7 Accounts Receivable Goals for Success in 2025 (and the Technologies Needed to Achieve Them)

- 13 min read

An effective accounts receivable team accelerates cash flow, drives efficiencies, and delivers exceptional customer experience.

But to achieve this, you need to set the right goals.

In this article, you’ll learn the 7 accounts receivable goals every AR team should look to achieve to ensure success in the coming years, alongside the technologies that'll help you achieve them.

The primary goal of managing accounts receivable is to accelerate cash flow by ensuring timely payments. And to achieve that, you need to set effective accounts receivable goals and objectives.

But setting AR collections goals is only half the battle. The other is equipping yourself with the tools necessary for success and for achieving loftier objectives—like digitally transforming your AR processes to both automate and make them more human; or retaining top-tier accounting talent. That’s because accounts receivable teams who rely on manual processes will encounter roadblocks and impediments to growth, making it harder to attain their long-term collections goals, or fully realize their function’s potential.

Conversely, those who embrace automation—and recognize that goals should contribute to building engaging customer experiences—will enjoy more sustainable cash flow and heightened customer lifetime values.

But automating your accounts receivable should not be a goal unto itself. That’s because accounts receivable has implications beyond just facilitating revenue and should be seen as a key touchpoint in your overall customer experience. Instead, automation should be a tool that helps you achieve your goals. Yes, you should inherently want to be more digital, however automation alone will not bridge the communication gap that so frequently causes payment disputes and gives AR teams headaches.

That’s why in this article, we’ll cover 7 goals for accounts receivable every finance team should look to achieve to ensure success in the coming years, alongside the technologies that’ll help you achieve them. Any—or all—of these goals should be on your list for 2025, but it’s all dependent on what you’re hoping to accomplish—and on how much you’ve digitized and transformed your accounts receivable to date.

🎥 Don’t feel like reading this article? Watch our webinar above instead! To help you take your best step in 2025, we’re highlighting what we’ve learned from our clients, and how those insights can help accounts receivable professionals like you.

What are accounts receivable goals and objectives?

Accounts receivable goals and objectives are tangible, achievable, actionable intentions that finance leaders set for their teams or for the broader business. Performance goals for accounts receivable provide focus and targets for the business to work towards.

There are many goals that finance teams can strive to achieve. These might include some more tactical—like sending invoices without delay—and others more strategic—like choosing to bill your customers electronically or to enact a new system for resolving disputes. Those we’re highlighting in this article represent the top goals B2B companies should focus on this year.

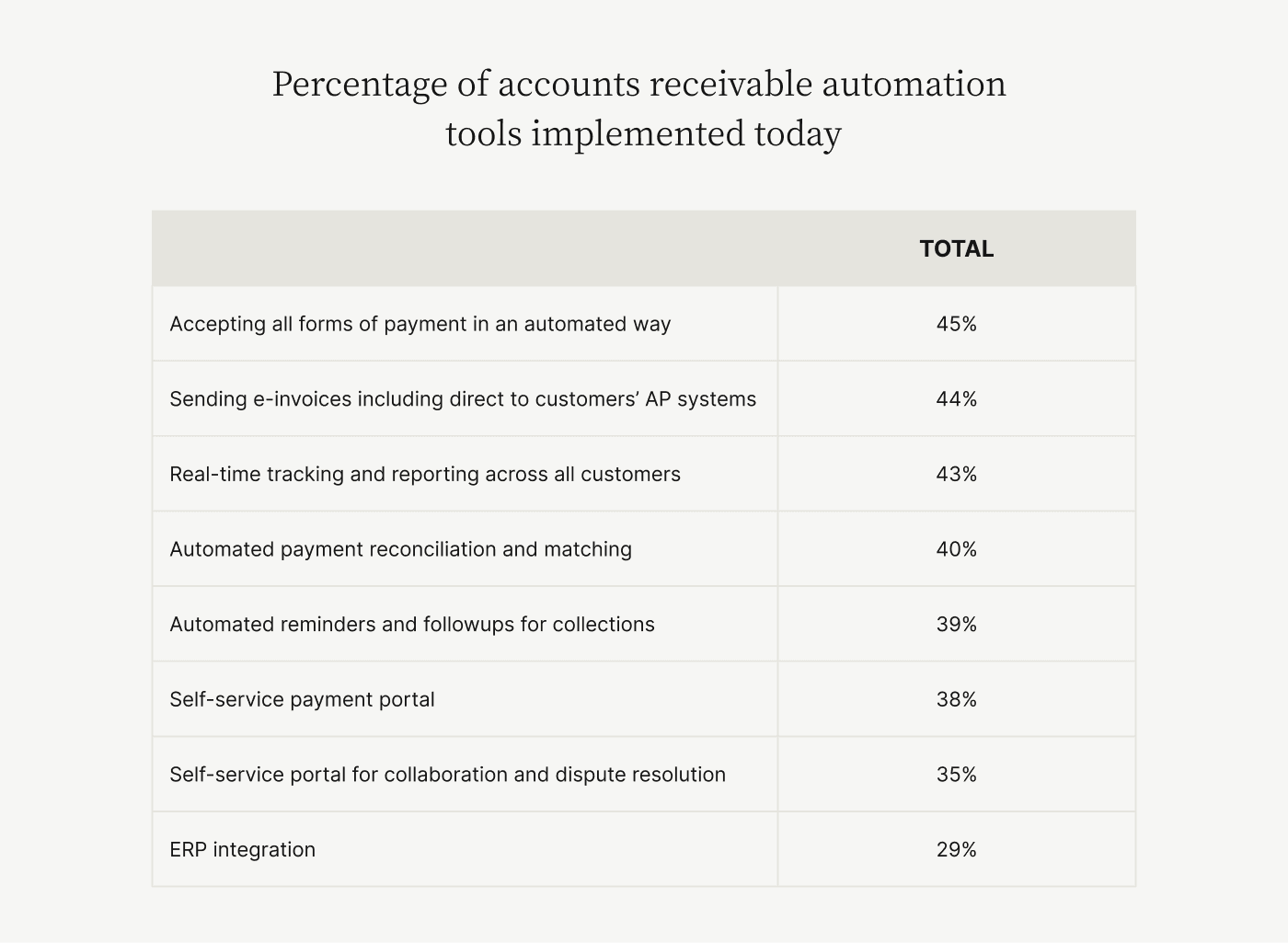

Now, just before getting into those goals, it’s important we note that most businesses view digitization as a key part of goal setting. However, despite digitization being more important than ever, few businesses have fully digitized their accounts receivable department. Even the highest-adopted AR automation tools have only been embraced by less than 50% of businesses.

7 goals for accounts receivable in 2025

Without further ado, here are 7 accounts receivable goals and objectives you should consider setting to ensure your business is well-equipped to accelerate cash flow, drive efficiencies, and deliver exceptional customer experiences.

- Accounts receivable goal 1: To eliminate manual, routine, error-prone, disjointed AR tasks, and automate activities like invoicing, reminders and payment processing

- Accounts receivable goal 2: To facilitate B2B payments and offer your customers a more convenient payment experience

- Accounts receivable goal 3: To automate the cash application and financial reconciliation process

- Accounts receivable goal 4: To increase the bandwidth of your AR team so they can focus on higher value strategic tasks (and less on administrative, tedious tasks)

- Accounts receivable goal 5: To improve your customers’ payment experience and your team’s communication

- Accounts receivable goal 6: To attract and retain top-tier accounting and finance talent

- Accounts receivable goal 7: To provide your customers and AR team shared access to the same information and data over the cloud

PS—before setting any goals, we recommend you are first clear on the factors impeding your existing AR processes. Otherwise your struggles will persist, regardless of your aspirations. If you’re unsure of what challenges you’re currently experiencing, take our 6-minute assessment and identify the most pressing problems facing your accounts receivable team today.

Accounts receivable goal 1: Eliminate manual, routine, error-prone, disjointed AR tasks, and automate activities like invoicing, reminders and payment processing

If you haven’t already, put this accounts receivable goal at the top of your list for 2025. You stand to gain major time-savings from transforming your accounts receivable, and much of this comes from bettering tasks like invoicing, collections reminders, payment processing, and reconciling information in your ERP. These are the typically routine tasks that eat up much of your AR team’s time.

Eighty percent of finance executives happen to report reducing time-consuming, error-prone processes as a top benefit of AR automation:

How to achieve this accounts receivable goal: the technology you need

Shared, cloud-based supplier and customer portals provide centralized real-time views of your customers’ invoice and payment history, helping you avoid the need to compile and track fragmented data across multiple places—like notes, spreadsheets, and outdated systems.

Automated internal notifications and other timely prompts keep you on task and focused on your collections priorities.

Automated customer notifications with customizable email templates and dunning notices help you engage customers before they become delinquent.

Automatic reconciliation of digital payments posted directly back to your ERP helps simplify the process of posting to and balancing the cash receipt journal.

Omni-channel electronic invoicing allows you to issue, track and automatically deliver electronic invoices and statements to your customers.

Accounts receivable goal 2: Facilitate B2B payments and offer your customers a more convenient payment experience

There are many advantages to being able to easily and securely accept payments online from your customers preferred B2B payment methods—including credit, debit, ACH, virtual cards, bank payments, and more.

Benefits include improvements to cash conversion, faster payment collection and processing across all sales channels, and optimized processing costs—making this accounts receivable goal highly desirable. In fact, 70% of finance executives report the ability to accept digital payments as a top benefit of AR automation:

How to achieve this accounts receivable goal: the technology you need

Integrated payments and omni-channel payment acceptance make it easier to accept a greater variety of digital payments and post them directly back to your ERP, helping you deliver the flexibility customers demand.

Embedded payment functionality within invoices makes it easy for customers to pay their invoices and for you to accept payments—from anywhere.

Fully customizable payment rules—including automatic recurring payments at the individual customer level, credit card surcharges, and fee exemptions—let you stay in control of the payment experience.

Flexible invoicing means fewer unpaid invoices as customers can pay for individual line items or group invoices together.

Accounts receivable goal 3: Automate the cash application and financial reconciliation process

Cash application is an important part of your business, but doing it manually brings challenges:

Decreased speed and accuracy

Longer days sales outstanding

Less working capital when you might need it most, and

Compromised relationships with your customers

With advanced cash application automation technology, you’re able to harness powerful tools that make your cash application process smarter, faster, and stronger. Having this capability makes capturing and reconciling payment data easy, eliminates data entry errors, and speeds up cash flow.

How to achieve this accounts receivable goal: the technology you need

Self-service online payment portals empower customers to pay at their convenience and dictate which payments apply to which invoices, taking the work out of cash application.

AI-powered advanced cash application technology leverages machine learning to automatically match traditional payments like checks and wire transfers with remittance data and open receivables.

Custom settlement routing allows you to easily settle incoming payments to the appropriate bank accounts.

Optical character recognition digitizes messy remittance information like illegible characters, unstructured formats, and missing information and quickly and reliably analyzes and normalizes it.

Integrated exception handling lets you easily identify unapplied payments and seek clarification from customers via familiar, chat-like collaboration tools.

Accounts receivable goal 4: Increase the bandwidth of your AR team so they can focus on higher value strategic tasks (and less on administrative, tedious tasks)

Help your AR team do what it does best: drive the business forward—not spend hours performing administrative duties.

In solving inefficient processes, you open the door to greater career development for your team of AR professionals. Automating the tedious, time-consuming work AR teams perform regularly—like preparing invoices, making collection calls, and processing payments—and empowering them with the technologies needed to prioritize customer experience, frees them to perform more strategic work.

Achieving this accounts receivable goal will make team members happier and more engaged as they get exposure to greater challenges that will set them on the course for career growth.

Seventy-five percent of finance executives report increasing bandwidth for accounting and finance teams to take on strategic initiatives as a top benefit of AR automation:

How to achieve this accounts receivable goal: the technology you need

Shared, cloud-based payment portals centralize customers’ invoice and payment history, providing your AR team with real-time visibility across all accounts and saving them the hassle of compiling important information from multiple sources and systems.

Omni-channel electronic invoicing lets your AR team automatically create, issue, track, and deliver electronic invoices and statements to customers, eliminating the need to physically print, prepare, and mail invoices—and receive payments the same way.

Built-in dispute management and chat-like online collaboration tools help your AR team engage customers faster, at the source of the problem—the invoice itself—without relying on clunky communication methods like phone and email.

Digital payment acceptance means customers can receive and pay bills online in minutes using their preferred payment methods at any time of the day, empowering them to self-serve without an AR professional’s assistance.

Accounts receivable goal 5: Improve your customers’ payment experience and your AR team’s communication with them

Miscommunication in the invoice to cash process leads to tangible, negative effects on revenue.

Fortunately, AR automation tools do have the capability to remedy that. And yet, not all AR automation solutions are created equally; and most traditional solutions don’t improve communication between your team members and your customers.

That’s why when looking to achieve this goal it’s important to seek out AR automation tools that prioritize ease of communication and collaboration between you and your customers. These tools can bridge the gap between AR being either exclusively hyper-efficient or a core contributor to customer experience—and can ensure AR teams are delivering not only against their efficiency targets, but simultaneously building flourishing, collaborative payment experiences.

Sixty-five percent of finance executives report fostering a culture of collaboration and an excellent customer experience as top benefits of AR automation. Meanwhile, 35% recognize that their existing difficulties communicating with customers are preventing them from capturing revenue faster:

How to achieve this accounts receivable goal: the technology you need

Real-time, two-way, chat-like collaboration tools help AR teams resolve issues by engaging their customers at the source of their frustrations—directly on the invoice in dispute.

Digital payment acceptance lets you meet your customers where they are, by encouraging easy, secure payments using their preferred payment methods

Shared, cloud-based supplier and customer portals allow for direct collaboration between your AR team and your customer’s AP team throughout the entire order-to-cash process.

Automated cash application unites account information and payment history while simultaneously facilitating digital transactions, for faster—discernible—payments your customers don’t need to clarify, and accelerated cash flows.

Accounts receivable goal 6: Attract and retain top-tier accounting and finance talent

With record numbers of employees choosing to leave their jobs in the last two years, or quiet quitting in their seats today, finance leaders who want to avoid the damaging impacts of high turnover should turn their attention to the accounts receivable goal of enabling long-term remote work and prioritizing employee satisfaction.

Digitizing the billing and payment process can ensure work from home continuity by eliminating the tedium of collecting on outstanding receivables, and empowering AR professionals to take on strategic work. In fact, 73% of finance executives report an improved ability to attract and retain accounting and finance talent as a top benefit of AR automation:

How to achieve this accounts receivable goal: the technology you need

Advanced automation helps AR departments focus less on routine tasks and become more integral parts of the customer service team. The automation of manual, routine, and error-prone tasks also frees AR teams to focus on more strategic work, unlocking potential opportunities for career advancement.

Electronic invoicing and digital payment acceptance streamlines the AR process, relieving accounting talent from having to be physically in-office to send and collect mail.

Cloud-based collaboration tools make it easy for team members (both inside and outside of the AR department) to communicate no matter where they’re located, helping accommodate employees’ desires to work remotely long-term.

Accounts receivable goal 7: Provide your customers and AR team shared access to the same information and data over the cloud

Delivering always-on access to complete, shared invoice and account information helps eliminate tedious manual workflows and create superior customer experiences. The latter is an increasingly sought-after competitive advantage that’s ripe for prioritization from within accounts receivable.

Sixty-five percent of finance executives report that providing shared access to information and data over the cloud is a top benefit of AR automation:

How to achieve this accounts receivable goal: the technology you need

Shared, cloud-based supplier and customer portals grant real-time visibility across full customer invoice and payment histories, giving AR teams everything they need to know about their customers— and customers everything they need to know about their accounts—in one place.

Integrated internal communication channels help AR teams answer their colleagues’ questions, request information from them, share documents, and loop team members into discussions.

Collaborative conversation tools allow for invoice line-item communications to take place, over-the- cloud, between your customers and your AR team. Customers can register disputes in real-time and your team can address them swiftly, making your team a collections force to be reckoned with.

—

Regardless of which accounts receivable goals and objectives you strive for, remember that automation alone is just one piece of a very large puzzle. The AR function has influences beyond capturing revenue and should be seen as integral to your overall customer experience initiatives.

To bridge the communication gap that so frequently infects AR and causes payment disputes; and to accelerate cash flow and drive efficiencies, you'll want to transform your accounts receivable. And to do so, you'll need the right technologies.

Take our 6-minute assessment and get your personalized accounts receivable transformation roadmap. Learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.