What are B2B Payments: A Guide to Streamlining Payment Acceptance

- 14 min read

Learn how B2B payments work, examples of these transactions, the challenges with accepting traditional B2B payments, and the benefits of B2B payment solutions.

Earning large enterprise clients is one of the top tactics for businesses looking to grow revenue. And even more important for a company’s bottom line is retaining this clientele. This requires offering quality services, building trust through consistency and security, and providing safe and convenient ways for customers to submit payments.

The larger the client, the more complex the process becomes for getting paid. B2B payments are notoriously more complex—and tedious to process—than B2C transactions because of their scale and the general lack of innovation in B2B payment methods.

B2B payments can be quite large, sometimes tallying millions of dollars. Combine that with the fact that the majority of enterprise companies still rely on paper checks which require manual effort to process on the seller’s part. Obstacles like these can hold up B2B payments for weeks or even months at a time.

B2B payment solutions are designed for companies to increase the efficiency and speed of business-to-business transactions. By implementing modern technology, including digital payment processing, companies can ensure they’re getting paid as fast as possible in a secure environment. Additionally, digital payment options offer a more enjoyable and convenient experience for the customer.

Let’s take a look at how B2B payments work, examples of these transactions, the challenges with accepting traditional B2B payments, and the benefits of implementing modern, B2B payment platforms.

Jump to a section of interest:

- How do B2B payments work?

- Examples of B2B payment methods

- Challenges of traditional B2B payments

- Benefits of digital B2B payment solutions

- Revolutionize B2B payments with Versapay

How do B2B payments work?

B2B payments refer to payments made between businesses. This involves one business, the buyer, paying another business, the seller, through the transfer of value denominated in currency for goods or services supplied.

B2B payments are more complex and time-consuming than B2C, or business-to-consumer, transactions. This is because B2B payment processing requires more time to approve and settle the transaction, which can take days or weeks. B2C transactions are typically settled on the spot.

Additionally, the scale of B2B payments often far exceeds their B2C counterparts. This adds complexity to what are already cumbersome payment methods—ultimately requiring more manual effort to reconcile.

In short, business customers have different payment needs than individual consumers, and sellers must have more sophisticated payment processing systems to accommodate higher sales amounts and complex remittances.

Examples of B2B payments

Even in 2023, the most common methods of B2B payments remain paper checks and ACH payments. With payment processing primed for digital disruption and innovation, numerous other methods have been introduced to enable more efficient B2B payments. Common—and not so common—examples of B2B payments include:

- ACH payments

- Wire transfers

- Commercial credit cards

- Digital wallets and digital payment services

- Virtual credit cards

- Electronic checks (or eChecks)

- Paper checks

ACH payments

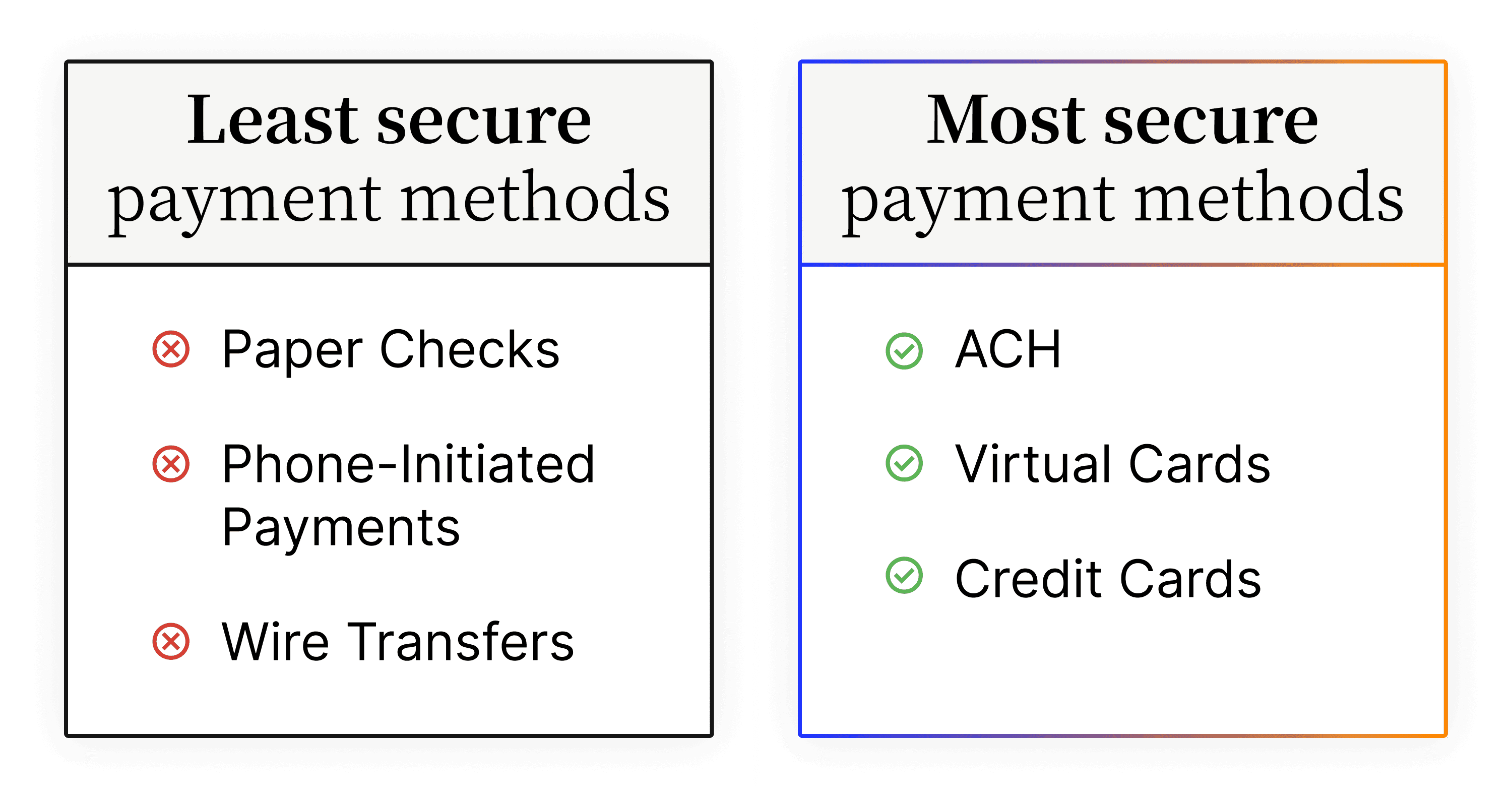

ACH (Automated Clearing House) payments is a method available in the United States for transferring funds electronically. This is a popular B2B payment method because ACH payments are inexpensive, convenient, and the most secure.

The Automated Clearing House network connects all banks in the United States. An ACH payment is simply the transfer of funds between accounts at two different banks. This process has limited friction and doesn’t require much communication between parties.

International ACH transfers are possible but are used less frequently than wire transfers, as wire transfers do not require an intermediary verification.

Wire transfers

While wire transfers represent one of the least common B2B payment methods, they account for a large percentage of B2B payment volume (per transaction). This is because wire transfers often involve high-value payment transactions with international players.

Wire transfers are typically managed through one of the three systems: Fedwire, CHIPS, or RTP. Once the funds land in the receiving account, the money is immediately available, making it a popular real-time payment method. However, it’s important to note that wire transfers are also one of the least secure options for B2B payments.

Commercial credit cards

Despite the associated processing fees, commercial credit cards remain one of the most popular methods of payment from a buyer standpoint, even when that customer is a business. But for the supplier, credit cards are one of the most expensive methods for accepting payments.

For most businesses, it’s not a question of whether to accept credit card payments. The potential business loss of not doing so far outweighs the short-term cost savings. There are things companies can do to reduce these costs, like credit card surcharging.

Additionally,credit card processing technology exists that is designed to further limit the cost passed along to businesses. These tools can speed up and automate credit card payments, reduce manual processes, accelerate cash flow, drive more revenue, and empower critical team members to spend their time on more strategic activities—rather than on payment processing.

Digital wallets and digital payment services

Digital wallets or digital payment services allow buyers to pay for goods or services through digital devices. Types of digital payment services include PayPal, Venmo, Apple Pay, Google Pay, and more.

These platforms electronically transfer funds from one account to another. Typically, the transfer is done between two entities and avoids dipping into the bank accounts directly, though the accounts are connected.

Some consumers prefer to use digital wallets and online payment services because of additional features, like the ability to add a note to a transaction and other tracking capabilities. The added convenience of managing transactions from a mobile device is also attractive.

Virtual credit cards

Virtual credit cards have quickly gained popularity from both the seller and buyer side for B2B payments. Virtual credit cards are digitally generated 16-digit numbers that can be used in place of a physical credit card.

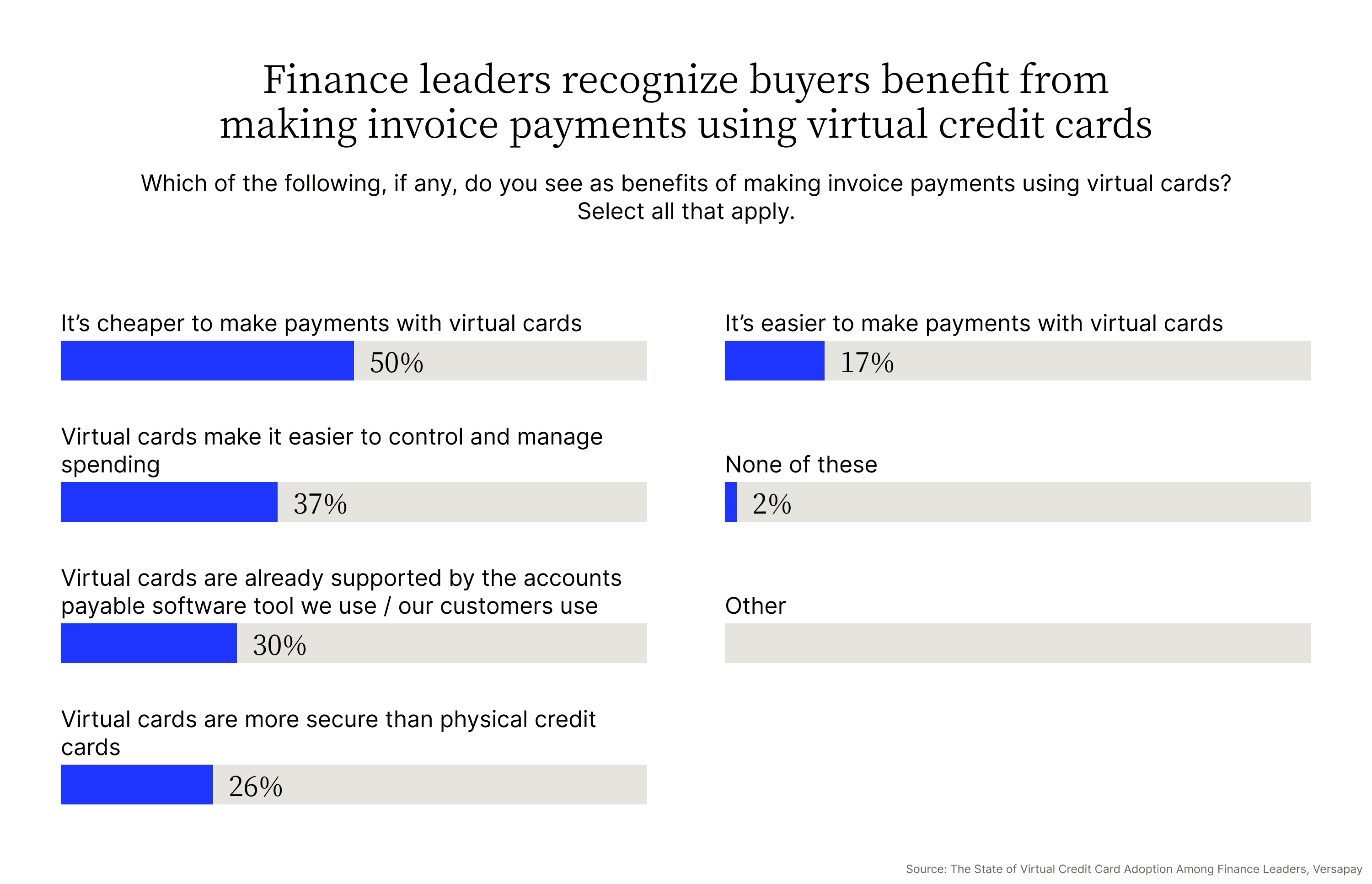

Tokenization and spend controls make virtual credit cards one of the most secure B2B payment methods because they are typically only used once. Controls can also be implemented on virtual credit card numbers to limit their use based on parameters like type of purchases, length of validity, and the dollar amount it can cover. There are numerous additional benefits to using virtual credit cards as B2B payment methods, which finance leaders are quick to recognize:

Electronic checks (eChecks)

An eCheck, or electronic check, is also known as a direct debit and contains the same information as a paper check. However, as the name suggests, transactions involving eChecks are managed digitally.

eChecks are a faster payment method than paper checks and less expensive to process than credit card payments. This makes them attractive to sellers while maintaining a level of digital convenience for the buyer.

Paper checks

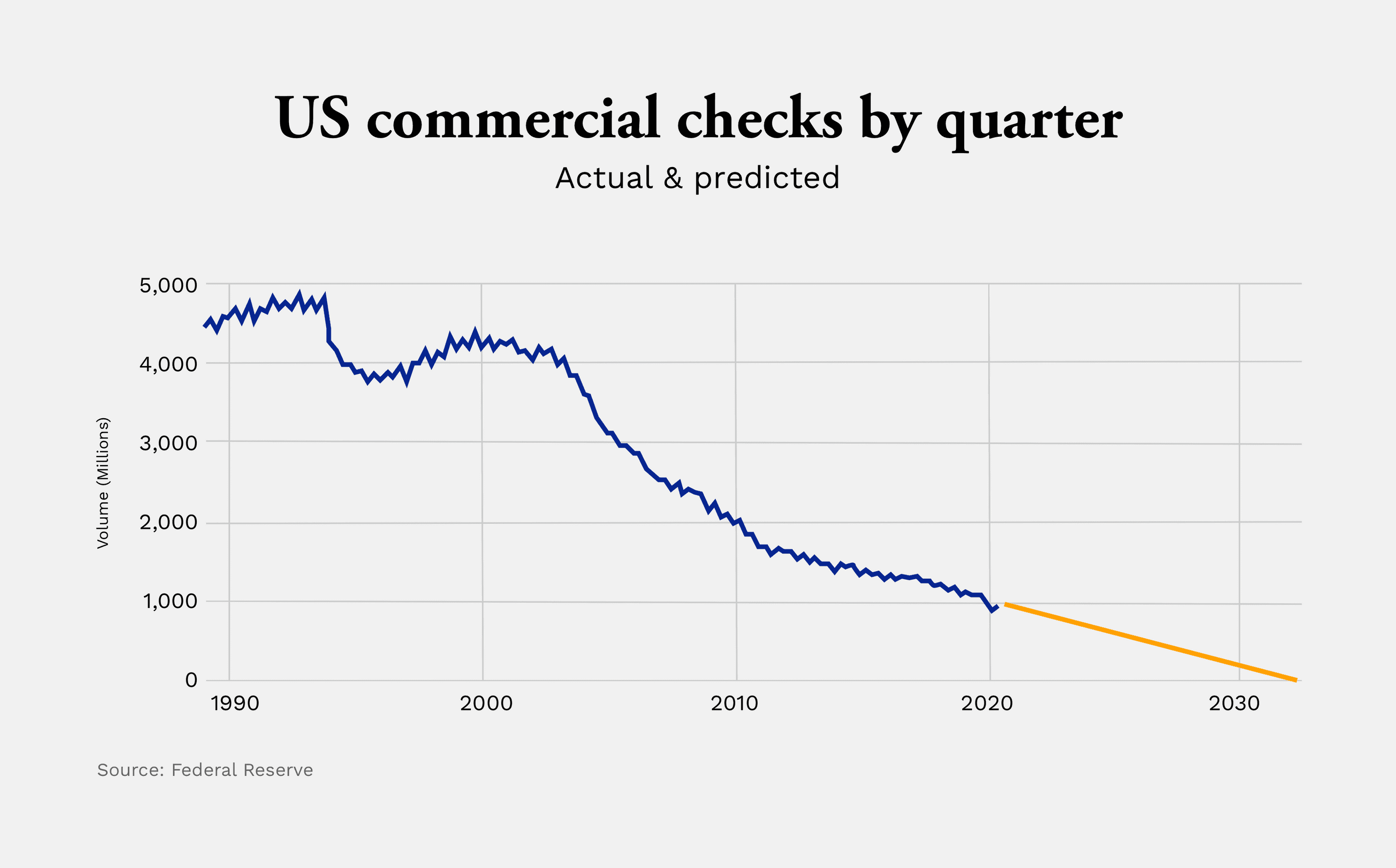

While the use of paper checks by individual consumers has plummeted in recent decades, this is still one of the most common B2B payment processing methods.

It’s hard to say exactly why so many businesses still rely on paper checks—outside of holding on to outmoded practices—and it doesn’t change the fact that digital payment methods are the way of the future.

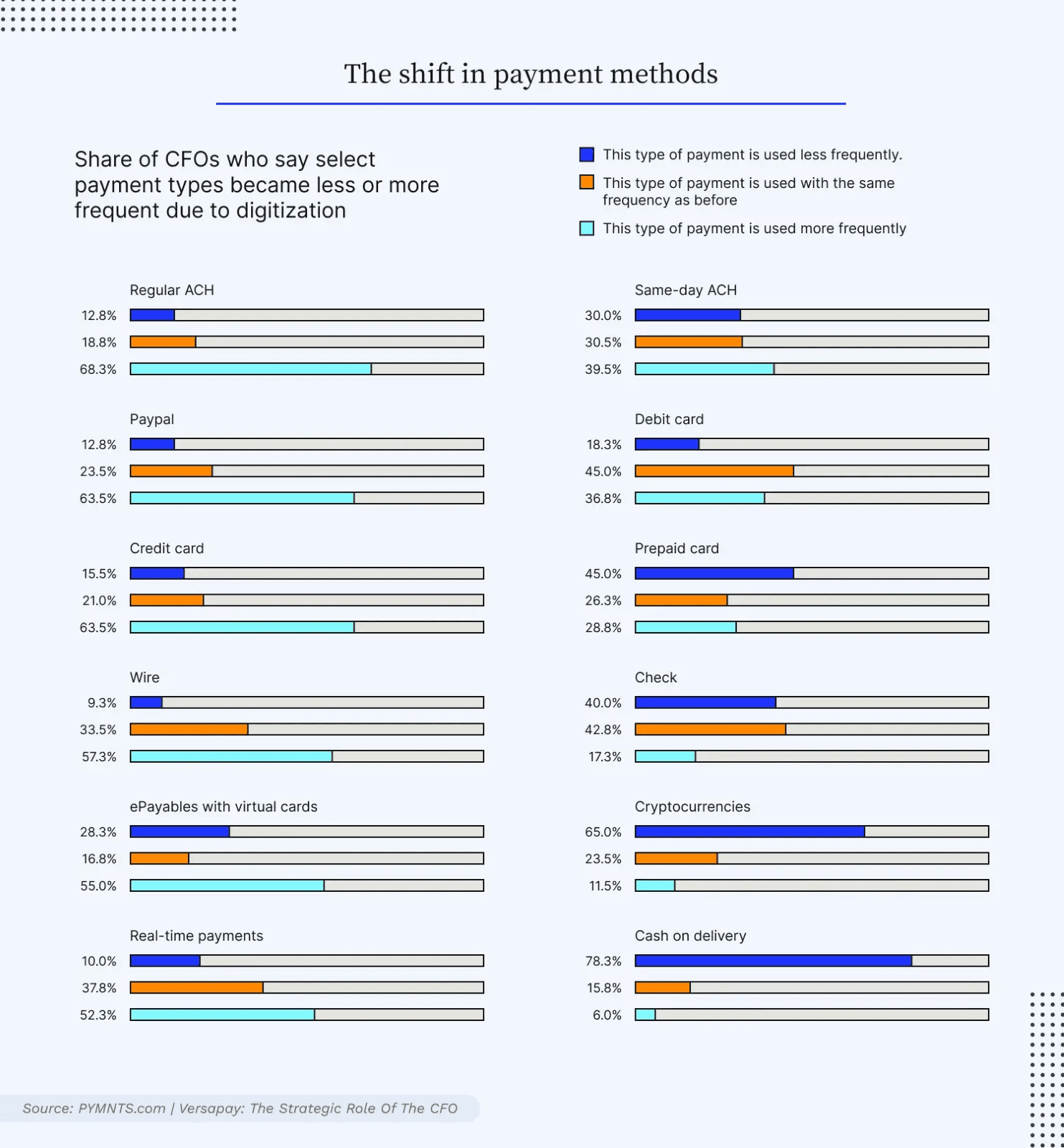

In general, digitization—and buyers’ continued quest for convenience—across industries has forced a shift towards digital B2B payment methods. In particular, the move to digitize AR processes and embrace B2B payment methods is transforming customer relationships and the ways in which AR and AP teams collaborate, because digitization boosts efficiency and transparency.

Challenges of traditional B2B payments

Non-digital payments like paper checks drastically slow down the B2B payment process, making them less convenient for the buyer and more costly for the seller. High invoice processing expenses, poor visibility, limited data, and longer payment cycles are all consequences of non-automated payments.

Thankfully, there are a number of modern solutions available to facilitate electronic payments from business to business that address these challenges. Here are some of those core challenges of traditional B2B payments and how they affect organizations managing payment acceptance:

- Slow processing times

- High transaction fees

- Security concerns

- Late payments

- Lack of collaboration

Slow processing times

Traditional payment methods increase processing times and slow down the overall payment cycle. Electronic payment methods facilitate faster payment cycles for both accounts payable and accounts receivable.

Traditional B2B payment methods can lead to time delays, negatively impacting cash flow. For example, checks can take several days or even weeks to clear, while wire transfers can take several days to process.

High transaction fees

There are a number of fees associated with traditional B2B payment methods like wire transfers and paper checks.. Most of these fees are passed along to the seller, drastically increasing the cost of doing business.

Some of the related fees include processing fees, intermediary fees, and currency conversion fees.

Security concerns

The vast majority of payment fraud attacks are targeted at businesses, as higher transaction quantities offer a better payoff. While malicious actors can still target electronic payments, it’s much easier for them to access sensitive information through traditional payment methods.

Invoice fraud remains a rising concern for companies, making the need for secure B2B payment systems and solutions a must. To prevent fraud, most businesses invest in additional security measures, like fraud detection software or staff to monitor transactions. These costs add up quickly, especially for companies with a high volume of B2B transactions.

Late payments

Traditional B2B payment methods can lead to late payments due to a variety of factors, including manual processes, payment disputes, inefficient payment systems, lack of visibility, and delays in fund transfers.

Manually processing checks is expensive, error-prone, and a wasteful timesuck for AR teams. This makes paper checks a huge impediment to increasing cash flow. Paper checks also take days to arrive in the mail, causing uncertainty for when payments will get settled. Even worse, customers can exploit these flaws to further delay payments when possible.

This makes them a major impediment to cash flow. Plus, checks can take days to arrive, leaving teams uncertain as to when payments will be settled. Even worse, some customers will inevitably use this flaw to delay payments when possible.

Lack of collaboration

Traditional B2B payment methods present barriers to collaboration for businesses. There is less flexibility among these payment options because they involve manual effort—on the behalf of all parties—and disconnected systems. They also lack integration capabilities with your ERP, provide limited payment data for remittance advice, and offer little to no transparency. The lack of visibility into consistent payment data makes it difficult to collaborate effectively with internal departments and external partners.

The lack of integration between systems makes it difficult for businesses to work with partners using more modern, digital payment methods. Traditional payment methods offer limited payment data, often only listing payment amount and date. This makes it difficult for AR teams to quickly identify which outstanding invoice a payment should be applied to.

Benefits of digital B2B payment solutions

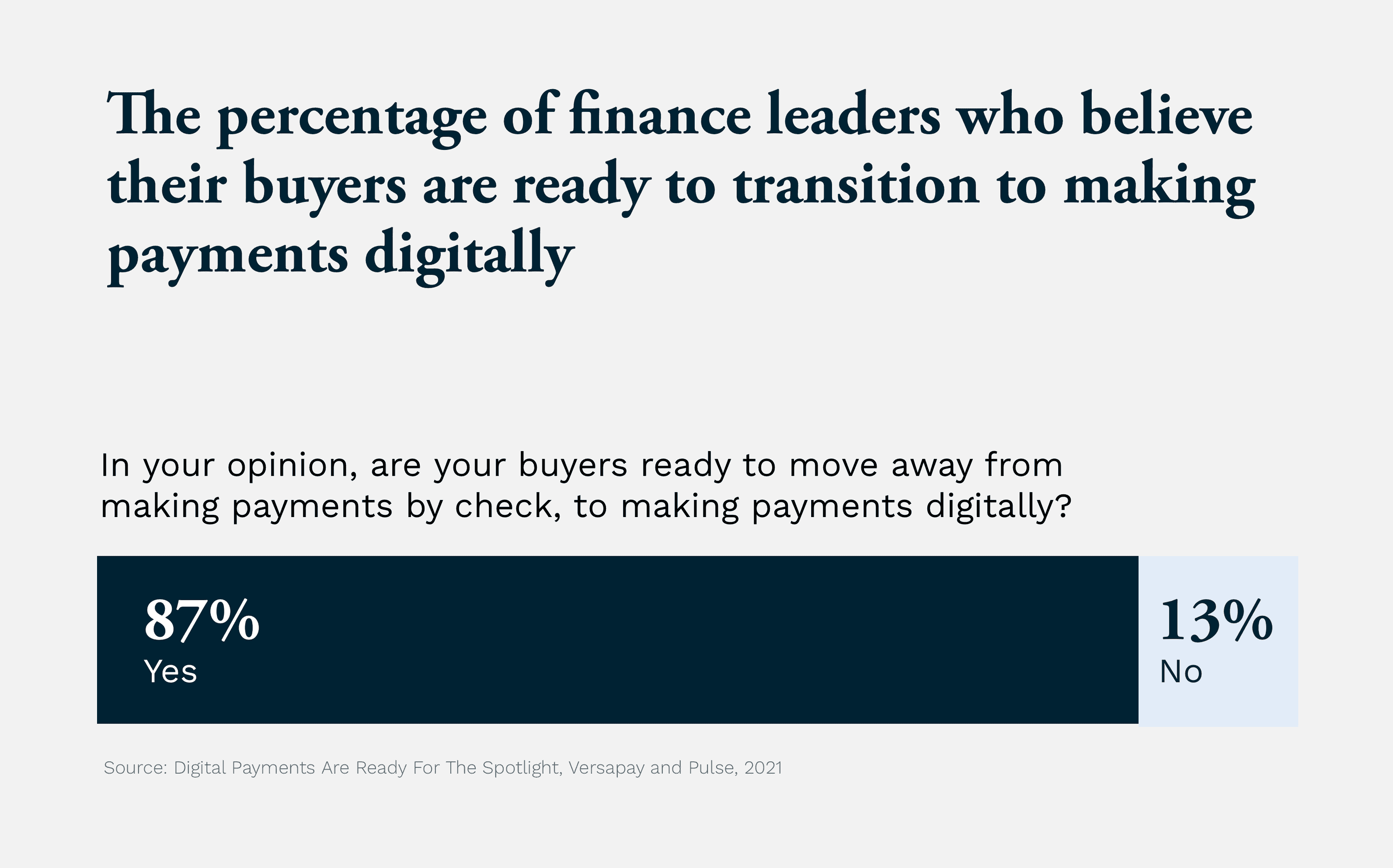

The good news is that digital B2B payment software can solve nearly all the challenges presented by their traditional, offline counterparts. And luckily, finance leaders believe their buyers are ready to transition to making payments digitally

Further optimizing these digital methods through automation generates additional business benefits, like improving accounts receivable processes and customer experience.

Benefits of accepting digital B2B payment methods include:

- Faster and more secure payments

- More efficient accounts receivable processes and payments

- Reduced business costs

- Better customer experiences and higher satisfaction

Faster and more secure payments

Digital B2B payment methods are processed almost instantly, eliminating long waiting periods. This enables businesses to receive payments faster, and customers to make payments more quickly. Reduced paperwork and manual processes make payment processing faster and more efficient.

Digital payments are also more secure than traditional methods. Payments made through a secure cloud-based payment portal or gateway are encrypted and protected against fraud, theft, and other security risks. This protects both the business and customer from financial losses and theft of sensitive data.

More efficient AR processes

Because digital B2B payment methods make automated payment reconciliation possible, businesses can match payments to invoices accurately and quickly. This eliminates the need for manual data entry or cash application, and reduces keystroke errors. Cutting down the need for manual administrative tasks creates a more streamlined accounts receivable process and reduces staffing costs.

Financial management becomes easier with digital payment methods because they offer more visibility and control over cash flow and enable teams to optimize working capital.

Reduced business cost

In addition to reducing staffing costs by limiting manual AR and administrative tasks, digital payment methods save organizations money in a number of ways. Lower processing fees, decreased administrative costs, and quicker payment processing are benefits associated with digital B2B payment options.

Better customer experience

We live in a digital age. Customers expect to have the ability to make payments online, even when making large-scale B2B transactions. Digital B2B payment methods offer customers convenience by allowing them to make payments online, from anywhere and at any time. This eliminates the need for customers to visit physical locations to send or deliver checks—through lockbox banking, for example—or make phone calls to submit payments.

The various digital B2B payment options allow customers to choose the best method for their organization’s needs. This adds convenience and enables the customer to have more control over their payment processes. Additionally, the enhanced security offered by digital B2B payment services builds customer trust and confidence.

Revolutionize B2B payments with Versapay

One of the most important aspects of digitizing a B2B payment process is using the right tools along the way. Choosing a B2B payment solution that facilitates business-grade online payments and gives your customers the convenient payment experience they expect is key.

Versapay’s collaborative AR network has helped countless businesses transform their B2B payment processes. Teams can optimize accounts receivable, cash application, payment processing, and more, all from one application.

Enjoy effortless invoicing, real-time visibility across customers, divisions, and locations, and collaborate more effortlessly with internal stakeholders and external partners. With the leading B2B payment network, Versapay enables transactions for over a million businesses built on a robust network designed for the unique needs of B2B commerce.

About the author

Ben Snedeker