8 Ways for Wholesale Distributors to Preserve Cash Flow in a Slowing Economy

- 15 min read

Sometimes, challenging situations force businesses to transform, and make operational changes that significantly benefit them in the long term.

This blog explores 8 things wholesale distributors can do—with an emphasis on targeting accounts receivable—to prepare in the face of a slowing economy, while still driving efficiencies and accelerating cash flow.

Wholesale distributors bridge the gap between manufacturers (who make products) and end users or customers (who need those products). Because of how they’re uniquely positioned, when it comes to managing cash flow, some things are simply out of their—and their accounts receivable teams’—control.

Unfortunately, businesses today face some of the most challenging headwinds in decades. And wholesale distributors are caught in the storm. Here’s just a taste of the global challenges 1000 C-level executives say are currently causing headaches for their AR departments:

Supply chain disruptions (49% of executives)

Rising energy costs (46%)

Inflation (45%)

Labor shortages (45%)

Increased remote work (40%)

Either directly or otherwise, all of these outside factors impact wholesale distributors’ ability to preserve cash flow, and lengthen their liquidity runway. Throw in those elements distributors can control (yet aren’t necessarily easy to, like managing inventory) and it becomes quickly evident that any path that accelerates cash flow and drives efficiencies should be considered.

Knowing how important it is to be financially stable (and flexible); and understanding the importance of avoiding financial distress, we’ve put together a list of 8 ways wholesale distributors can face a slowing economy head-on, and come out the other side stronger and more prepared (and more profitable).

After all, just because something’s out of your control, it doesn’t mean it’s intrinsically bad. Sometimes challenging situations force us to transform, and make operational changes that significantly benefit us long term.

Oh, and since accounts receivable is sort-of our bread and butter, we’ve chosen to focus most of our suggestions in that area, and include some insights from our own wholesale clients on how AR automation software drives their business forward!

Jump ahead to a tip of interest:

Tip 1. Spend your pennies wisely (better yet, don’t let the pennies you’re owed, get away)

Cash leakage is the concept of cash that you’re owed, but are on the cusp of writing off as bad debt. It’s a critical and costly issue for businesses of all sizes and industries, but especially so for distributors.

Right now, delayed payments are compounding at an alarming rate. In fact, it’s touch and go for most businesses, who are finding their cash flows increasingly destabilizing due to unpaid invoices that should have been paid on time.

A recent study of ours surfaced that mid- to upper-midsized businesses have approximately $4 million in outstanding invoices each month due to lapses in communication. So, for wholesalers looking to preserve more cash flow, we highly recommend diverting attention toward capturing revenue that should have closed months prior, as this likely accounts for a sizable chunk of change.

Definitely spend your pennies wisely, but don’t stretch your human resources or get creative to survive with less cash on hand. Instead, capture the pennies (and we’re sure there are millions and millions of them) you’re owed.

Tip 2. Proactively open a line of credit

This one’s short and sweet: Consider opening a business line of credit—before you think you need one. In fact, consider doing so when you’re flush with cash.

Banks are less likely to help out a struggling business, as they are a thriving one. So, it’s best to arrange lines of credit well in advance. (Of course, this doesn’t displace the need to maintain positive cash flow. It simply offers an additional means of making ends meet when cash flow slows, and your liquidity runway shortens.)

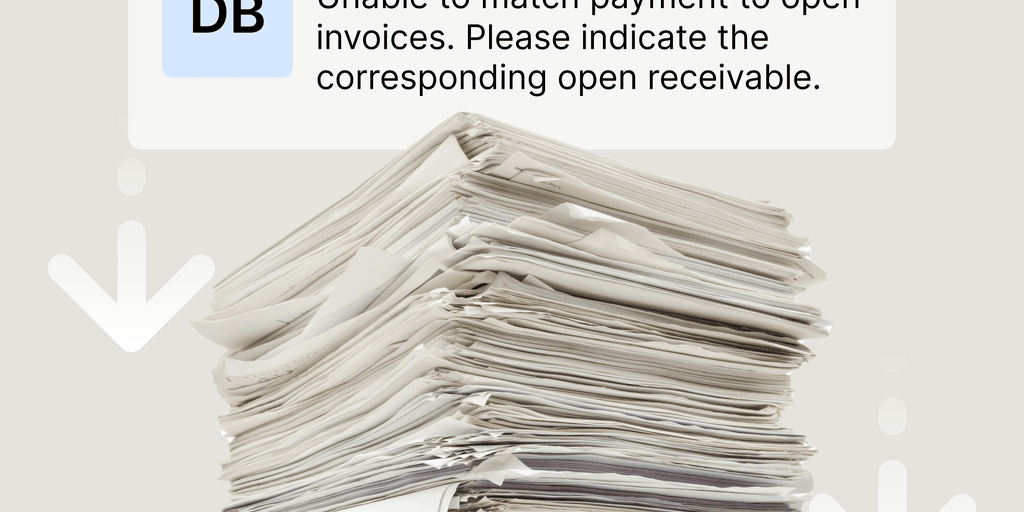

Tip 3. Transition away from traditional paper-based invoicing

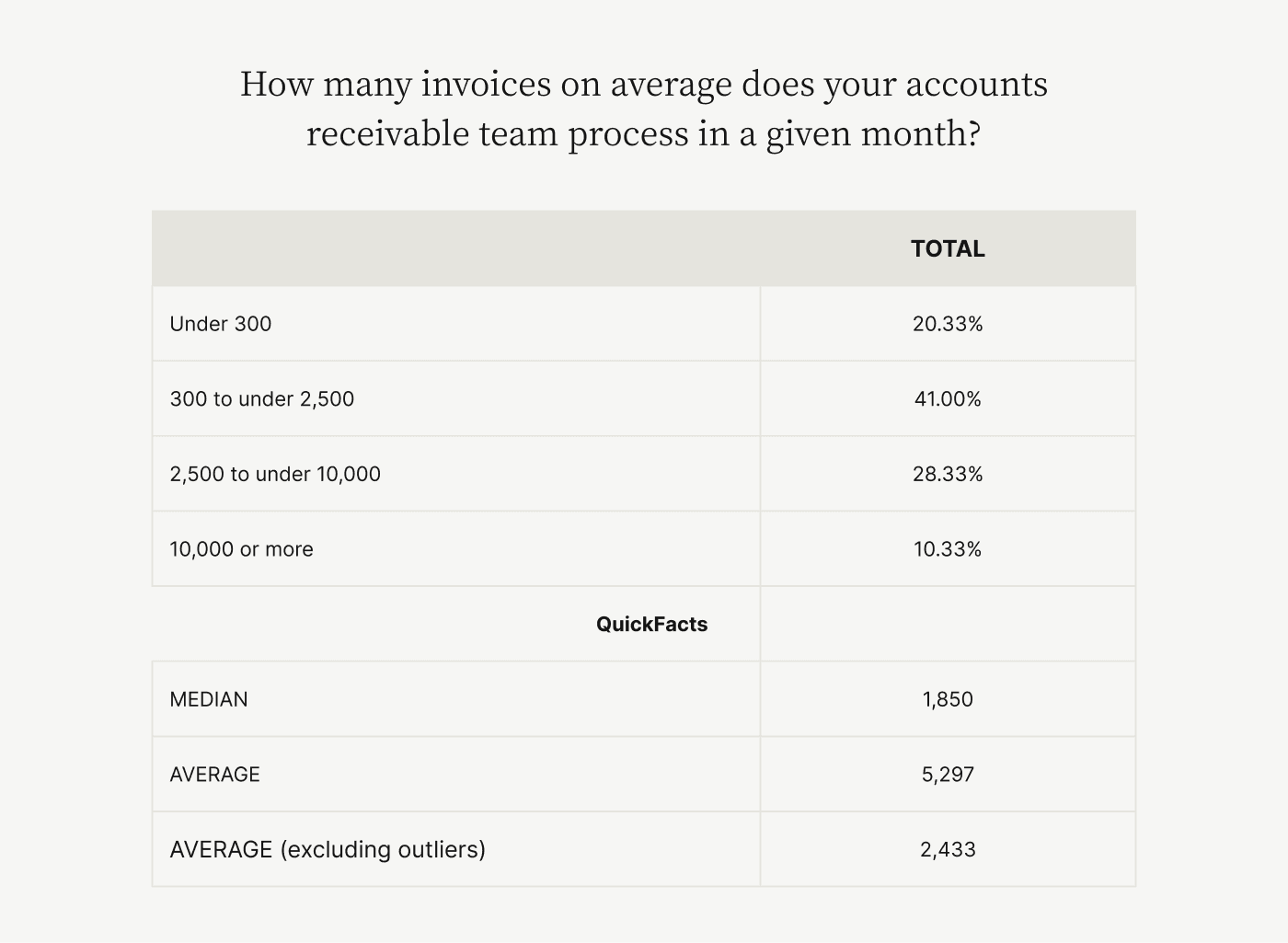

Paper-based invoicing is bad for business. It’s manual, tedious, inefficient, and terribly unmanageable at scale. (The average mid- to upper-midsized business processes 5,297 invoices monthly; with some processing upwards of 100,000.)

Invoicing is an essential function for wholesale distributors, yet many are still invoicing inefficiently—for instance, by sending physical invoices in the mail. And as the economy slows, these inefficiencies further contribute to cash flow problems by:

Draining company resources

Dissatisfying staff

Delaying payments

Delivering moral, environmental, and reputational damage, and

Hampering customer experience

And that’s just the tip of the iceberg. The consequences of paper-based invoicing aren’t minor inconveniences, and distributors should consider transitioning to electronic invoicing.

Customer spotlight 💡

Rexel, a tailor-made electrical equipment and services distributor sends roughly 160,000 invoices monthly. Rashid Maqsood, the VP of Treasury, Rexel North America, says that “after 20 years of significant effort” they got to a point where they “were digitizing invoices for about 60% of customers.”

When they learned about Versapay, they considered it a “catalyst to eliminate print services.” Since implementing our solution, Rexel is “digitizing close to 95% of invoices” with the goal to “turn off print services in the next 12 months and go completely paperless.”

Tip 4. Incentivize customers to embrace paying invoices online

Transitioning to paperless invoicing is half the battle. Getting your customers to embrace receiving those e-invoices and then ultimately paying for them digitally is the other half. Luckily, most customers want to pay digitally, using their preferred payment methods (like ACH or credit card).

For wholesale distributors, accepting digital payments is a great strategy for growing revenue, accelerating cash flow, and retaining clientele. When done right, it’s also great for building trust through consistency and security, and providing safe and convenient ways for customers to submit payments.

Generally, when your customers embrace paying invoices digitally, you’ll reap 3 major benefits. You’ll:

Improve customer relations

Reduce time, labor, and operational costs, and

Improve efficiency of back-office processes

Customer spotlight 💡

That same wholesaler, Rexel, deals with a range of customers, “from the largest corporations in Canada to local contractors.” And each has different needs regarding their preferred rules of engagement.

Rashid suggests businesses “help their customers along that journey” when asking them to embrace receiving and paying invoices online. He says that to provide support, Rexel first “holds training sessions with its internal team of 50 collections staff to build confidence using the Versapay portal. After this, those staff members are ready to talk about the portal with their customers. Rexel believes in a ‘train the trainer’ philosophy, meaning once internal staff are trained on the platform, they can advocate its value to customers.”

And this has resulted in great adoption numbers.

Rexel also created a “steering committee” that engages every part of their management structure, and includes IT, Sales, and Credit departments.

As for Versapay, our hot tip is to include your preferred payment methods in your contract agreement as the standard through which you’ll collect payment.

—

There are many guides on how to invoice electronically and how to get customers paying digitally. We recommend this one (it even has an interactive checklist!):

Tip 5. Use an inventory management system

Use an inventory management system (IMS). I repeat. Use an inventory management system.

By their very nature, wholesale distributors have much of their resources tied up in inventory. Some track manually, others use spreadsheets, and yet others perform inventory management duties through their enterprise resource planning (ERP) systems.

Another strong consideration is a robust inventory management system that can be used to track inventory in real-time, set reorder levels, manage barcode or RFID scanning, and/or integrate with existing distribution systems (such as a warehouse management system).

There’s immense value in connecting your IMS to other ERP systems, as this streamlines workflows, maintains data integrity, and drives efficiencies that generate cost savings—all things worth pursuing in service of accelerating (or just preserving) cash flow during a downturn.

Perhaps more simply put: when growth slows, it’s important you look at internal investments to improve inventory position; this can be the difference between making or missing your plan.

Tip 6. Transform your accounts receivable through digitization

Traditional accounts receivable processes can see wholesale distributors:

Spending upwards of 50% more time managing receivables

Processing 30% more past-due invoices, and

Collecting payments 25% slower

But when the economy slows, these are activities you want optimized and efficient. After all, sustainable revenue gains make weathering a recession easier, and collections teams are uniquely positioned to drive payments forward.

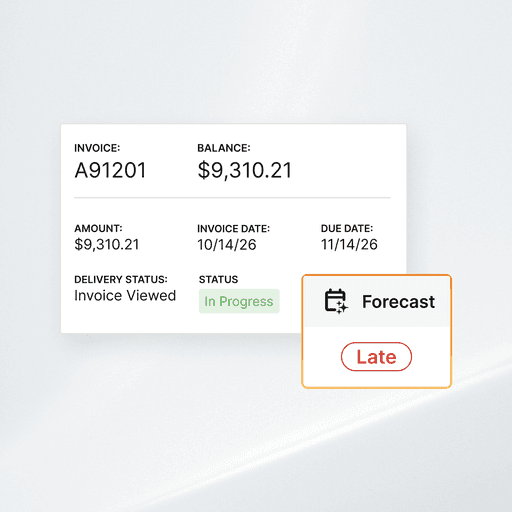

So, we propose distributors preserve their cash flow and solve for their most pressing accounts receivable challenges by automating and transforming how they invoice, collect payments, apply cash, and handle disputes.

By automating many of the rote, routine processes your collections teams face, you can reorient them toward more strategic activities. And, by completely transforming those that are intrinsically broken (by addressing the core of your AR problems), you can create scalable, sustainable receivables solutions that drive cash flow, even in challenging times.

If you’re unsure which specific AR challenges you’re facing (or are looking for a personalized diagnosis), take our 6-minute assessment. You’ll get a customized accounts receivable transformation roadmap to learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success.

Customer spotlight 💡

Here’s some advice from our customers on how wholesale distributors can better implement accounts receivable automation software:

From Rashid Maqsood, VP of Treasury, Rexel North America

When Rexel rolled out Versapay to their customers they started with one division.

“We did this so we could study how it went and beta test for three months,” says Rashid. “Then we rolled it out to our remaining nine divisions.”

As the solution went live to all customers, Rexel’s collectors had concerns about email delivery.

“With the great tools IT departments have developed to protect the assets of their company against phishing and fraud, this unfortunately affects how we email invoices. Many times, even if you’re a recognized company, your emails may be getting blocked. On a typical day, we’re sending out about 5000 to 6000 invoices a day. If even 3% of those emails get rejected, then that creates a lot of work.”

So, Rexel’s solution to this (and their suggestion to other distributors) was to engage with customers to update their whitelisting.

“We worked with a third party to help customers make those changes,” says Rashid. “Now close to a year after our full Versapay launch, email rejections are a nonissue.”

From Matthew Brown, Regional Credit MAnager, JJ Haines

JJ Haines initially started by inviting their customers that would give them the biggest bang for their buck on Versapay’s platform.

“These were the customers that were already receiving some sort of email or electronic invoice,” says Matthew. “These were naturally the early adopters. We went for those customers first and then focused on our customers paying by credit card and sending checks by fax.”

Then, JJ Haines was able to greatly reduce manual processing of credit cards and check-by-fax payments once these customers were engaged on Versapay.

“We surcharge customers 2% for credit card payments, which nearly eliminates our transaction costs for credit card payments,” says Matthew. “Since we’ve moved credit card transactions from our internal gateway over to the Versapay platform, we’ve been able to cut our expenses in this area by a huge margin.”

Tip 7. Double (nay, triple!) down on customer experience

To preserve cash flow, wholesale distributors will want to prioritize customer experience not only to delight customers, but to ensure payments come in more predictably and faster. And (to no one’s surprise), we believe that accounts receivable is the only discipline that provides customer engagement opportunities across every relevant cash flow touchpoint.

Here are a few statistics that prove AR is a core factor in driving customer experience:

73% of executives say the invoice to cash process can negatively affect a customer’s experience

85% say poor communication between their AR team and customers has led to nonpayment

78% say payment disputes could have been alleviated with better communication

82% say their company has lost future work due to miscommunication in the payment process

For a full list of 21 statistics, check out this article.

Not convinced? Then how about this: In a recent study of 300 CFOs, when exploring how they evaluate the ROI of software, the impact to customer experience outweighed direct labor- and time-savings.

This validates that finance plays an increasingly important part in turning the business into a CX giant. It also demonstrates the belief leaders have in finance’s ability to boost CX in service of withstanding economic downturns.

Customer spotlight 💡

Distribution logistics company, TireHub, transformed their accounts receivable process, giving customers the exceptional invoicing, billing, and payment experience they deserve.

They recognized early that their initial search for a solution that could improve lockbox payments wouldn’t be enough. Ultimately, they understood that by doubling down on customer experience and reprioritizing their preferences to ensure their customers could solve their inquiries through self-service would generate substantially better results.

“As we started getting closer and closer to selecting the right software, there was a shift in our thought process to give self-service more importance than the back-office piece,” says TireHub’s former Product Manager, Venkat Korapaty. “And that’s where Versapay shined.”

This mindset shift transformed their collections experience and unlocked massive operational savings.

Tip 8. Understand your expenses, don’t hoard cash, and use good forecasting practices

Lastly, to preserve cash flow in a slowing economy, we suggest wholesale distributors get really good at executing on the basics. These insights from an MDM study that came out a few years ago ring truer than ever.

Understand your expenses

In that report, distribution expert Albert D. Bates gives distributors pointers on how to prepare for a potential slower growth period. As part of that process, he tells companies to look carefully at their fixed and variable expenses and ensure that they fall within these ranges:

Fixed expenses are overhead expenses. The key factor is that once a budget is set for

the year, these expenses will only change if management takes specific actions to change them, such as negotiating a lower rent. For most firms, fixed expenses represent somewhere around 80% of total expenses.Variable expenses, in contrast, rise and fall automatically as sales rise and fall. They

include sales commissions, interest on accounts receivable and the like. For the typical firm variable expenses are estimated to be 5% of sales.

Don’t hoard your cash

A common reaction to declining sales, hoarding cash is a no-win proposition during a downturn. “Inevitably, this leads to converting inventory and accounts receivable into cash,” says Bates. In fact, lowering inventory almost always involves a “stop buying” edict that causes the firm’s service level to deteriorate. “Accounts receivable reductions have a similar impact on sales,” Bates cautions. “Lowering either of these will simply drive sales down at a faster rate.”

Use good forecasting practices

An important aspect of cash management and profitability, cash flow forecasting involves looking at both income and cash flow statements and linking your cash flow forecasts to key working capital metrics from the balance sheet, such as DIO (days inventory on-hand), DSO (days sales outstanding), and DPO (days payables outstanding).

Deloitte tells firms to also include capital expenditures, debt repayments and other operating cash flows into the equation. “To enhance the accuracy of these forecasts, consider automating this process rather than relying on error-prone and labor-intensive spreadsheets,” the firm advises. “Also, be sure to integrate cash flow forecasting with your profit & loss (P&L) statement and balance sheet so you can track performance against a range of indicators.”

—

There are innumerable factors influencing wholesale distributors’ ability to preserve cash flow in a slowing economy. Some are outside their control; others are firmly within it. Regardless of the challenges you’re facing, there are strategies and tactics you can consider to drive your business forward and come out the other side stronger and more prepared (and more profitable).

Accounts receivable is one such area to consider. There’s immense potential for increased efficiencies and better customer experiences; and adding those will see you capture more revenue and accelerate cash flow.

Talk with an expert of Versapay, and see firsthand how we help wholesale distributors transform their AR, cash application, and payments—in a more human way.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.