Why AR Automation is Critical to Unlocking Faster Payments for Wholesalers

- 3 min read

From complex pricing structures to compliance and regulatory charges… wholesale distributors face challenges from every direction.

Luckily, there’s a solution.

This article explores how accounts receivable automation helps wholesale distributors unlock faster payments and strengthen customer relationships.

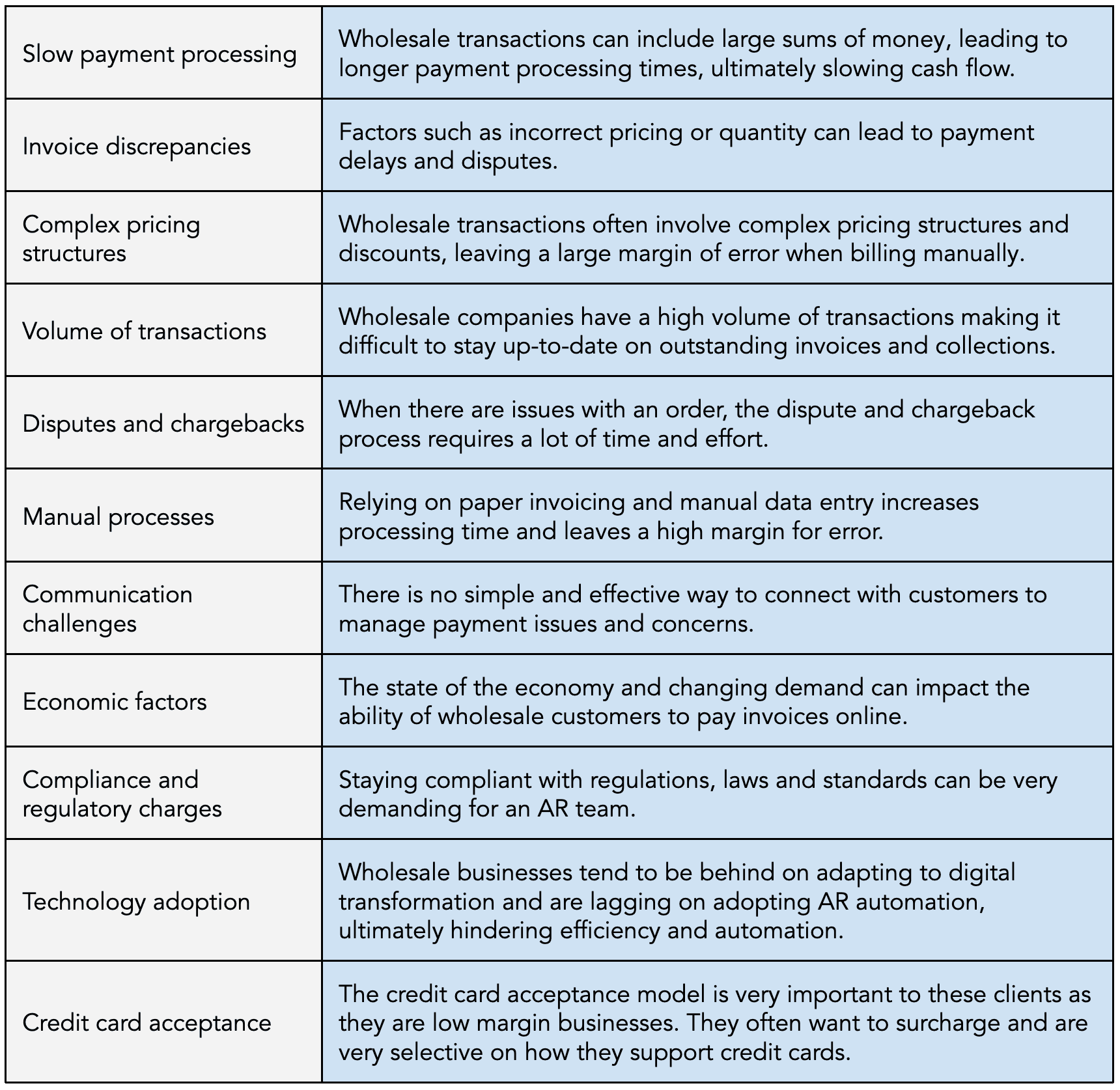

Wholesale distributors face tight margins and can use all the order-to-cash (O2C) efficiency gains they can get. Take a look at some of the accounts receivable (AR) specific challenges wholesalers face:

While some of these challenges occur due to issues with customer processes, you can avoid many of them by digitizing your AR workflows. The good news is that several common AR processes still depend on manual execution and digitizing them will give you a quick efficiency boost.

In fact, Versapay's research shows just how much room for digitization there is. Ninety-six percent of B2B C-suite executives believe AR needs further digitization. And ninety-two percent of them agree that digitizing every department in their companies is key to achieving peak performance.

Now, let’s take a much closer look at some of the issues wholesale distributors face, and how digitization can help you avoid them:

What ails wholesale distributors' AR workflows

The challenges wholesalers face when collecting cash are a symptom of deeper issues within their AR processes. Here are the three primary causes of these challenges:

Inefficiency cause #1: Manual processes

Inefficiency cause #2: Communication gaps

Inefficiency cause #3: A back office mentality

Inefficiency cause #1: Manual processes

Our research shows that AR teams are overburdened, with 98% of executives reporting that upper management must dive in to solve customer disputes and payment delays.

Manual processes are the root cause of AR having too much on its plate. Instead of helping you analyze cash flow and apply cash to your books, accounts receivable is busy chasing paper. Whether sending invoices or emailing payment reminders to customers, your AR department has no time to conduct value-added work.

Worse, these manual processes create paper trails that get lost. For example, AR cannot instantly pull sales agreements to verify customer credit claims or proactively offer your best customers better credit terms to enhance that relationship.

Manual processes do not create data—or make what little data there is, transparent—and without data, you cannot generate cash flow insights.

Without automation, your processing times increase, invoice errors increase, you get discounts and credit wrong, and create needless disputes that create customer and AR frustration.

Inefficiency cause #2: Communication gaps

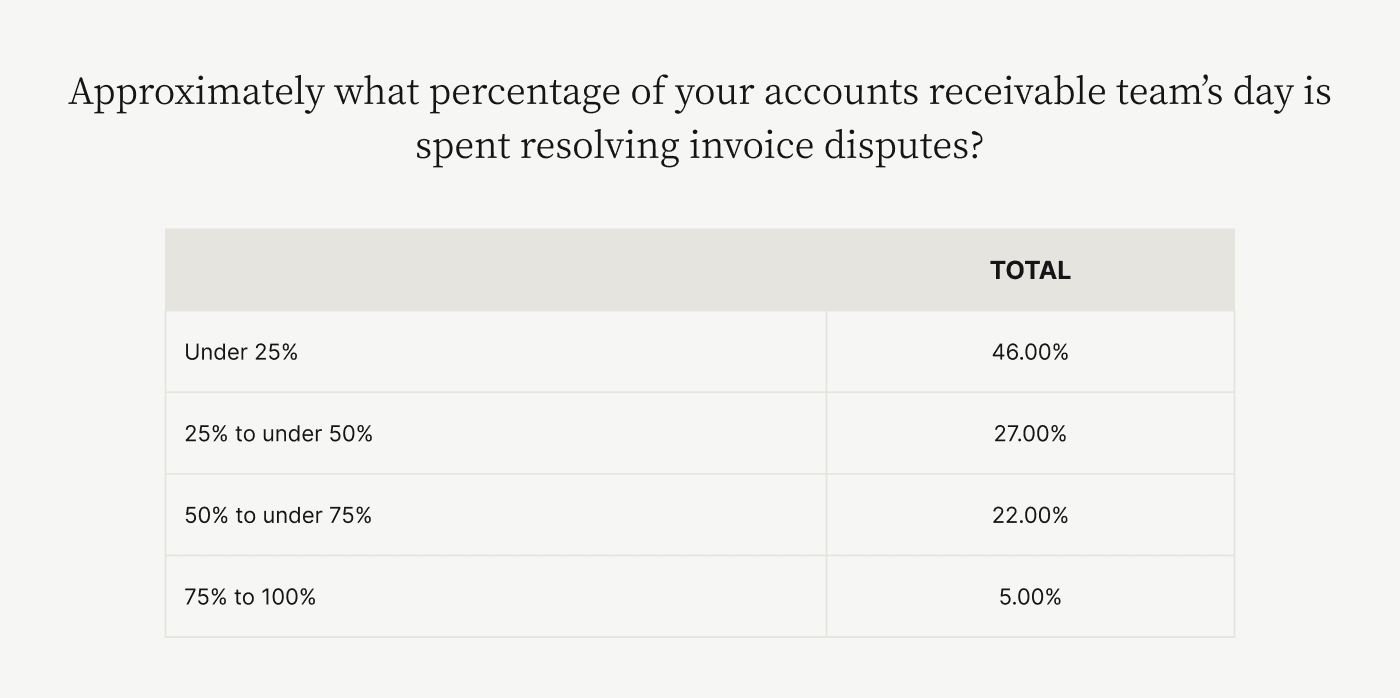

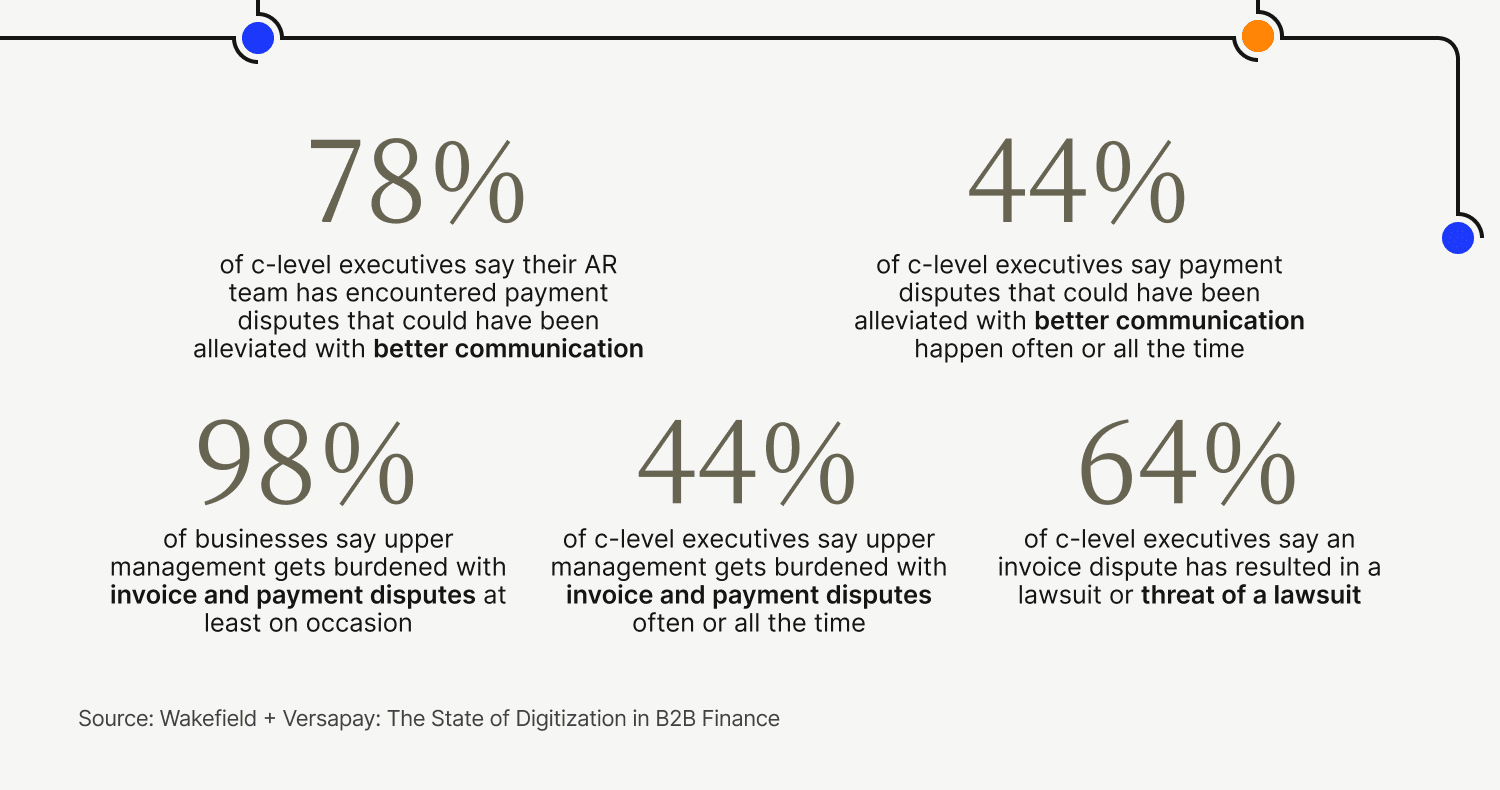

When speaking of customer-facing teams, most wholesalers think of sales and customer service. They ignore AR's (and the finance department’s) place in this list, which explains the fact below:

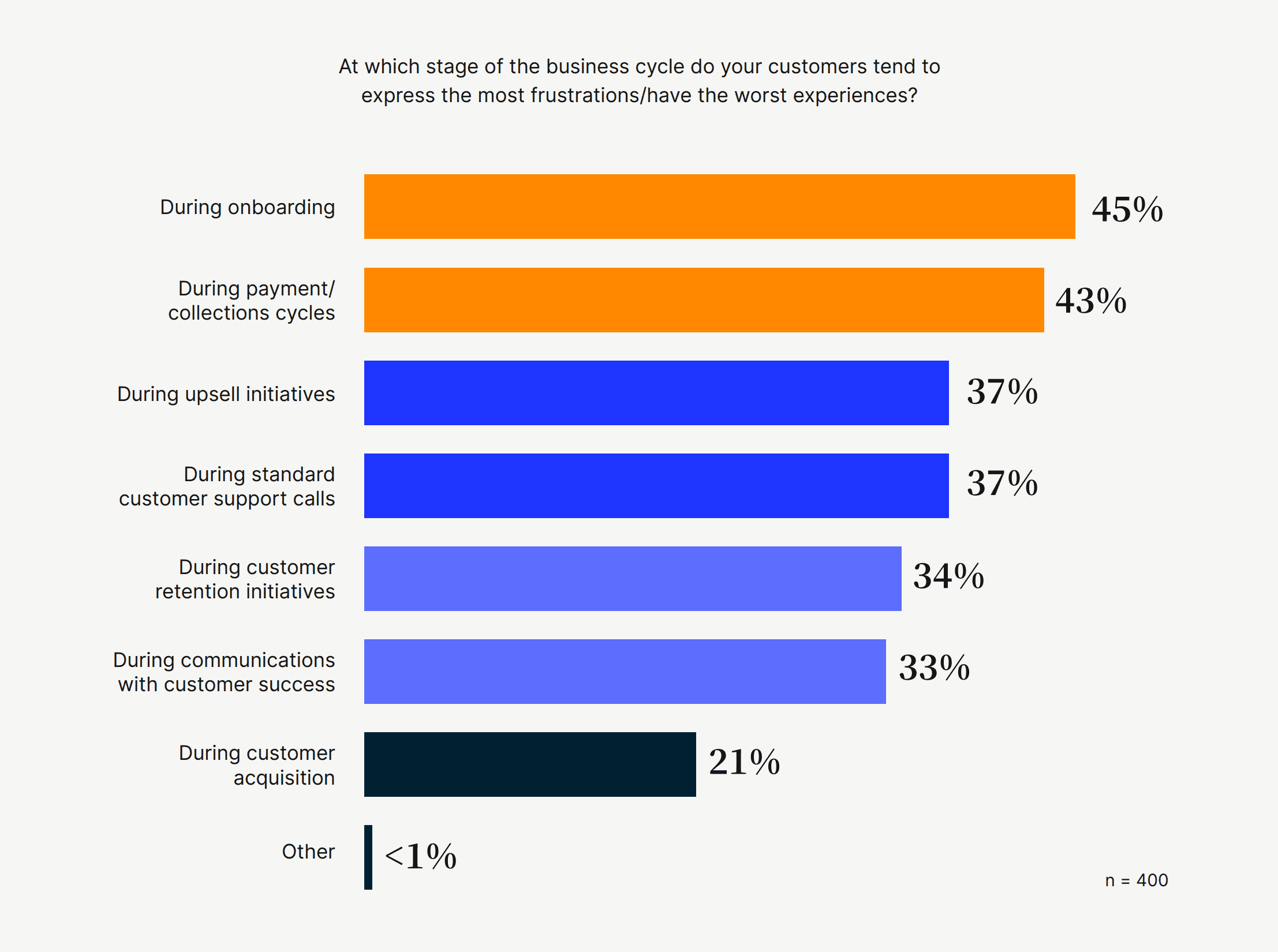

AR presents a huge CX opportunity, yet to most customers, AR is a faceless entity that only arrives with bad news. Either payments are overdue or the team has no idea about dispute nuances. The result is poor CX and immense frustration.

Better communication through collaboration is a solution, but the lack of technological investment doesn't do AR any favors. Some companies electronify existing AR processes, but this is a veneer of digital transformation instead of the real thing.

Without good communication channels, your AR team cannot understand complex disputes quickly or involve other stakeholders to solve issues. Poor CX is almost guaranteed, as a result.

Inefficiency cause #3: A back office mentality

AR is a customer-facing team, yet lacks the resources sales and customer service receive. We've already highlighted how digitization in AR lags behind the rest of the company.

Manual workflows and communication gaps point to a phenomenon we've titled the AR Disconnect. The AR Disconnect refers to the gap between AR teams and their customers, with both sides failing to understand the other's issues.

Thinking of AR as a back office function or cost center instead of a CX driver is a big reason the AR Disconnect exists. As long as wholesale distributors continue treating AR as a back office, their O2C headaches will continue, creating greater customer frustrations, slow payments and cash application, and poor cash flow visibility.

Here's how digitization solves your AR issues and brings you closer to your customers.

How accounts receivable automation gets wholesalers paid faster

One reason for slow payments is that your customers are probably paying you with paper checks. These take time to collect, deposit, and clear. And once they do clear, applying cash is a process unto itself.

Here's how AR automation gets you paid faster:

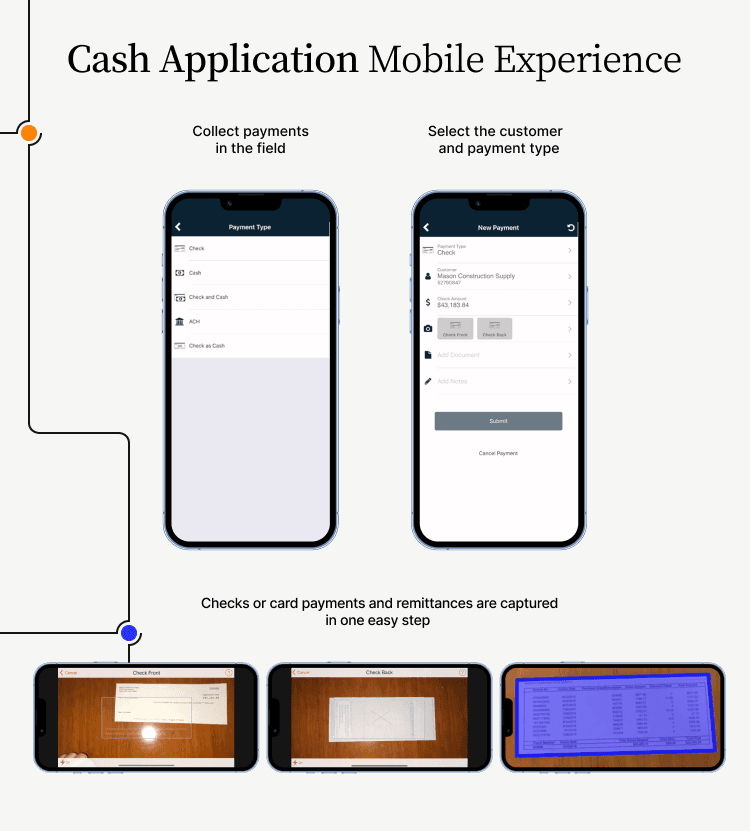

Collect checks through mobile AR

Offer quicker payment methods

Automate cash application

Collect checks through mobile AR

Collaborative accounts receivable portals like Versapay’s come chock-full of digital features like mobile check deposits that remove wholesalers’ check collection hurdles.

Features like these have helped Würth Canada reduce its check processing time by 75%.

Michael Malone, Credit Manager and Company Compliance Officer for Würth Canada details a common wholesale distributor experience.

"We have 40,000 customers across Canada serviced by over 470 sales reps. The majority of these customers mail their checks to our Head Office in Guelph via Canada Post, but many customers prefer to hand payments in person to their Würth Sales Representative," he says.

Würth was collecting over 50 checks daily, paying between $10 and 50 CAD to post those checks by mail for processing. Mobile check deposits helped the company cut those costs and automatically send checks for reconciliation.

Offer quicker payment methods

Wholesalers face lengthy invoice processing times since their customers use traditional and slow payment methods. What if you could offer them faster and more convenient payment methods though?

Digitization helps you offer a wide range of B2B payments like:

Credit and debit cards

ACH

Bank transfers

Instead of waiting for customers to issue a check, collect, deposit, and wait for it to clear, you can send them a link to pay you instantly.

Our customer TireHub removed manual billing from its workflows and now saves 200 hours weekly.

"The speed with which we’re now able to get the payment applied to the open invoice allows our business to charge faster," says Matt Marin, TireHub’s Senior Manager of Financial Processes and Data Management. "And, the increased visibility we have into which orders have holds on them helps us resolve those issues faster."

Automate cash application

Manual cash application takes time and has highly qualified AR personnel conducting clerical work. Worse, manual cash application guarantees errors when you're processing high invoice volumes.

Matt explains a few other problems TireHub was facing. "We also couldn’t hold customers accountable for what they owed when we were misapplying payments and credits. We were really struggling to manage our accounts and our customers were frustrated with the mistakes we were making."

Recent advances in AI and optical character recognition (OCR) technology help you automate cash application. Versapay's AI-powered cash application recognizes data from lockbox files, matches buyer and supplier codes, and matches data to invoices.

Cash gets on your books faster and gives your AR team more time to analyze complex issues, instead of conducting clerical work like manually matching remittance data to outstanding invoices.

How accounts receivable automation reduces invoice processing costs

Paper-based and manual processes increase processing timelines and costs. Worse, they obscure AR data, leaving you without insights into cash flow issues.

Here's how AR automation reduces invoice processing costs:

Offer customers real-time statuses

Establishes direct communication with customers

Enables better credit decisions

Offer customers real-time statuses

While a lack of visibility hampers your AR team, it also creates immense frustration among your customers. Without any visibility into statuses, they're reduced to chasing email trails and reaching out to your AR team to receive information.

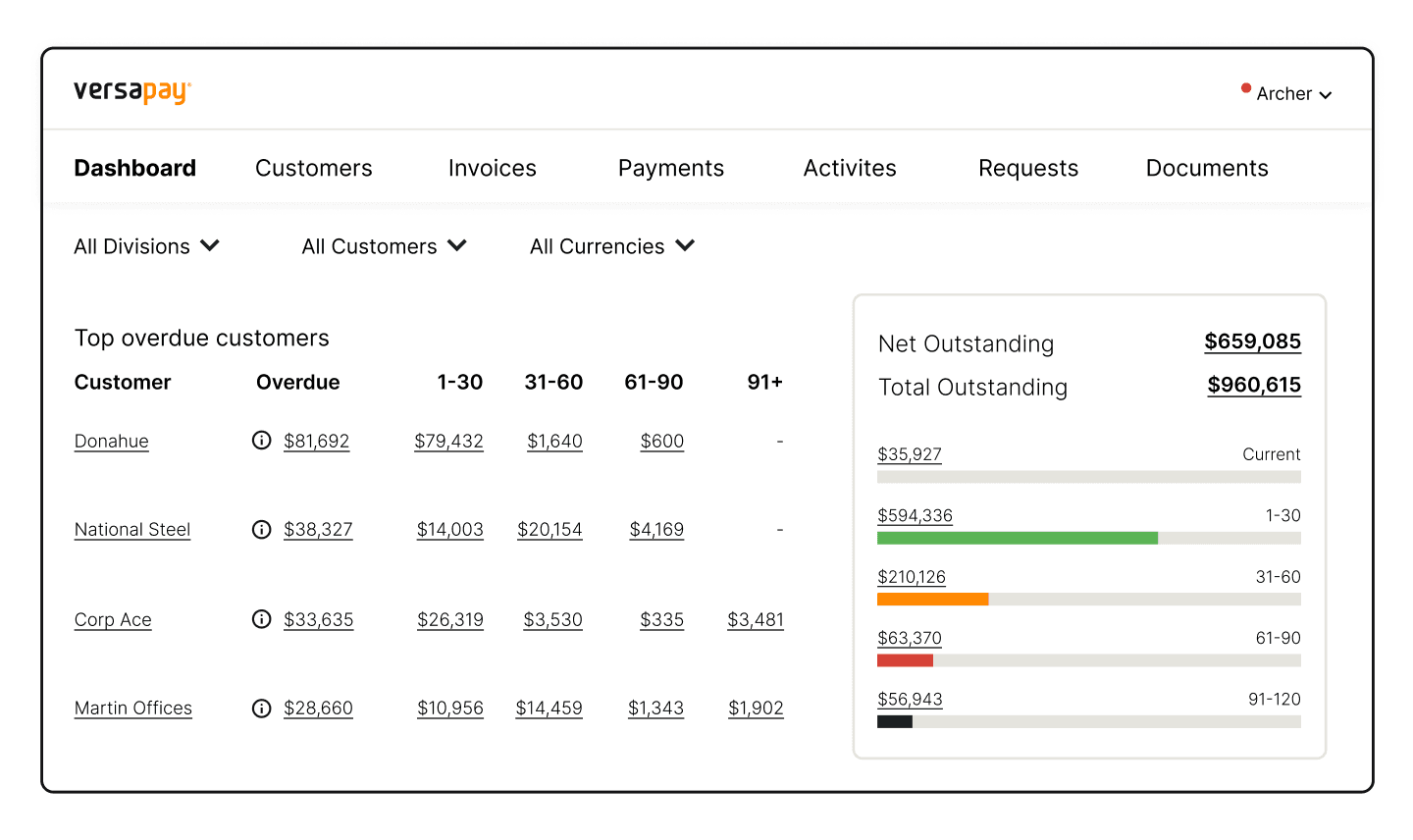

AR automation helps you offer self-service options to your customers. They can view and pay invoices in real-time, 24/7, download statements, and clarify issues instantly, freeing up your AR team's time for value-added work.

Often, automation's benefits become apparent after implementation. For instance, TireHub realized it was saving over 200 hours of paid contract work tasked with solving customer questions after switching to Versapay.

Versapay's automated AR platform centralizes invoice data for TireHub's AR teams and customers, giving all stakeholders visibility to important information.

Establishes direct communication with customers

A lack of direct communication is a persistent AR problem with wholesale distributors. Emails, phone calls, and messages have their advantages but cannot establish audit trails or store important data for easy reference.

These channels create constant back-and-forth which has serious AR consequences. In our State of B2B Digitization report, 85% of C-suite executives admitted that poor AR communication has led to non-payment.

Collaborative AR solutions like Versapay’s offer direct messaging channels to your customers. Your AR team can chat with them, clarify issues in real-time by referencing data, and include sales teams in conversations when resolving issues.

The result is visibility, communication, and fast invoice processing.

Enables better credit decisions

Wholesale distributors have a delicate credit balance to maintain. Customers demand lengthy credit periods while suppliers would rather get paid as quickly as possible.

While invoice and receivables financing mitigate the effect of an inefficient credit cycle balance, they increase costs you'd rather avoid. The key to good credit decisions is data analysis—specifically AR data analysis.

Collaborative AR portals like Versapay’s centralize invoice and payment data while integrating with your ERP software. The result is end-to-end visibility into outstanding invoices and future cash flow.

Evaluate customer credit applications quickly and even proactively offer credit terms to ideal customers. Versapay's platform pulls these data into your invoices automatically, removing any need for AR to hunt current data.

Your customers will appreciate the effort and you get to build strong relationships while keeping your cash flow ideal.

How accounts receivable automation eliminates costly disputes

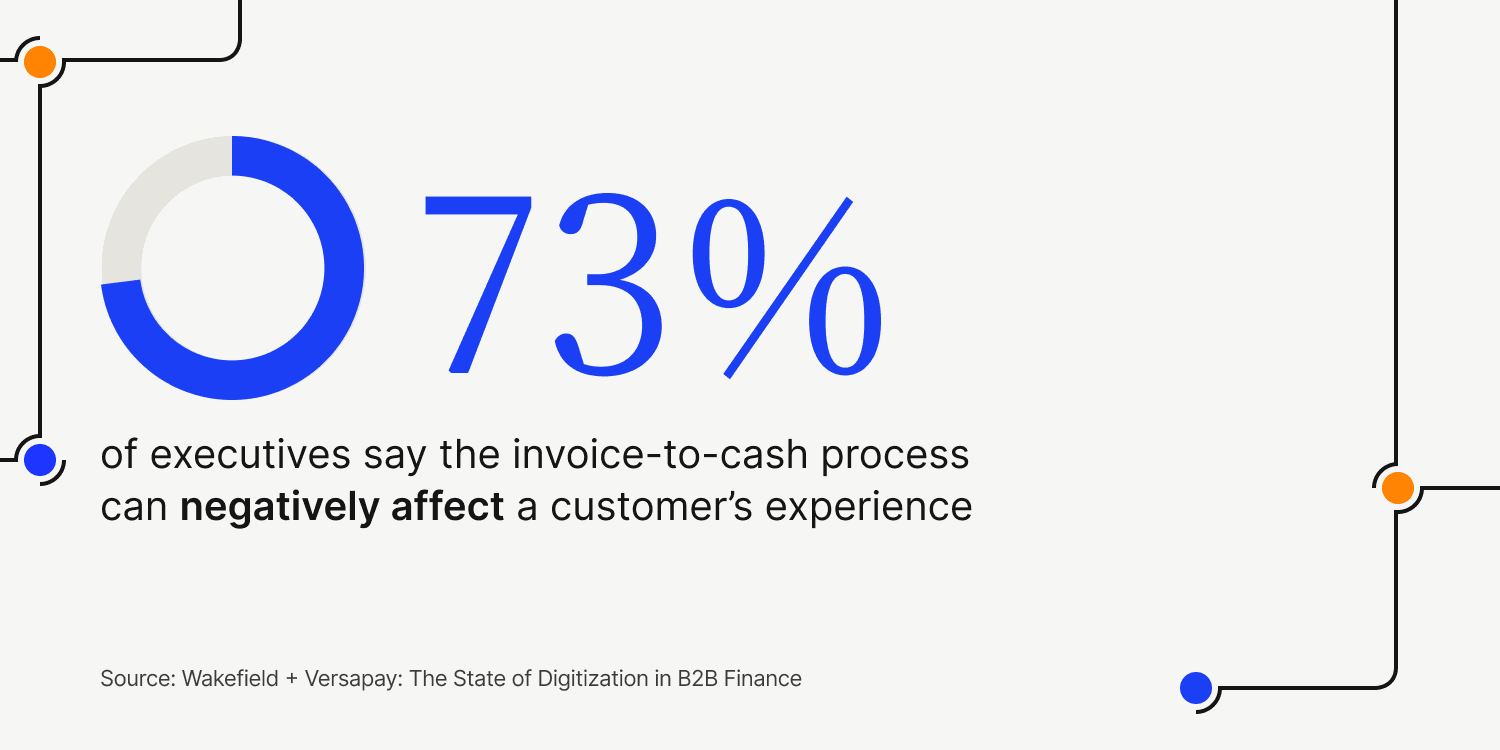

Disputes do more than delay cash entering your books—they also damage customer relationships. Our research reveals that 73% of C-suite executives believe a poor invoice-to-cash experience negatively impacts CX.

Here are a few ways in which AR automation helps wholesalers build strong customer relationships:

Pull invoice data automatically

Send reminders automatically

Deliver memorable CX

Pull invoice data automatically

Wholesale distributors tend to have complex pricing mechanisms, thanks to credit and discounts. Manual invoicing processes will fail to account for all of these factors at volume.

Simply put, your staff cannot keep pace with complexity when they have to chase tons of paper before creating an invoice. With errors come disputes, and more time spent by your AR team chasing the causes behind those errors.

Software like Versapay’s helps you define complex rules (like releasing pending order inventory after a percentage of existing payments clear), pull data automatically, and calculate invoice amounts accurately with a few clicks. You'll avoid invoicing errors and leave no reason for your customers to delay payments.

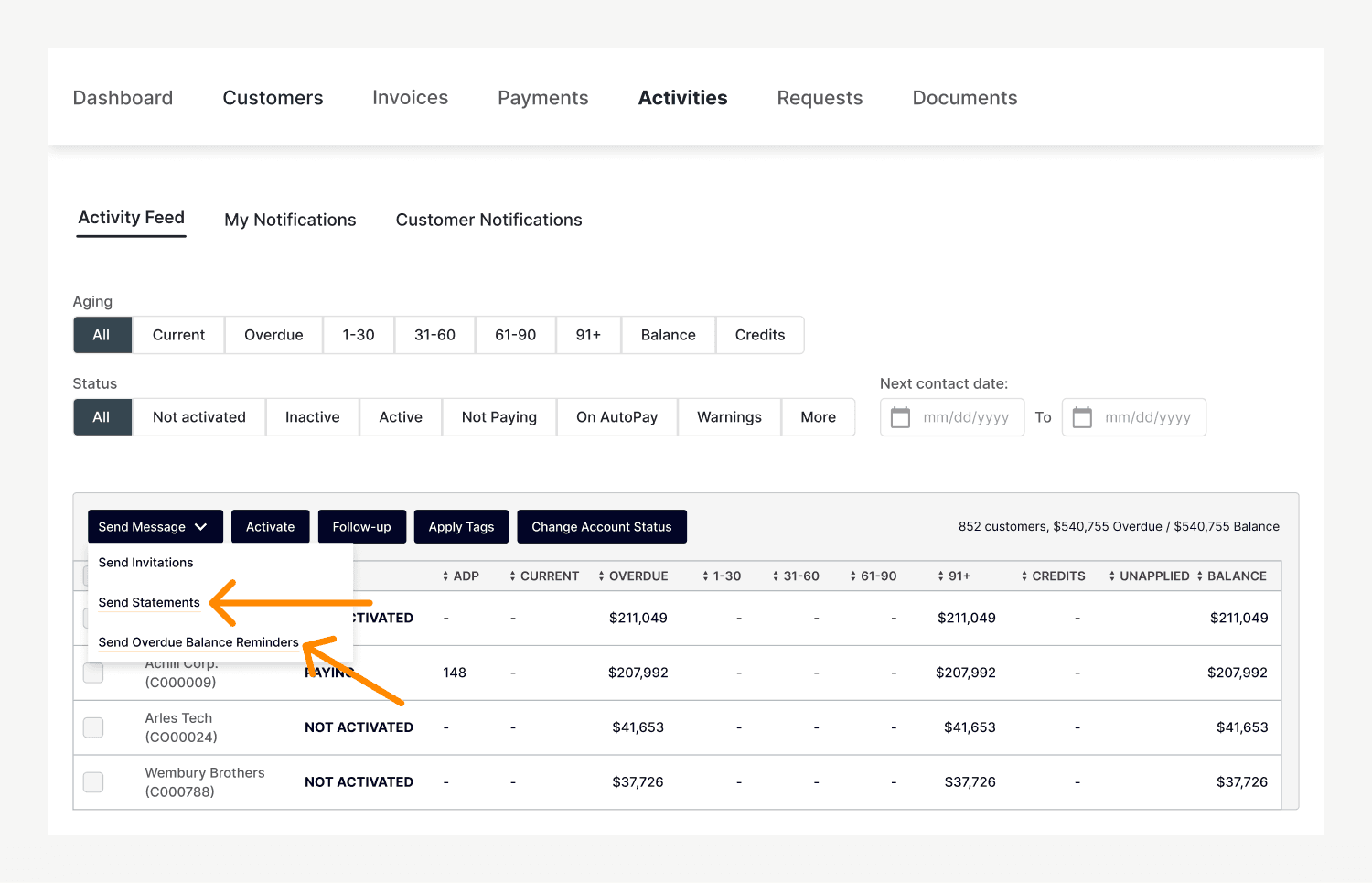

Send reminders automatically

Even the best customers delay payments sometimes. Chasing after payment is a tedious AR task—one which automation can transform.

Versapay's Collaborative AR platform lets you schedule payment reminders, define what data to attach, and deliver them automatically. Your AR team can spend more time on complex disputes that need customized attention instead of chasing routine payment reminder responses.

With reminders automated and sent on time, you'll have fewer late payments and disputes to track.

Deliver memorable CX

Customer relationships are critical in the wholesale industry. With tight margins prone to disruption at the slightest macroeconomic event, you need strong relationships to help you tide over challenging times.

Strong customer relationships also get you paid faster—customers are less likely to delay payments to a favored supplier. Automation gives your customers visibility into payment statuses, a huge improvement from chasing statuses over email.

TireHub's CTO and CIO Ashok Vantipalli also says that his company has moved its AR team to a higher class of problem-solving—one that prioritizes customers more and delights them.

"Versapay has found a way to solve a complicated problem," he says. "And somehow, they found a simple way to solve the problem that also increases customers’ trust. After deploying Versapay, our customers are really happy that they have a handle on everything and can have more meaningful, natural interactions with us."

With strong customer relationships in place and invoice processing costs down, TireHub is less exposed to adverse economic changes. AR digitization has certainly played a role in this shift.

What can AR automation do for you?

Digitized AR holds immense promise for wholesale distributors. Faster cash flow, reduced invoice processing costs, and strong customer relationships are just a few benefits you can realize for your company.

Curious about how Versapay’s accounts receivable automation unleashes your AR team and gets you paid faster? Talk with an expert with us and get control of your AR challenges.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.