What Is Credit Management? Plus, 3 Ways To Improve Your Credit Management Process

- 11 min read

Effective B2B credit management helps companies take on new business while avoiding the risk of bad debt.

Finance leaders know the success of their business depends on how efficiently they can get cash in the door. Credit managers play a central role in this mission, as they’re tasked with striking a balance between helping sales move forward quickly and ensuring the business doesn’t take on the risk of bad debt.

This is especially true for business-to-business (B2B) focused companies, the majority of which provide their products, goods, or services ahead of customers paying their invoices (i.e., on credit).

In this article, we’ll cover:

What is credit management?

Credit management is the process of deciding which customers to extend credit to and evaluating those customers’ creditworthiness over time. It involves setting credit limits for customers, monitoring customer payments and collections, and assessing the risks associated with extending credit to customers.

The risk of customers defaulting on payment is a high concern in B2B, with nearly half of all B2B invoices in the US getting paid late according to a 2022 Atradius survey. Effective credit management processes help businesses mitigate this early on.

The 5 steps in the credit management process

1. You establish your credit policy

Your credit decisioning process should follow a documented credit policy that establishes the company’s rules for offering credit terms.

Your credit policy should outline information such as:

- The criteria your credit team should follow when evaluating a customer’s creditworthiness

- The payment terms you’ll enforce (e.g. net 30, 60, or 90 days) and where exceptions may apply

- Rules for early payment discounts

- How you’ll set credit limits for customers, and how they may differ for new vs. existing customers

- The information you require from customers to make a decision about granting them credit

- How you’ll follow up on overdue payments and your procedures for dealing with delinquent accounts

2. Customers fill out a credit application

Before you agree to do business with a new customer on credit, you’ll need to collect some information from them in order to determine whether you can count on them to pay their invoices. You’ll do this through the credit application process.

During this stage, customers will supply information such as:

- Their contact information (including their point of contact for accounts payable)

- How much credit they’re requesting

- A reference from their bank, and potentially a reference from a supplier they’ve worked with before (a trade reference)

- Financial information like their company’s annual sales volume

3. You conduct research

Your credit management staff will then do their due diligence with the information potential customers have supplied. At this stage, your team will contact the references the applicant provided to get a sense of their financial history. They’ll also pull additional information from credit bureaus to further assess prospective customers’ financial health.

4. You approve or deny the request for credit

Processing a customer's credit application can take several days, after which you’ll decide whether to approve or deny the customer’s request for credit. For large credit requests, you might require approval from multiple stakeholders.

If you decide a customer isn’t a good fit for receiving payment terms, you may still decide to take their business but on the condition they pay upfront or upon delivery.

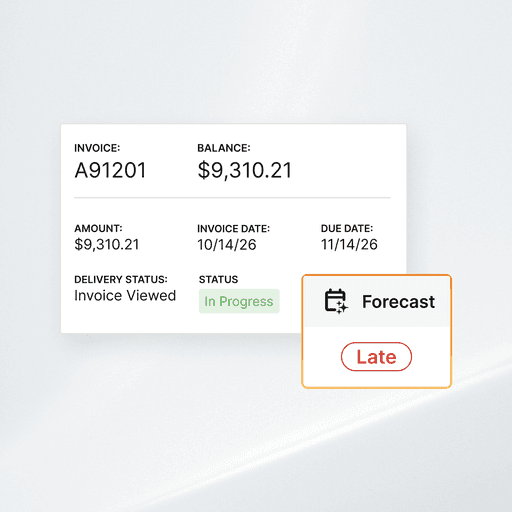

5. You continuously monitor customers’ credit

After granting a customer credit, you’ll want to continuously monitor them to ensure they stay on track with their payments. Payment history provides a good predictor of a customer’s future payment behavior.

Regular customer credit checks are also a good way to catch any deterioration in customers’ creditworthiness.

The credit review and risk analysis process

When evaluating whether to extend credit to a customer, businesses will look at several factors. These will differ based on whether you’re evaluating a new customer or potentially looking to increase an existing customer’s credit limit.

The credit review process for a new customer

When evaluating new customers, positive indicators of creditworthiness include:

- A favorable credit score and credit history according to agencies like Dun & Bradstreet

- The company has never filed for bankruptcy in the past

- The company does not have multiple liens (where the company has put up collateral to satisfy a debt) open

- The company has not exhibited any fraudulent activity

- The company has been in business for many years

- The company is operating in a stable or growing industry

Every company’s risk tolerance will vary, based on their size, cash flow, and margins. And while credit managers will often use a credit scoring model to make their decisions, there is undeniably an aspect of “trusting your gut.”

The credit review process for an existing customer

With an existing customer, you have the benefit of access to data about their payment history when making decisions about their credit.

If an existing customer meets all the conditions below, then you can confidently approve their request for additional credit.

- The majority of their past invoices have been paid on or before the due date

- The majority of their past invoices have been paid in full, and if they have short paid in the past it was for a valid reason

- The customer has little or no outstanding debt on your books

- The customer’s business has experienced no drastic deterioration in financial health

Conversely, if an existing customer meets any of the conditions below, then you may want to be prudent and avoid raising their allowed credit limits.

- The customer has consistently paid their invoices late over the last several months, suggesting their business is experiencing cash flow issues

- The customer has disregarded your terms of sale on several occasions

- The customer has a significant overdue balance of more than 90 days past due

- The customer has a history of ignoring your collections communications for several weeks or longer

That being said, professional credit management revolves highly around human judgment. There will be instances where you’ll want to cut a customer some slack, especially if it’s a relationship you want to preserve.

If a customer has recently started paying their invoices late but has an otherwise timely payment history, then you can likely be more lenient with them. For routinely late-paying customers, however, you’ll want to consider working with them on a specific payment plan or changing their payment terms.

The responsibilities and traits of effective credit managers

Given the difficulties and sensitivities around collecting payment from some customers, credit managers must be able to juggle a range of complex responsibilities. These include:

- Conducting credit checks on new and potential customers

- Implementing collection policies and regulations

- Helping accounts receivable (AR) colleagues (especially collections staff) manage days sales outstanding (DSO).

Great credit managers are savvy communicators, agile problem-solvers, and generally risk-averse. They also know that offering credit is never a one-and-done process. Customers change, industries go through boom and bust periods, and credit review and risk analyses need to evolve with these shifting situations.

3 ways to strengthen your credit management processes

Here are three ways you can improve your credit management process to reduce late payments and bad debts, improve cash flow, and build stronger relationships with your customers.

1. Make payments more convenient for customers

To incentivize prompt payment, remove as many barriers in your customers’ payment experience as possible.

When you dictate which payment methods customers can pay with—like paper checks—you may be unwittingly extending your DSO. Paying with a check requires extra work from your customers’ accounts payable (AP) team, like preparing it to be posted in the mail.

A survey we ran of technology leaders within finance departments found that 87% of respondents believe their buyers are ready to move away from checks in favor of digital payments. Giving customers more digital payment options, especially through a convenient online payment portal, can encourage your customers to settle their invoices before they're even due.

You can also get customers on the path to paying you faster by automating your invoice delivery and credit management collections outreach.

2. Post payments faster for real-time reporting

It’s very difficult to make credit decisions when you lack visibility into the current status of your customers’ payments.

Manual cash application processes are a big contributor to this, as delays in applying payments to invoices can prevent your team from replenishing customers’ credit—and in turn, prevent customers from making any more purchases.

Cash application automation can significantly speed up the process of matching payments to receivables, especially in complex cases like short payments and payments covering multiple invoices. As a result, you’re able to arm your credit management team with a real-time view of customers’ payment status.

3. Improve the way you handle invoice disputes

Customers don’t just default on payments due to unforeseen changes in their business. Sometimes, as the Atradius study we referenced earlier indicates, customers intentionally pay late. The research found that nearly 30% of companies polled said customers defaulting on payment was largely due to disputes.

Invoice disputes tend to escalate because of miscommunication, given that traditional AR workflows make it difficult to find information and share it with customers’ AP teams quickly.

In fact, our research with Wakefield uncovered a direct link between miscommunication in the payment phase of a deal and disputes. Eighty-five percent of the 1,000 C-suite executives we surveyed agreed that poor communication between their AR team and their customers led to the company being paid less than they were owed.

To prevent a dispute from souring a customer relationship and holding up payment as a result, address invoice discrepancies as early as possible. You can do this with a Collaborative AR solution that allows your team to communicate with customers over the cloud, directly on the invoice in question.

You can learn more about the causes of invoice disputes here.

—

With the economic headwinds we’re currently seeing, aged receivables are getting even harder to predict. This makes credit managers’ jobs more challenging—and all the more pertinent.

But, boosting credit management by focusing on having an effective credit management system, automating manual accounts receivable tasks, staying on top of credit reviews and policies, and nurturing customer relationships can help your business protect cash flow during an otherwise uncertain time.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.