6 Benefits of Electronic Invoicing and Collaborative Payment Portals

- 9 min read

Learn how pairing electronic invoicing with collaborative payment portals can:

- Deliver more efficient cash application processes,

- Streamline document management,

- Increase cost- and time-savings, and

- Improve customer experience.

Sometimes two things that are independently great are even better together. Think classics like chicken and waffles and sleeper hits like electronic invoices and collaborative payment portals.

If the latter isn’t on your radar, it should be. For context, here’s what each is, separately:

- Electronic invoicing, sometimes called paperless invoicing, is the process of sending invoices in a digital format.

- Collaborative payment portals allow buyers and sellers to connect and interact over the cloud in real-time and manage the invoice to cash process together. They provide a streamlined, customer-experience-focused way for customers to pay invoices online, access documents from a central source, and better communicate with your AR department.

On their own, collaborative payment portals deliver amazing benefits that many CFOs sorely need—like improved access to pertinent accounts receivable data, in-portal communication with their customers, and the ability to accept numerous digital payment methods—and cannot get with standard payment portals.

Electronic invoices, on the other hand, also provide major benefits over their paper-based counterparts, such as eliminating tedious administrative work and manual processes, decreasing paper and printing costs, and removing friction for the customer when they’re making payments.

However, in this article, we’ll focus on the benefits you can expect when combining electronic invoices and collaborative payment portals. Such benefits include more efficient cash application processes, better document management, enhanced security, cost and time savings, and improved customer experience.

6 benefits of combining electronic invoicing with collaborative accounts receivable payment portals

Jump to a section of interest:

1. Streamline the cash application process

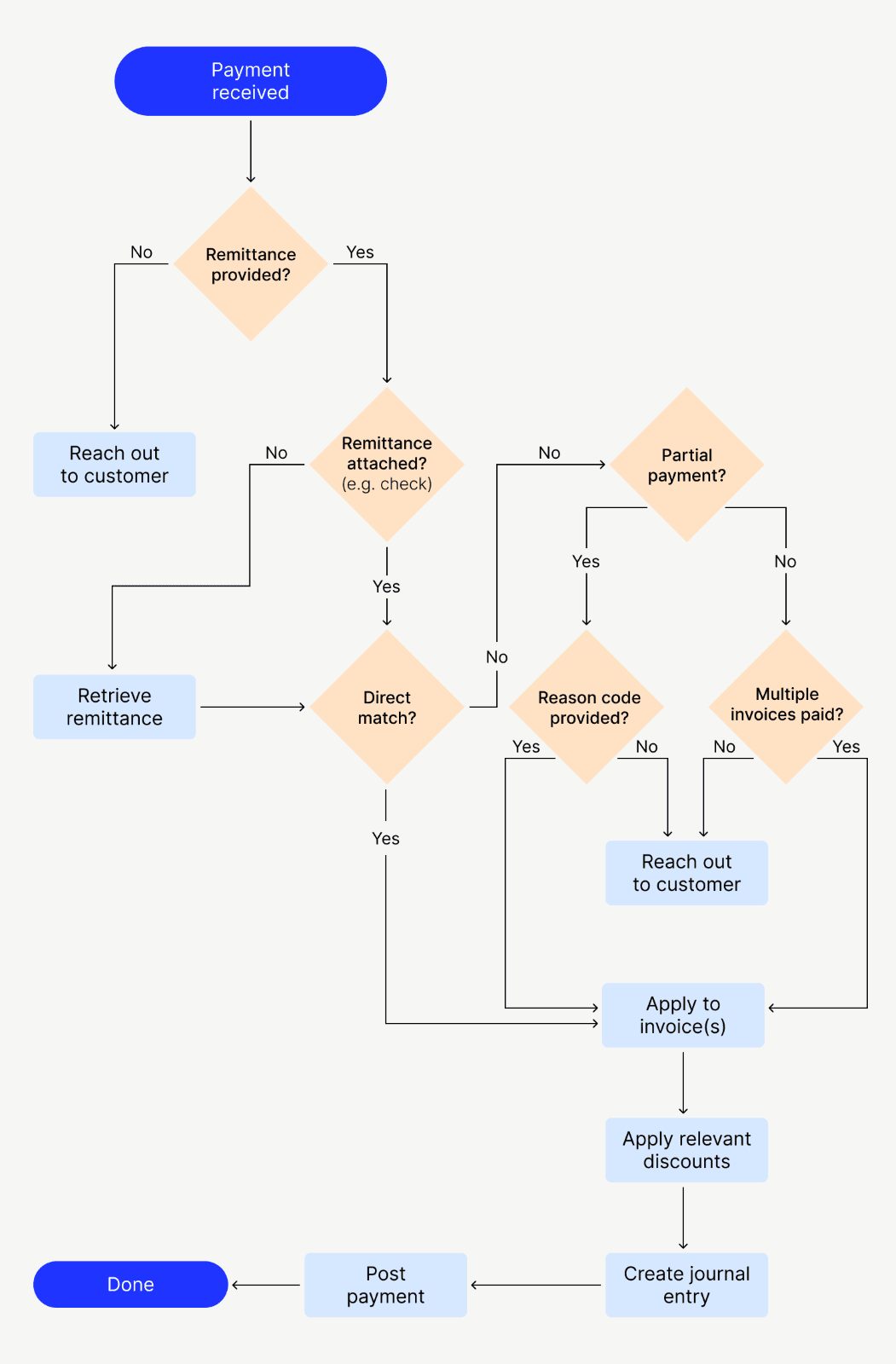

The traditional cash application process is labor-intensive and prone to errors. Businesses can streamline the entire process with electronic invoicing and collaborative payment portals.

Collaborative accounts receivable payment portals essentially automate data entry; because when electronic invoices are created in your ERP and posted directly to the portal where your customers can review them at their leisure, a majority of manual work evaporates. In-portal digital payments then enable automated payment reconciliation by customers who can apply their payments directly on or against the invoice—or a portion of one—which ensures accurate fund allocation.

A collaborative AR payment portal that delivers electronic invoices can help teams build more effective collection processes—ones with straight-through processing rates of 90% or more. (In other words, their payment application process will be 90% free of human intervention. And—according to our recent study on payment portals [report coming July 17]—given that AR teams without collaborative payment portals are forced to manually resolve more than $3.5 million on average in invoices per month, this technology ensures ample—valuable—time back when deployed to handle the bulk of these issues.)

In fact, that same survey found that accounts receivable teams with collaborative payment portals are absolved from having to manually resolve over $1.6 million worth of invoices monthly. That’s 44% more cash automatically brought in monthly, without teams needing to be directly involved in the application process.

A streamlined cash application process can even help lower your day sales outstanding (DSO) numbers by making it easier for clients to pay, minimizing delayed payments.

2. Improve document management

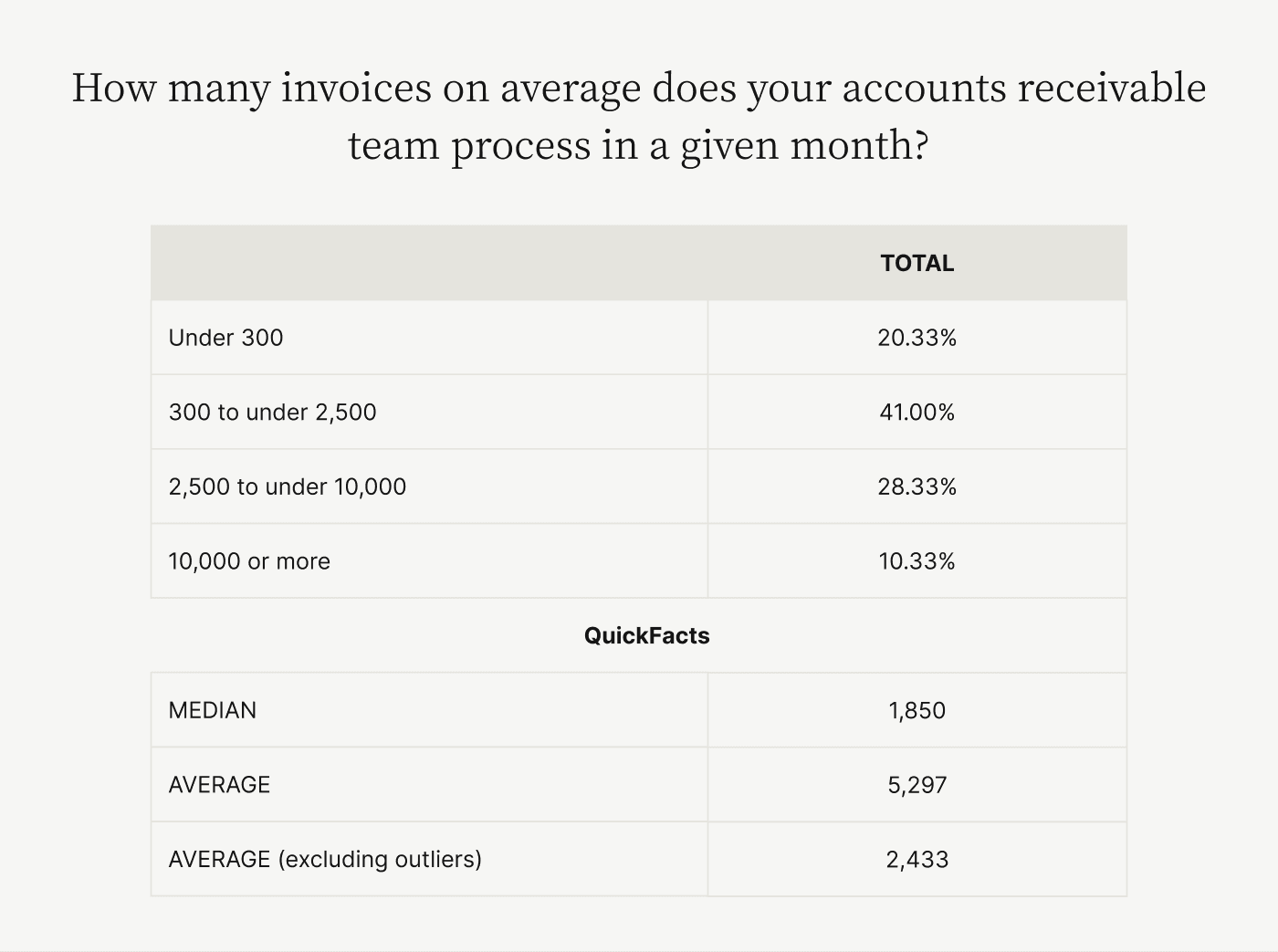

Managing invoices and associated documents is a daunting task—especially for mid- to upper-midsized accounts receivable teams who process an average of 2,433 invoices each month. That’s a lot of document management to undertake.

Electronic invoicing and collaborative payment portals offer robust document management solutions to drastically simplify the process.

Through an online payment portal, AR teams can automatically attach supporting documents to electronic invoices for quick and easy reference on their end and their customers’. This is especially convenient for auditing purposes and dispute resolution. Such enhanced transparency provides context and evidence for transactions to verify payment accuracy and legitimacy. It also helps that this absolves both stakeholders from sifting through disparate databases—like email—to retrieve past conversations and relevant documentation.

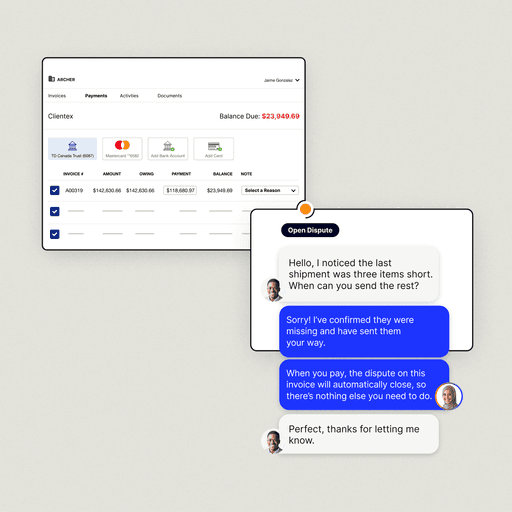

Beyond surfacing pertinent information, a collaborative payment portal enables efficient dispute resolution mechanisms. This allows teams to expedite evidence collection to support claims or resolve misunderstandings.

Invoice disputes are the primary cause of late payments. When a company can quickly revise and re-share invoices through a collaborative online payment portal, they’ll get paid faster. By eliminating the need for manual document handling, filing, and storage, businesses reduce the risk of document loss. And when AR teams and customers’ AP teams can effortlessly retrieve documents from anywhere at any time, it hastens the resolution process should a dispute arise.

3. Empower customers with real-time access to account information and statuses

One of the biggest benefits of collaborative AR payment portals is that customers can use them to instantly access their invoices, payment history, and outstanding balances. And, when invoices are digitized and posted to a collaborative payment portal, customers have opportunities to self-serve, meaning they can take control of their payment process.

Electronic invoices posted to a collaborative payment portal also allow customers to receive—and AR teams to send—notifications and reminders for upcoming payments due. Such proactive outreach enables them to anticipate payments and more effectively manage their cash flow. Real-time access to account information and statuses also helps your AR team improve collaboration with their customers, as they’re more attuned to their behaviors and financial standing. This increases efficiency, ensures disputes are settled faster—and with more empathy—and reduces delayed payments.

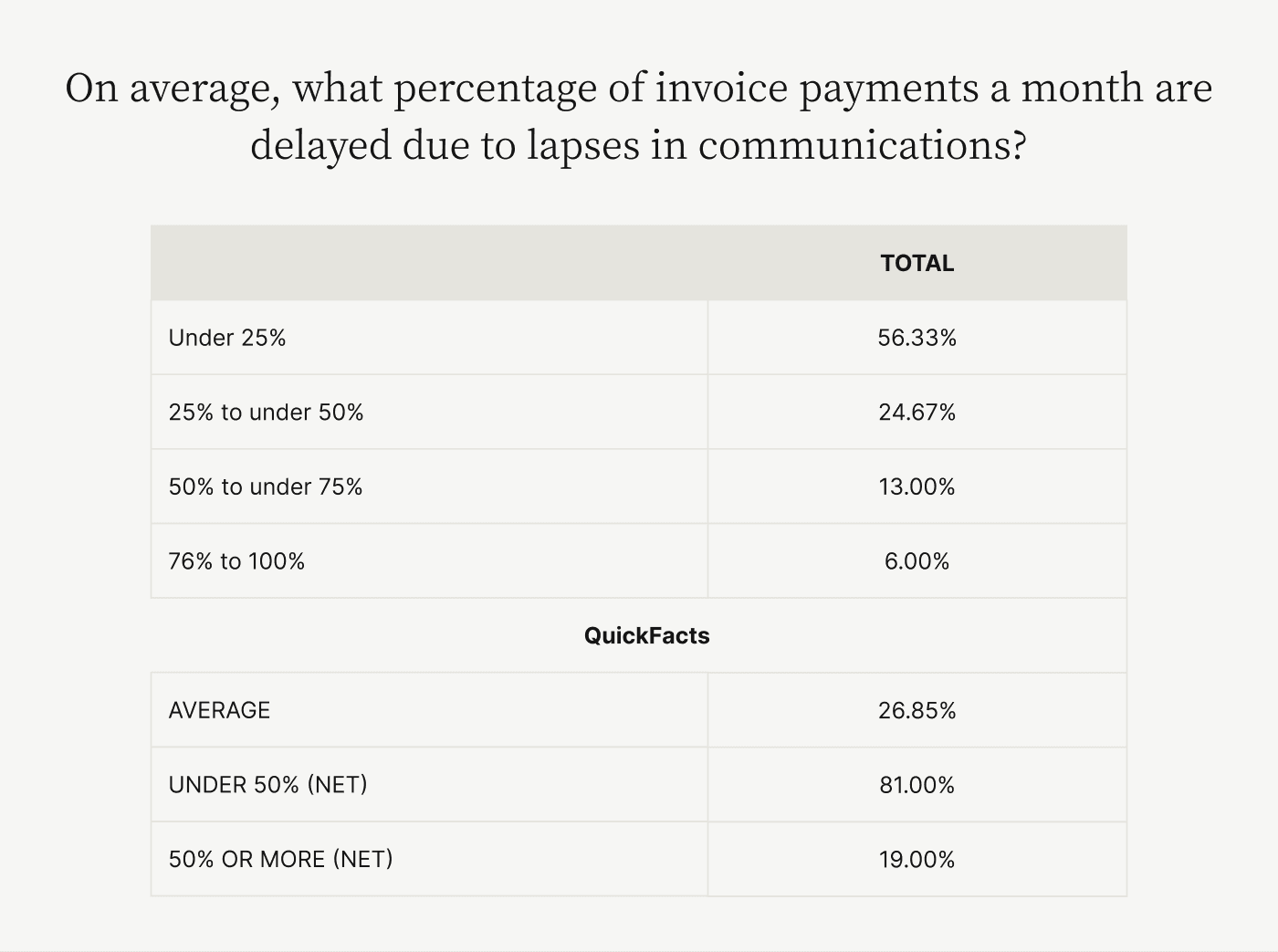

Solid communication between AR and AP teams is about more than just teamwork. Our study found that businesses have nearly $4 million in outstanding invoices each month due specifically to communication lapses. Posting electronic invoices to a collaborative payment portal prevents these costly miscommunications, ultimately reducing communication lapses and saving your business significant sums of money.

4. Enhance security and compliance

Collaborative accounts receivable payment portals often use encryption technology to protect payment information and invoices from unauthorized access or interception. Access controls within the portal also make it easy for businesses to set user permissions and control information access. Such controls ensure compliance with regulations and reduce risk of data breaches. The detailed audit trails and transaction logs these platforms offer further simplify compliance and support internal and external audits.

To reap the benefits of security, it’s not enough for customers to simply receive physical invoices and make their payments in a secure portal. The best value comes when invoices are posted into a collaborative portal where the customer can make direct payments.

💡 To ensure ongoing payment security and smooth operations, Finance and IT departments must collaborate effectively and regularly. Dealing with security failure is often siloed to the IT team, and while they may be able to resolve technical issues, they must work with Finance to ensure the same issues do not arise again. When Finance can understand the need for certain controls and IT can help improve Finance’s digital processes, they can design a scalable process with a strong security posture.

5. Realize cost and time savings

Paper-based invoicing comes with a high cost for staff time, paper, printing, postage, and labor. It also requires intensive manual work such as data entry, mailing, and logistics with third-party printers.

Pairing electronic invoicing and collaborative payment portals saves almost all of this money and time and brings with them the benefits of immediate invoice delivery, real-time tracking, and notifications. This automation can speed up payment cycles and improve cash flow management. Plus, Finance managers can reallocate these newly freed-up resources to more strategic initiatives.

Customers also see benefits. With fewer episodes of mishandling, an easier communication and dispute resolution process, easy access to their invoices and payment history, and automated reminders, customers will be more likely to pay on time.

Automated payment reconciliation—made possible through this pairing—processes further reduce late payments and disputes, as customers can indicate which payments made in-portal are for which electronic invoices, with those payments then getting posted back to your ERP automatically, without manual intervention or investigation.

6. Improve customer experience and satisfaction

A seamless payment experience is vital for providing a good user experience and maintaining customer satisfaction. The benefits of electronic invoices and collaborative payment portals include convenient, real-time access to invoices, documents, payment history, and communication threads. This level of transparency builds customer trust and encourages a more self-service experience while increasing AR productivity.

Collaborative payment portals eliminate the need for manual payment methods—goodbye physical checks, hello echecks!—and do not require customers to use an external platform to make a payment. This too reduces friction in the payment experience and makes paying for invoices more secure—which enterprise buyers love.

Customers can also communicate directly within collaborative payment portals through chat-like messaging functionality they’re well accustomed to, or by commenting directly on invoices or invoice line-items. This empowers customers to easily and frequently communicate with your AR teams—who, notably, can easily pull other internal stakeholders into the already-happening conversations if necessary, further delighting customers.

When customers can ask questions, raise issues, and receive quick responses, their problems will be solved faster and better. And who doesn’t want happier customers?

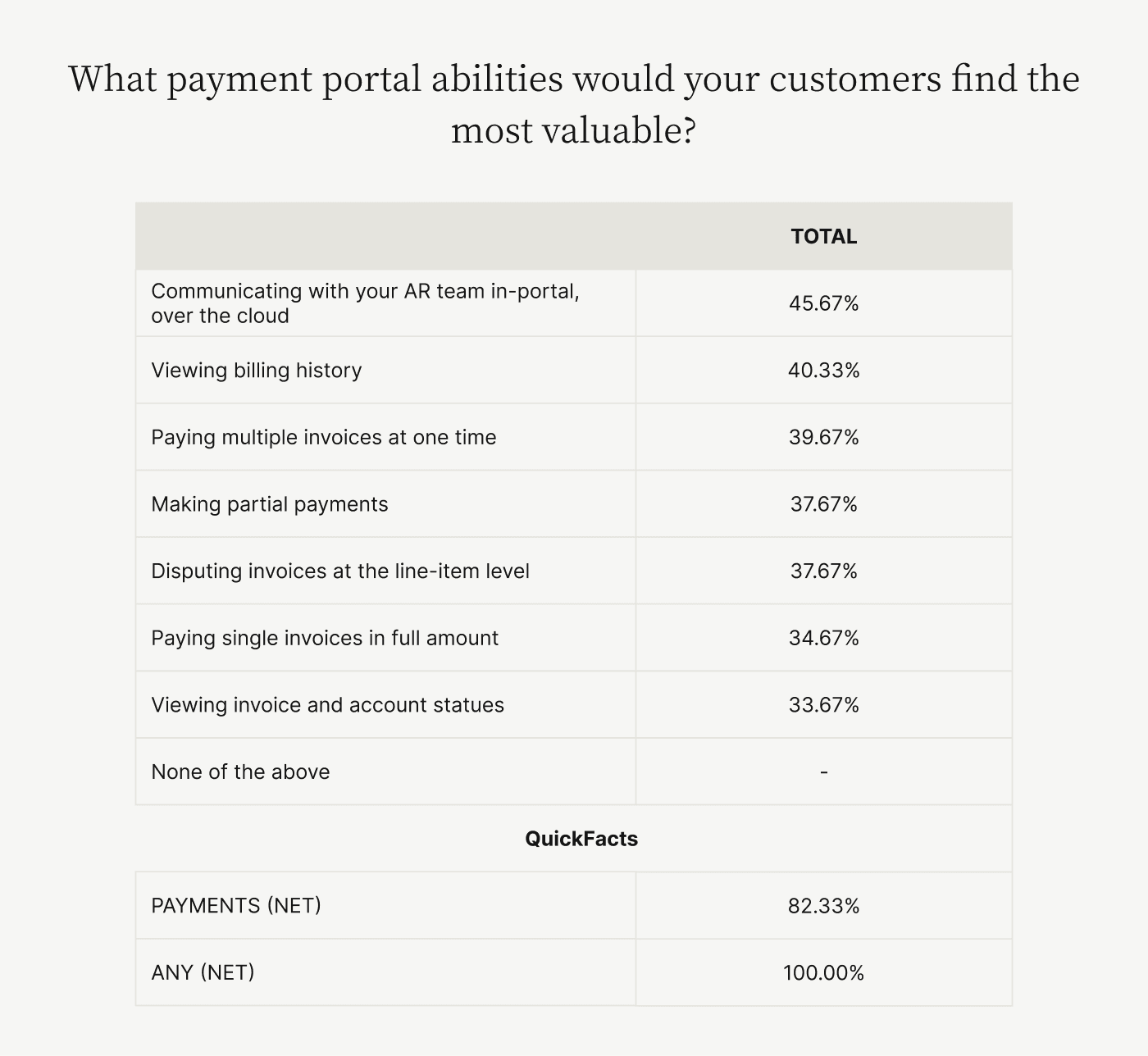

This collaborative AR payment portal functionality, by the way, where customers can communicate over the cloud with your AR team, is a capability that CFOs think their customers would find most valuable—more so than any other payment portal can-do:

—

⚡️ Bonus benefit: Robust collaborative payment portals offer omni-channel invoicing so teams can distribute electronic invoices via email, in-portal, accounts payable portal, or EDI. So, even if you never explicitly pair your electronic invoices with your portal, the two are still a match made in heaven. With collaborative payment portals, customers never need to compromise on how they receive or pay invoices.

Revolutize invoicing with Versapay’s collaborative accounts receivable payment portal

In a single platform, Versapay brings together the benefits of electronic invoicing and collaborative payment portals, giving AR teams better control over the invoicing, payment and collection processes.

Versapay’s collaborative AR portal optimizes cash application, document management, customer empowerment, security, cost savings, and user experience. By leveraging Versapay, businesses can unlock the full potential of electronic invoicing to drive operational efficiency and improve their bottom line.

About the author

Ben Snedeker