7 Accounts Receivable Collections Best Practices for Faster Payments and Happier Customers

- 10 min read

This article explores seven proven accounts receivable collection best practices to accelerate B2B payments and promote customer satisfaction.

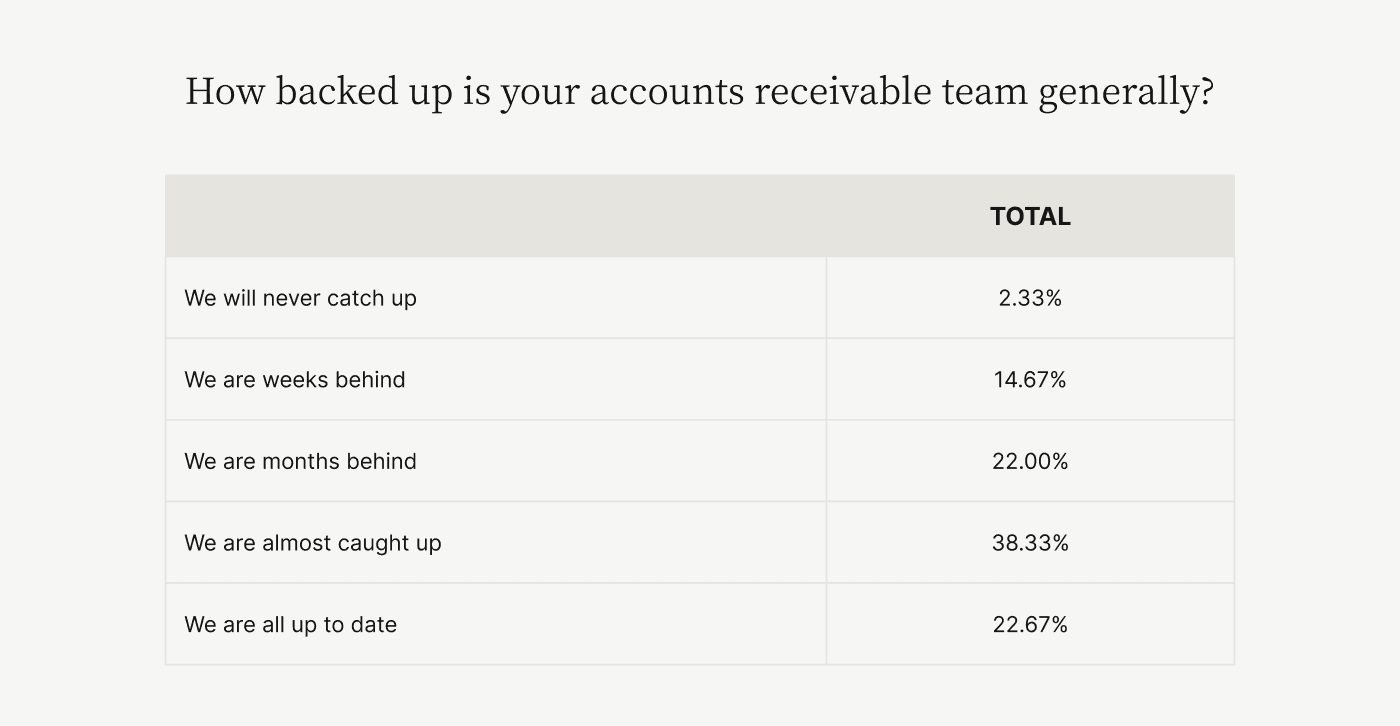

Seventy-seven percent of accounts receivable (AR) teams can’t keep up with their invoices, according to a survey of 300 CFOs conducted by Wakefield Research. The complications of poor collections processes are so profound that nearly two in five CFOs (39%) admit that their AR teams are weeks behind, months behind, or will never catch up.

Trying to dig out of a hole not only impacts the morale and performance of your accounts receivable team, but it can also drag down your entire business. Collection delays—especially for companies with lots of high-dollar invoices—create a compounding problem that causes cash flow to suffer and adds friction to customer relationships.

Wakefield researchers estimate that most mid- to upper-midsized companies have nearly $4 million in outstanding invoices each month, which are either tied-up in disputes or linger in a growing backlog of neglected priorities. These unpaid invoices can’t help fund company operations. And a continuous stream of phone calls, emails, and dunning letters without a real conversation with a customer can often delay payments even more.

Chasing down payments also forces skilled AR professionals to prioritize routine—often administrative—tasks, preventing them from focusing on more important strategic initiatives. This is one of the most common accounts receivable problems we see time and again.

To eliminate collection bottlenecks—and prevent them from occurring in the first place—CFOs and their accounts receivable teams must evaluate and update their collections procedures. The good news is that a few proven best practices can help you get paid faster, improve your customer relationships, and streamline your workflows.

Jump to a section of interest:

Best practice 7: Turn accounts receivable into a strategic asset →

How to transform your accounts receivable collections today →

Accounts receivable collections best practices

In this post, we discuss seven accounts receivable collections best practices you can leverage to improve your AR. A few of them might even surprise you!

1. Understand what you’re up against

This one’s fairly straightforward: Identifying the most important AR KPIs and tracking your progress with data is critical for understanding where collections bottlenecks are forming and how you can alleviate them. You can also see where you’re doing well and build on that success.

If you can’t identify your accounts receivable strengths and weaknesses, you’ll lack the insights you need to make meaningful change.

🎥 Here’s what Russell Lester, Versapay’s CFO, has to say about measuring accounts receivable performance, taking stock of your current situation, and improving your execution:

Watch the full webinar for proven strategies on optimizing AR performance.

2. Get your collections ducks in a row

It’s important to establish consistent credit policies, payment terms, billing processes, and collections procedures to eliminate confusion among internal teams and your customers.

If your sales team offers discounts that your AR team is unaware of, for example, your customers can get upset (when they’re invoiced at unexpected rates) and payments can get delayed. Documenting your collections policies and procedures helps eliminate the ambiguities and discrepancies that can lead to disputes and late payments.

Strong accounts receivable governance also enables you to establish repeatable processes. With a regular workflow, your customers start to learn when and how they’re going to hear from you and your AR team can accomplish more with fewer, more predictable tasks.

💡 Collaboration tools are great for enhancing communication—both internally and with customers—and make governance and repetition simpler.

3. Be proactive and respond rapidly

Sadly, paying your invoices isn’t always at the top of your customers’ minds. But your AR team can help customers make paying you a priority by delivering invoices on time, sending reminders before payments are due, and following up on questions and disputes as quickly as possible.

We’ll be talking about accounts receivable automation soon, but we’ll just mention here that it’s easier to be proactive and responsive when you have systems in place that enable such behaviors.

But if you insist on doing things the old-fashioned way—through the postal service, email, phone calls, and voicemail—it’s even MORE important to send your invoices promptly, prioritize regular follow-up, and answer questions as soon as they come in.

Sending invoices, receiving checks, and processing payments manually all extend the time it takes to get from invoice to cash. So you can’t afford to add to the delays by sending invoices late, failing to remind customers about their due dates, and taking too long to answer questions about your invoices.

4. Make your customers WANT to pay you

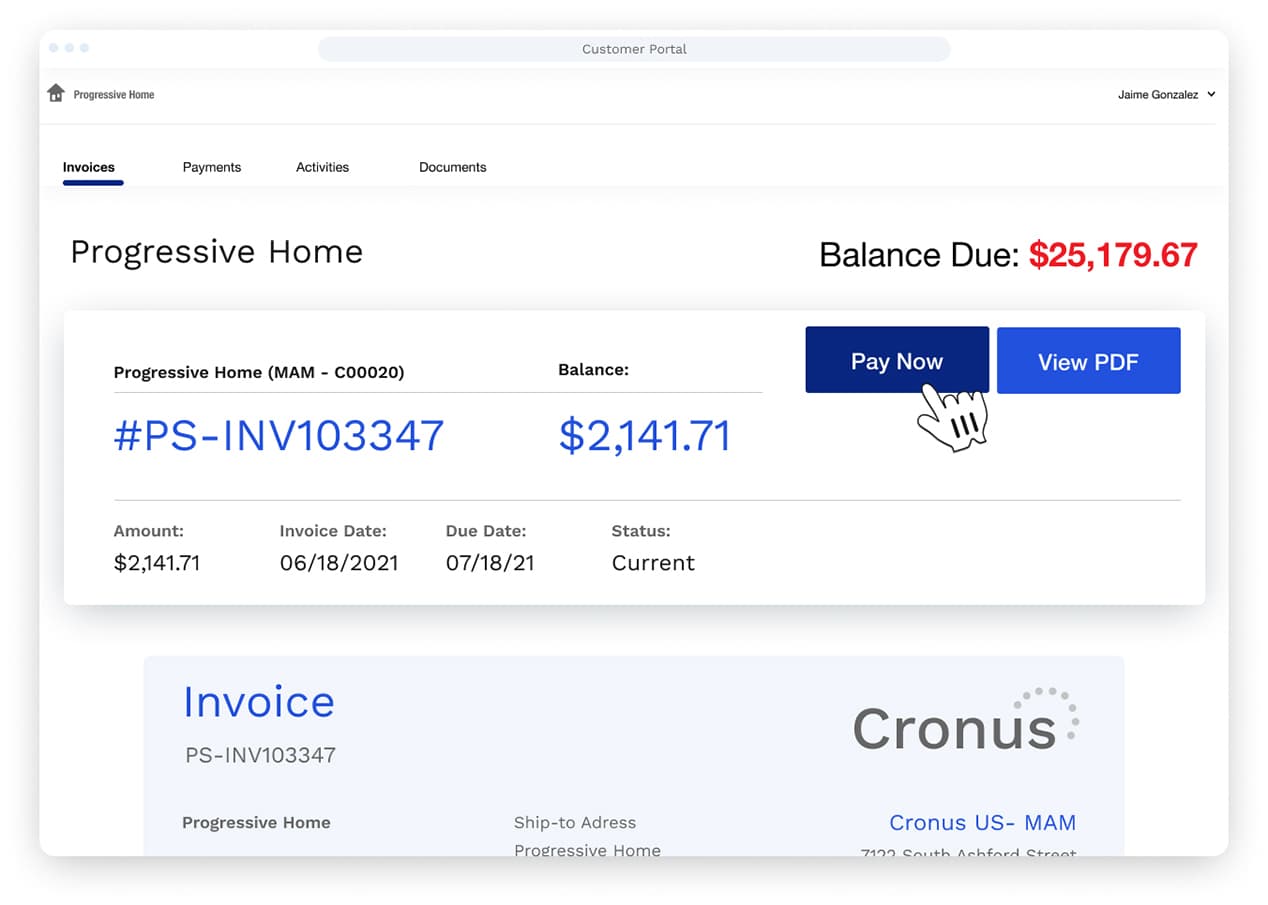

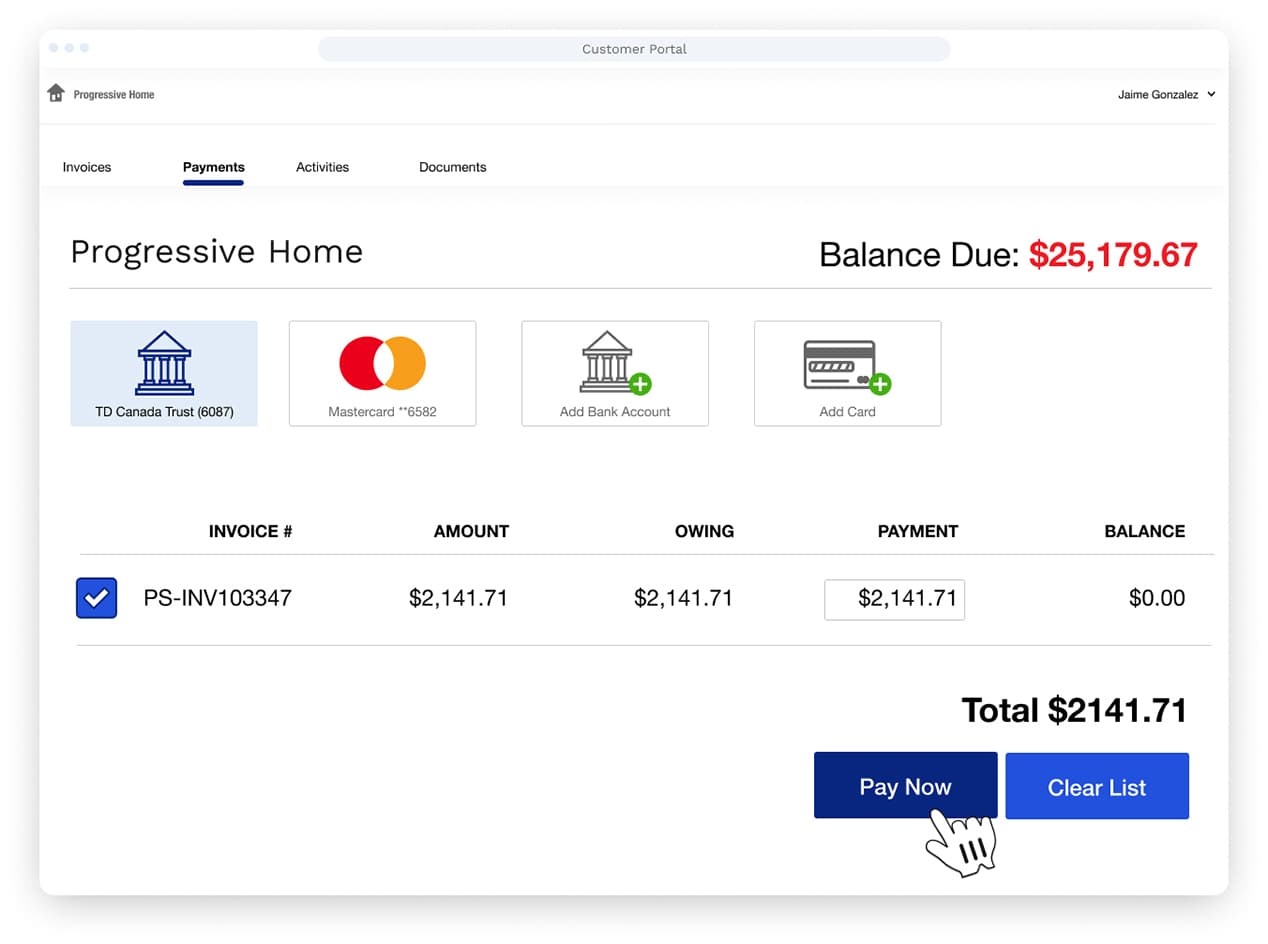

Most customers intend to pay their invoices, but they want the payment process to be as easy as possible. Having to go somewhere to send a check—through lockbox banking, for example—or making a phone call to submit a payment is a hassle. Most customers prefer to make payments online, even for large-scale B2B transactions.

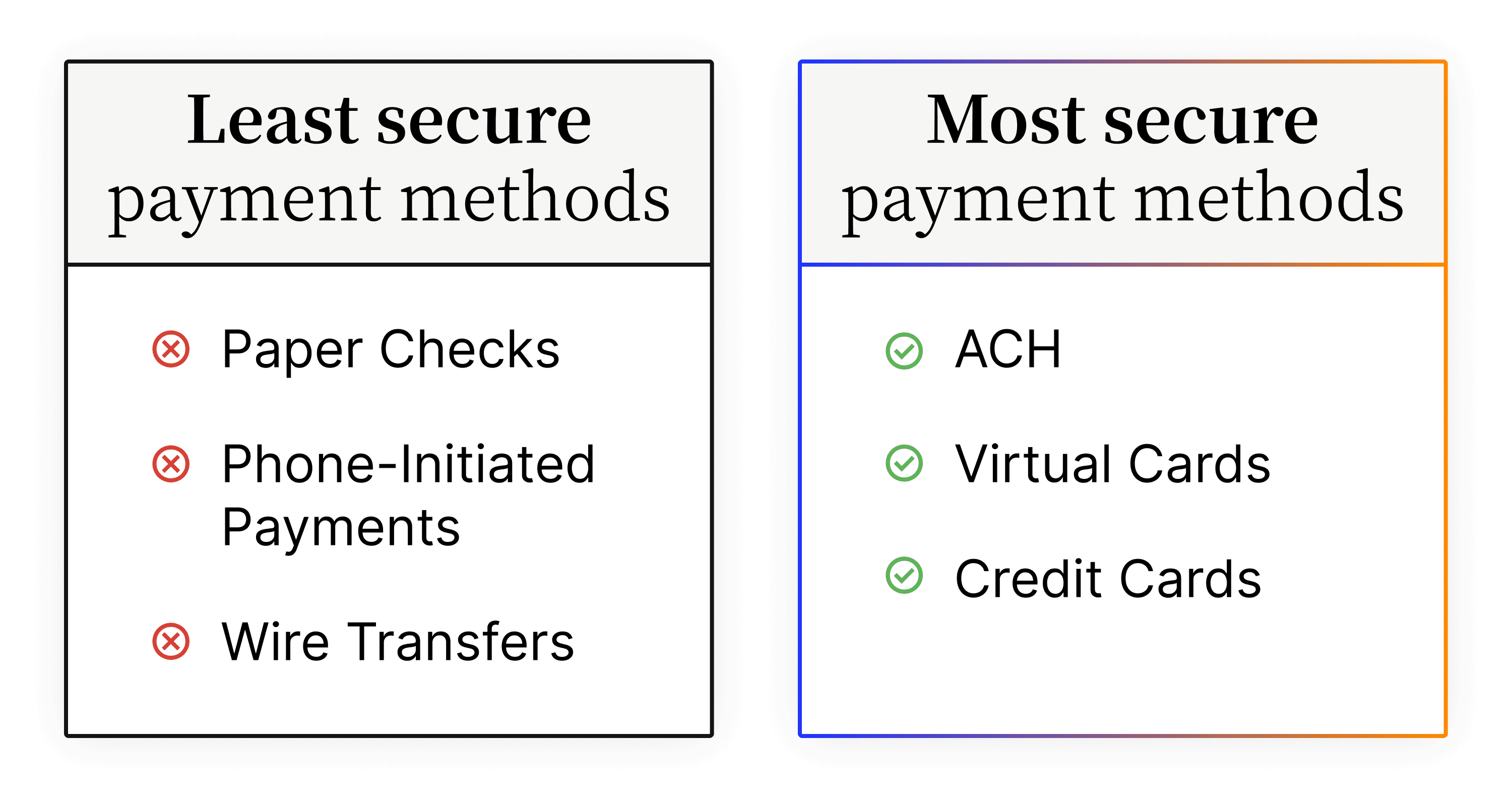

Traditional payments like paper checks are also among the least secure methods, along with phone-initiated payments and wire transfers. Payments made through a secure cloud-based payment portal or payment gateway are encrypted and protected against fraud, theft, and other security risks, protecting both your business and your customers from financial losses and data theft. What’s more, digital payment methods are processed almost instantly, eliminating long waiting periods.

Giving your customers secure and convenient payment options—such as credit card, ACH, or autopay—will make them more likely to pay you faster. With automated accounts receivable collections platforms, the payment mechanism can be built right into an electronic invoice.

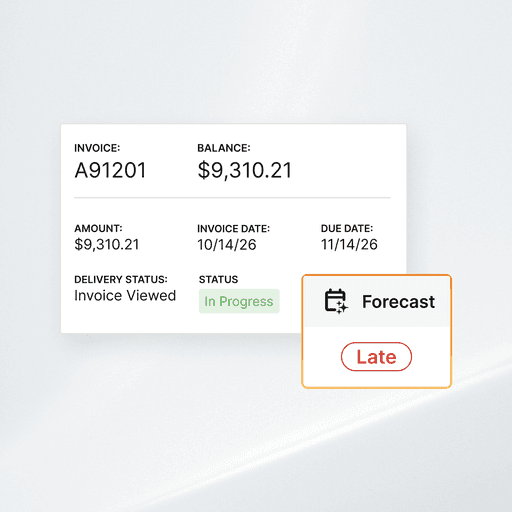

5. Modernize and automate

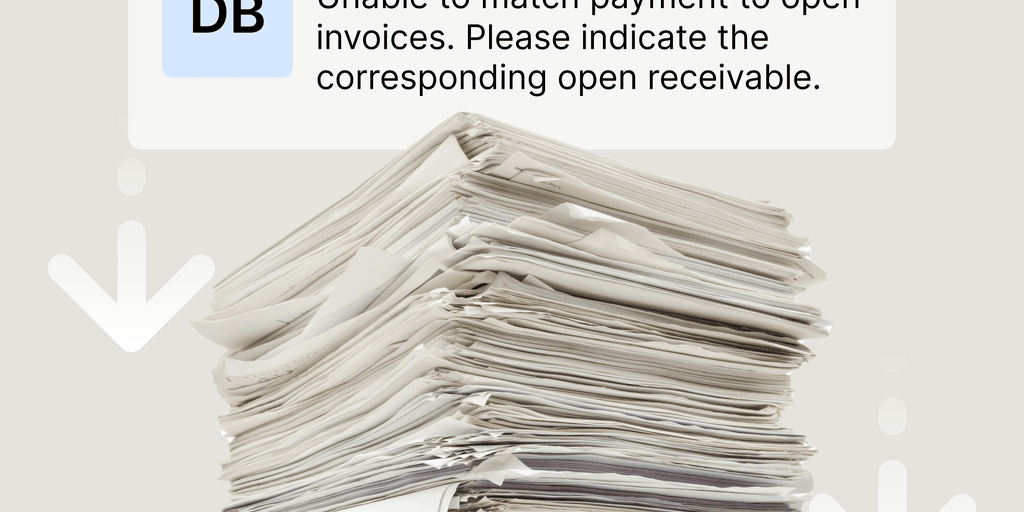

Manual processes can be disastrous for AR departments. Outdated and time intensive, they are the primary reason why accounts receivable teams are ineffective. Manual processes result in miscommunication throughout the payment process, inefficient payment methods, and frequent errors that lead to delays and disputes.

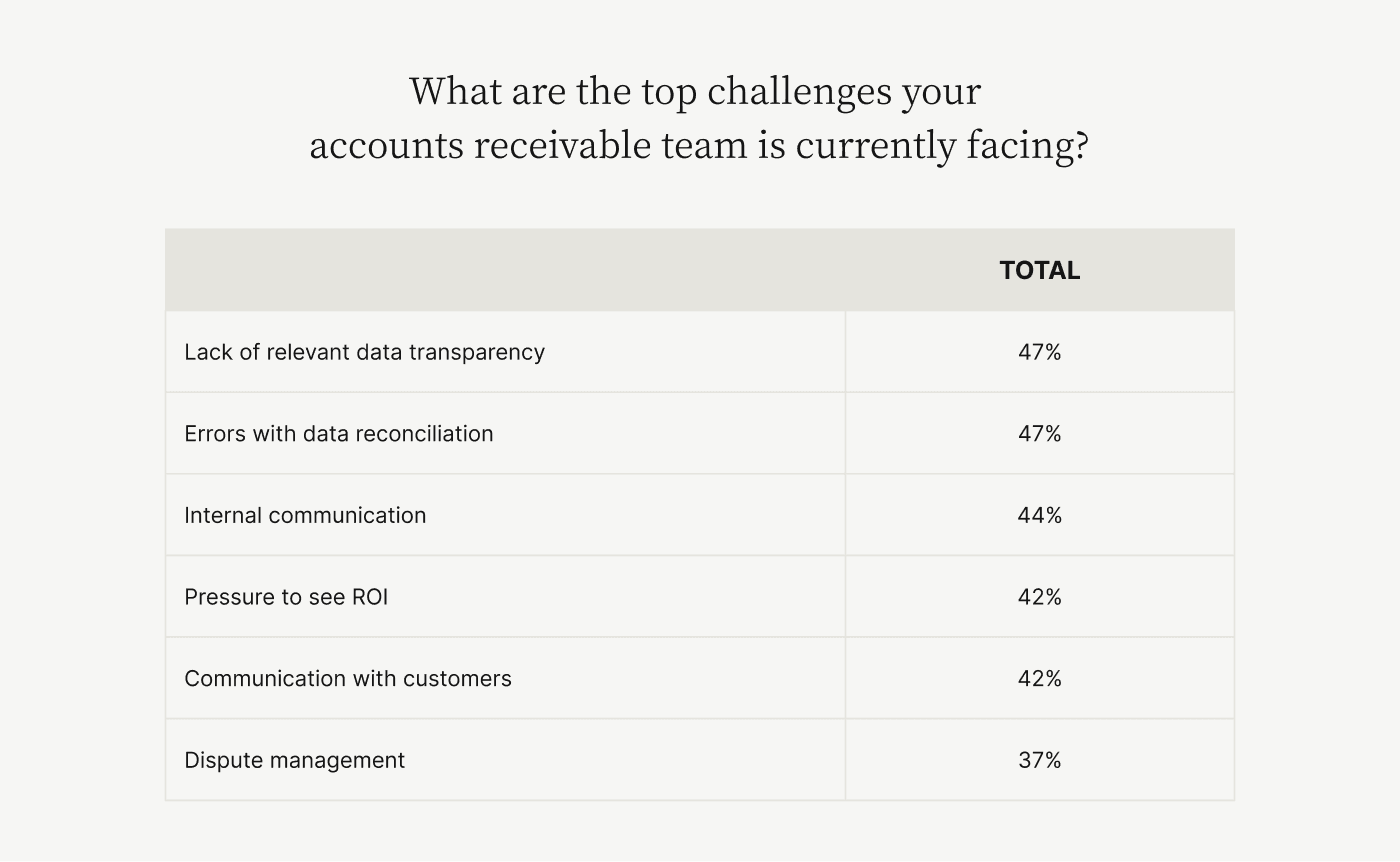

In fact, the top challenges AR teams face all stem from manual processes:

If manual processes cause lost revenue, alienate customers, increase invoice processing costs, cause a higher risk of litigation threats, and lead to employee disengagement, why are AR teams still using them when automated platforms are readily available?

People naturally resist change before they embrace it, which is why only 14% of CFOs currently utilize cloud-based automation, according to Wakefield. Opportunity abounds for the other 86%, who are stuck using outdated, antiquated, and inefficient invoicing and collections methods.

With an automated accounts receivable platform linked to your company’s ERP system, you’ll be able to eliminate manual entry and reduce human errors, automate reminders and collections actions, automate cash application, and post payments back to your ERP with ease.

Here are some real-life examples of how AR automation can be transformative:

The cash application team at a leading healthcare service provider would often take until 10:00 p.m. to finish applying cash for the day. With AR automation, the team got 4.5 hours back—every single day.

The credit management team at a major construction company was spending 75% of its time on paper mailings, customer calls, and manual collections. With AR automation, the team switched more than 90% of its customers to timely, online payments.

Before AR automation, distribution logistics giant TireHub needed nine contractors to support its accounts receivables activities, including three that worked full-time just to manage lockboxes. After automation, the company went down to four contractors and is saving 200 hours each week.

6. Prioritize customer communication

While most people don’t think of finance as having a role in customer experience, their activities are often a major cause of friction and dissatisfaction.

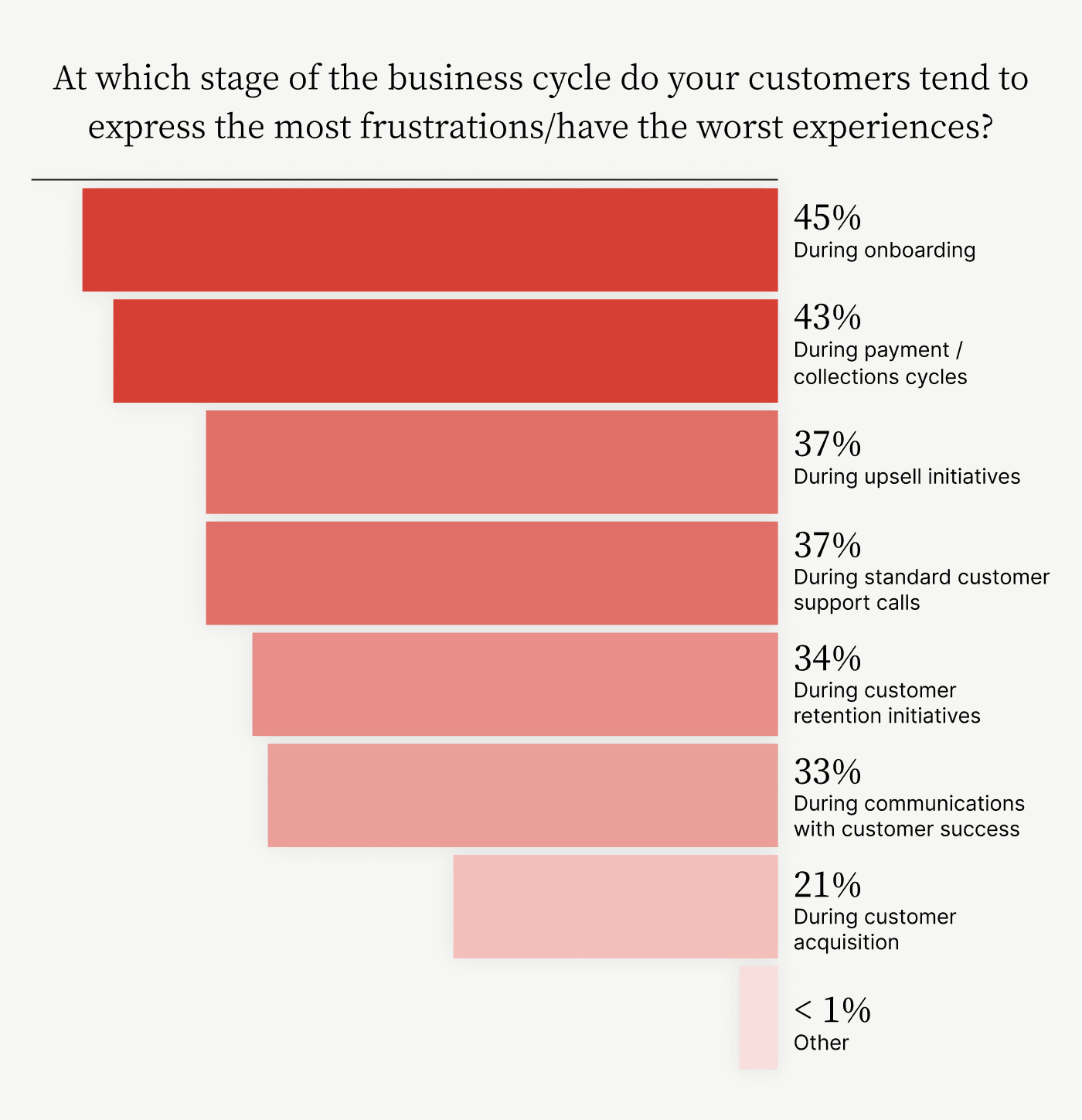

Research by Versapay and Gartner Peer Community found that just 4% of company leaders believe that finance/procurement has a positive impact on customer experience. In fact, 73% say that the invoice-to-cash cycle is a frequent source of NEGATIVE customer experiences, with 43% saying that customers tend to express the MOST FRUSTRATION over collections cycles.

If you really want to transform your accounts receivable collection efforts, you won’t allow your AR team to hide in the shadows of the back office. AR teams that collaborate with customers get paid faster, resolve disputes more easily, and eliminate disputes from the outset.

One of the best ways to facilitate open communication is through a collaborative payment portal. Unlike standard portals, collaborative portals:

Provide a single and complete source of valuable documentation needed to avoid and resolve disputes

Enable direct, two-way communication over the cloud, without creating convoluted email threads or having to play phone tag

Makes personalized communication possible, beginning with customized invoices

7. Turn accounts receivable into a strategic asset

Transforming your AR activities and automating them through a collaborative platform pulls your accounts receivable team members out of broken invoice-to-cash cycles. Finally, you can free them up for strategic work that’s more valuable to the business.

Do you want your AR team spending its time mailing invoices, manually reconciling payments, and chasing down delinquent accounts? Or would you rather they work to build cross-departmental partnerships, get everyone on the same page about credit management, and align business goals with AR metrics? The choice is clear if you want to improve the financial health of your company!

—

🚨 Take our six-minute assessment and get a personalized diagnosis of the challenges you face in your accounts receivable process. You’ll get a customized accounts receivable transformation roadmap to learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success

Transform your accounts receivable collections today

Applying the seven accounts receivable collections best practices outlined in this article is worth the effort. Right away, you can start analyzing your accounts receivable metrics, create and document consistent policies and procedures, and commit to engage with customers in a timely, proactive manner.

Then you can turbocharge your efforts by:

Automating in ways that eliminate tedium and errors

Investing in AR solutions that elevate the customer experience

Redirecting your team to more productive, strategic work

Making your AR collections more efficient will empower you to improve your business’ financial health and stability. Versapay’s collaborative AR platform can help you overcome the collections challenges caused by poor communication, so contact us today for more information or to arrange a free demo.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.