5 Reasons Why Automated Invoicing is Needed for Faster Cash Flow and More Efficiency

- 11 min read

Learn what automated invoicing is, how it works, and how it can be used to streamline your accounts receivable process.

Invoice processing is a daily task for most accounts receivable (AR) teams but is also one of the least efficient. Our research shows that invoice processing delays create nearly $1 million in delayed payments every month.

These delays occur due to data entry errors and poor AR visibility into customer data—hallmarks of manual invoice processing. Automating invoice processing can eliminate these errors and give AR teams more time to solve complex cash flow bottlenecks.

In this article, we list five reasons AR must automate invoice processing to speed up collections and get cash on your books quickly.

What's in this article?

Invoice automation benefit #4: Reduce customer back-and-forth

Invoice automation benefit #5: Get cash on your books faster

What is automated invoicing?

Automated invoicing (sometimes referenced as electronic or e-invoicing) is a set of software-powered processes that automate every invoicing task in the invoice-to-cash (I2C) process. These tasks include:

Invoice creation

Invoice reminders

Invoice delivery

Cash application

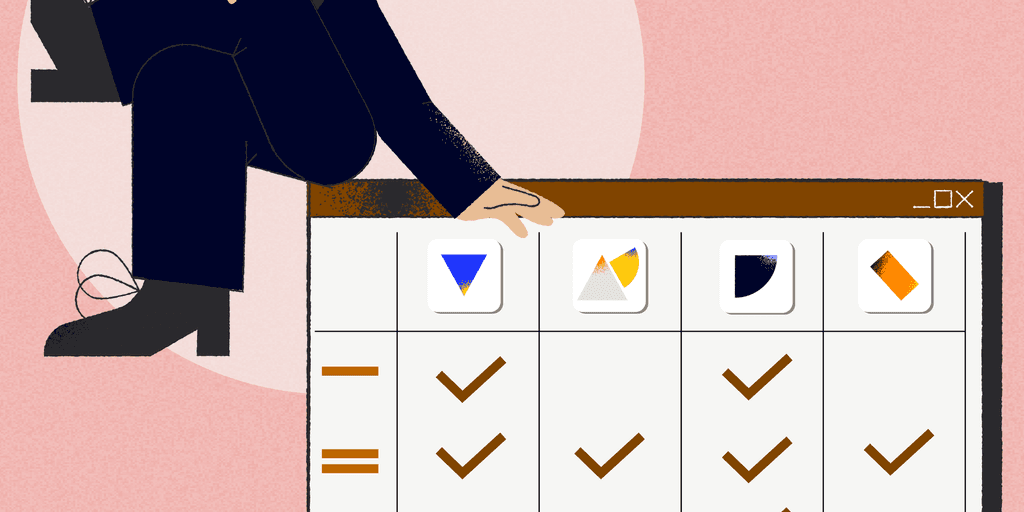

Automated invoicing delivers five primary benefits to your company. These are:

Invoice personalization

Easy invoice modification

Reduce delayed payments

Reduce customer back-and-forth

Get cash on your books faster.

Let's look at these benefits one by one.

Invoice automation benefit #1: Invoice personalization

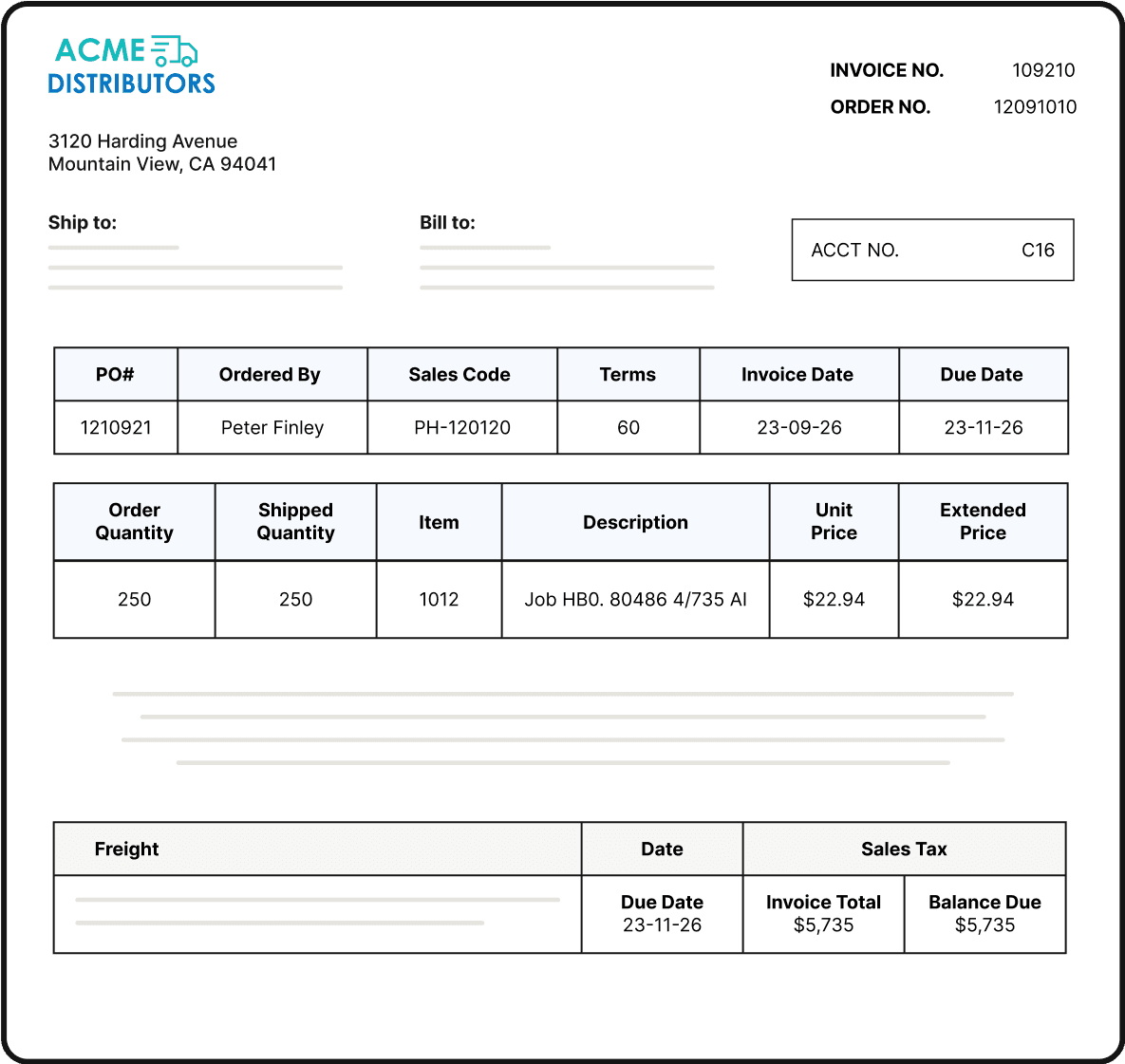

Your customers have varied accounts payable (AP) processes that need different data. Some need purchase order (PO) numbers on their invoices, while others ask for templated data formats.

Manual invoicing cannot meet such varied needs at scale. Your AR team will spend more time creating invoices and double-checking them for errors instead of focusing on collecting payment and applying cash to your books.

Automated invoicing allows you to customize invoice delivery according to your customers' preferences—this means delivering all the supporting documentation they need, in the format or layout they want, as a unit through their preferred channel.

You'll sync with their AP workflow and have your invoices recognized faster, increasing the likelihood of an on-time payment.

How automated invoice personalization works

Automated invoicing solutions integrate with your enterprise resource and planning (ERP) systems and pull customer data. You can create invoice templates at a customer level, including or excluding whatever data they need.

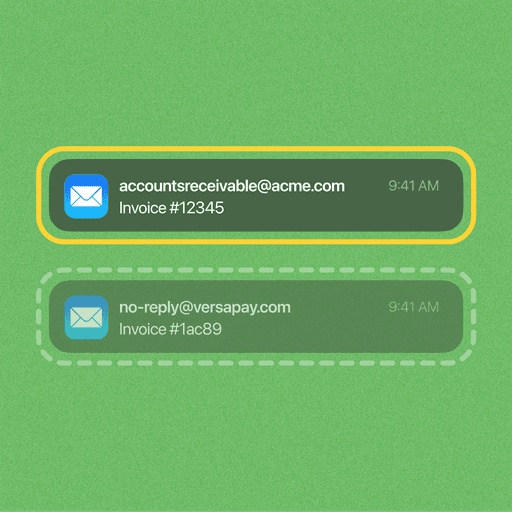

Once you deliver your goods or services, AR can easily pull relevant data into a template, and deliver it to your customers' preferred AP channels. (This is extremely convenient, as most customers have varied preferences; some prefer emailed invoices, while others demand suppliers log into AP payment portals like Coupa or Ariba and upload invoices there. Automated invoicing enables you to adhere to their wishes.)

Customer AP teams will acknowledge and approve your invoices faster, lowering your Days Deduction Outstanding (DDO) and other critical receivables metrics.

Invoice automation benefit #2: Easy invoice modification

Invoice resends and reissues are two big reasons for lengthy invoice processing times. When processing invoices at scale, reissues add up. If your number of revised invoices is high, you likely already have broader invoicing problems, like frequent errors from manual data entry, and invoice automation might be the only viable solution.

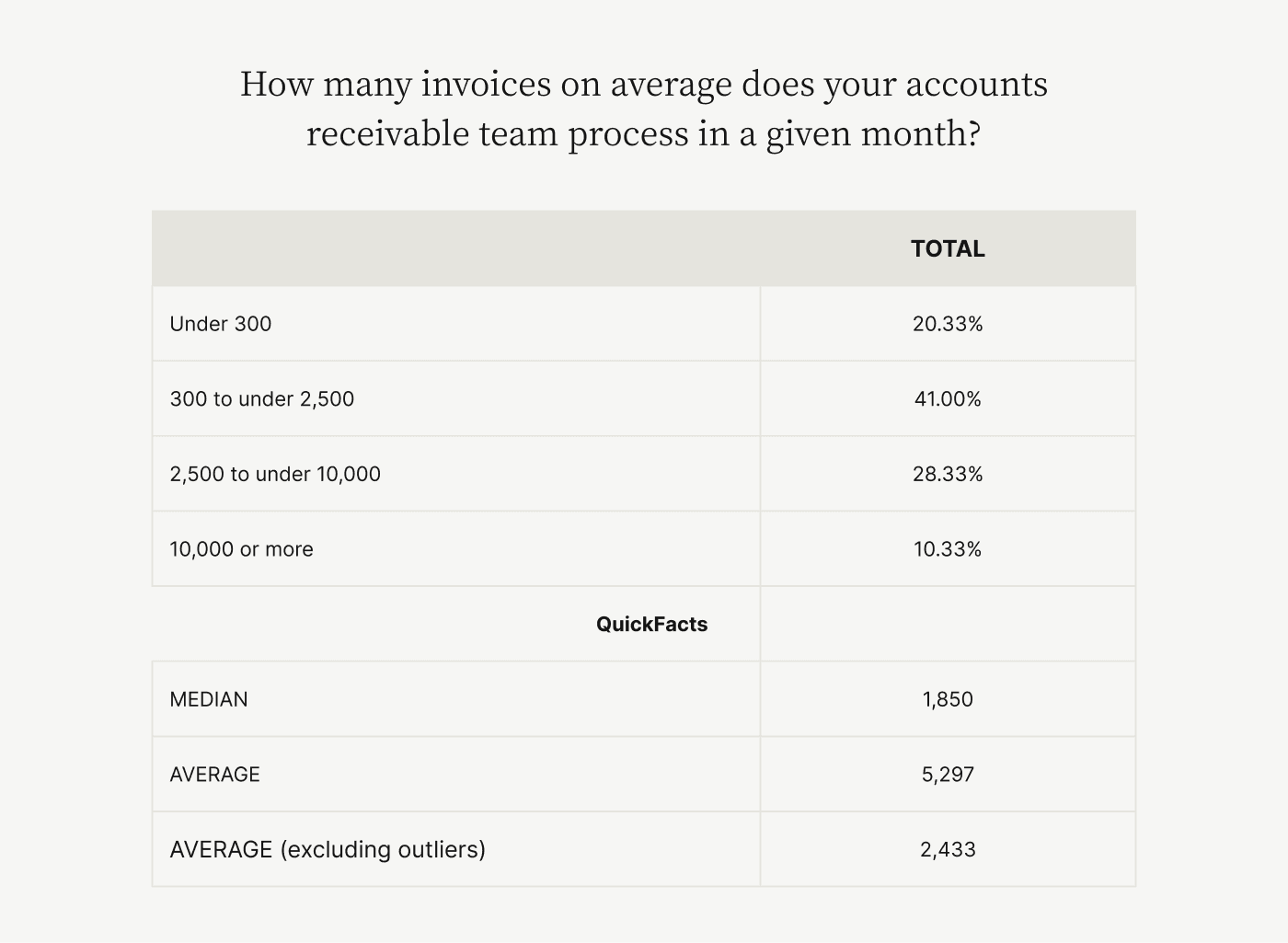

Our research shows that mid to upper-midsized companies process an average of 1,850 invoices each month. Modify, reissue, and resend even 10% of that volume and you'll stress an already overworked AR team.

But what if AR could modify and reissue an invoice with a few clicks? Even better, what if AR could reduce reissues to begin with?

Automated invoicing simplifies reissues and modification requests by:

Giving AR all the data it needs in a single platform. No more hunting for customer data in endless spreadsheets.

Pulling correct data automatically to minimize invoice errors that lead to reissue requests.

Giving customers visibility into invoice statuses, payment requests, and supporting documentation. This enables self-service and reduces AR back-and-forth.

Even with modification requests that occur, AR can validate existing data quickly, change or adjust invoices if needed, or communicate invoice statuses directly with your customers.

The result is less time spent manually changing invoices and re-delivering them through physical channels (like mail) or following up with other departments for order data.

How automation speeds up invoice modification and reissues

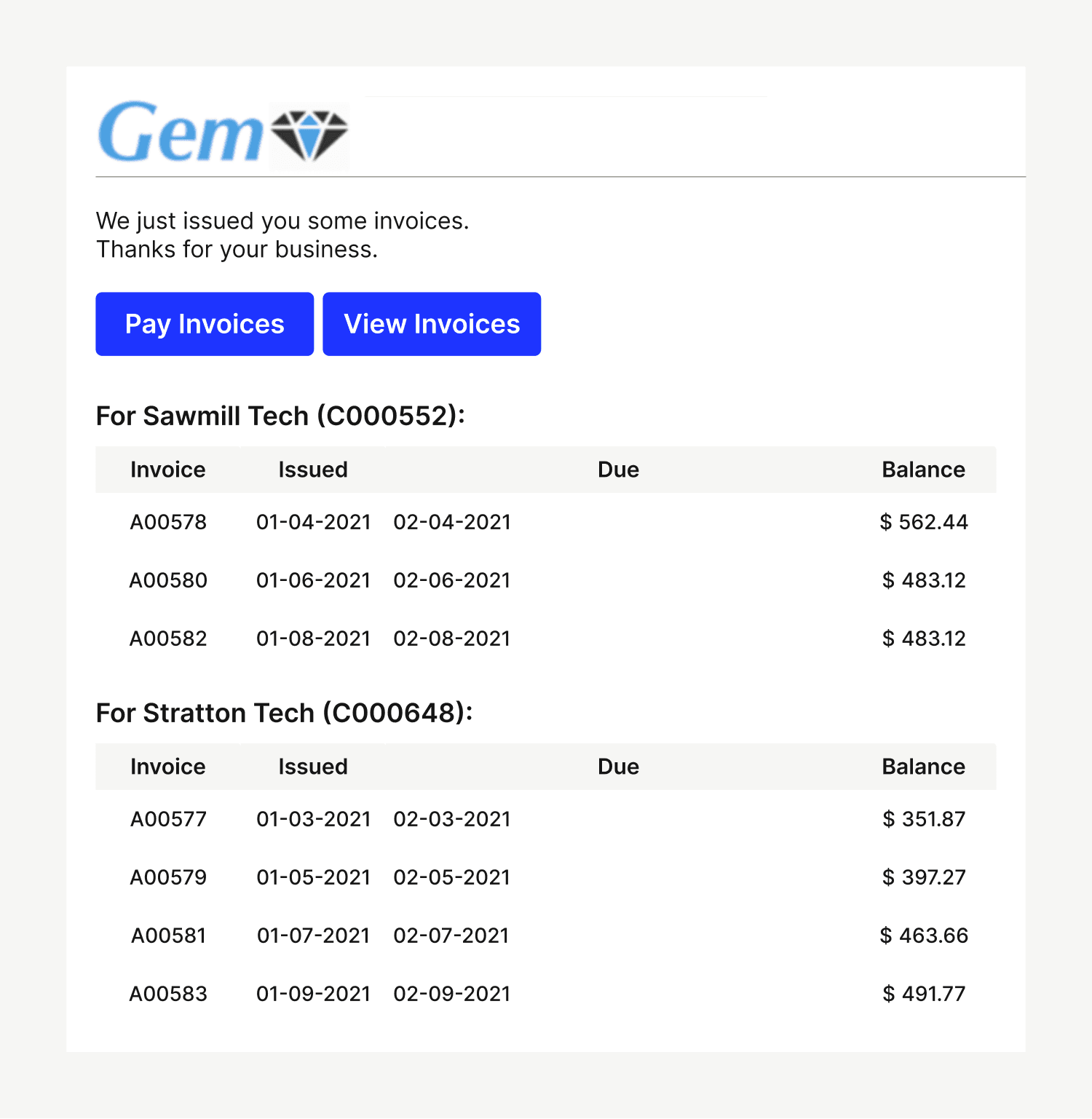

Automated invoicing portals help you create and modify invoices with a few clicks. You can import invoice templates and autofill them with customer data. Integrations with your ERP ensure you pull correct order-related data. An automated portal will deliver your invoices automatically, removing any need to print and stuff envelopes.

Customers can log into your invoicing portal and view statuses, helping you proactively answer any questions that lead to unnecessary back-and-forth.

Invoice automation benefit #3: Reduce delayed payments

Late payments are a significant time sink in every AR team's collections workflow. AR usually follows up via emails or phone calls, leading to even more manual work, like collection calls.

Automated invoicing extends beyond merely creating and sending an invoice. You can create invoice reminder workflows that remove any need for manual follow-ups.

Create custom invoice payment reminders, attach relevant documentation like invoices or account statements, and your automated AR platform delivers them to your customers instantly. Customers will receive updates about outstanding payments at the right time, leading to fewer delayed payments.

How automated invoice payment reminders work

Automated invoicing solutions help you create invoice reminder templates and workflows. You can customize the kinds of data you want included in your reminders and send them at custom intervals.

These sequences can be configured to terminate when your AR platform detects payment on an invoice. Alternatively, you can escalate highly delinquent accounts automatically to upper management if needed, involving them seamlessly in the collection process.

In addition, you can set up reminder delivery, customer response, and delinquent payment alters to keep your team in the loop at all times.

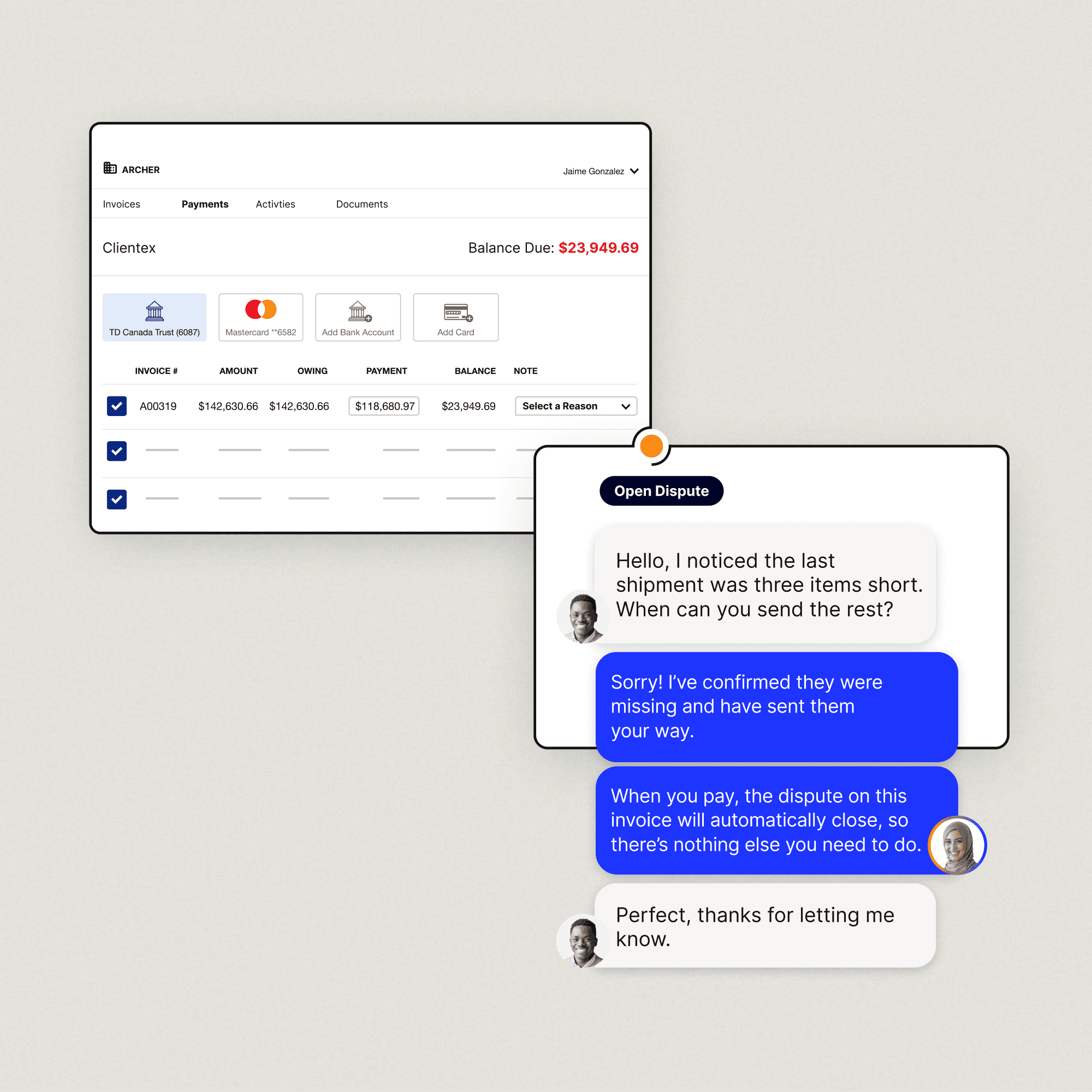

Invoice automation benefit #4: Reduce customer back-and-forth

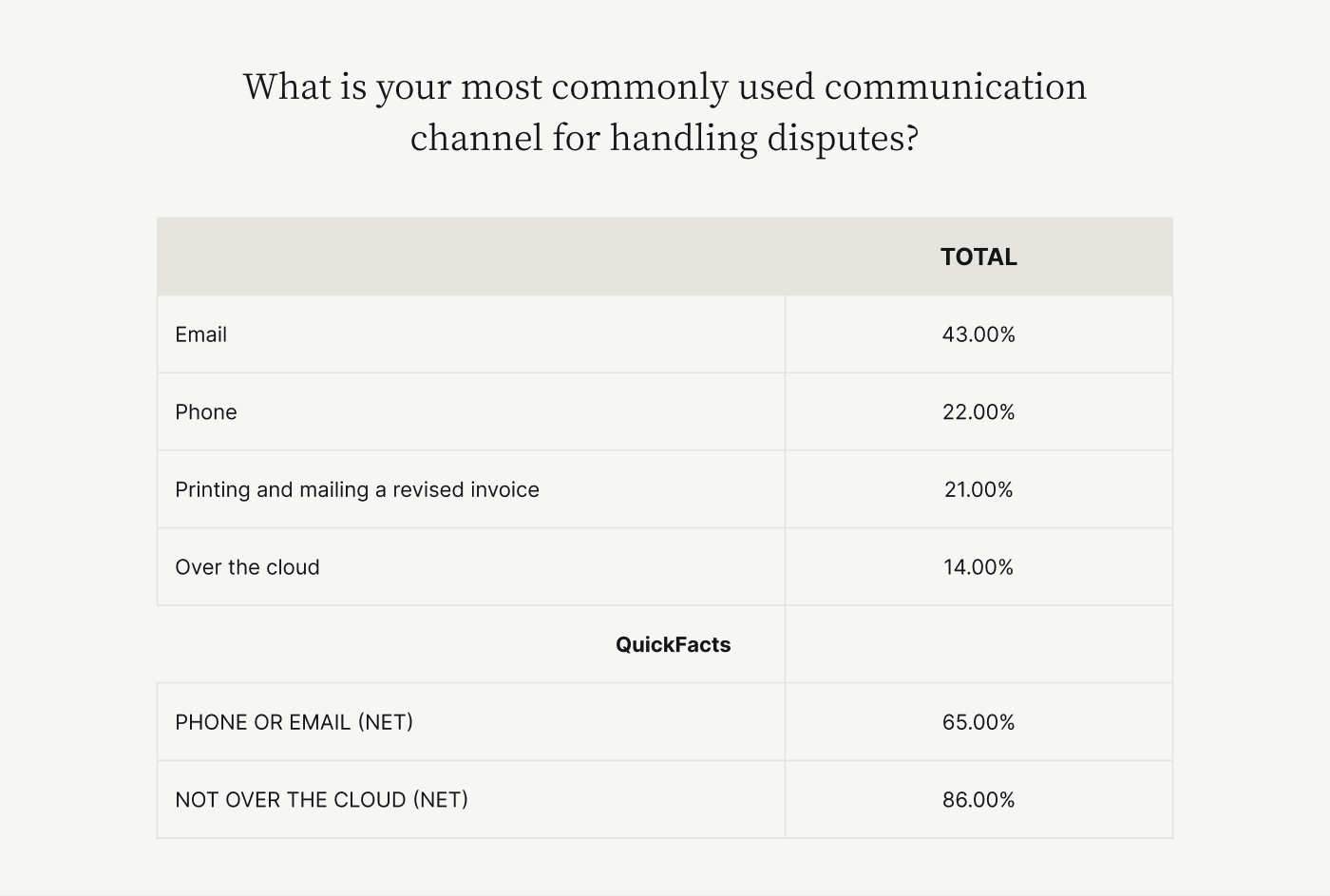

Manually driven AR teams are overburdened. They spend much of their day addressing easily avoided customer disputes (like pricing or discount errors) on tedious communication channels.

Despite the rise of sophisticated communications technology, 86% of AR teams we surveyed communicate with customers on everything but the Cloud.

While emails are great for delivering status updates, they're a relatively opaque mode of communication. You don't know if your customer has read them or understands what you're communicating. And if your customers receive half as many emails as you do, their invoices and previous communications are likely buried and near-impossible to retain or audit.

An automated invoicing platform helps customers self-service their needs, automating large portions of your communication chain. Instead of calling AR for status updates, AP teams log into your AR portal and view it themselves. In extreme cases that need clarification, they can directly message your AR team, ensuring speedy replies.

How automation helps customers self-service invoice payments

Automated invoicing platforms centralize all invoice-related data in one place, making it easy for customers to self-service their needs.

Here are a few tasks they can execute:

Group and pay invoices in a batch

Make short payments and leave reasons for AR to review

Open line item-level disputes

Review dispute statuses, documents, and AR communication

Set up auto payments on recurring invoices

Receive a statement-level view of outstanding payments, simplifying cash flow planning

Automated invoicing gives your customers a memorable payment experience, making on-time payments more likely. It also removes your AR team from clerical tasks, reducing your invoice processing costs.

Invoice automation benefit #5: Get cash on your books faster

Manual cash application at most companies is pushing AR teams to the breaking point. This was the case for one of our clients. Here are some numbers that highlight the depth of the issue:

One day—The time it took AR to post one check

10 PM—When cash application for the day would end

Six hours—How long the cash application process took

This tedious cash application process turned growth—an outcome every company desires—into a curse.

"It was two or three o’clock in the morning and there we were trying to apply cash," says this company's Senior Manager of Financial Services. "At that moment, we knew we needed a tool to help us if we were going to sustain the growth that we ultimately wanted beyond this flash.”

Automated invoicing also automates cash application. You'll bring cash onto your books as soon as customers pay. Best of all, you'll do this without errors or overburdening your AR team.

—

Watch Versapay’s cash application product demo to learn how we use machine learning to match any payment type with open receivables:

How automated invoice cash application works

Electronic invoicing in an automated AR solution gives your customers the option to pay using multiple payment options and tracks payments on outstanding invoices. Payments made directly against those posted invoices are automatically processed at a near 100% rate.

With certain solutions, you can capture different payment types, extract remittance data from multiple sources, and even use AI and optical character recognition to recognize and decode printed remittance information.

ERP integration pushes payment data back to your books, creating a seamless automated invoice-to-cash application cycle.

How to get started with invoice automation

Automated invoicing offers several benefits to AR teams burdened by manual processes. Best of all, you can choose to automate your invoicing process at different levels—whether automating just invoice creation or automating everything up to cash application.

Curious about how Versapay's automated invoicing can transform your accounts receivable? Learn how we helped TireHub overhaul its invoicing experience and save over 200 hours every week.

Read the entire story, here.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.