Basic vs. Collaborative Payment Portals: Why Accounts Receivable Teams Should Know the Difference

- 9 min read

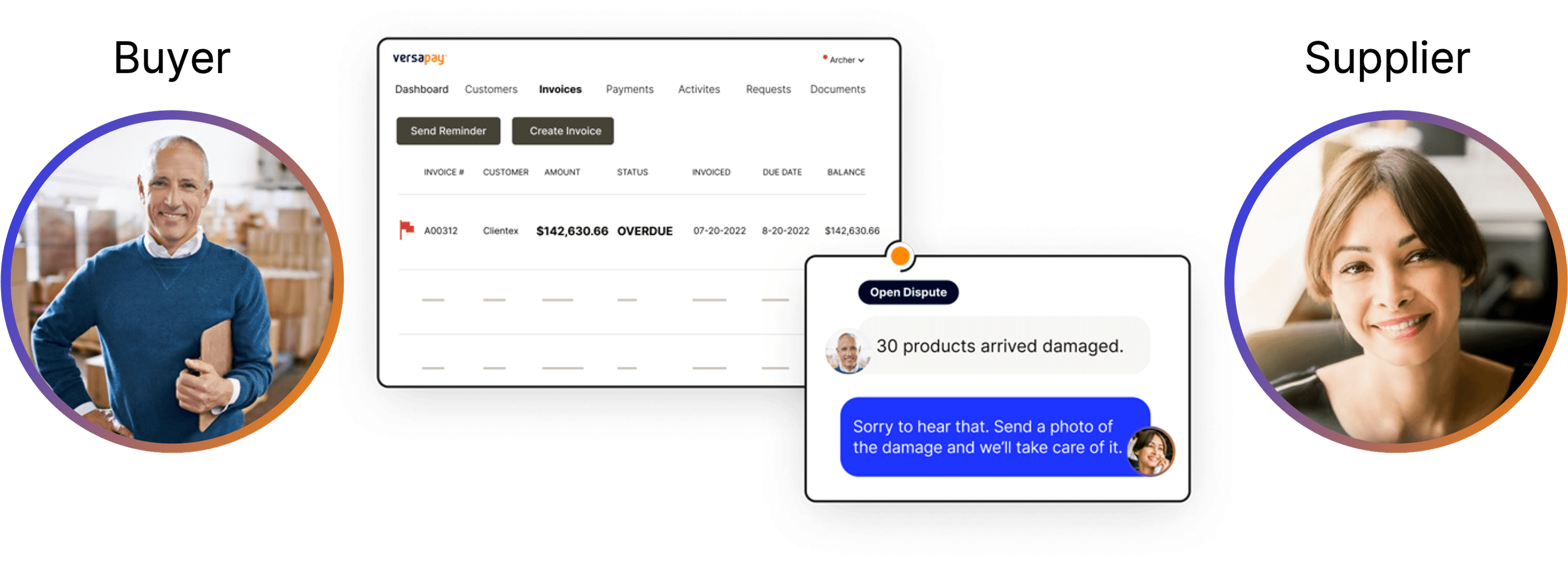

Customer payment portals provide a self-service way for buyers to view invoices and make payments. But, what they traditionally lack is a way for buyers to communicate back to their supplier.

Collaborative payment portals solve for this by allowing AP and AR teams to communicate and resolve invoice issues in one place.

Accepting electronic payments is an important mechanism for accounts receivable (AR) teams, both for satisfying B2B buyers’ desire for digital payments and getting back-office processes away from labor-intensive paper checks.

But without a way to let customers self-serve, many AR teams have had to resort to processing digital payment methods like credit cards over the phone.

This challenge of giving customers convenience without creating more work for AR teams is what led to the introduction of online payment portals. These allow customers to log in and submit payments on their own, without requiring involvement on the AR team’s behalf.

Customer payment portals have created significant efficiencies for payment processing and cash application, but they don’t come without challenges of their own.

There are two kinds of customer payment portals:

- Basic payment portals, and

- Collaborative payment portals

Both allow AR teams to accept online payments, but they aren’t created equally. Only one addresses the need for better customer experience (CX) in the invoice to cash (I2C) process, and that’s collaborative payment portals.

In this article we’ll explore the important differences between these two types of payment portals and why they matter for your AR team.

The customer experience gap in accounts receivable

In a recent Versapay and Wakefield Research study, 73% of 1,000 C-level executives surveyed agreed that the I2C process can be a source of negative CX. Seventy-two percent also said they’re concerned that their AR department is not customer-oriented enough.

These statistics show a dissonance in C-suite leaders’ minds. The same survey found that most executives (89%) consider customer experience to be a critical measure of the C-suite’s effectiveness. Where CX is a problem, these executives see it as a reflection on them. And yet they acknowledge the CX limitations in their AR processes and haven’t addressed them.

When it comes to AR, a surprisingly large share of finance teams still relies on manual and paper-based processes. This means customers are usually left waiting for their invoice to come in the mail before they can even know what they owe. This lack of visibility only breeds confusion that later holds up payments.

Customer payment portals have made inroads solving this problem by giving customers an opportunity to keep track of what they owe and pay their invoices promptly online.

B2B buyers facing hundreds or thousands of invoices for payment each month tend to prioritize payments they can get out of the way fastest. Suppliers who provide a convenient way to pay online will get preferential treatment in the payment process, making it in AR teams’ best interest to put technology in place that allows them to do this.

What is a customer payment portal?

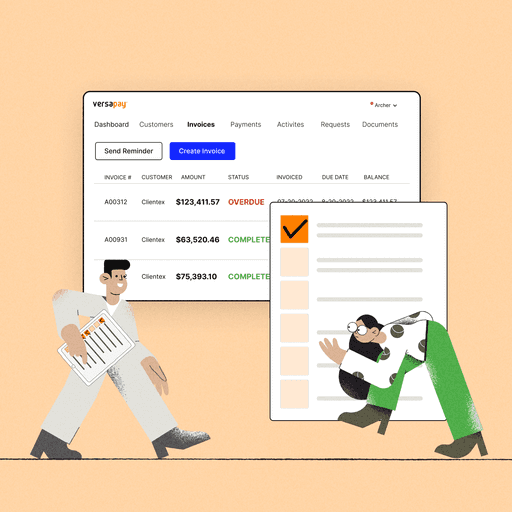

A customer payment portal (also known as a customer billing portal) provides a streamlined way for customers to pay invoices. It also allows buyers and sellers to view invoice and account histories, providing a helpful audit trail for both.

With a standard customer payment portal, the efficiency gains lend themselves mostly to the AR back office. Payment portals reduce human effort by allowing AR teams to automatically apply incoming payments to their matching invoices. However, for customers’ accounts payable (AP) teams, these simple payment portals can be frustrating.

A typical payment portal allows AR teams to share information with their customers’ AP team, but not the other way around. When disputes or questions arise, the AP rep is forced to turn to traditional communication methods, like phone and email, to clear up any issues with the AR team. Phone calls go unanswered, and emails get buried in people’s inboxes, making it difficult for customers to get a timely response.

Now take this problem and contextualize it in an environment where increased supply chain and staffing issues impact order delivery. AR teams have a higher volume of invoice disputes to deal with, making it difficult to resolve them quickly.

And all this for what? Just to complete a single transaction. Your customer’s AP team has hundreds more to process, and so does your AR team.

What is a collaborative payment portal?

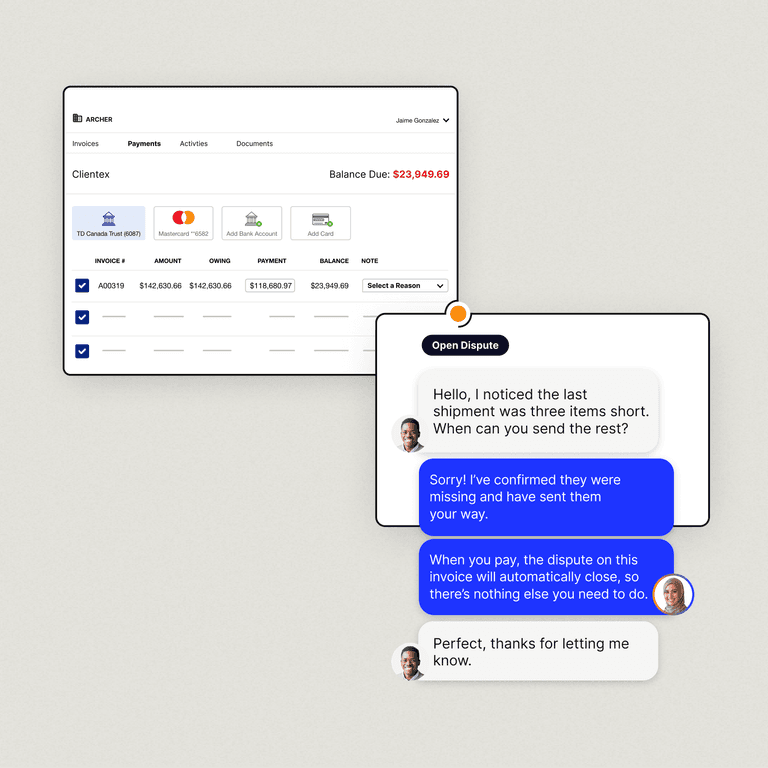

A collaborative payment portal goes beyond a traditional customer payment portal by allowing buyers and sellers to interact over the cloud to manage the invoice to cash process together. It includes all the back-office efficiencies of a regular customer payment portal, but is much more CX-focused.

Collaborative payment portals allow for the two-way communication that’s missing with traditional payment portals. Not only can you share invoices with customers, but they can also leave questions and comments directly on those invoices for your team to answer.

By keeping conversations within the portal, this greatly reduces the need for AR and AP teams to pick up the phone or turn to email, speeding up dispute resolution and avoiding significant payment delays.

Not only does this let you collect online payments faster, but it also lets your customers process invoices faster. And any time you can make your customer’s job easier, you pave the way for higher customer lifetime value (CLV).

Why opt for a collaborative payment portal instead of a regular payment portal?

When looking to improve your own AR operations with a self-service customer payment portal, seeking out a tool that prioritizes collaboration can have positive downstream effects on your business.

Here’s why collaborative payment portals have an edge on basic payment portals:

Collaborative payment portals streamline dispute resolution

AR teams spend much of their day handling dispute resolution. Not only is this costly from a labor perspective, but the longer a dispute goes unresolved, the longer you’re missing out on the cash you’re owed. These costs can add up quickly, directly impacting your bottom line.

According to the executives polled in our study with Wakefield Research, 100% of CFOs (and 99% of CEOs) agreed that disputes in the I2C process could have been alleviated with better communication between their AR department and the AP departments they deal with.

A further 85% of the C-suite noted that poor communication between their AR teams and their customers led to their business being paid less than it was owed.

Collaborative payment portals have two distinct features that make handling disputes far easier:

- They allow your customers to interact with invoices at the line-item level. For example, if your customer received all items noted on their invoice except for one, they can flag the missing item and exclude it from their payment.

Your AR team receives that short payment along with clear communication of the reason for the short payment. Without a collaborative payment portal, customers would have to call or email your AR team to resolve the invoice dispute, meanwhile, you would receive no payment until the one line item issue was resolved. - They make it easy for your AR team to collaborate internally and with other departments. With a portal that anyone on your team can access, issues that need to be escalated to upper management can be easily routed to the right person.

And with the complete record of the issue consolidated in one place, this makes it easier for upper management to understand the issue and reach a resolution.

Many times, there can be a disconnect between sales and AR teams that leads to invoice disputes. For instance, if a salesperson offered a customer a discount that wasn’t applied to an invoice, AR has the frustrating job of working with the customer to resolve the dispute.

Read more here about how collaborative payment portals can help AR and sales teams work together better.

Collaborative payment portals see higher customer adoption

Further evidence of the effectiveness of collaborative payment portals in creating superior customer experiences is the high end-user adoption they encourage. That is, how frequently your customers engage with the portal.

Industry standard for customer payment portals tends to hover around 20%. In contrast, Versapay’s collaborative payment portal sees over 80% adoption rate on average. This means our clients’ customers see significant value in the platform and continue to use it to manage their payments.

How executives are prioritizing payment portals right now

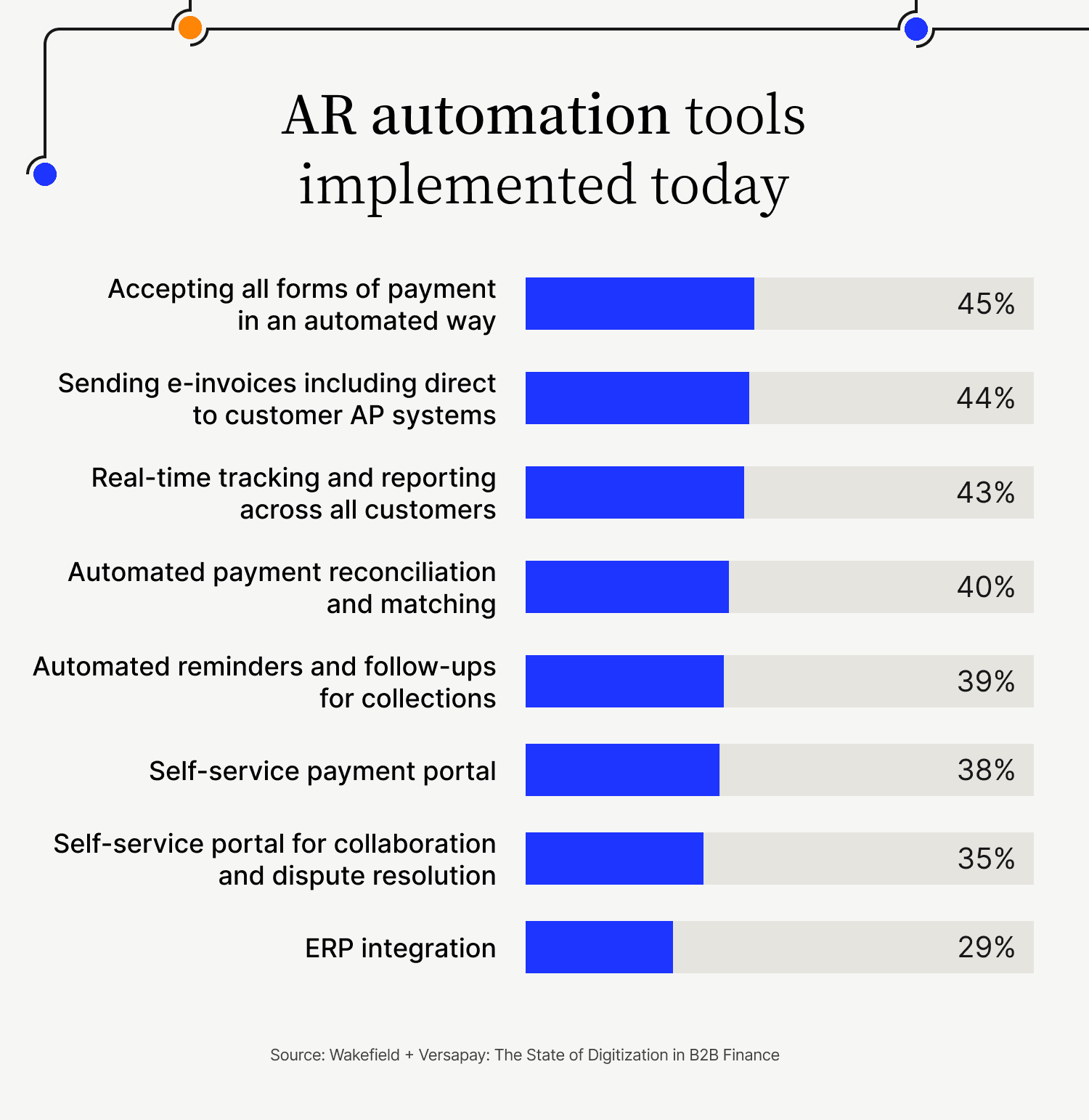

As revealed in our survey of 1,000 C-level executives, payment portals (of all types) haven't historically been prioritized as part of AR digital transformation projects, ranked at the bottom of business’ list of already implemented technologies.

Case in point: 38% of executives have already implemented a customer payment portal, and 35% have implemented a collaborative payment portal. Meanwhile, nearly half have implemented automation technologies for accepting multiple forms of payment and sending electronic invoices, at 45% and 44% respectively.

Luckily (and despite the limited progress made to date), CFOs do recognize the value of online payment portals and are actively re-imaging the impact they can have on their invoice to cash cycles.

When asked to look ahead to the next 12 months, CFOs have prioritized customer payment portals (34%) ahead of collaborative accounts receivable portals (27%) for next steps in their AR digital transformation. So, online payment portals are on CFOs’ minds when thinking about what’s next for AR digital transformation, but fewer than a third are looking at collaborative payment portals specifically.

The strides CFOs have taken to prioritize payment portals will only deliver so much value if customer collaboration continues to be absent from the conversation. If they want to make good on their promises to deliver exceptional customer experiences—a self-admitted measurement of the C-suite's effectiveness—then it’s time for business leaders to think more critically about the billing and payment experience.

As executives consider what solutions to adopt in their accounts receivable digital transformation efforts, it’s imperative to think beyond traditional AR automation technologies and lean into Collaborative AR technologies.

With Collaborative AR, businesses can implement critical solutions that add efficiencies in the back office, while also improving CX. This combination can generate a far greater ROI than efficiency alone can offer.

—

Want to see a real-life example of the ROI of a collaborative payment portal? Learn how distribution logistics company TireHub eliminated 200 hours of weekly contractor support and reduced the value of their overdue accounts by 50% with Versapay.

About the author

Ben Snedeker