How Accounts Receivable Automation Helps Manufacturers Solve Cash Flow Woes

- 11 min read

From managing complex invoicing workflows to handling cross-border payment risks to lengthy customer disputes... manufacturers face headwinds from every direction.

Luckily, there's a solution.

This article examines how accounts receivable automation solves the key cash flow challenges that manufacturers face, and puts them on the path to getting paid quickly.

How do we get paid quickly and track those payments accurately?

These questions have long plagued financial leaders in manufacturing companies, and not being able to do either efficiently is having negative consequences.

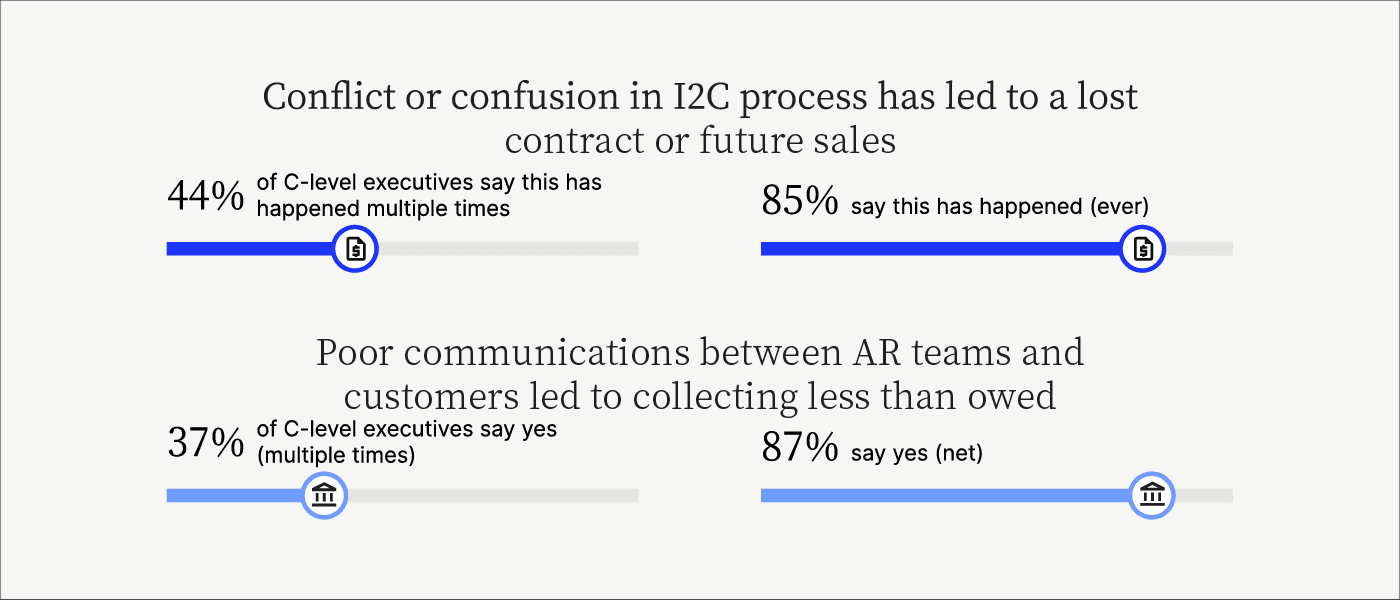

Our research on the State of Accounts Receivable Digitization in Manufacturing highlights some of these consequences. Eighty-five percent of respondents conceded that confusion or conflicts in the invoice-to-cash (I2C) process has cost them revenue. A further 87% of respondents noted that poor communication between AR and customers has led to underpaid invoices.

Miscommunication or conflict isn’t the only culprit, unfortunately. Manufacturers experience several issues in their invoice to cash (I2C) processes, such as:

Cash flow issues due to flawed credit analysis

Managing complex invoicing workflows

Invoice to PO discrepancies

Cross-border payment risks

Inefficient collections

Cash-on-delivery delaying order deliveries

Seasonal sales fluctuations

Lengthy customer disputes delaying cash collection

Complex customer payment chains

Regulations affecting invoicing processes

Inefficient AR systems

Lack of order management and AR integration

These issues are symptoms of a malaise—the AR Disconnect. This refers to accounts receivable processes falling out of sync with customer needs, resulting in disputes, higher invoice processing costs, and poor customer experiences.

Collaborative accounts receivable is the solution for manufacturer’s cash flow woes, as it realigns your AR around customers. It also solves the four biggest groups of I2C challenges manufacturers face:

See how automation solves each challenge group:

Challenge 1: Automation powers accurate credit decisions

Manufacturers need to make accurate credit decisions since this impacts your cash flow. Good credit decisions also strengthen customer relationships. However, arriving at the right decisions isn’t easy.

Automated accounts receivable processes—especially those powered by collaborative accounts receivable payment portals) help you calculate how much credit you can extend to customers and how those decisions impact your cash flow.

Specifically, collaborative AR automation powers better credit analysis by:

Centralizing customer payment data, and

Simplifying cash flow impact analysis

1. Collaborative accounts receivable automation solutions centralize customer payment data

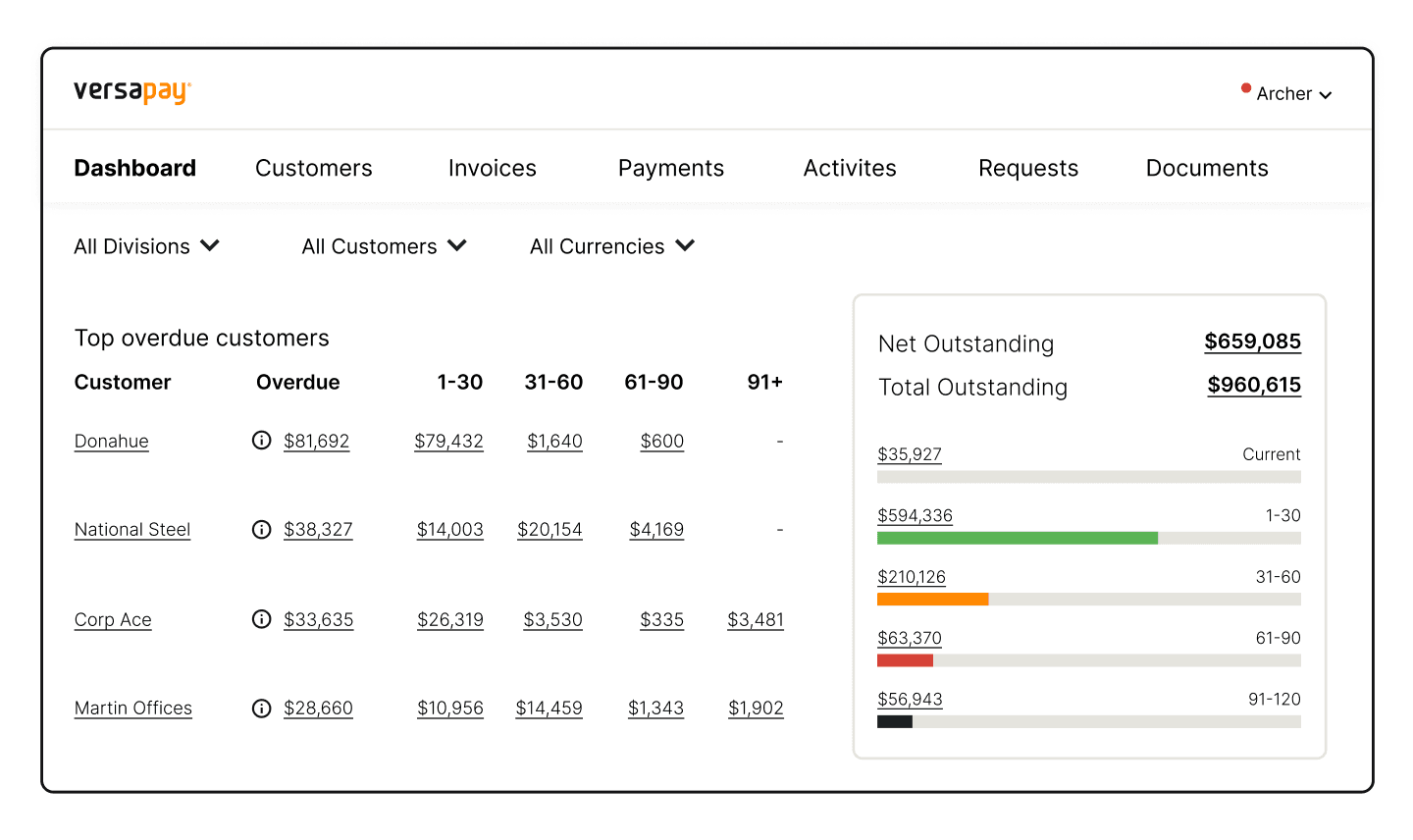

These payment portals offer your finance teams easy access to customer payment histories. Even better, these platforms depict data in easily understood dashboards—which include AR aging tables—that speed up credit decision-making.

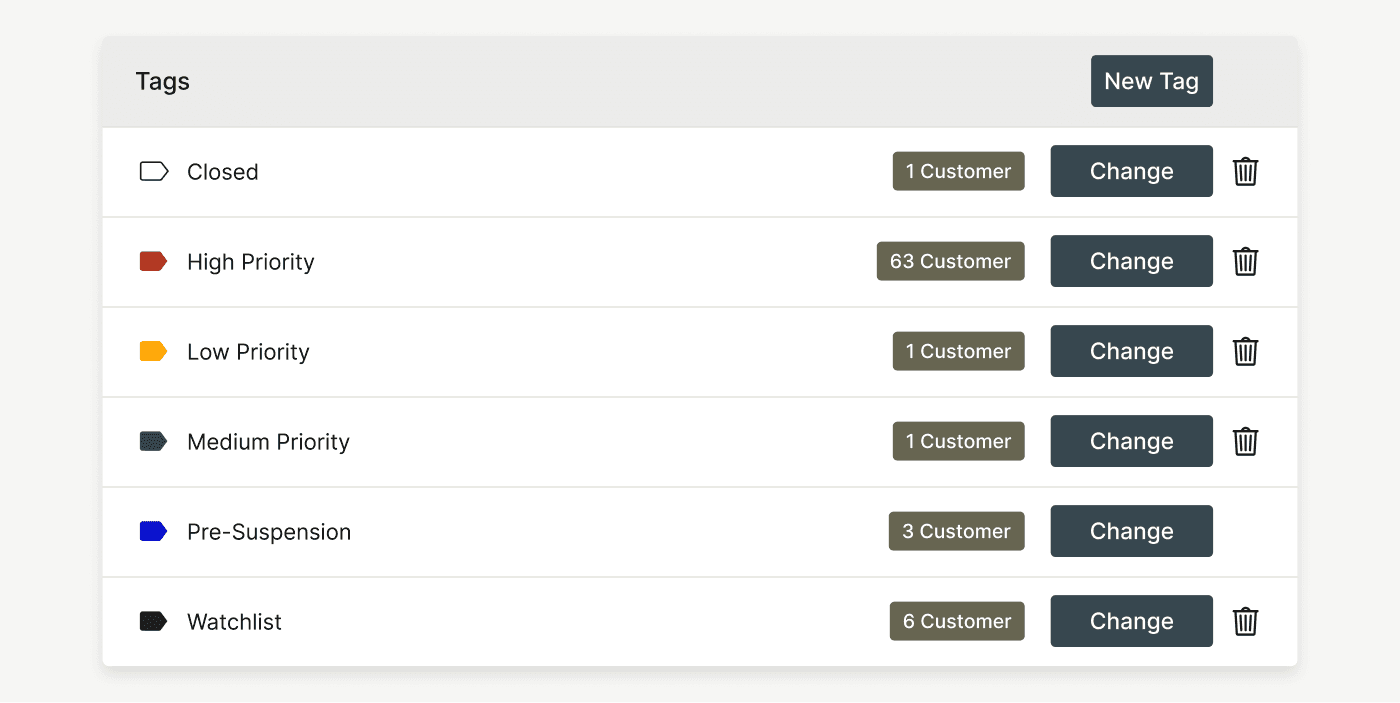

To make it even easier to make accurate credit decisions, these technologies automate and streamline how manufacturers can segment their customers. Using customizable tags, for instance, you can group your customers by any number of criteria.

By centralizing customer payment data, you eliminate the need for your teams to jump between different platforms. With everything in one place, you can make accurate credit decisions quickly and back your decisions with data when communicating them to customers.

2. Collaborative accounts receivable automation solutions simplify cash flow impact analyses

With all your invoice and payment data centralized and grouped by customers, your teams can quickly compare the impact of credit decisions on your cash flow. For instance, a customer's credit profile might warrant a credit term of Net 90. However, if your accounts receivable aging tables show little receivables due in 60 days, you can offer Net 60 terms to smooth cash flow and avoid working capital shortfalls.

Challenge 2: Automation speeds up collections

A manual accounts receivable collections process will have your team doing plenty of "busywork" but leave little—positive—impact on your cash flow. One of our manufacturing customers, Sharp Corporation, found themselves in this exact situation.

"People were calling us for $1 and $2 invoices and we’d spend time on the phone taking their credit card information, leaving us little time for strategic projects," says Ellen Chammas, Manager, Credit & Accounts Receivable, Sharp Corporation (Canada).

Here's how automation powered by a collaborative accounts receivable payment portal solved Sharp's problem, and how you can adopt a similar solution:

Automation enabled self-service payments

Automation helped them offer omnichannel payments

Automation integrated offline customer payments

1. Automation enables self-service payments

Modern consumers prefer self-service. A collaborative accounts receivable payment portal enables this by automating collections, ultimately helping buyers manage and pay invoices on time.

Chammas and Sharp's experience with Versapay's portal bears these assertions out. "Now when we have customers calling us to ask if they can pay on their own," she says, "we direct them to Versapay and our online payment portal. They're all very happy going in and making their own payments on Versapay, using their preferred payment methods."

She notes a knock-on benefit of self-service portals, too. Thanks to customers initiating payments, Sharp doesn't have to store credit card information, reducing their PCI compliance costs (and risks).

2. Automation helps you offer omnichannel payments

Manufacturers often receive payments late due to convoluted accounts payable (AP) processes in customer organizations. While you can't necessarily control their processes, you can make it as easy as possible for your customers to pay.

Omnichannel payment experiences—the act of offering customers several ways to pay—can speed up collections. For instance, a collaborative accounts receivable payment portal can host popular payment options like card and ACH payments. It can also integrate with customer AP portals, giving you an easy way to deliver your invoices, and your customers an easy way to pay without changing their workflows.

Here's what David Buzell, MIS-Manager at Croell, said about integrating e-check processing.

"Versapay’s Collaborative AR platform has been instrumental in addressing one of our most significant challenges—integrating e-check processing into our portal," he said. "We've successfully reduced the volume of checks our team previously managed, accelerated payments, reduced costs, and can now give customers a choice in their preferred payment method."

3. Automation integrates offline customer payments

Vanilla electronic accounts receivable payment portals struggle to integrate paper checks, cash on delivery, and eCheck payments into manufacturer’s ERPs. When receiving these payments, your AR team typically still has to manually enter payment data, reconcile it to invoices, and apply cash.

Collaborative AR payment portals like Versapay automate such processing. For instance, you can speed up cash application through Versapay's mobile check deposit feature.

Challenge 3: Automation prevents unnecessary disputes

Invoice errors are the biggest source of customer disputes. Plus, they frustrate every stakeholder since most errors are easily avoided. Worse, these errors create even more downstream issues.

Matt Marin, Senior Manager of Financial Processes and Data Management at TireHub, details the issues his team was experiencing thanks to manual accounts receivable processes. "We couldn’t hold customers accountable for what they owed when we were misapplying payments and credits," he says. "We were really struggling to manage our accounts and our customers were frustrated with the mistakes we were making."

Here's how automation supported through a collaborative accounts receivable payment portal helps you avoid these issues:

Automatic invoice creation

Greater visibility for customers (and increased data transparency)

Faster cash flow

1. Automatic invoice creation

A collaborative accounts receivable payment portal can integrate with your ERP and receive invoice data from it. Create an invoice once and automatically send it to your payment portal (and by extension, your customers), schedule follow ups, and track customer disputes.

2. Greater visibility for customers (and increased data transparency)

A payment portal can host pertinent collections material—payment statuses, alerts, and messages between your accounts receivable teams and your customers. With payment data centralized and accessible 24/7, customer disputes are less likely to occur. Thanks to self-servicing and data transparency, miscommunications between customers and your AR team are less likely to occur, vastly speeding up collections.

3. Faster cash flow

After switching to Versapay, TireHub reduced the number of contractors managing their accounts receivable from 9 to 4, saving 200 hours a month. Yet time savings alone weren't the only advantage TireHub received:

"Payments being made online and immediately applied to open orders has real, positive downstream implications on our business,” Marin says. "The speed with which we’re now able to get the payment applied to the open invoice allows our business to charge faster."

Collaborative accounts receivable payment portals integrate with your ERP to automate accounting entries and use AI-powered OCR technology to reconcile payment remittance information with open invoices and accounts to reduce invoice processing time. In fact, payments made in Versapay achieve a straight-through processing rate of +90%. That’s some fast cash application and cash flow.

Challenge 4: Automation aligns AR around your customer

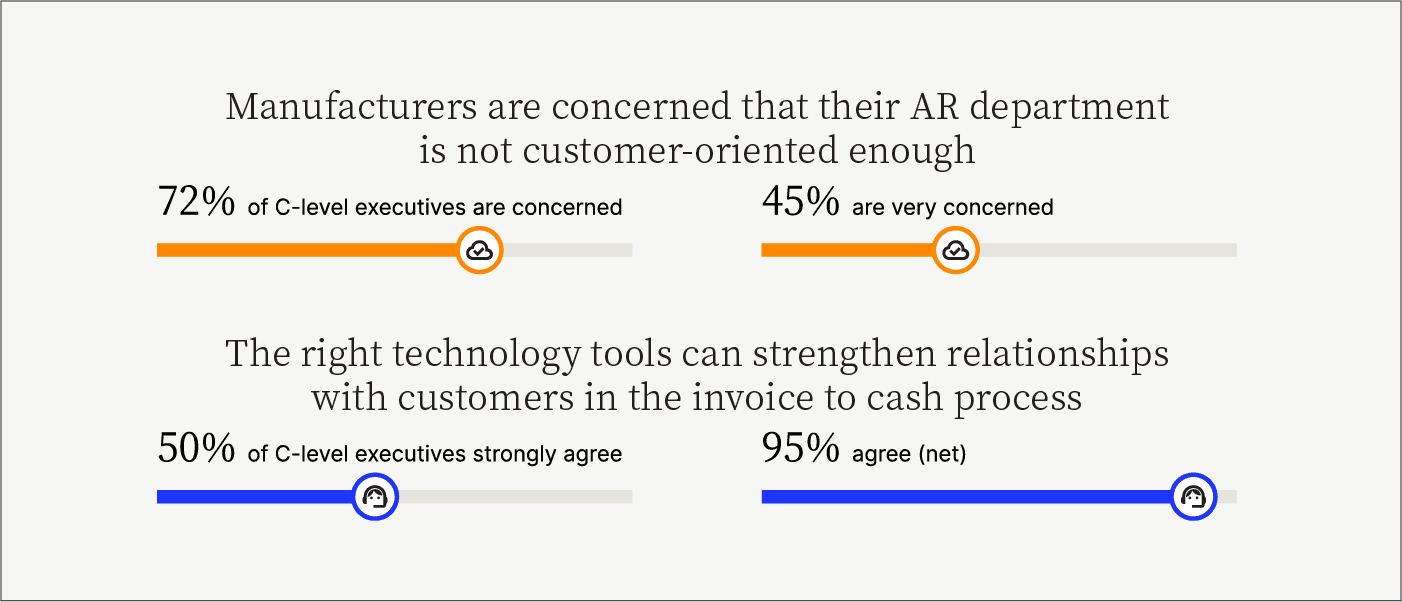

Customer experience is a big concern for finance leaders, per our research on the state of AR digitization amongst manufacturers. Forty-five percent of respondents are very concerned that their AR departments are not customer-oriented, with 72% admitting some degree of concern.

A further 95% of them agree that technology has the power to change this picture.

Here's how automation can help manufacturers realign accounts receivable around their customers:

It smooths customer communication

It makes follow up quick, and uncovers customer issues

1. Smoother customer communication

Collaborative accounts receivable payment portals bring every stakeholder together on the same page. With these AR automation solutions, your customers can directly message your AR teams with their concerns, receive information on dispute statuses, and communicate with other stakeholders like sales.

These features make customer communication easy.

2. Faster follow up and deeper insight into customer issues

Payment reminders are a time-consuming task that risks alienating customers. Accounts receivable teams spend time crafting them, emailing them to customers, monitoring inboxes for responses, and creating even more—unnecessary—sequences.

All the while, you have no clue whether your customers are even reading your reminders or filtering them into some neglected email folder. Automated reminders that are delivered to customers directly via a shared payment portal are far more effective. Your customers are more likely to read messages delivered through a centralized—and frequented—channel and respond with any issues they may have.

In turn, this helps your accounts receivable teams understand customer issues better and work to solve them quickly.

Here's what Sharp's Chammas says. "Versapay’s reminder letters are working because I now have customers with invoices 90 days past due engaging with them and saying, ‘I've already paid this’ or ‘I don't have a copy of this invoice’. These letters are helping us to reduce our DSO."

By uncovering such gaps, Sharp is collecting cash faster and saving time in its AR workflows.

💡 Read more automation success stories in our essential guide to accounts receivable automation.

—

Automation technology can solve manufacturers’ cash flow management problems by turning their accounts receivable teams into models of efficiency. It also helps them make the right credit decisions, speeds up collections, and smooths customer communication.

The key is adopting a collaborative AR payment portal that focuses on aligning your teams around your customers’ issues. Curious about what automating accounts receivable can do for you? Get in touch with us and ask for a demonstration of Versapay!

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.