Paperless Invoicing: How to Convert Paper to Electronic Invoices

- 12 min read

Paper invoices cost time, money, and customer sentiment.

Paperless invoicing on the other hand, leads to greater visibility and accuracy, significant labor and cost savings, and higher customer satisfaction rates.

Accounts receivable digitization is inevitable. And it’s only been accelerated by the widespread move to remote work, and businesses’ need to accomplish more with less resources. So, for finance teams that rely heavily on manual processes—like paper invoicing—a switch to electronic invoicing is well overdue.

Embracing paperless invoicing by fully digitizing the invoicing and billing process enables you to minimize resource use—including labor, paper, printing ink, and shipping costs. A paperless invoicing system also streamlines the invoicing process by empowering you to easily fix errors digitally instead of having to reprint and re-mail invoices.

With paperless invoicing, you can even accelerate the payment process by delivering invoices immediately via digital means and encouraging customers to pay instantly and digitally, which can help improve your cash flow.

The benefits of paperless invoicing are plenty, and in this article, we’ll explore them while helping you understand how to convert your traditional, paper invoices to electronic invoices.

Jump to a section of interest:

How accounts receivable digitization is forcing electronic invoicing

If you’re invoicing your customers through physical channels—like mail—there’s a good chance you’re also receiving payment through similar means—and via physical payment methods like checks. But with finance’s—and your customers’—increasing modernization requests, this really isn’t the right way for you to manage your accounts receivable.

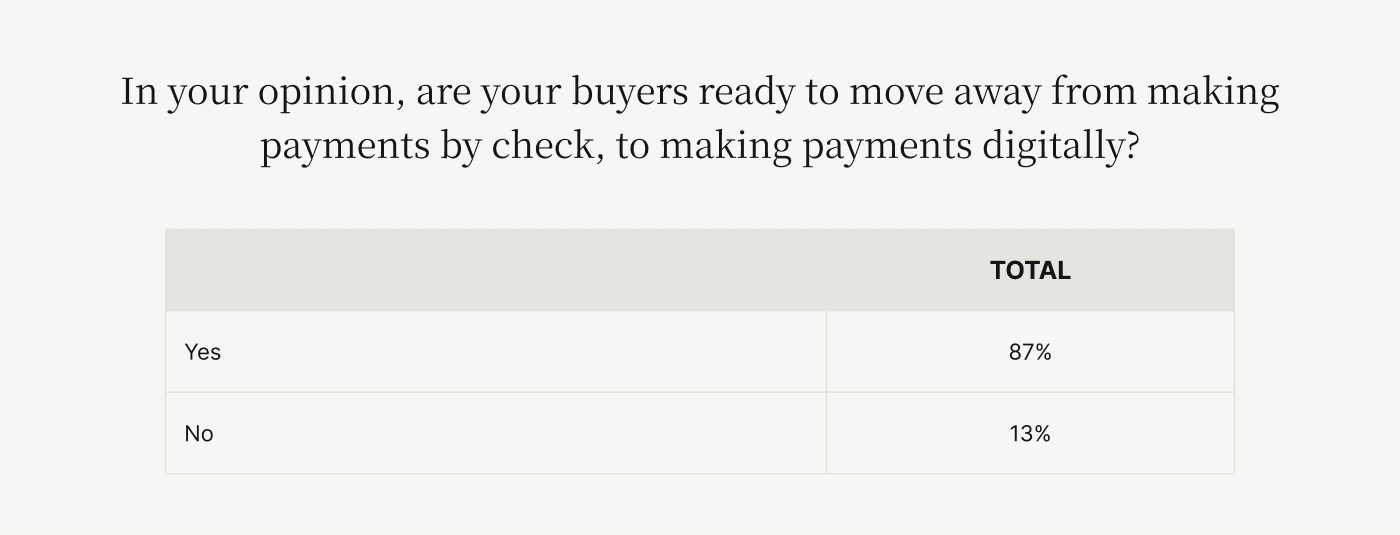

The movement to digitize accounts receivable is well underway, with 90% of mid-market enterprises pursuing automation, according to a Payments Cards & Mobile and Versapay study. Meanwhile, 87% of finance and technology professionals separately noted that they think their customers are ready to adopt digital payments.

Accounts receivable digitization has long had its supporters, but has gone from optional to non-negotiable over the last few years—especially considering the seismic shift to remote work.

And there’s little sign that the trend will reverse. A third study—by Versapay and CFO Dive—reveals that 25% of finance executives believe that up to 60% of their staff will be working from home permanently and another 28% expect that share to be as high as 100%.

In this context, it’s clear that businesses must now embrace invoice digitization.

So, what is paperless invoicing?

Paperless invoicing—also known as electronic invoicing or e-invoicing—is the process of invoicing your customers or clients digitally. Businesses will use software to generate, send, accept payment for, process, and record each invoice.

This kind of software will typically integrate with your enterprise resource planning (ERP) system—or other accounting software—so that invoice data can be drawn from and seamlessly recorded in your existing system for ease of reconciliation.

🎥 In a rush? Watch this 3-minute video to learn what paperless invoicing is, and how moving away from traditional paper invoices (towards electronic invoicing) can help your business.

A common feature of paperless invoicing systems is an online invoicing portal, which allows both your team and your customers to view all activity associated with an invoice—like revisions, disputes and discrepancies, supporting documentation, outstanding balances, and more—and communicate directly with each other.

Paperless invoicing opens the door to eliminating paper use from your accounts receivable operations entirely—a change that can help reduce your costs and carbon footprint, too. Invoices are often associated with a variety of supporting documents, such as proof of delivery or proof of installation, which amount to your team going through reams of paper when this process is done manually. With the rightinvoice automation platform, you can send electronic documents along with each invoice and host it all in an easily accessible cloud-based portal.

What are the disadvantages of paper invoices?

Paper invoicing isn’t great for business. It’s manual, tedious, inefficient, and unmanageable at scale. And companies using paper invoicing processes are confronted with a wide assortment of problems and issues. Those issues are only becoming more profound as their competitors implement paperless invoicing solutions, putting laggards at a glaring disadvantage.

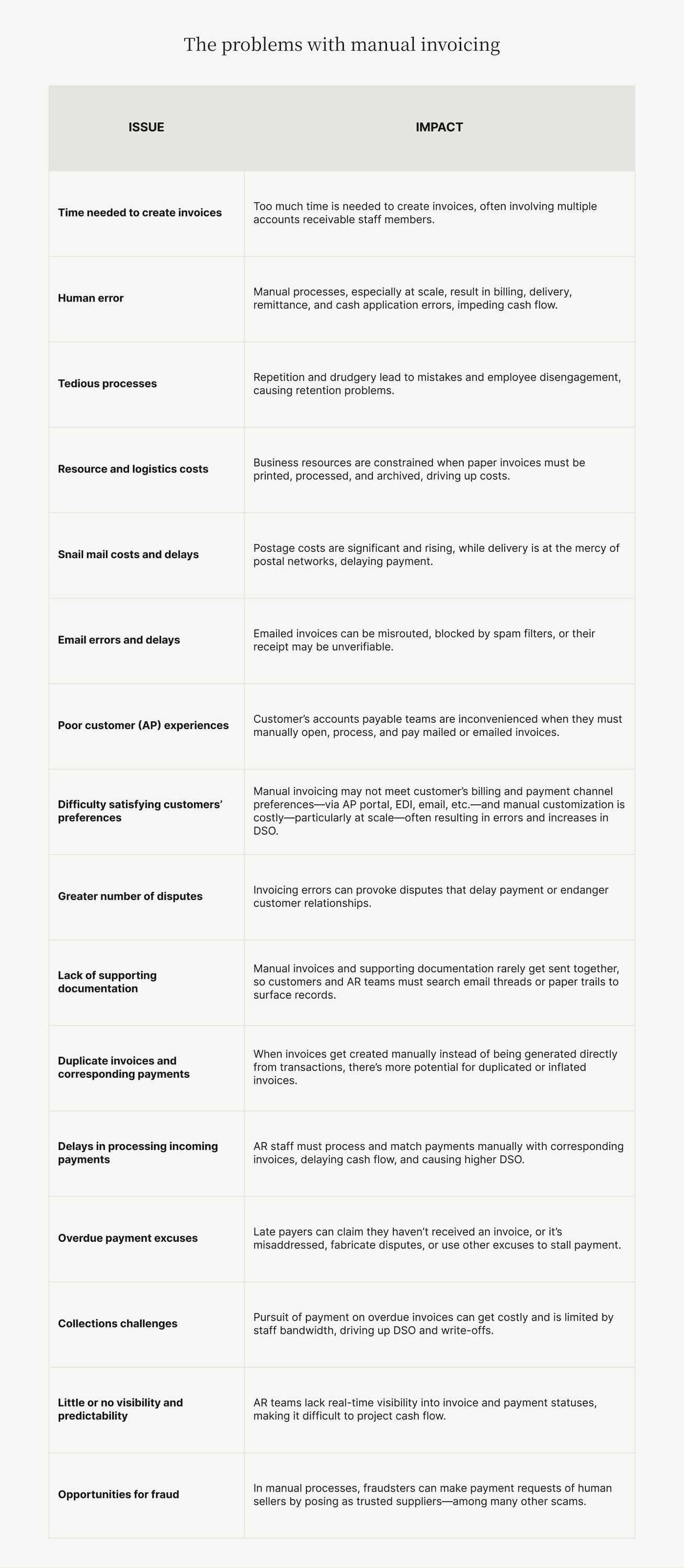

Here’s a comprehensive—yet not exhaustive—list of issues that come from manual invoicing approaches, and the impacts they have on the organization:

8 signs you need to eliminate paper invoices

Why switch to paperless billing, you ask? If you use a paper-based invoicing process, odds are you’re so used to it that you may not even see how limiting it is. “That’s just how we’ve always done things,” is a valid response, but it doesn’t mean it’s the best option for the future of your business. There are so many digital tools available that can help finance and accounting teams improve the invoicing process.

The following challenges are all symptoms of sending paper invoices. If any—or all—of them describe your collections team’s experience, it’s a likely time to shift to paperless invoicing:

Delayed payments — Sending out paper invoices delays when payment terms start, meaning it takes longer for your business to get paid

Staff monopolization — Your accounts receivable staff spends an overwhelming amount on shipping invoices and manual data entry

Problems with accuracy — You're finding a number of errors appearing in customer invoices

Difficult communication — You find it hard to communicate with customers about billing questions and disputes

Customer complaints — You often receive complaints about inaccuracies and other problems pertaining to their invoices

Requests for digitization — Your customers are asking you for digital or paperless invoicing and payment options

High costs — Your invoicing process represents a major cost center

Limited talent pool — You experience difficulties attracting and retaining top-tier accounts receivable professionals

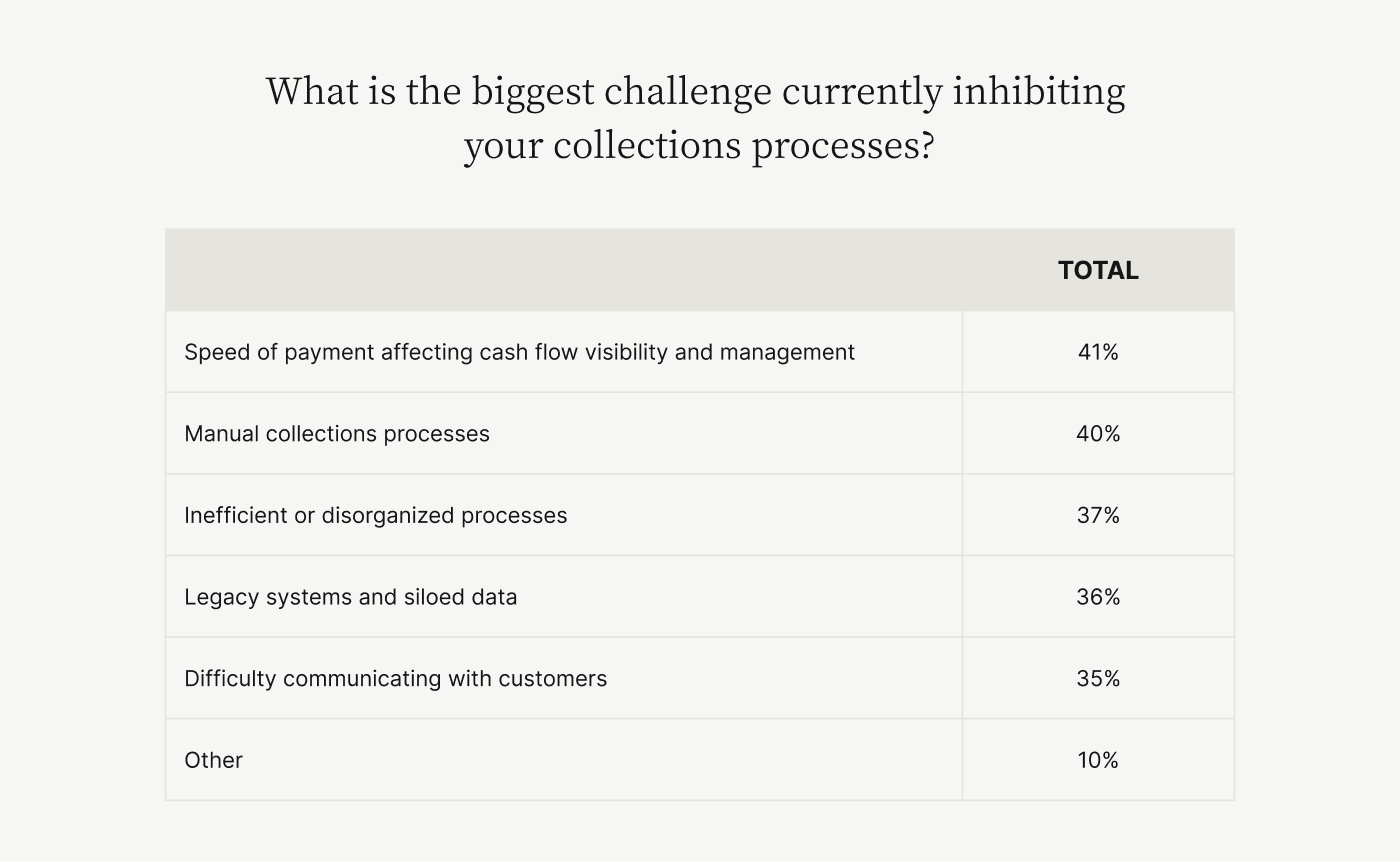

Many of these challenges align with what business leaders currently report facing. Forty-one percent note that slow speed of payment is a top challenge, inspiring them to digitize accounts receivable. Others indicated the pain of manual collections processes (40%), inefficient processes (37%), and difficulty communicating with customers (35%).

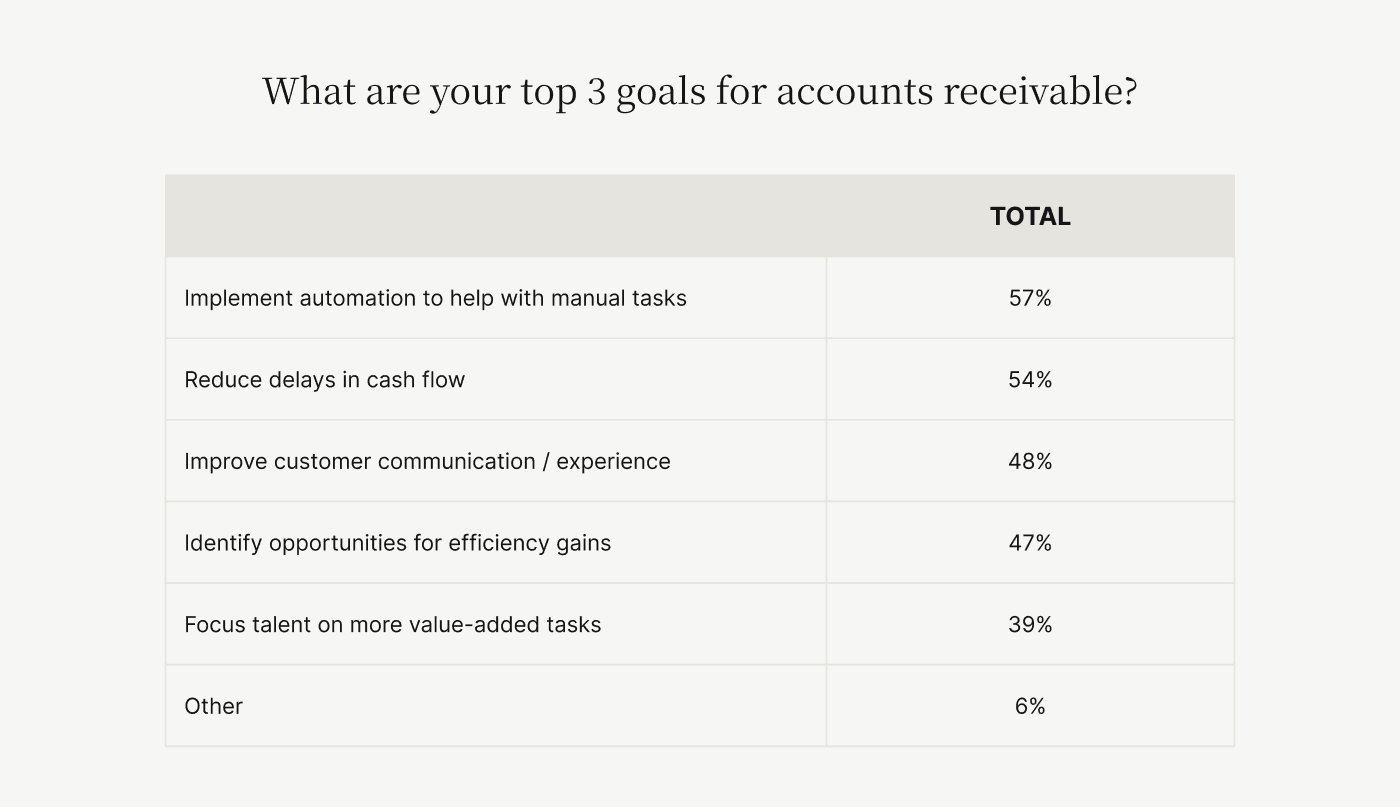

Accordingly, this audience’s top goals for their accounts receivable are to implement automation (57%), reduce delays in cash flow (54%), improve customer communication (48%), and make efficiency gains.

Going paperless: 3 major benefits of eliminating paper invoices

There’s a long list of advantages to paperless invoicing, but the most significant of these benefits are:

Greater visibility and accuracy

Significant time and cost savings

Greater customer satisfaction

1. Greater visibility and accuracy

Opting to digitize invoices using a solution that prioritizes collaboration—between you and your buyers—provides everyone with a single source of truth for invoices. Staff and customers alike get access to invoices through a dedicated online portal and can view invoice and account statuses in real time.

Plus with a paperless invoicing system that allows customers to make payments through that very same portal, payments can be reconciled automatically with their corresponding invoices in your ERP.

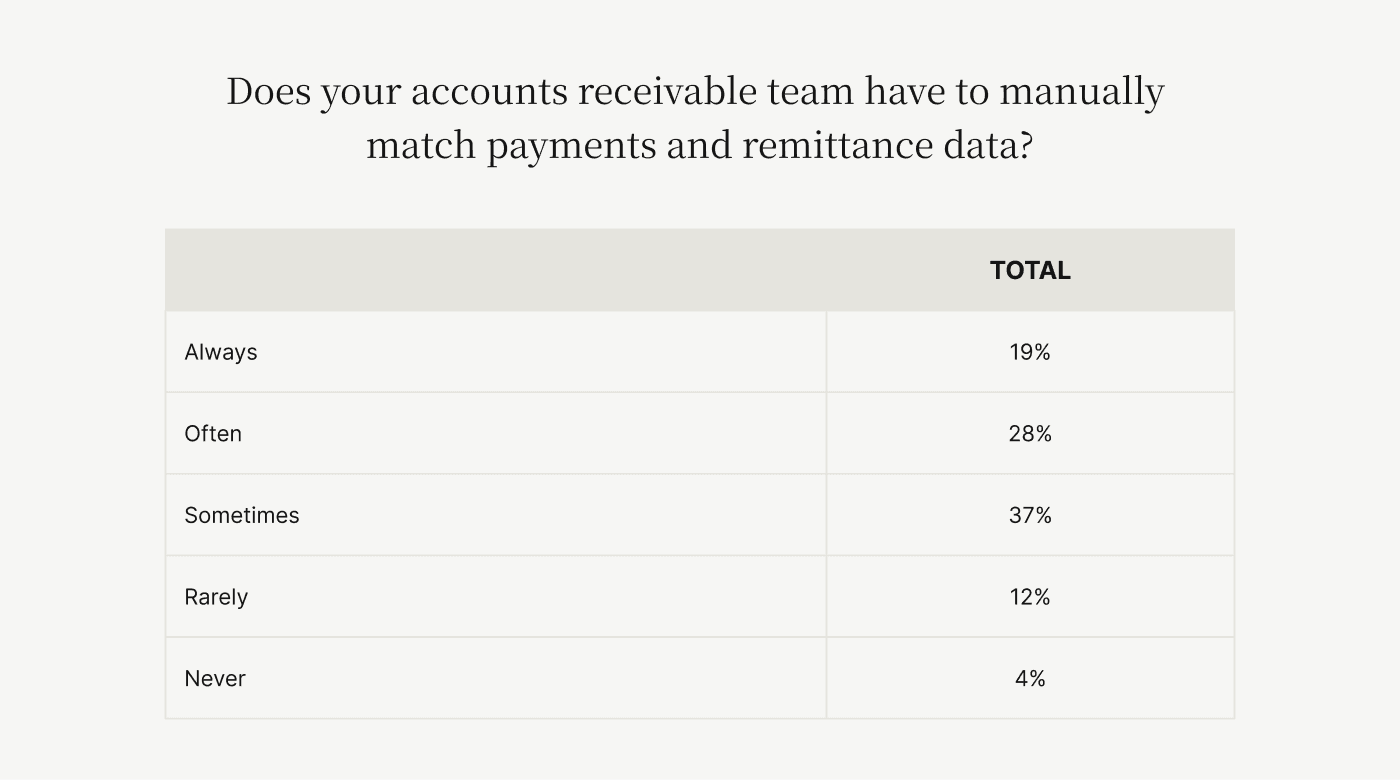

This type of automation would save a lot of accounts receivable staff effort, and ensure your records are always up to date. In fact, we found that 47% of accounts receivable teams are manually matching payments and remittance data either always or often. With electronic invoicing comes the opportunity to put that data—and time—to greater use and automate more work in the process.

2. Significant time and cost savings

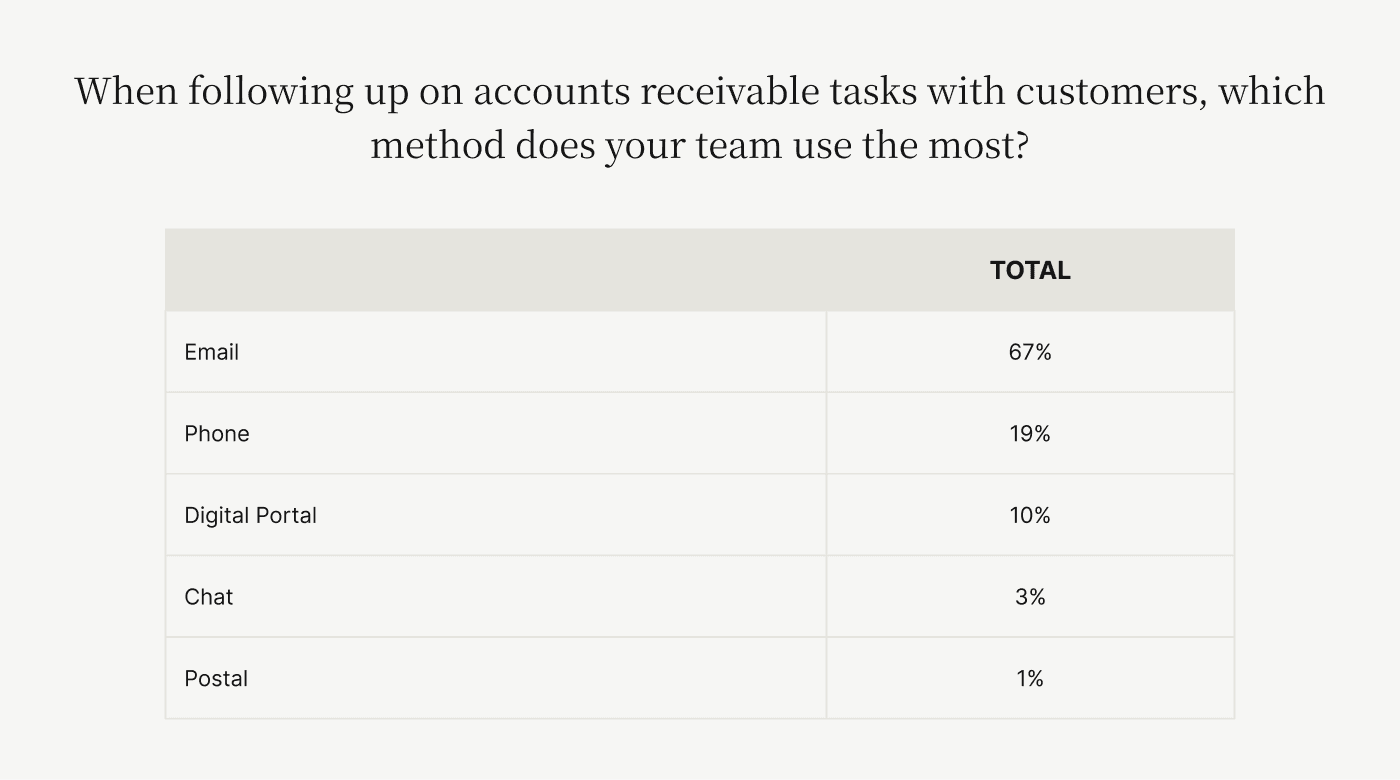

The same survey referenced above notes that when following up on accounts receivable tasks with customers, 86% of collections teams’ preferred communication methods are email and phone—which are both slow and cumbersome ways of doing business.

CFOs who take steps to automate manual accounting processes—like paper invoicing—can free up as much as 60% of their team’s time. And 75% of finance executives agree that a major benefit of AR automation is that it gives their teams time back in their day to focus on more strategic initiatives.

Freeing up staff time results in major cost savings, as does the fact that automated accounts receivable processes can speed up payment, reduce errors, and eliminate the cost of paper and other materials needed for manual invoicing.

Our customer, Boston Properties, used to spend $0.55 per paper mailing to 2,200 tenants. By switching to paperless invoicing with Versapay, they’ve saved at least $1,210 monthly—amounting to $14,520 yearly—plus the cost of the labor required to prep those mailers.

3. Greater customer satisfaction

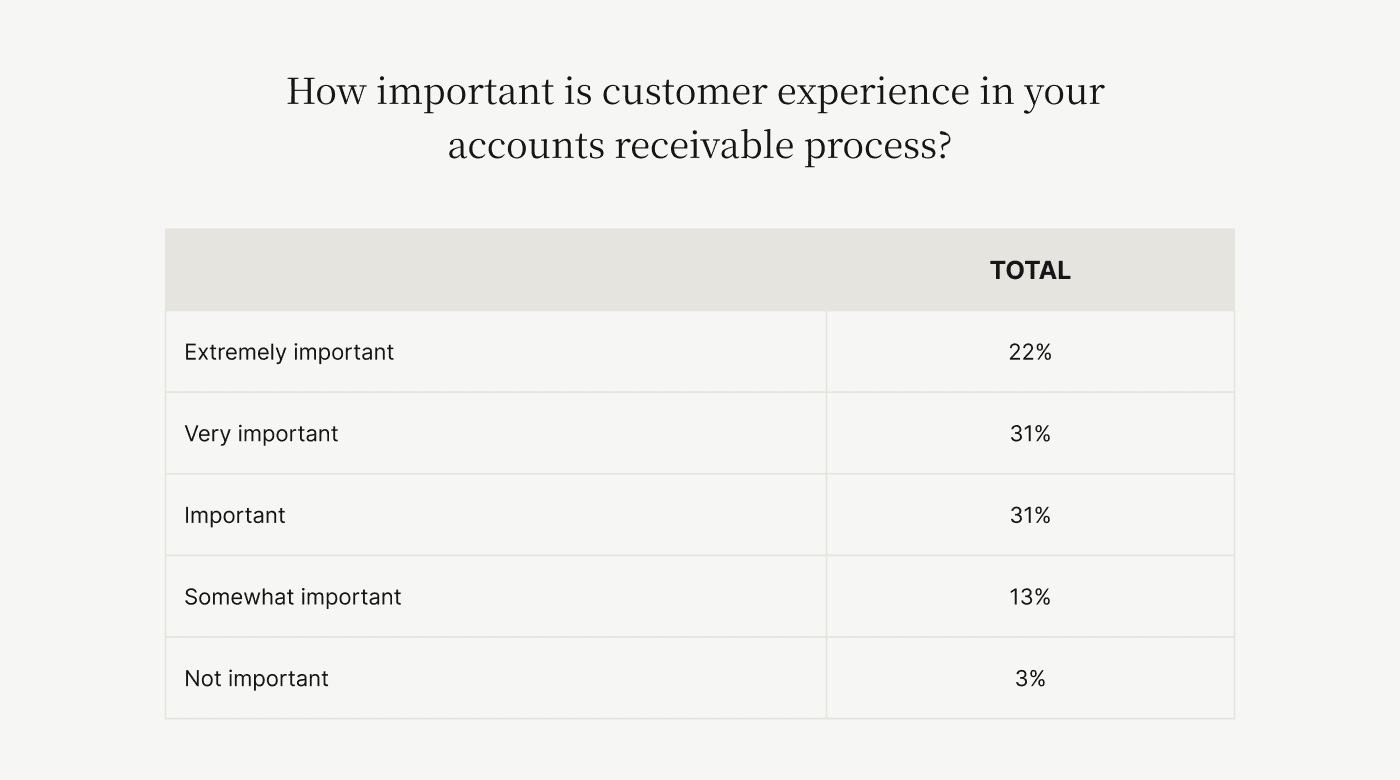

Finance leaders are increasingly prioritizing customer experience—with 84% of leaders—citing it as an important priority in their accounts receivable process.

One of the first interactions you’ll have with a customer—post-purchase—is through invoicing. The way you engage with them then will set the tone for the rest of their experience with you.

Sending invoices electronically means customers receive them faster and can pay more quickly. And with digitization comes the ability to support a greater variety of payment methods, meaning customers can pay via the method that’s most convenient for them and their accounts payable system.

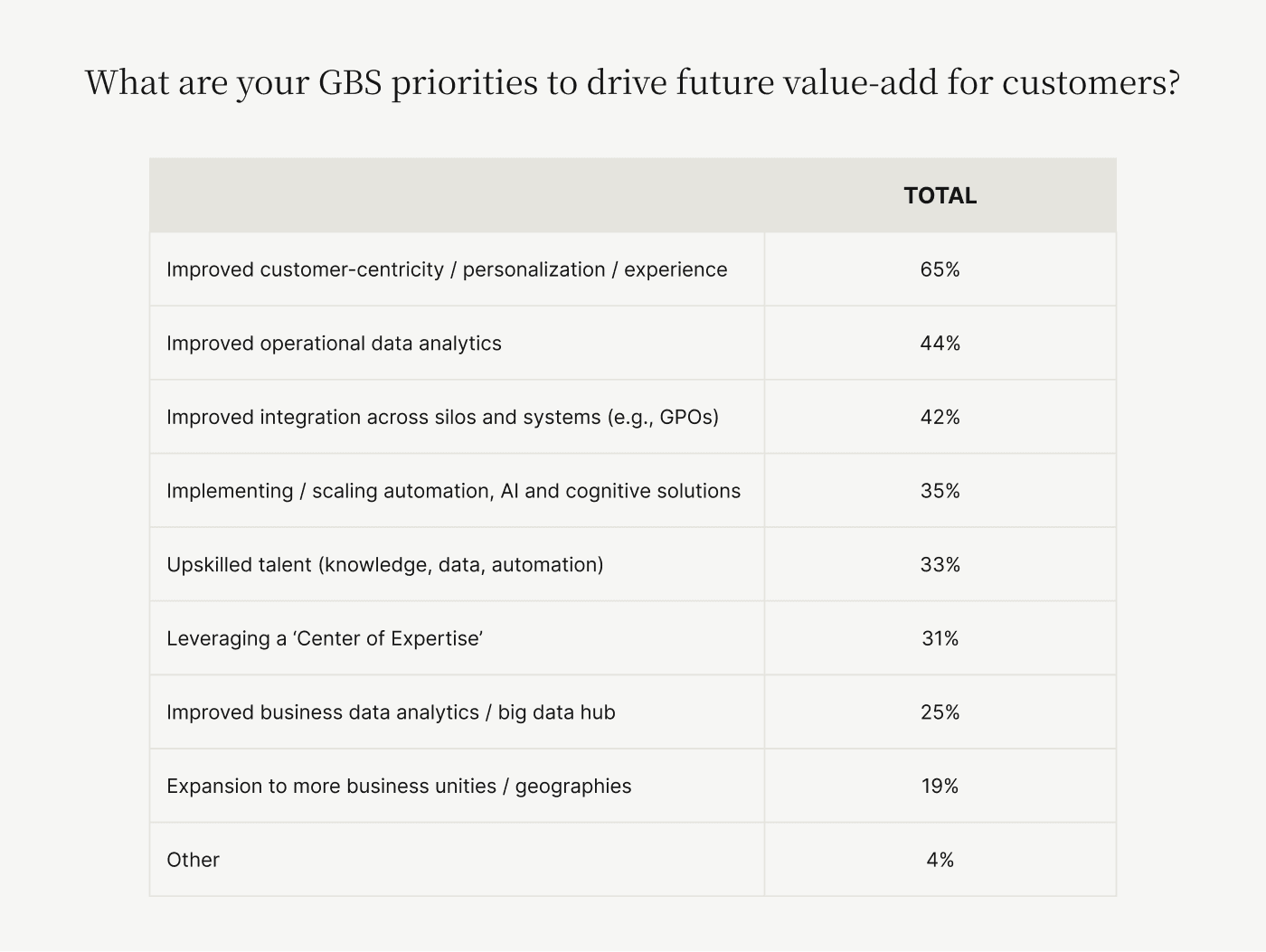

Happier customers typically means more loyal customers. In a survey of 400 CFOs, 70% of respondents said they believe digitizing accounts receivable functions boosts customer lifetime value. Another 65% of respondents—from the survey above—identified improved customer centricity and experience as a key driver for business transformation.

5 steps to converting paper to electronic invoices

Ready to make the switch to paperless invoicing? Here are five steps that can ease that process:

Make a plan

Organize customer records

Train your team

Communicate with customers

Choose your roll-out method

Step 1. Make a plan

Clearly outline your goals for switching to a digital invoicing process—and implementing a paperless invoicing system—as well as your desired timeline.

Research how to choose accounts receivable automation software, and have your staff view demos of various products to identify the best choices. Here’s a great checklist to support your evaluations. Assign team members responsibilities for implementation and identify the metrics you’ll use to measure how your efficiencies, costs, and customer satisfaction have benefited from electronic invoicing.

Step 2. Organize customer records

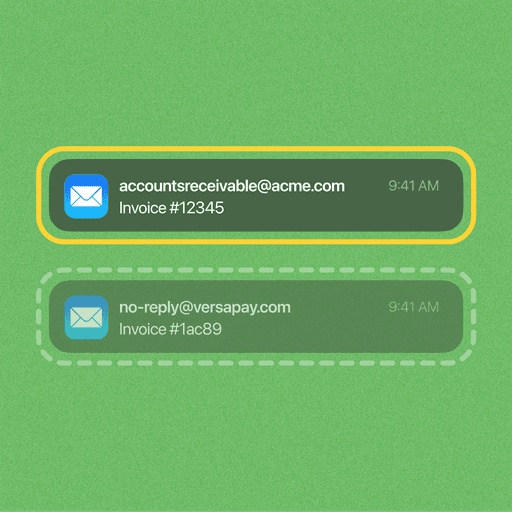

To eliminate paper invoices and start delivering invoices digitally, you’ll need your customers’ email addresses, so ensure that your business has those records or a plan for collecting them. Load your customer data into the new paperless invoicing system—or ensure the software you choose can seamlessly integrate with your ERP, where your customer records might already exist. Digitize and upload any paper documents that you need in the system for outstanding invoices.

You’ll also want to work with customers to make sure that communications coming from your new system will be whitelisted so your invoices don’t get lost in customers’ spam filters.

Step 3. Train your team

Ensure that your accounts receivable team gets proper training on how to use the new paperless invoicing system. As you’re evaluating potential software vendors, a great question to ask is what kind of training they can provide your team with. Make sure everyone involved in your company’s receivables operations knows about the new system and its full capabilities.

Step 4. Communicate with customers

Communicate with your customers in advance of making the switch to paperless invoicing. They should be aware of the changes coming, the benefits the new process will bring them, and any adjustments they may need to make on their end. Make some of your staff available to answer customer questions before and immediately after the implementation of the new system.

Step 5. Choose your roll-out method and monitor things closely post-launch

Decide if you’re going to invite customers to receive their digital invoices through the system in phases or all at once. Provide your staff with a detailed timeline of this plan so they know what they’ll need to do and when. Meet with staff frequently during the first weeks of the roll-out to help answer any questions or troubleshoot problems.

Why eliminating paper invoices should be your top priority

Electronic invoicing makes your accounts receivable team’s job easier, with fewer manual tasks, easier record-keeping, and less possibility for errors. It also provides a far better invoicing and payment experience for your customers, who can access their invoices securely online and pay immediately in just a few clicks no matter where they are.

With cost and time savings along with greater customer loyalty, it’s worth making this transition a top priority if you haven’t yet made the switch. Get a demo of Versapay’s paperless invoicing software to see how it can lower costs, drive digital invoice acceptance, and capture more payments.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.