Why RPA in Accounts Receivable is a Big Deal for Customer Experience

- 10 min read

Robotic process automation (RPA) can impact many areas of the order-to-cash process.

When deployed across the entirety of the accounts receivable function, RPA delivers:

- Reduced days sales outstanding,

- Better customer experiences, and

- More accurate cash flow forecasts.

If you’re in accounts receivable, you’ve likely heard the term RPA. But, what is RPA in accounts receivable? Well, the good news is you’ve come to the perfect place to learn.

RPA is the short form of Robotic Process Automation. UiPath, the pioneer of RPA, defines it as "a software technology that makes it easy to build, deploy, and manage software robots that emulate human actions interacting with digital systems and software.”

This new technology has applications across many departments, including finance. However, we’ll focus mostly on RPA in accounts receivable. Then, we’ll show you how it can be applied in your organization to not just make your job easier, but also make life significantly better for your customers throughout the invoice-to-cash cycle.

In this blog, we’ll cover:

- How RPA applies to finance

- How RPA transforms AR

- RPA implementation requirements

- How RPA makes AR teams more efficient

- How RPA improves customer experiences

- How AR automation solutions like Versapay use RPA

What is RPA in finance?

You can think of RPA as an easy and efficient way to tell software to complete digital tasks that would normally be undertaken by a human. While it may seem similar to artificial intelligence (AI), they are somewhat different. While AI is capable of learning from experiences and processes, RPA simply repeats processes as it is directed.

There are many reasons why RPA is becoming so popular in finance. First, it does what a human can. But because it’s done by a “robot”, it gets done faster, more consistently, and for less. Second, despite the fear employees might feel at the thought of robots taking their place, 57% of executives say RPA actually improves employee engagement. That’s because RPA eliminates tedious manual tasks, freeing workers to focus on more engaging and strategic work.

Looking beyond accounts receivable, RPA has a number of applications in other areas of finance:

- Accounts payable: RPA can streamline unstandardized invoices and direct them to the right person in the right department.

- Inter-company reconciliations: RPA can automatically acquire and review data to find mistakes in invoices that could prove costly.

- Payroll: Robots can save you time and improve accuracy by reviewing data entries, timesheets, and deductions.

How does RPA transform finance from the top down?

First, RPA in finance can simplify procurement significantly. Through automation, businesses can cut the amount of human effort required to complete vendor verification and setup, data management, invoice data extraction, and much more.

At the other end of finance, RPA can also be of major value to the treasury department. The Treasury has to deal with a variety of fluctuating ratings, rates, and regulations. RPA can do the hard work of monitoring and gathering all of this relevant information. This allows the Treasury to focus on managing these factors, and deliver the best possible working capital management.

Now that we’ve covered RPA in finance, let’s dive specifically into automation in accounts receivable. With so many repetitive tasks—even when you’ve already added automation—it’s the perfect place to apply RPA in finance.

How does RPA transform accounts receivable?

As AR professionals likely know, accounts receivable is filled with repetitive manual tasks. Whether it’s reviewing payments, keying in invoice and lockbox data, or matching payment data to open receivables, there are endless ways for these tasks to eat up an AR team’s time.

According to UiPath, the most impactful areas of the order-to-cash process to automate are:

- Sales order entry

- Customer data setup

- Customer data management

- Billing/invoicing

- Collection activities (dunning)

- Cash application and reconciliation

- Credit risk management

- Dispute verification and resolution

- Chargeback management

- Daily cash review and forecasting

As you can see, if it’s an AR process you can complete digitally, RPA can help. When deployed across the entirety of the accounts receivable function, RPA equates to reduced days sales outstanding, better customer experiences, and more accurate cash flow forecasts.

—

RPA is powerful—but it's just the start. Learn how Madison Resources leveraged AI-powered technology to phase out lockboxes and streamline cash application.

What data and processes are required to implement RPA?

Before you can introduce automation in accounts receivable such as RPA, you first need to know:

- Each step in the process you’re automating.

- Where relevant data exists, and where it needs to go.

This is what makes implementing RPA in-house—rather than leveraging a pre-built solution—a challenge. If, for example, you were looking to use RPA to automate the process of creating and sending invoices, you would at the very least need to know:

- Where purchase data is stored

- Where customer contact data is stored

- Which parts of that contact data is relevant

- How invoices should be formatted

- The program through which emails are sent

- How emails are tracked for receipt, opens, and views

- How responses are managed

As you can see, it’s not a small amount of information. Knowing what data is needed is just the start—you also need to understand the nuts and bolts of how to actually set up RPA. Technology as new as this is rarely something organizations want to have an employee learn how to use on their critical systems. Plus, given how new RPA is, it’s unlikely that you’ll find someone internally with significant experience.

That’s partially why many businesses choose instead to use AR automation solutions that include RPA—or similar technologies—as part of their standard offering. These solutions generally deliver higher speed-to-value and ROI as they have a great deal more experience in accomplishing the same tasks.

How does RPA make AR teams more efficient?

One of the fundamental benefits of RPA is increasing efficiency. In the context of RPA in accounts receivable, it does so in a variety of ways. Looking back at all the order-to-cash functions RPA can assist with, the following three are the most significant:

1. RPA automates billing/invoicing

Creating and sending invoices involves repetitive, tedious steps that are perfect for RPA. This technology can take the data from your payment processing system, and upload it to your AR automation tool (like, say, Versapay), and even email it to the client—something that would take a human a much longer time (and increase the risk of errors).

2. RPA streamlines collection activities (dunning)

RPA doesn’t just make sending an invoice more efficient—it also simplifies following up on it. With RPA, you can set a desired amount of days to wait, as well as the template of the follow-up email. From there, RPA takes care of the heavy lifting.

3. RPA simplifies cash application

As you’ll discover shortly, RPA works in tandem with AI to find and match payment information to open receivables. It does so both faster and more accurately than a human—in some cases increasing efficiency by up to 75%.

How does RPA improve customer experiences?

RPA in accounts receivable also helps AR teams deliver superior customer experiences in the invoice to cash cycle in two main ways: speed and accuracy.

RPA accomplishes tasks significantly faster than humans can. Unlike humans, it doesn’t slow down, get tired, or become more error-prone the longer it works.

With RPA completing many back-office tasks faster than before, your customers spend less time waiting for important information. This could include invoices, payment reminders, or anything else necessary to keep cash flowing. And the less time customers spend waiting for you to provide them with these details, the happier they’ll be to continue doing business with you.

In terms of accuracy, RPA simply doesn’t make the same mistakes humans are bound to. For example, our research shows that more invoice disputes are caused by human error in the payment process (50%) than any other source. This, in turn, creates disruptions to customer experience. RPA doesn’t forget to copy a new field before pasting it. It doesn’t accidentally place the data in the wrong field. It doesn’t forget the date an invoice is due.

Rather, it does exactly what it’s told, every time. That means your customers aren’t getting sent invoices for the wrong amount, or not getting a reminder about an upcoming payment. Instead, they enjoy the confidence and peace of mind that comes with always knowing exactly what they owe you, and when they owe it by.

And in times where cash flow is tightening and customer relationships are more important than ever, RPA in accounts receivable goes a long way in keeping those critical partnerships in healthy shape.

How do AR automation solutions like Versapay use RPA?

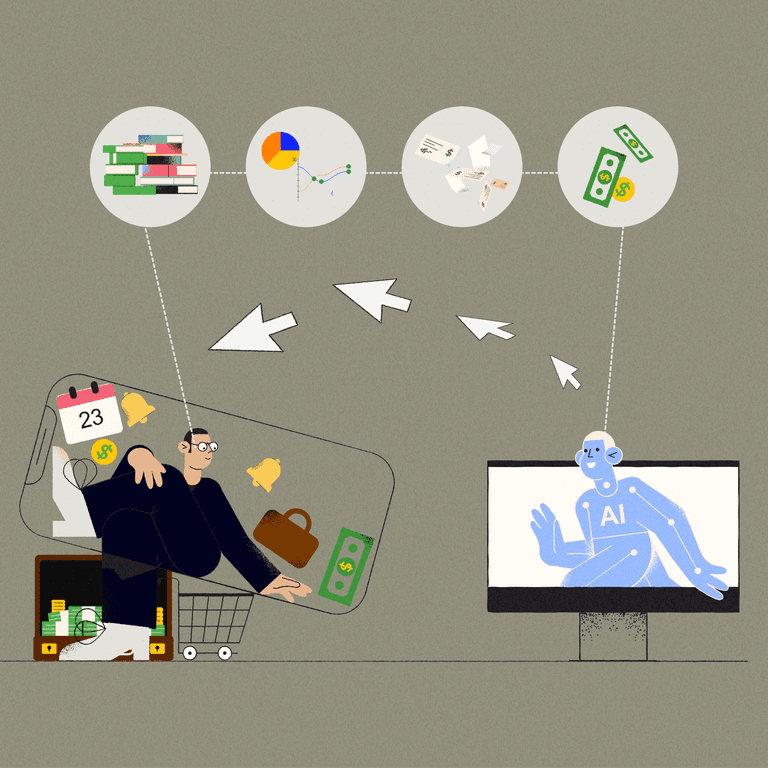

At Versapay, it isn’t a case of RPA vs AI. Our solutions are powered by a combination of RPA and AI, which is also known as “Intelligent Process Automation”. Here’s a quick breakdown of how these technologies work together in our Collaborative AR automation software.

Our Cash Application solution performs a variety of tasks for you. For example, it’s able to view and extract data, such as from an invoice, and import that data into your ERP system. That process, which has a clear set of repeatable steps, is ideal for the repetition that comes with RPA.

However, not all remittance and payment information is always clear—or even available. Let’s say our Cash Application solution is applying a payment made by check to an unmatched invoice. Let’s assume the check is missing a note detailing which outstanding payment it should be applied to. Our solution then uses AI and machine learning to look at open receivables, and see if there are any for the amount on the check. If there are, it will apply the payment.*

And while RPA continues to handle the same repeat tasks, it’s the AI infusion element that learns and becomes more accurate the more it interacts with the data.

But even though these technologies can do so much, alone they aren’t enough. Not all transactions can be automated. That’s where humans come in. With a lower volume of transactions to handle manually, AR staff can do a better job at handling them. And when you pair an AR automation solution that empowers collaboration between AR teams and their customers, you get even more from RPA.

*Versapay’s Cash Application solution offers 90%+ straight-through processing—and gets smarter with each transaction it processes.

Get the benefits of RPA without all the hassle

Considering RPA’s ability to help finance and AR teams get more done, reduce errors, and create better customer experiences, there’s no doubt it’s an attractive technology. Still, given the technology’s infancy, it’s reasonable that many businesses would be better served by selecting an AR automation solution with RPA built in, rather than trying to implement it on their own.

You can learn all about two great options by exploring our Collaborative AR and Cash Application solutions.

About the author

Joe Crawford

Joe Crawford is the Senior Copywriter at Versapay. While currently focused on Fintech, he’s written extensively across industries including automotive, telecom, and communications technology. Coming from a background in comedy, he welcomes any chance he can to introduce some levity to world of Accounts Receivable.