Why B2B Payment Automation Is a Top Priority for CFOs

- 11 min read

B2B payment automation is experiencing rapid growth.

Embracing it will lead to benefits like accelerated cash flow, greater efficiencies, and reduced payment fraud risks.

In this article, you'll learn what B2B payment automation is, and the numerous real-time benefits it offers AR and finance teams.

“We’ve always done things this way…,” “New technology is expensive…,” “Where’s our data going…,” “I don’t have time to train people…”

These are just some of the reasons why many business-to-business (B2B) sellers are missing out on the advantages of B2B payment automation. Instead of accepting digital payments that increase cash flow and eliminate error-prone manual tasks, these sellers continue to be bogged down by the hassles of physical checks and manual credit card processing.

While some companies will stubbornly choose to not adopt it, B2B payment automation is experiencing rapid growth. According to Research Reports World, a projected compound annual growth rate (CAGR) of 13.26% will double the B2B payment automation market to nearly $2 billion by 2030.

Those businesses that are open to payment automation will soon realize that the benefits far outweigh any perceived challenges. The most notable advantages include:

Accelerated cash flow by making it easier for customers to approve and pay your invoices.

Efficiency gains by streamlining processes and reducing errors. Seamless integration with popular accounting and ERP platforms eliminates the need for duplicative work.

Robust security measures that protect data and reduce fraud risk

Reduced workload for your AR team members, who’ll become more enthusiastic about their jobs when mundane tasks are taken off their plates.

In this post, we’ll discuss the reasons why B2B payment automation is at a tipping point for many CFOs, and how you can make it work for your organization.

Jump to a section of interest:

What is B2B payment automation?

B2B payment automation is software that integrates with your enterprise resource planning (ERP) system. It allows you to quickly capture any payment type from any channel, such as ecommerce, POS systems, card-not-present, or secure payment portals.

With a B2B payment automation solution in place, customers can elect to pay for invoices using their preferred payment methods (credit card, virtual card, ACH, eCheck, etc.), with options for managing recurring payments, auto-payments, and more.

And here’s where it gets really cool: Once a payment is made, the appropriate payment information enters your ERP, where it’s automatically applied to the correct invoices and connects to all the other data you’ve saved about that customer with no human touch points to bog things down. With straight-through processing, your customers also receive immediate payment verification, making their lives easier, too.

Payment automation lets you conveniently manage the entire payment process from within your ERP, eliminating the need for redundant data entry and process management across multiple systems.

Accounts receivable teams that deploy payment automation software experience tangible benefits, including a 50% reduction in manual work, 30% fewer past-due invoices, and 25% faster payments.

2 reasons why B2B payment automation is a must-have for accounts receivable teams

CFOs and other C-level executives at B2B companies nationwide are feeling more urgency about implementing payment automation. Both buyers and sellers are becoming more aware of the technology, and they’re getting more comfortable with it by paying for more things digitally in their personal lives.

The main driver of B2B payment automation, however, is a growing frustration with manual payment processes that negatively impact cash flow. Buyers and sellers are looking for ways to accelerate the payment process, while eliminating the hassles of processing checks and credit cards manually.

Here are 2 main factors fuelling those frustrations and shining a spotlight on on payment automation:

1. Most accounts receivable teams are backlogged

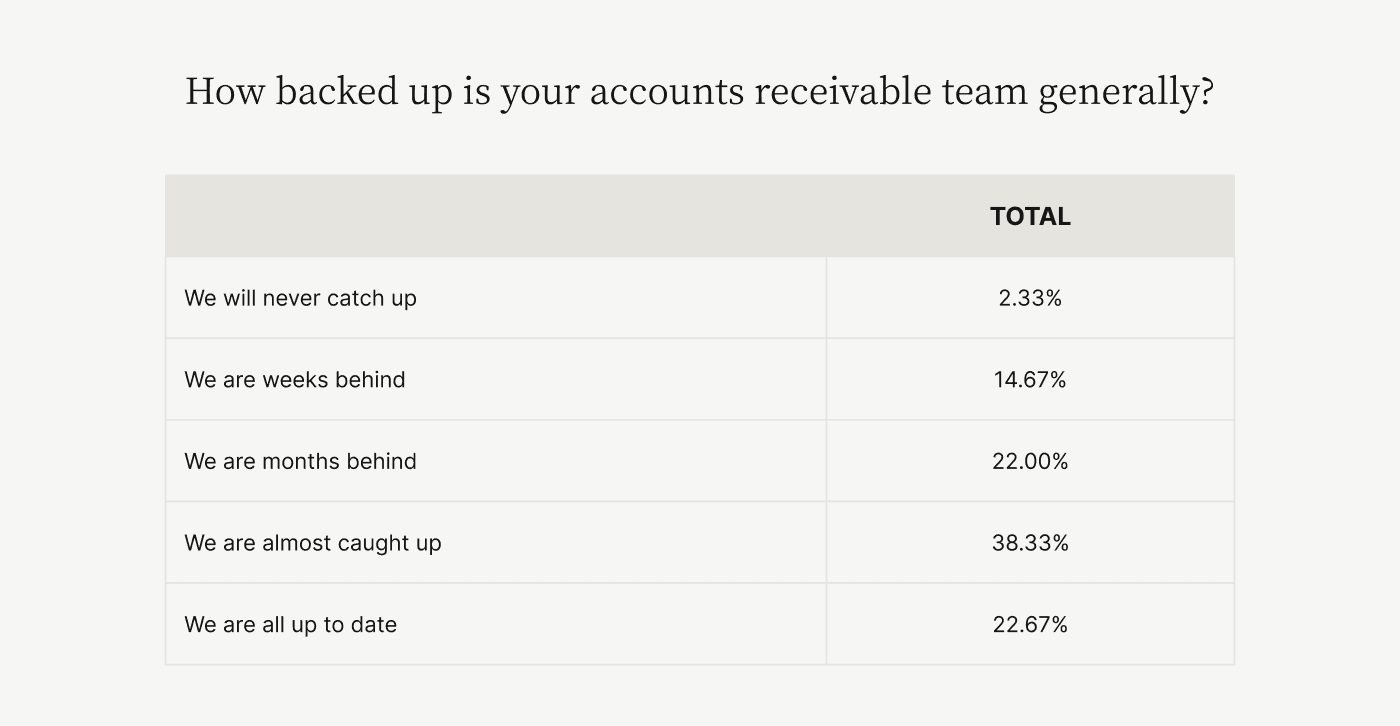

Because of cumbersome, manual payment processes, most accounts receivable teams are getting further behind in their work. In the State of Digitization in B2B Finance, a study of 300 CFOs we conducted with Wakefield Research, 77% of respondents said their AR teams aren’t up to date on their accounts receivable.

This pervasive backlog among AR teams is creating an average cash-flow shortfall of $4 million monthly at the typical mid- to upper-mid sized company with revenues of $250 million or more.

Such a scenario is never a good one, and it’s even worse in an inflationary economy. “Liquidity is not as free flowing as it was before,” says Versapay CFO, Russell Lester, about the increased urgency to accelerate payments.

With inflation reducing purchasing power and driving up the cost of credit, accounts receivable teams are challenged to bring working capital in more quickly. “A lot of people forget that the AR department is critical to the cash flow for a company,” Lester says. “If we’re not getting paid, or not getting paid on time, then we are diminishing our opportunity to invest back into that flywheel.”

2. Too few accounts receivable teams are focused on the customer

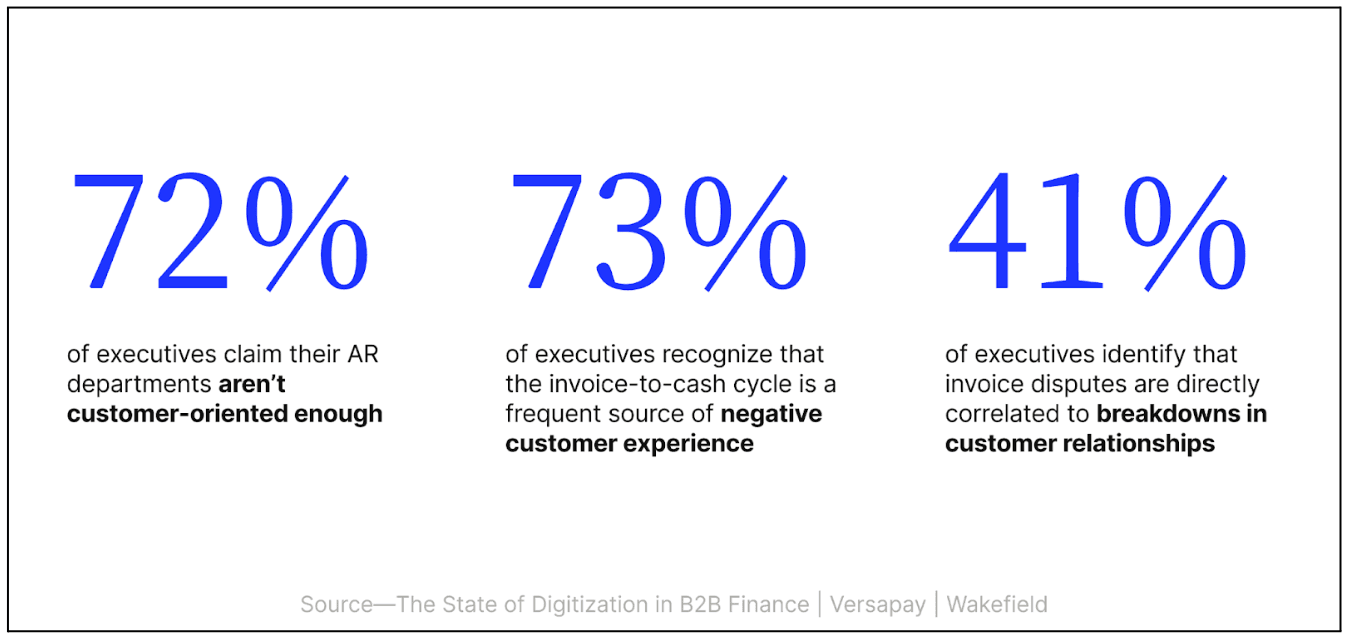

In another recent study, The Impact of Customer Experience on B2B Payments, more than 70% of executives said they’re concerned that their AR departments aren’t customer-oriented enough.

Poor communication between AR teams and their AP counterparts is a direct consequence of cumbersome manual payment processes, giving more reasons for CFOs to view B2B payment automation as a necessary catalyst for accelerating cash flow.

The more quickly companies can collect payments and resolve payment disputes, the more capital they’ll have on hand to run their businesses. And having more working capital can relieve stress on companies so they can focus more on operations and growth.

—

In summary, here are some of the primary pain points that are driving CFOs to implement payment automation technology:

Poor cash flow—The typical upper mid-sized company struggles with more than $4 million worth of unpaid invoices each month.

Strained customer relationships—More than 80% of executives say they’ve lost work because of a payment process miscommunication, with just over half saying it’s happened more than once.

Higher operating costs—Manual processes are bogging companies down in unnecessary work: TireHub, for example, had three full-time employees just managing lockbox payments before implementing B2B payment automation.

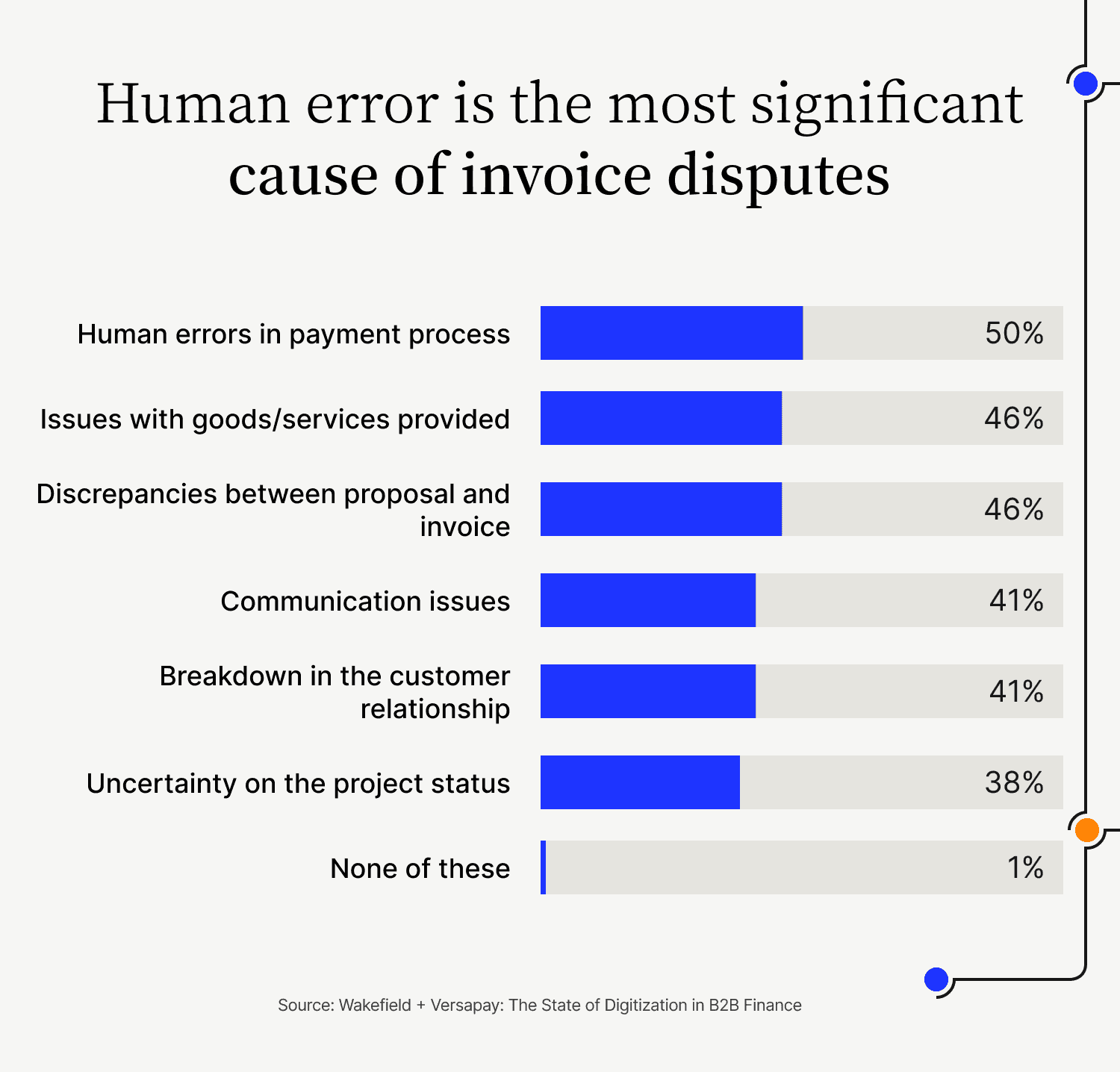

Processing, data entry, and document matching inefficiencies—Without an integrated B2B payment automation solution, your accounts receivables team must manually enter credit card and other payment information into your ERP or accounting system. This tedious process takes enormous amounts of time and increases the risk of error, which is the most significant cause of invoice disputes and payment delays.

How 4 accounts receivable teams benefit from B2B payment automation

While every organization is different, the benefits of B2B payment automation are essentially the same for any company that’s feeling slowed down by inefficient, manual payment processes.

These benefits include faster, more secure payments, significant process and cost efficiency gains, enhanced customer experiences, and, ultimately, improved cash flow. Throughout this section, you’ll see how the benefits of B2B payment automation came to life at a number of different companies.

1. Sharp Canada frees up time for collections

Before implementing B2B payment automation, Sharp Canada was fielding more than 200 phone calls from customers paying by credit card each month. This unnecessary administrative burden was taking the team away from pursuing collections, which affected their days sales outstanding (DSO) and collection effectiveness index (CEI).

After implementing a payment automation solution from Versapay, Sharp’s AR team saved 8-10 hours on manual credit card processing each month and eliminated the communication gap with their customers.

2. A leading healthcare service provider accelerates cash application

B2B payment automation allowed one healthcare service provider to give 4.5 hours back daily to its cash application specialists. Before adopting Versapay’s payment automation solution, the cash application team would often stay at work until 10:00 pm, because it could take a full day to post a single check.

After B2B payment automation, cash application was completed in a quarter of the time with one-third fewer resources. The team started posting payments twice a day, and 96% of incoming payments were automatically matched with open receivables.

Are you seeing the pattern yet? Companies burdened by manual processes and other payment complexities can eliminate these cash-flow-delaying obstacles with B2B payment automation.

3. Cole, Scott & Kissane stops annoying its customers

Law firm Cole, Scott & Kissane (CSK) is another organization that reduced errors, reduced reversals, and reduced re-billings through payment automation.

Before Versapay, the firm received a large volume of checks that had to be picked up at a P.O. box, opened, remotely deposited, and manually entered in an accounting system. Remittance advice was often mailed separately or made available for download from a customer’s website, adding to the complexity.

What’s more, CSK often received payments without accompanying detail and the firm’s AR team kept having to follow up with customers who had already paid.

With B2B payment automation in place, same-day cash application is a regular occurrence at the law firm, and financial data is always accurate and up to date. Eliminating manual entry misapplications saved the firm and its customers from those unnecessary collection calls, and the firm was able to repurpose existing accounts receivable staff to more strategic roles.

4. Madison Resources breaks free from lockboxes

If you’ve ever had to use a lockbox service for receiving checks, you probably know how costly and inefficient they can be. That’s one of the main reasons why staffing agency support company Madison Resources turned to B2B payment automation.

Under the old lockbox system, the company’s AR team was spending an excessive amount of time on keyed exceptions and needed a better way to post receipts and payments received. After implementing Versapay, the team has been able to save money and time without adding new staff or replacing outgoing staff.

Get started with payment automation today

Finance leaders must balance competing digitization projects, such as procure-to-pay modernization and order management/CRM automation. But putting B2B payment automation at the top of the list can result in several quick wins, including lower DSO, reduced bad debt expense, higher collection productivity, and less revenue leakage.

Automating payments is clearly an opportunity for CFOs to improve their companies’ bottom line by improving efficiency, reducing human error, and improving the customer experience.

A smooth payment process makes a big difference: In 2021, an average of 50% of all B2B invoices issued in the US were paid late. That trend has shown little sign of slowing down. Every late payment negatively impacts cash flow, and the longer the delay the more likely a payment will never be made. In fact, nearly 10% of invoices over 90 days past due are written off by B2B businesses.

Smart CFOs understand that late payments, disputes, missed calls and emails, and other payment friction points are frustrating for their teams and customers alike. That’s why they’re realizing the importance of offering flexible payment options, improving communication, and reducing errors —all things that B2B payment automation can handle with ease.

While it all comes down to improved cash flow, payment automation has the added benefits of improving your relationships with customers and empowering your accounts receivable team.

As Versapay’s CFO Russell Lester says, “Real-time data allows you to move into the upper echelon of being relevant and proactively persuasive with your insights. If you can arm your AR team with a tool that allows them to be very fast with those insights—even surface insights that the business was not aware of previously—that puts them in a position of being a strategic advisor. It gives them a seat at the table.”

To learn more about B2B payment automation, book a demo today. Or, see for yourself what check and digital payments use looks like for 100 finance leaders in our report, Digital Payments Are Ready For The Spotlight:

About the author

Ben Snedeker