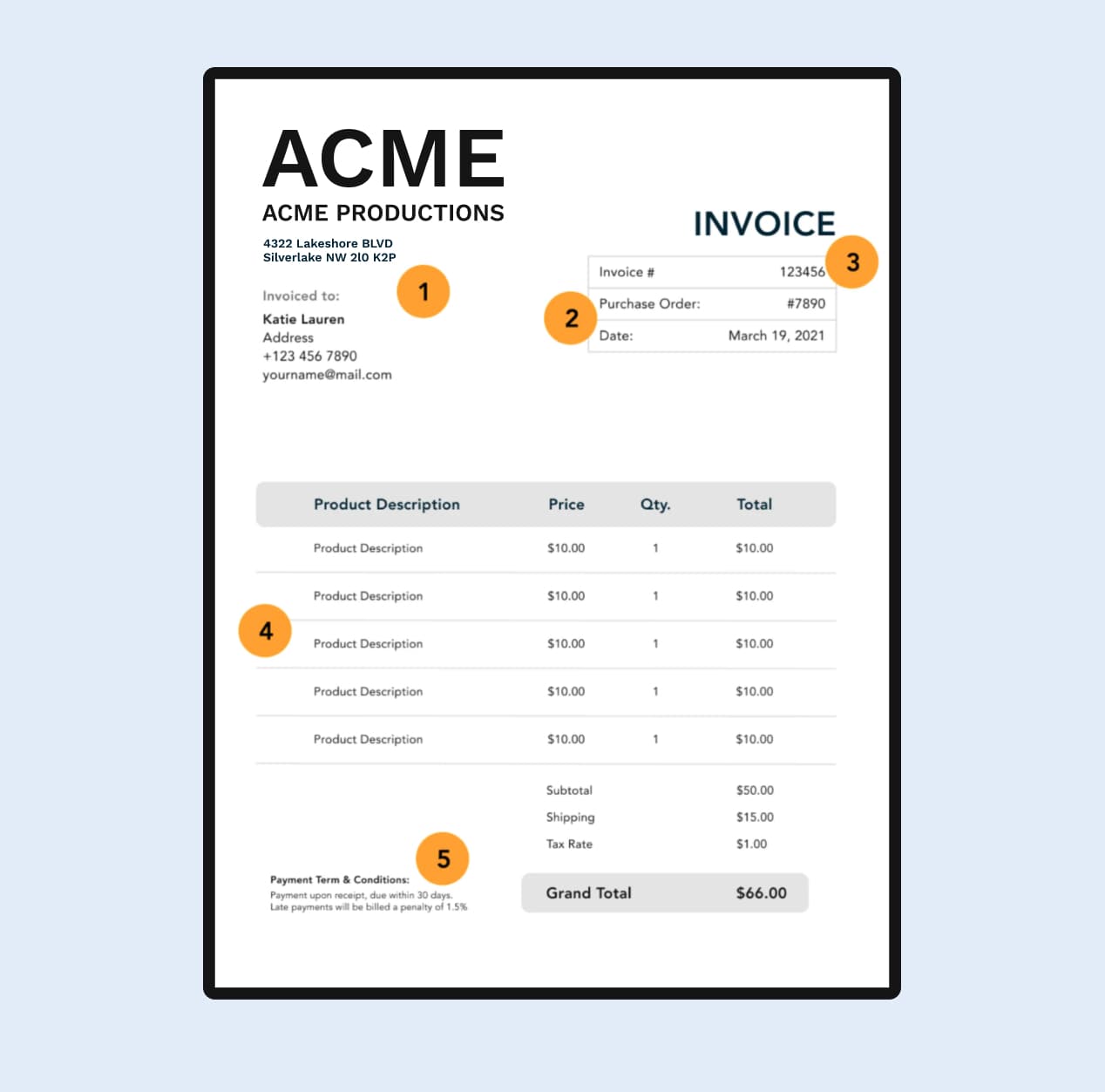

What should an invoice look like?

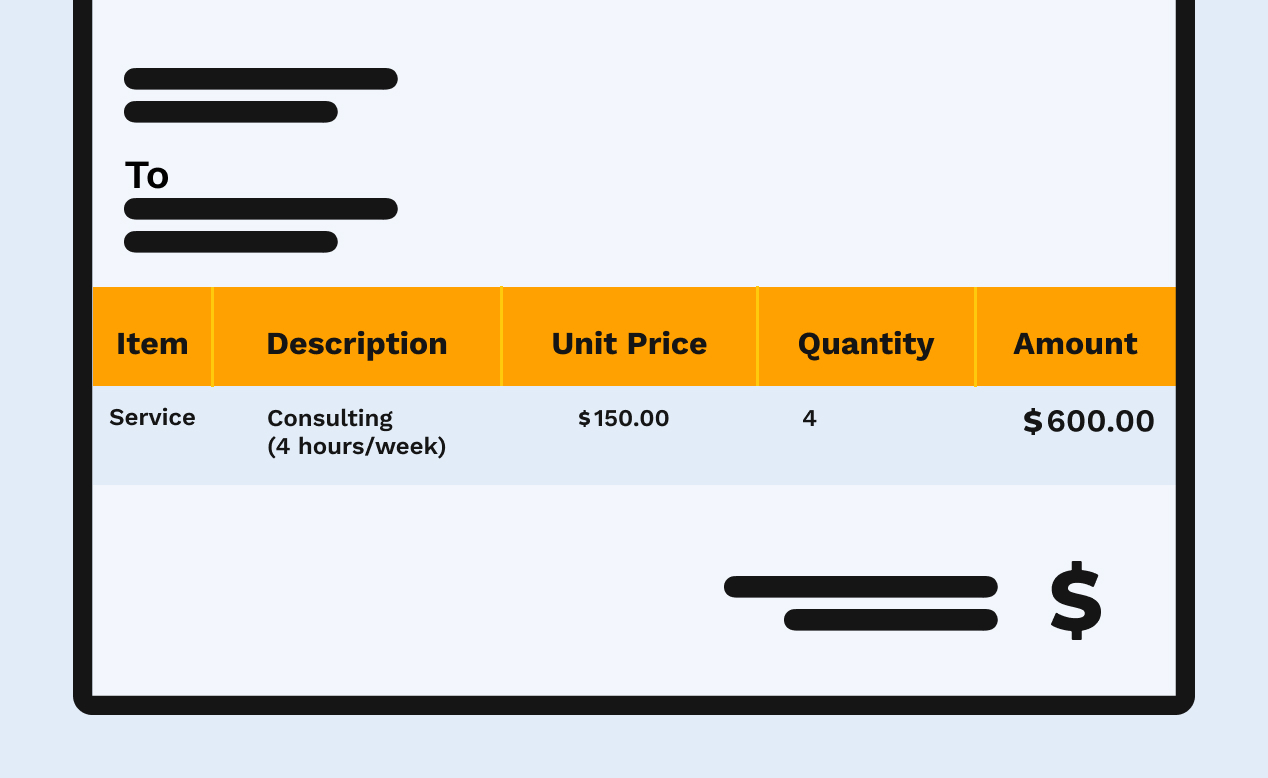

An invoice is comprised of several elements. Below are the five most important components of an invoice and what each means.

1. Vendor and customer contact information

An invoice should clearly display the seller’s contact information. This includes the company’s name, mailing address, and primary contact. This information is especially vital when payments are being made using physical methods (like checks).

To ensure the right person receives your invoice (and increase your likelihood of getting paid), be sure to include the name of your contact at the company who’s receiving the receiving the invoice.

2. Purchase order number

The purchase order number lets the customer’s accounts payable department know if the transaction they’re being invoiced for has previously been authorized. The AP department will reference this number when matching the invoice with the original purchase order to complete payment.

3. Invoice number

The invoice number, or invoice ID, is created by the seller. It serves as a reference for the payment once you’ve received it from the buyer. You don't need to assign invoice numbers sequentially, but there should be consistency in the way you assign them to avoid duplications and future bookkeeping errors. If you generate your invoices through a financial management system, this shouldn't be an issue.

When the buyer’s AP department pays the invoice, the original purchase order will be closed out. This indicates that the transaction is complete. The invoice number will be referenced as confirmation.

4. Product description and pricing

The product descriptions and accompanying prices define what goods or services the buyer is being invoiced for. What’s stated here should exactly reflect the product descriptions and prices found in the purchase order.

5. Invoice payment terms

The invoice payment terms will indicate to the buyer’s AP department when the seller expects to receive their payment (payable upon receipt, net 30 days, net 45 days, etc.). This section will also outline by which method the seller prefers to receive their payment, which could be by check, ACH, bank transfer, or credit card.

Sellers that have automated much of their invoicing processes and are accepting digital payments will likely include steps on how the customer might pay digitally. For example, the invoice might include a link to their online payment portal.

How to send an invoice: 12 steps

Once the seller is ready to collect payment from the buyer, the seller must follow certain steps to properly compose and send an invoice. These steps need to be followed carefully, as invoicing errors can lead to late payments and further potential compilations. Follow the 12 steps below to ensure all invoices are sent out correctly from the start:

- Step 1—Include your brand on the invoice

- Step 2—Label the document as an invoice

- Step 3—Include the unique invoicing number, the purchase order number (if applicable), and the date the invoice will be sent

- Step 4—Add your company name, address, and contact information

- Step 5—Add your buyer’s name, address, and contact information

- Step 6—Feature a Product description & pricing section with a summary of the services provided including quantities and costs

- Step 7—List the full balance due including tax and additional rates

- Step 8—Include all invoice payment terms and conditions

- Step 9—Highlight the acceptable payment methods

- Step 10—Send the invoice via the agreed upon invoice delivery method

- Step 11—Use an invoice tracker to ensure payment deadlines are met

- Step 12—Schedule routine payment reminders to be sent

While these steps should be adhered to for all invoicing methods, electronic invoicing helps streamline the process for faster payment collections.

3 invoicing best practices

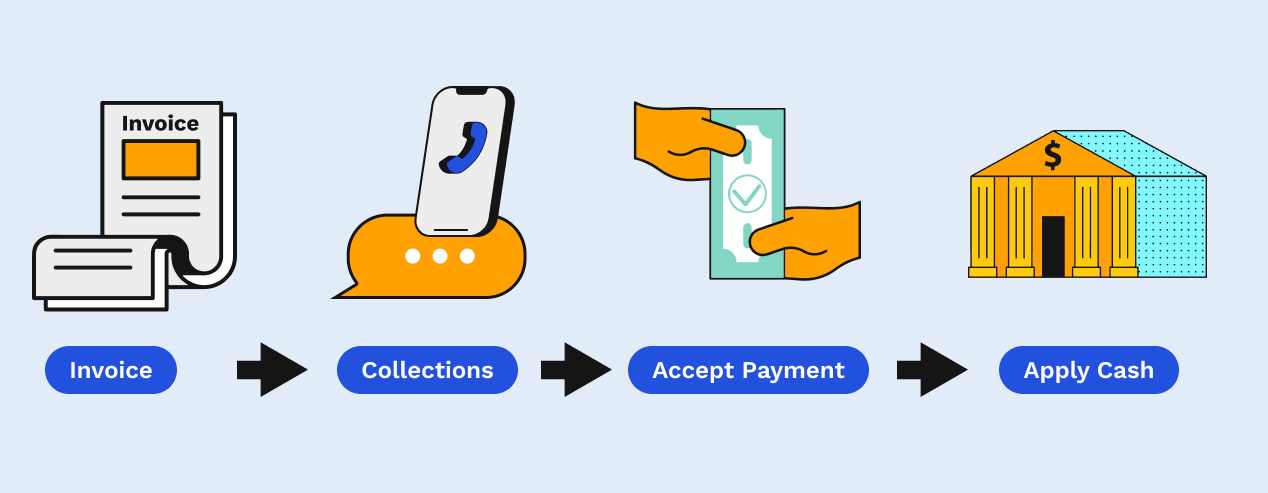

Invoicing is just the first step in the receivables lifecycle. How efficient you are at getting invoices out to customers will affect the speed with which you can carry out the next steps in the invoice to cash cycle.

The invoicing process—from creation through to payment application—is rife with challenges. Businesses that rely on manual invoicing practices tend to bear the brunt of this and should consider revising their approach if they want to improve their cash flow.

Here are three best practices we recommend for streamlining the invoicing process for both you and your customers.

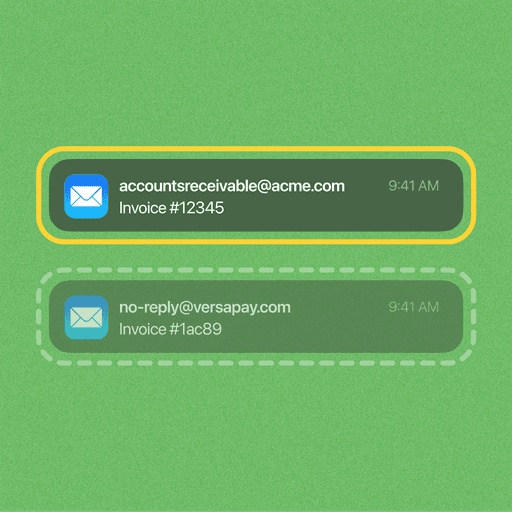

1. Give customers multiple options for receiving their invoices

Your customers each have their own wants and needs. That extends to invoicing, too. There’s no rule that states each invoice must be sent by mail or each invoice must be sent on the first of the month.

In giving customers multiple invoice delivery options—whether that’s via email, electronic data interchange, accounts payable portal integration, or traditional mail—, you’ll give them a more convenient experience tailored to their own accounting processes.

2. Combine your invoices and supporting documents so that they’re always together

Traditionally, invoices and their supporting documents have been sent separately. Technological limitations and that’s just the way things are done tend to be the main culprits behind AR teams sending documents separately. This creates inefficiencies, as customers are forced to access the two individually, leading to confusion and payment delays.

The solution is to allow customers to access invoices and supporting documentation together. Seek out invoicing software that links invoices with relevant documentation electronically, so that it’s always on-hand and everyone is speaking to a single source of truth.

3. Invoice through a dedicated, cloud-based portal

Wouldn’t it be nice if you and your customers could get access to the same invoice information and view their status in real time? What about the possibility of spotting trends regarding when invoices tend to become past due?

Electronic invoicing can decrease that stack of outgoing, paper invoices that just keeps growing. If you want to provide your customers with an easy and efficient way of receiving and paying invoices electronically, then an online invoicing portal is a great place to start.

Beyond the increased visibility that a cloud-based invoicing portal gives your customers and AR team, there are other reasons to embrace online invoicing software.

How AR automation transforms the invoicing process and beyond

Printing and sending out invoices through the mail is a costly and time-consuming process. If each individual invoice costs between 50 cents to a dollar to mail, then you could be spending thousands of dollars each month (depending on the volume of invoices you send) on a cost you thought was nominal. And that doesn’t even account for the cost of the labor it took to print invoices and stuff envelopes.

And you may think that simply sending invoices electronically (via a PDF attached to an email for example) will address all your team’s challenges when it comes to invoicing, but unless you’re automating the delivery of the invoice too, it’s still a manual process.

An accounts receivable automation platform like Versapay allows you to transition away from traditional manual invoicing processes to a fully automated process. In digitizing and automating your invoicing you’ll:

- Create fewer opportunities for data to be keyed in inaccurately, files to be lost, or payments to be incorrectly applied

- Eliminate the time your team spends preparing and mailing invoices, helping you to receive payment faster and lowering your days sales outstanding (DSO), and

- Build better customer relationships through a more convenient billing and invoicing experience

How to handle a late or unpaid invoice

To minimize late invoice payments, consider scheduling automatic email reminders to your customers prior to the stated deadlines. However, if the deadlines pass and the invoices remain unpaid, your next step should be to contact your customers.

In situations where customers refuse to pay, it’s important to reach out to them and find out what specifically they disagree with—or are disputing. If the disputes can’t be amended through conversation, you may need to take legal action to collect payment for your goods or services.

Even if they don’t refuse, customers may still fail to follow the payment guidelines or lack the funds to pay. To discourage this, consider offering early payment incentives through discounted rates or late fees. However, if these incentives aren’t effective, legal action may still be necessary.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.