3 Critical AR Payment Portal Evaluation Criteria for CFOs

- 9 min read

How can you tell which AR payment portal is right for you?

In this guide, we'll explore the most critical accounts receivable payment portal evaluation criteria that CFOs should consider to accelerate their AR processes and strengthen customer experience.

Key takeaways

Accounts receivable processes impact customer experience (CX) significantly, and the right software will boost cash flow and CX.

However, accounts receivable payment portal features vary, and choosing the wrong option can have significant ROI consequences.

Versapay’s research proves CFOs must focus on account management, online payments, and collaboration when evaluating AR payment portal software.

Collaborative AR payment portals are the key to digitally transforming AR and delivering memorable customer experiences.

—

Every company that issues several—or several hundred—invoices each month has a CX problem. Inefficiencies in payment and collection cycles alienate their customers and damage brand trust.

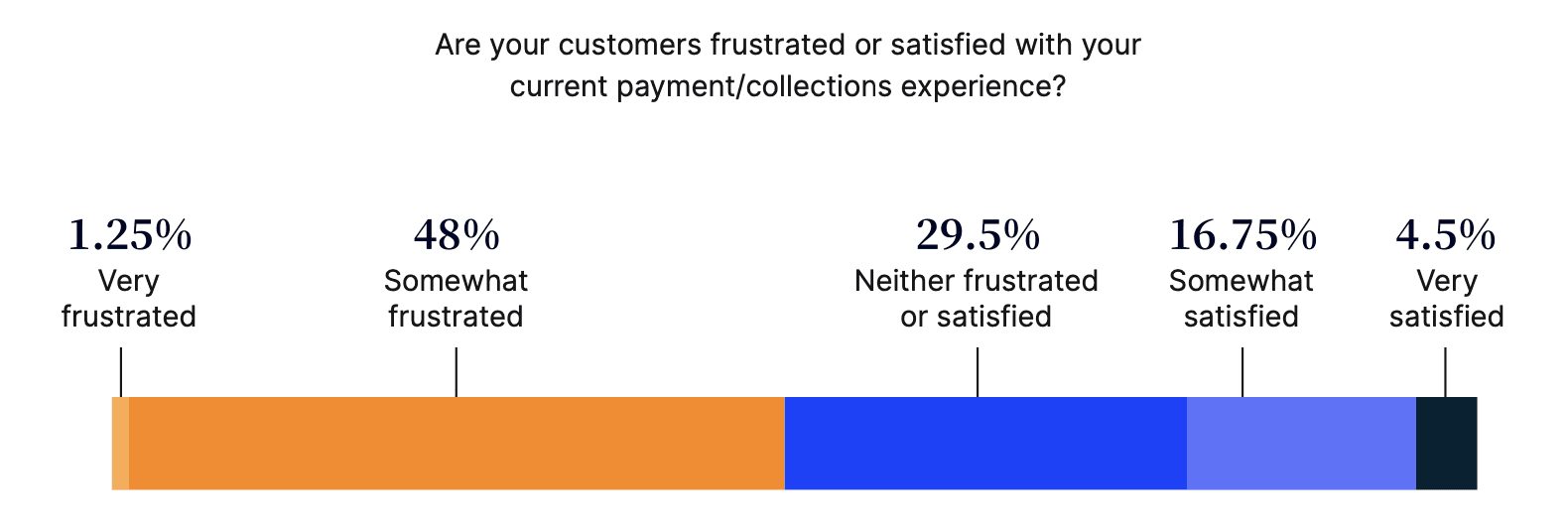

Versapay's survey on Gartner's Peer Community Platform shows that company executives know the CX problem exists but are struggling to solve it.

Investing in cloud-based accounts receivable payment portals is a great way of boosting CX by digitizing AR workflows. However, choosing the right accounts receivable payment portal can be tricky. Companies can pick from two categories:

Standard payment portals — These technologies focus on centralizing data and offer customers fixed payment methods.

Collaborative payment portals — These technologies focus on improving communication and alignment between stakeholders to drive faster collections.

How do you know which AR portal is right for you, and what criteria should you consider?

In this guide, we dive into three important criteria for choosing an accounts receivable payment portal and explain why these criteria matter:

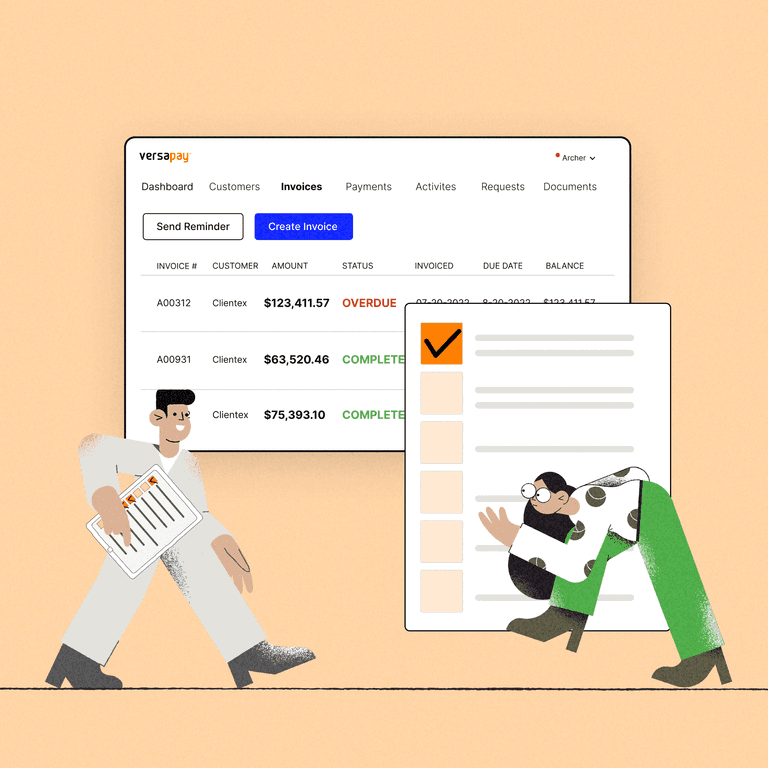

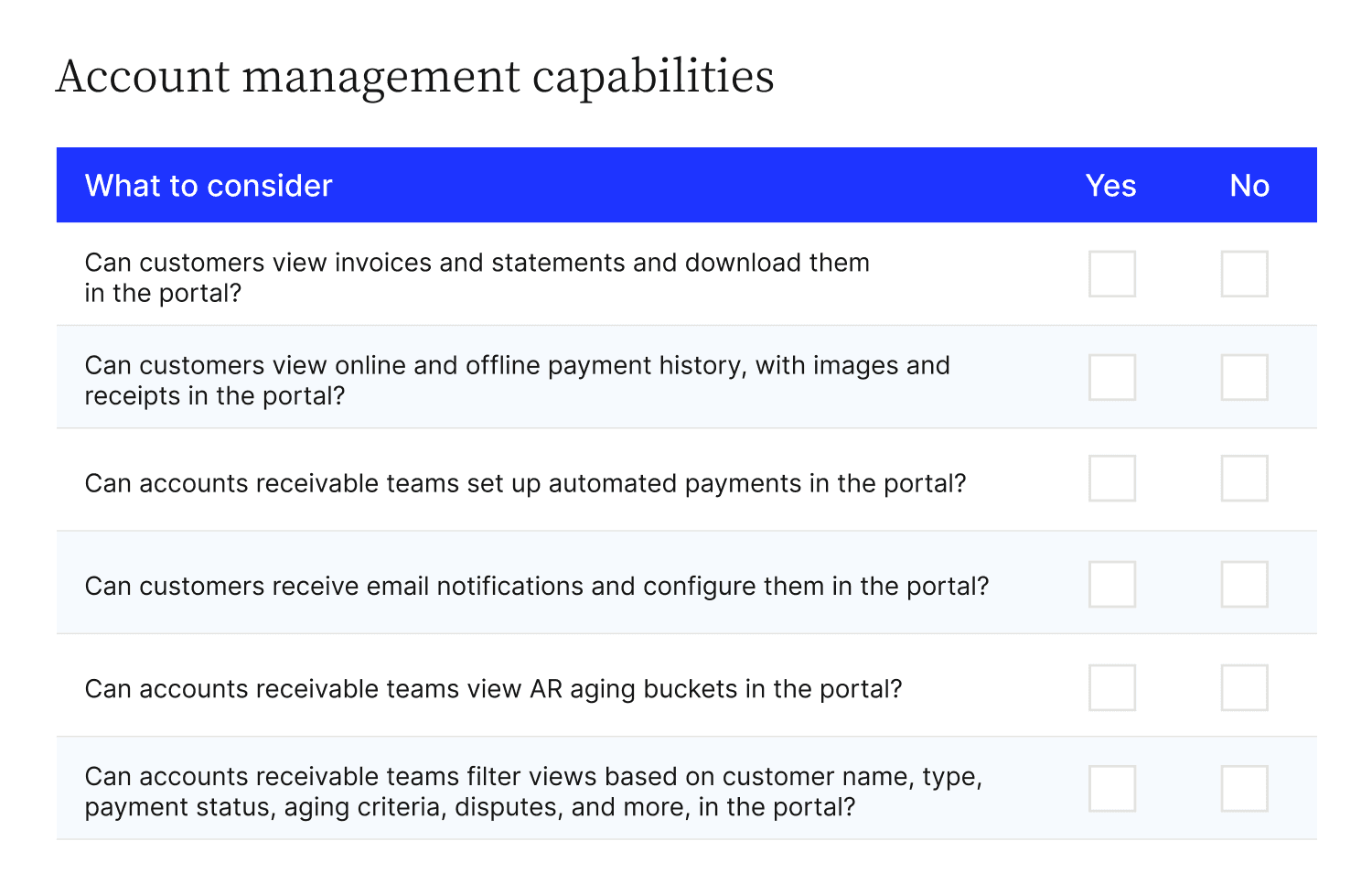

Evaluation criterion one: Account management capabilities

Account management with an AR process refers to centralizing and managing all customer-related data. Some examples of account management-related data are:

Invoices and statements.

Payment statuses.

Payment acceptance rules.

AR aging buckets.

Customer payment methods.

Here’s why evaluating an AR portal’s account management functionality is critical.

Why should you focus on account management?

Accounts receivable is a customer-facing process, and account management data gives AR teams critical information that drives customer communication. It has a direct CX impact and is a significant criterion when evaluating an accounts receivable portal's capabilities.

Centralized customer-level data also aligns internal teams around common pillars. For instance, AR teams can access credit terms offered by sales and prevent invoicing errors. Sales can refer to dispute-related communications and smooth hurdles by offering inputs and preserving positive customer perception.

Account management functionalities also accelerate cash flow. For instance, automated email reminders and the rules governing them are critical to reducing AR workload and speeding up collections. An AR portal must offer customers the ability to quickly view their outstanding invoices, payment, and dispute statuses.

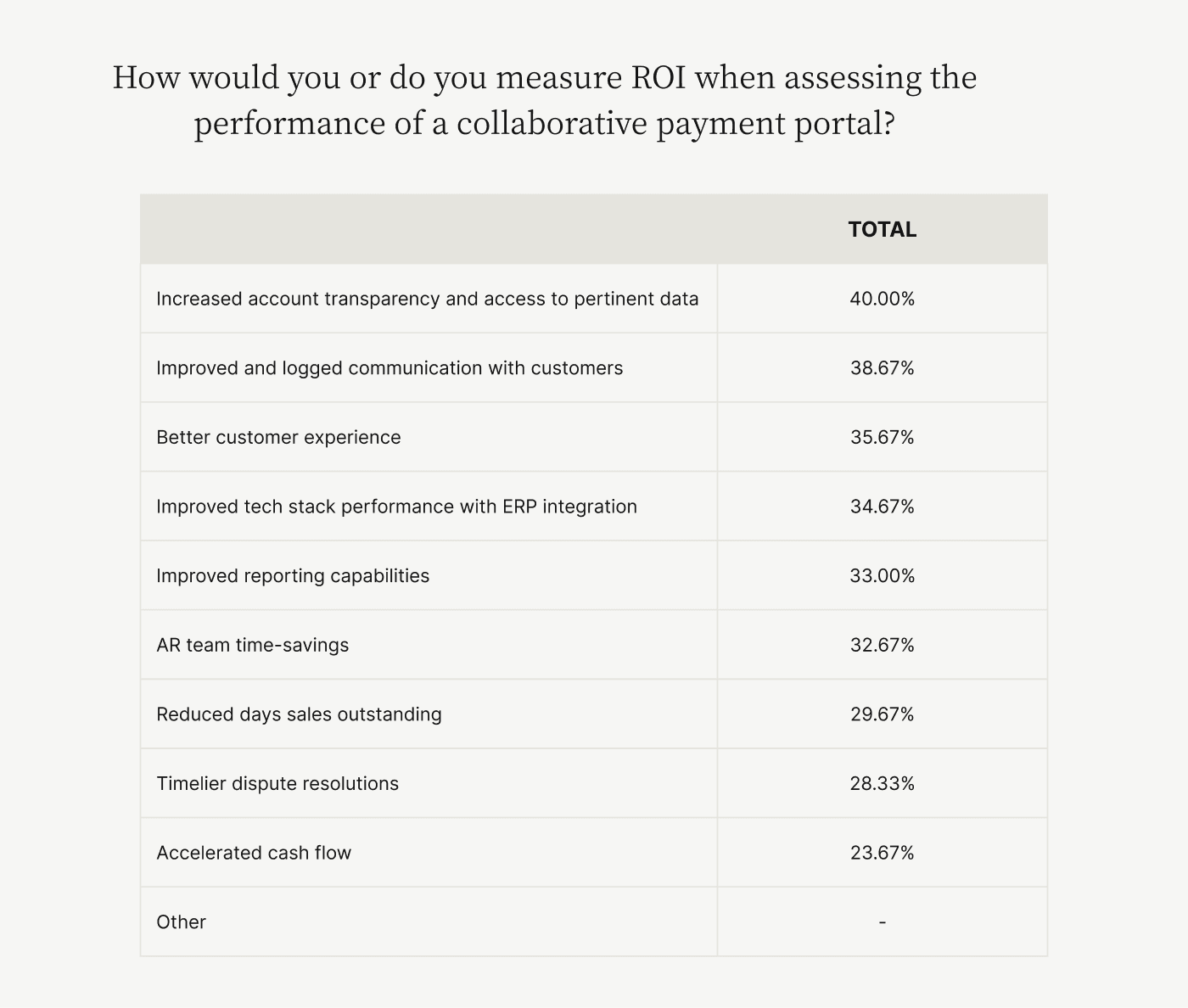

In short, it must make accounts receivable transparent. Respondents to Versapay's CFO survey placed account transparency and data access as the top criterion for evaluating a collaborative accounts receivable payment portal's ROI.

Important account management features

Here are the most important account management features you must evaluate when choosing an accounts receivable payment portal.

Customers can view invoices, statements, and download them.

Customers can view online and offline payment history, with images and receipts.

AR can set up automated payments.

Customers can receive email notifications and configure them.

All stakeholders can view supporting documents.

AR can view aging buckets.

AR can filter views based on customer name, type, payment status, aging criteria, disputes, etc.

Evaluation criterion two: Online payment facilitation

Online payments revolve around offering your customers several payment channels. Some relevant online payment feature examples are:

Payment by card, ACH, and wire transfer.

Paying multiple invoices with a single payment.

Scheduling payments.

Creating and managing payment plans.

Paying per statement.

Here’s why evaluating an AR payment portal’s ability to facilitate online payments is critical.

Why should you focus on online payments?

Payments are a critical portion of accounts receivable workflows. For one, the easier customers find making payments, the faster you collect cash. Second, faster cash collections means increased cash flow and the need for more AR visibility into payment-related data.

Digital and online channels simplify payments, giving customers several B2B payment options and establishing data trails for AR teams to oversee. The result is better CX and AR visibility into cash flow.

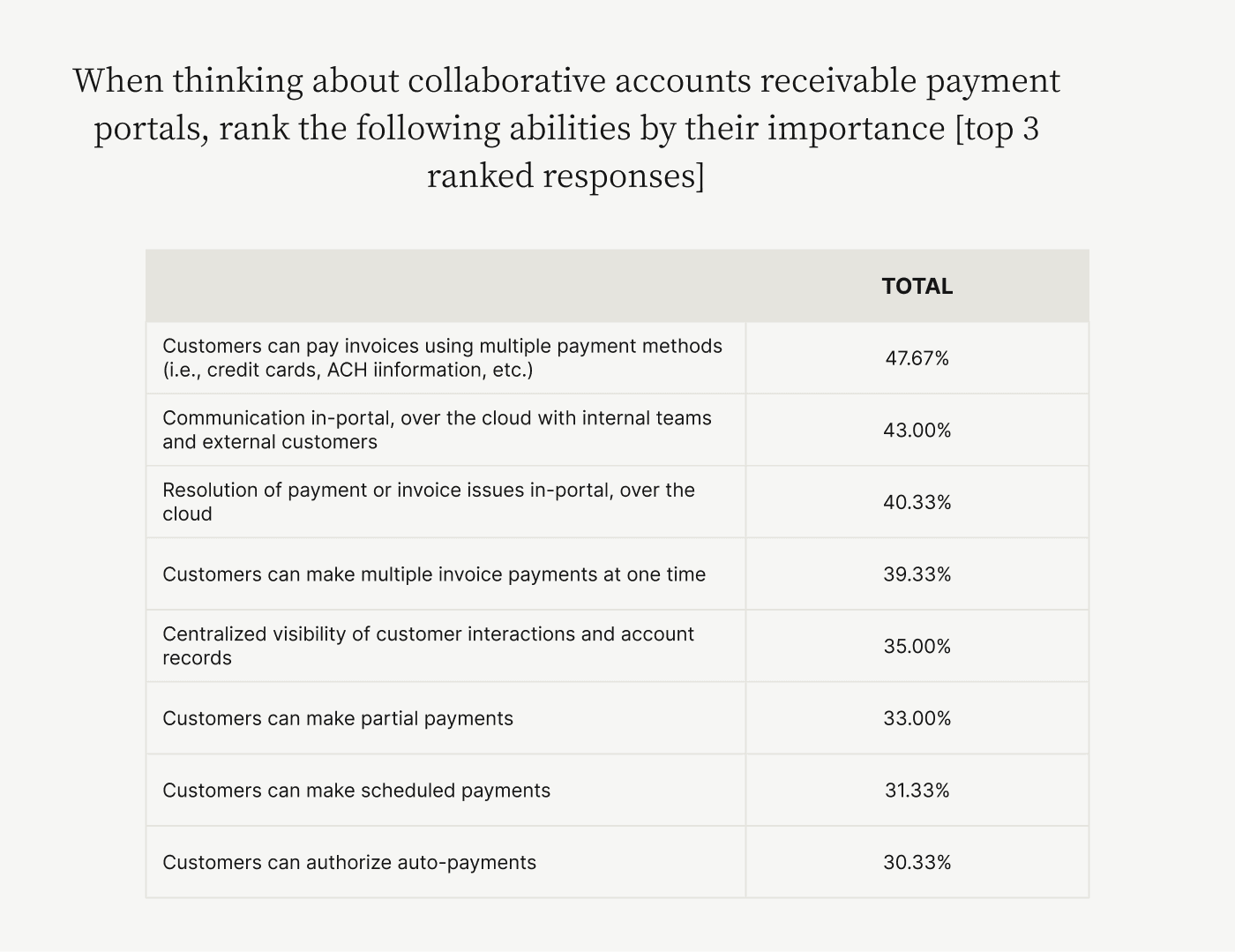

Our research confirmed that CFOs prioritize an AR portal's ability to offer customers multiple payment methods the most, with 47.67% of CFOs picking this option.

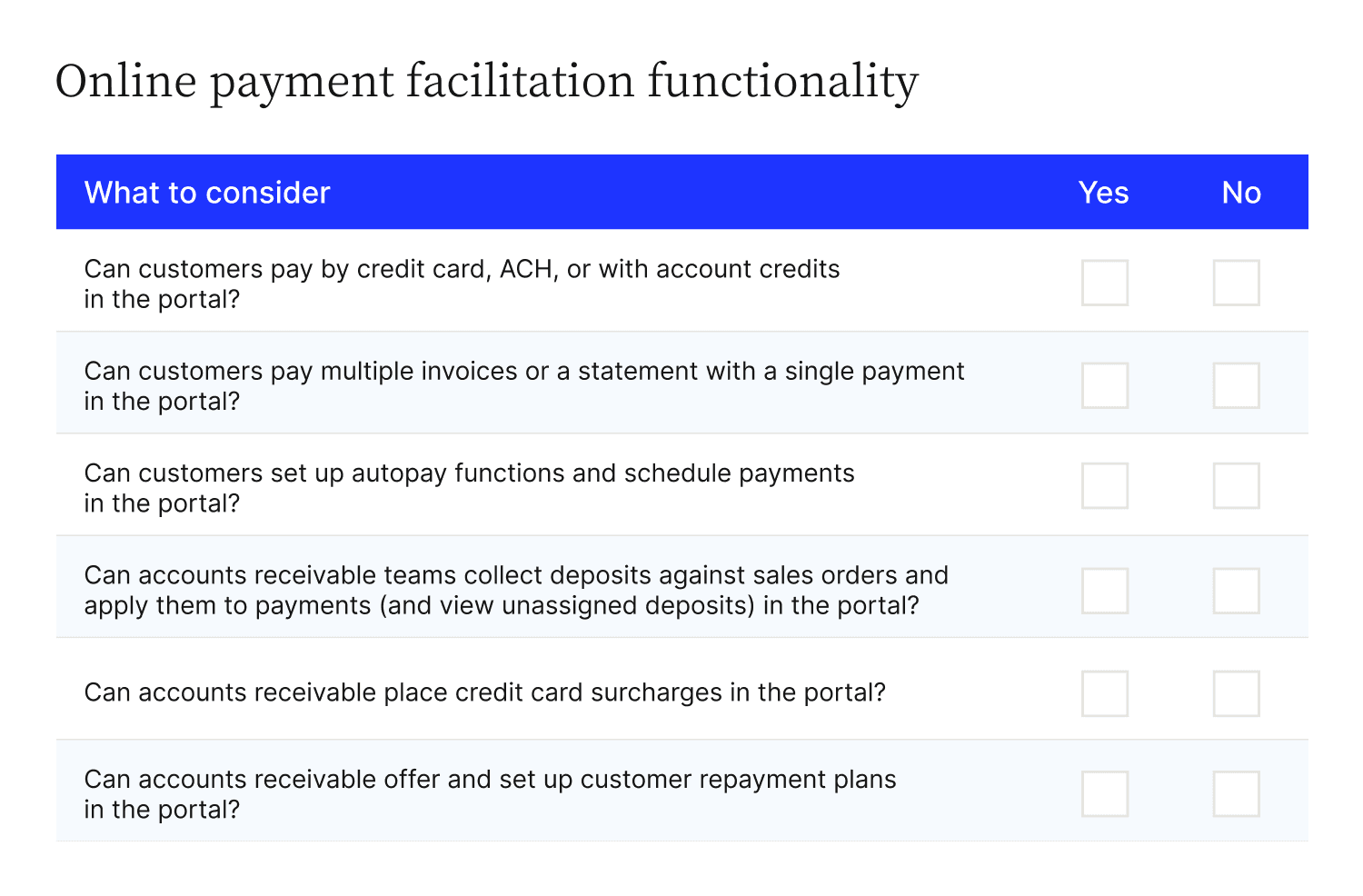

Important online payment features

Here are the most important online payment features you must evaluate when choosing an accounts receivable payment portal.

Customers can pay by credit card, ACH, or credits.

Customers can pay multiple invoices or a statement with a single payment.

Customers can set up autopay features and schedule payments.

AR can collect deposits against sales orders and apply them to payments (and view unassigned deposits.)

AR can place credit card surcharges.

AR can offer and set up customer repayment plans.

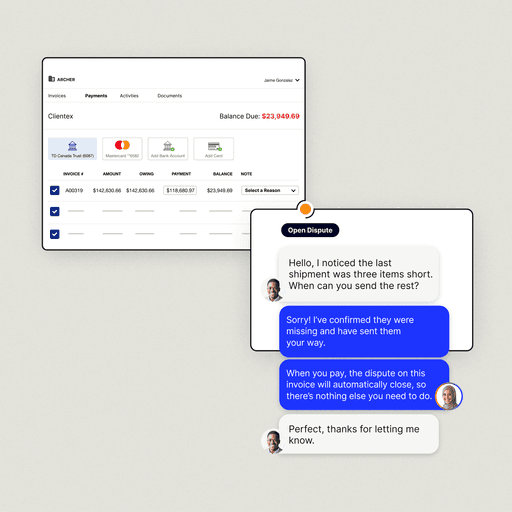

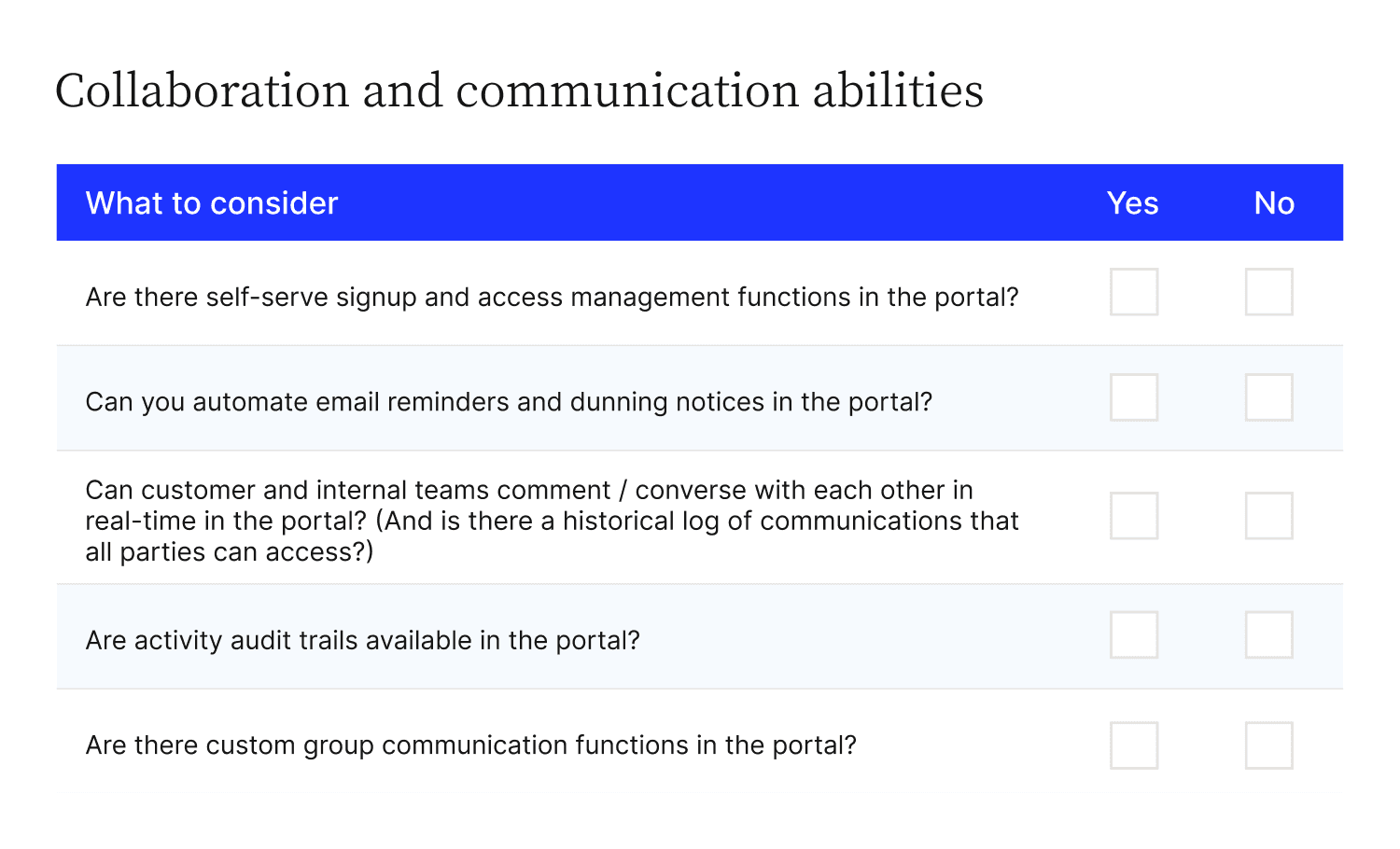

Evaluation criterion three: Collaboration and communication

Communication and collaboration are two features standard accounts receivable payment portals don't possess, yet collaborative payment portals do. While you cannot quantitatively measure the bottom-line impact these features create, they go a long way toward creating memorable CX.

Here are some examples of collaborative AR payment portal features:

Self-serve signup and access management.

Email reminders and dunning notices.

Customer and internal team comments (real-time and historical).

Activity audit trails.

Custom group communications.

Here’s why evaluating an AR payment portal’s ability to smooth communication between stakeholders and foster collaboration is critical.

Why should you focus on collaboration?

Customer communication is problematic in most accounts receivable teams. Poor digitization has led to AR teams transferring manual workflows to electronic platforms. For instance, emails have replaced phone calls without significantly impacting collection times.

AR teams that lack relevant data repeatedly reach out to customers for clarification, creating an impression of organizational misalignment. Collaboration aligns internal teams around customer issues by giving every team equal access to pertinent data.

Collaborative AR portals ease communication by helping AR establish instant messaging channels with customers, quickly clarifying issues and reducing invoice processing times. As a result, the AR Disconnect—defined as the gap between AR teams and customers caused by poor infrastructure—disappears.

Customers pay faster due to fewer invoice errors, AR has more time to handle complex disputes, and your teams deliver great CX that keeps customers returning for more.

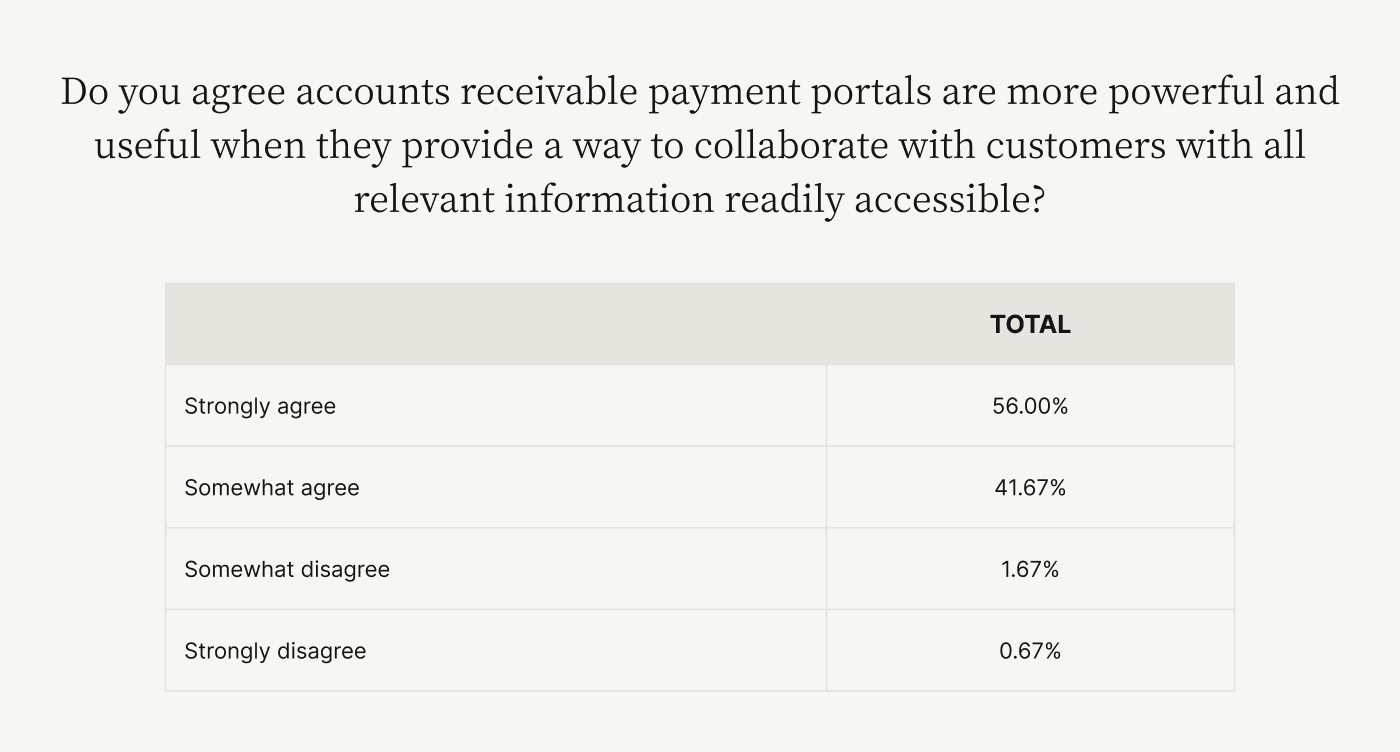

The CFOs we surveyed agreed that collaborative features make accounts receivable payment portals far more powerful, with 97.67% indicating so.

Important collaborative features

Here are the most important collaborative features you must evaluate when choosing an accounts receivable payment portal.

Customers have 24/7 access to payment, invoice, and dispute dashboards.

Customers can self-serve when seeking invoices, payment, and dispute statuses.

Internal teams and customers can communicate via instant messages and refer to historical comments.

The portal creates active audit trails for invoices, payments, and customer records.

AR teams can segment customers using tags.

AR can execute team assignments, list building, and reporting to aid collections.

AR can publish documents to one or more customers.

Choosing the right accounts receivable payment portal

Evaluating an accounts receivable payment portal boils down to choosing between a standard or a collaborative AR payment portal. Standard portals centralize data and give your customers the option of paying via a few channels.

However, these portals don't ease communication or erase the AR Disconnect. They offer a veneer of electronification and cannot bring true transformation.

Collaborative AR payment portals offer everything that standard ones do and give your AR processes a chance to transform with technological help. They also experience greater customer adoption—a true ROI indicator of the utility a payment portal offers.

Accounts receivable software evaluation checklist

Customers can view invoices, statements, and download them.

Customers can view online and offline payment history, with images and receipts.

AR can set up automated payments.

Customers can receive email notifications and configure them.

All stakeholders can view supporting documents.

AR can view aging buckets.

AR can filter views based on customer name, type, payment status, aging criteria, disputes, etc.

Customers can pay by credit card, ACH, or credits.

Customers can pay multiple invoices or a statement with a single payment.

Customers can set up autopay features and schedule payments.

AR can collect deposits against sales orders and apply them to payments (and view unassigned deposits.)

AR can place credit card surcharges.

AR can offer and set up customer repayment plans.

Customers have 24/7 access to payment, invoice, and dispute dashboards.

Customers can self-serve when seeking invoices, payment, and dispute statuses.

Internal teams and customers can communicate via instant messages and refer to historical comments.

The portal creates active audit trails for invoices, payments, and customer records.

AR teams can segment customers using tags.

AR can execute team assignments, list building, and reporting to aid collections.

AR can publish documents to one or more customers.

—

Keen to explore your options further? Check out our guide to choosing accounts receivable automation software.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.