Accounts Receivable Process Flow Chart: A Guide to Optimizing the AR Cycle

- 15 min read

The accounts receivable process is the series of steps finance teams follow to collect on credit sales and record revenue. In this guide, we explain the nine steps in the AR process (with flow charts!) and how to optimize it.

Accounts receivable (AR) teams have the most immediate impact on a business’ cash availability.

And while their jobs—collecting payments and recording revenue—may seem simple in premise, in practice, the collection process is anything but linear. The accounts receivable process has its fair share of exceptions and complications, often requiring plenty of back-and-forth between AR teams and their customers.

In this guide, we’ll break down the entire AR cycle from start to finish (AR process flow charts included!), highlight the most common limitations in companies’ accounts receivable processes, and share how you can optimize your own AR workflows.

Jump to a section:

- Section 1: The accounts receivable process

- Section 2: The 9 steps in the AR process (with flow charts)

- Section 3: The 5 most common challenges in the AR process

- Section 4: How automation streamlines the AR process (with flow charts)

- Section 5: The traditional vs. modern AR process flow

What is the accounts receivable process?

The AR process boils down to a few key tasks:

- Sending out invoices

- Managing collections

- Processing payments

- Matching payments to invoices and posting them to your ERP

Each of these tasks, however, can be a highly involved process in its own right, especially if your AR team still relies on a high degree of manual workflows.

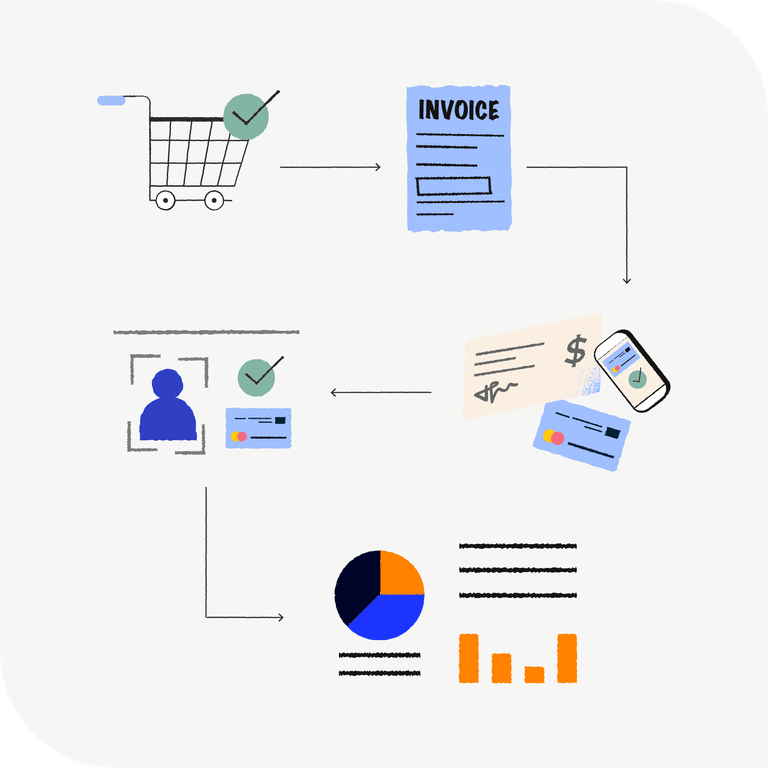

The lifecycle of a receivable

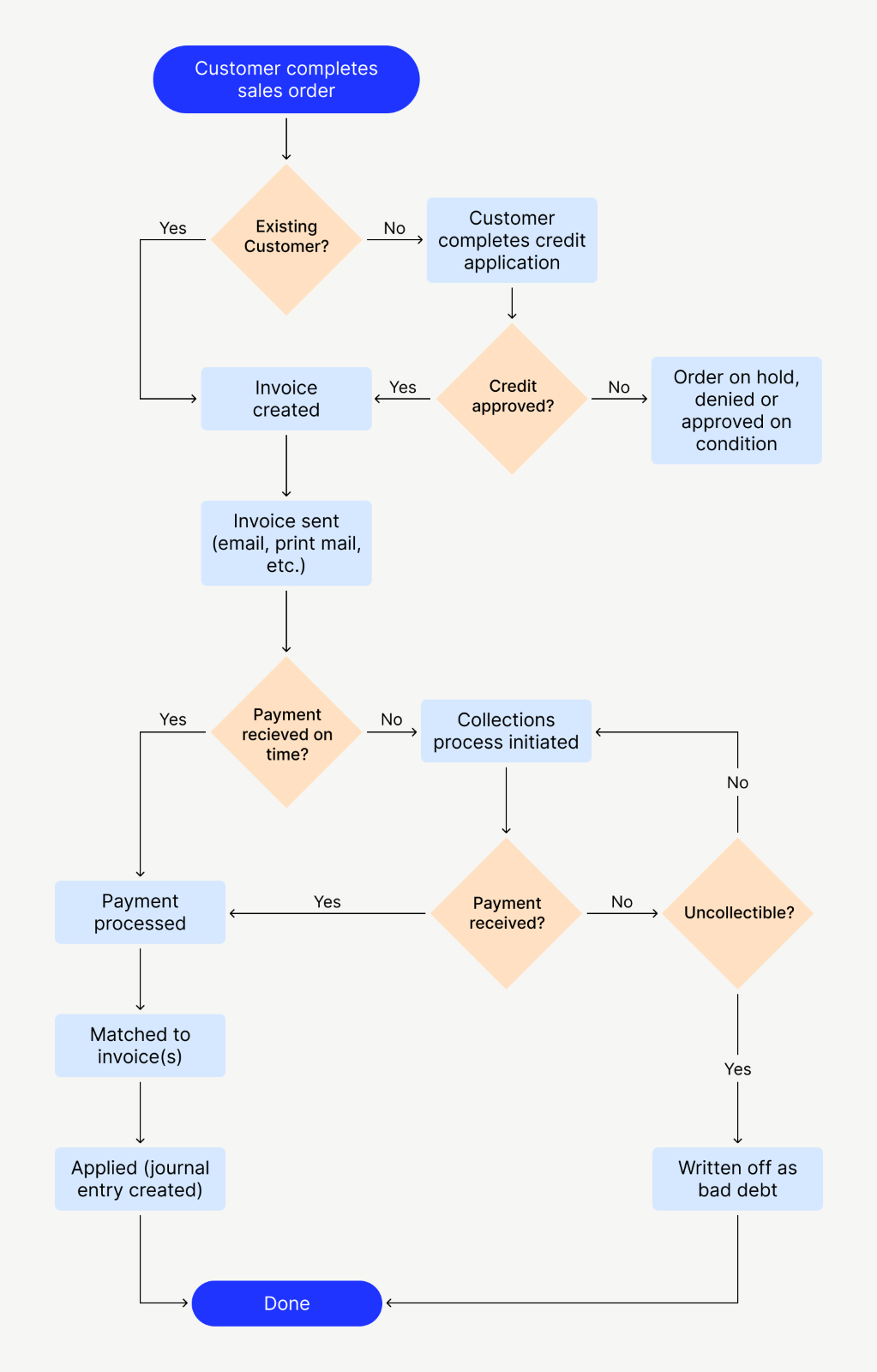

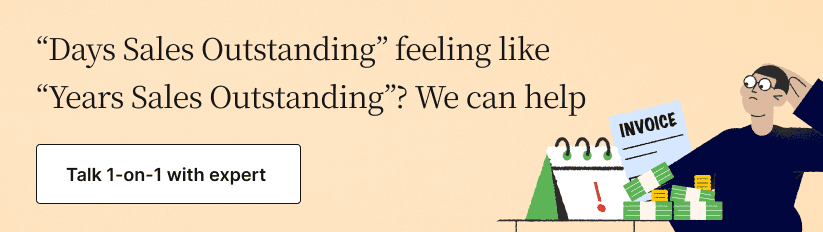

If we break down the accounts receivable process even further, it involves these nine steps:

The 9 steps in the accounts receivable process

1. A customer makes an order

When a customer expresses their intent to purchase, they’ll send you a purchase order (PO). Once you’ve approved the PO, you’ll create a sales order (SO). A sales order is a binding agreement with the customer that covers:

- The goods and/or services you’re selling to the customer

- The quantity and price of those goods/services

- The delivery date and location

- Any terms and conditions of the sale

Before you send the customer the sales order, your credit manager or credit department will review and approve it.

2. You approve the customer for credit

When you sell on account, you agree to extend credit to your customers and collect payment later. Most business-to-business (B2B) purchases are made on account.

Because there’s an inherent risk in giving customers credit (customers don’t always pay their invoices, leading to bad debt), businesses need to assess each new customer's creditworthiness before fulfilling an order.

You’ll do this through the credit application process, which can take several days. Your business should have a documented credit policy, which you’ll use to assess customers’ credit risk. Your risk tolerance may vary depending on your business’ size, margins, and current cash flow.

If you determine that a potential customer isn’t a good fit for receiving credit, you might arrange alternative payment terms like cash on delivery.

3. You send the invoice

Unlike a sales order, an invoice is the definitive record of a customer’s purchase; it details how much they owe, and by which date they need to pay. Depending on your business’ specific credit practices, this could be 30, 60, or 90 days. If you charge a fee for late payments, it’s very important that you express this clearly in the invoice.

Accounting teams will typically create their invoices in their ERP or using a program like Microsoft Word or Excel, then deliver them to customers by email, electronic data interchange (EDI), or regular mail. The faster you can get your invoices out the door, the better. The longer it takes customers to receive their invoice, the more time goes by before your payment terms officially start.

For this reason, it’s in your best interest to eliminate as much manual work—like printing invoices and stuffing envelopes—as possible from your billing practices.

4. You manage collections

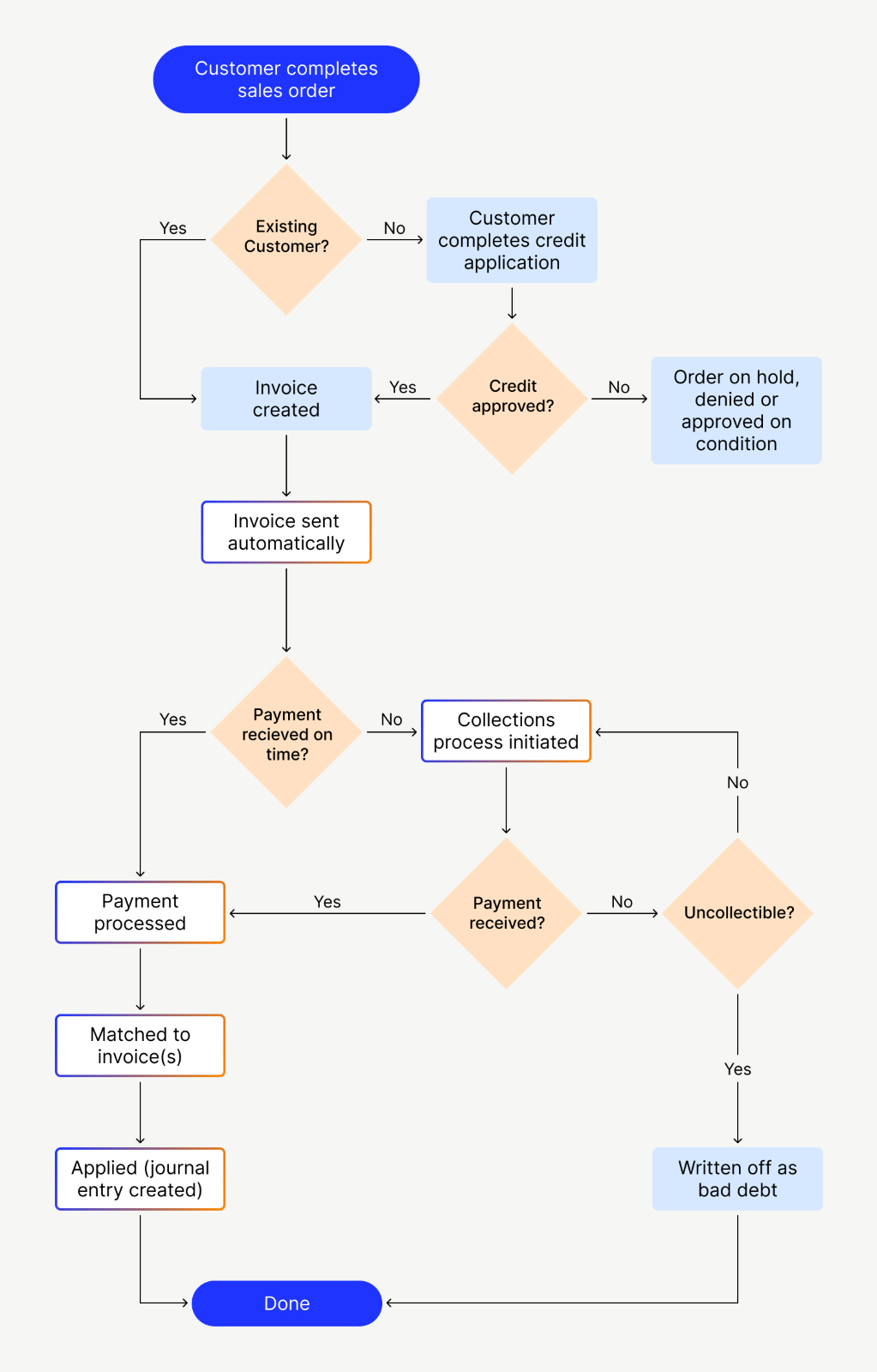

Some portion of your customers will inevitably pay their invoices late. To increase your chances of collecting on unpaid invoices promptly, it’s important to have your collections staff follow up with customers at regular intervals.

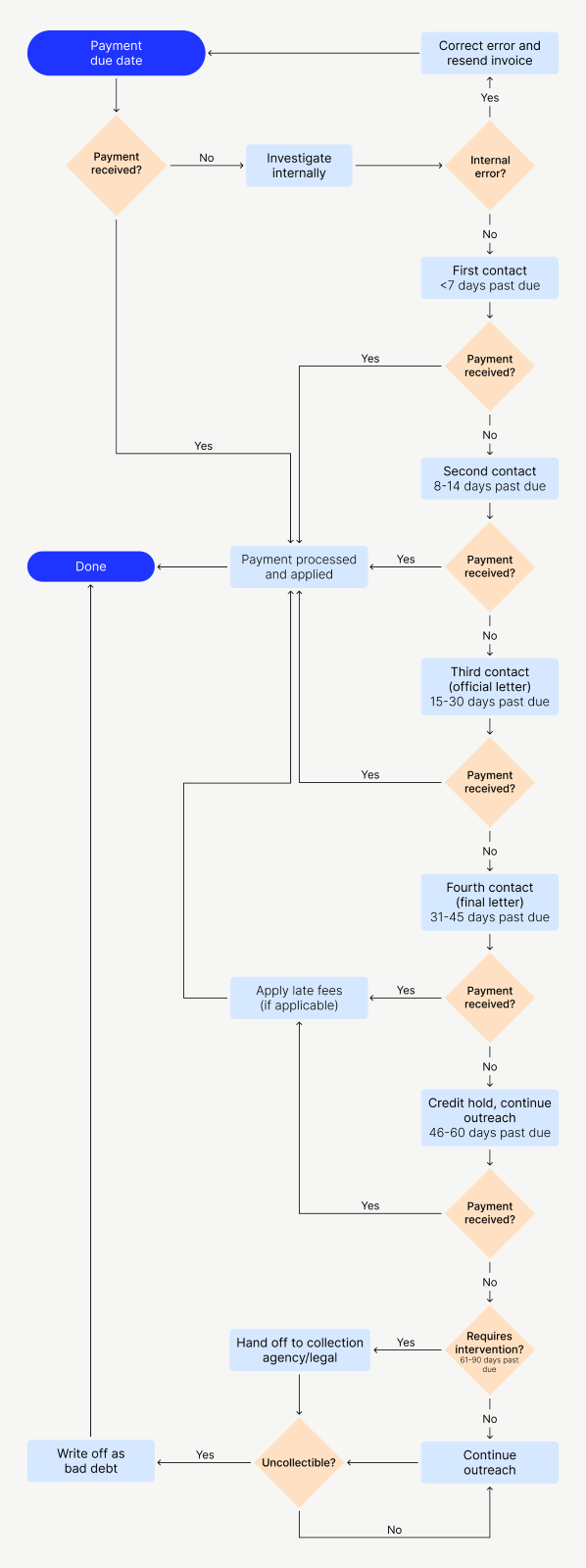

Below are some time frames commonly used by companies for carrying out their collections outreach:

- <7 days past due: First contact with the customer to provide a gentle reminder about the payment

- 8–14 days past due: Second contact with the customer

- 15–30 days past due: Third contact with the customer; an official dunning letter can go out stating the payment is 30 days late (late fees may also kick in after this time)

- 31–45 days past due: Fourth contact with the customer; if the request is still unactioned a final letter can go out

- 46–60 days past due: Continued outreach (for example, every 5 business days)

- 61–90 days past due: If the request is still unactioned at this point, you may want to involve senior management, legal counsel, or a collection agency for help pursuing the debt (if the amount owed is worth it—if not, you’ll simply write off the amount as uncollectible)

Before beginning your collections outreach, you should first investigate the late payment to determine if it’s the result of an internal error. It’s possible the invoice was never sent, or the customer was promised a discount that wasn’t reflected in the invoice.

It’s also a good idea to review a customer’s payment history before springing into action. If a late-paying customer has a history of paying on time, you can be more lenient to preserve an already positive working relationship. If a late-paying customer is routinely late, however, then you’ll want to watch them closely and work with them on a specific payment plan.

As you’ll see in the flow chart below, some steps in the accounts receivable collections process are circular, as you’ll carry out the same actions until you receive the payment or deem it to be uncollectible.

The accounts receivable collections process

5. You investigate and address any existing disputes

Invoice disputes are one of the biggest causes of late payments. If a customer has an issue with their order, they’ll want to resolve it before releasing any funds to you. In a survey of 1,000 C-level executives on the status of their AR processes, we found that the most frequent cause of invoice disputes is human error in the payment process. 50% of executives cited this as a cause.

Close behind were issues with goods or services provided (reported by 46% of executives), discrepancies between proposals and invoices (46%), and communication issues (41%).

Customers will often pay the portion of their invoice that’s not in dispute (a short payment), which adds another layer of complexity for your AR team. They’ll have to confirm why the short payment happened, whether it was for a valid reason, and how to apply the payment in your accounting system.

Your AR team should kick off the dispute investigation process as early as possible (as soon as an invoice becomes overdue) to prevent payments from getting delayed further and preserve customer relationships.

6. You write off any uncollectible debt

Your chances of collecting on outstanding invoices decrease as time goes on. When you’ve exhausted your outreach efforts (including passing off the debt to a collection agency or legal counsel) and determine the payment is uncollectible, you’ll write off the receivable as bad debt.

Under accrual basis accounting, companies plan for a certain portion of their accounts receivable to be uncollectible by setting aside an allowance for doubtful accounts.

The point at which you deem an invoice uncollectible will vary by your industry. For some industries, like transportation services for example, an average days sales outstanding (DSO) of above 50 days is normal. If late payments are common in your line of work, it makes sense to wait before writing off an invoice as bad debt.

Average DSO by industry

7. You process the payment

Business buyers pay their invoices in several ways, including:

- ACH or EFT

- Wire transfer

- Debit, credit, or virtual card

- Checks

Businesses that want to accept payments online will need a payment processor, payment gateway, and at least one merchant account, not to mention a platform to support ecommerce or self-service customer payments. Some payment services providers will wrap all of this up into one offering.

Most B2B businesses still accept a significant volume of paper checks and continue to use checks for incoming payments. To support this, businesses will often resort to managing multiple lockboxes (where a bank receives and processes checks for you).

Note that although lockbox services eliminate the need for you to receive checks at your office, they don’t take away the effort involved in processing them. Going through lockbox files to apply payments to invoices still takes work.

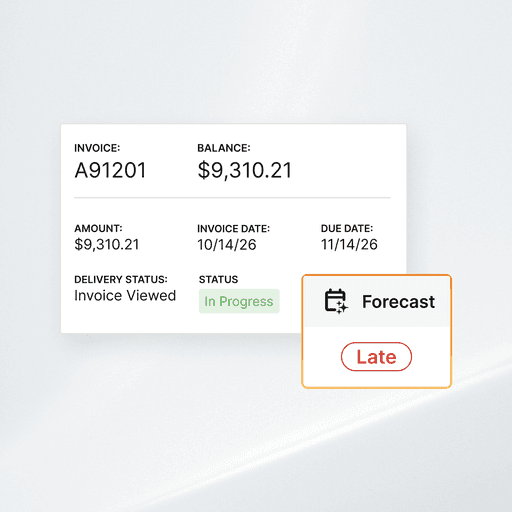

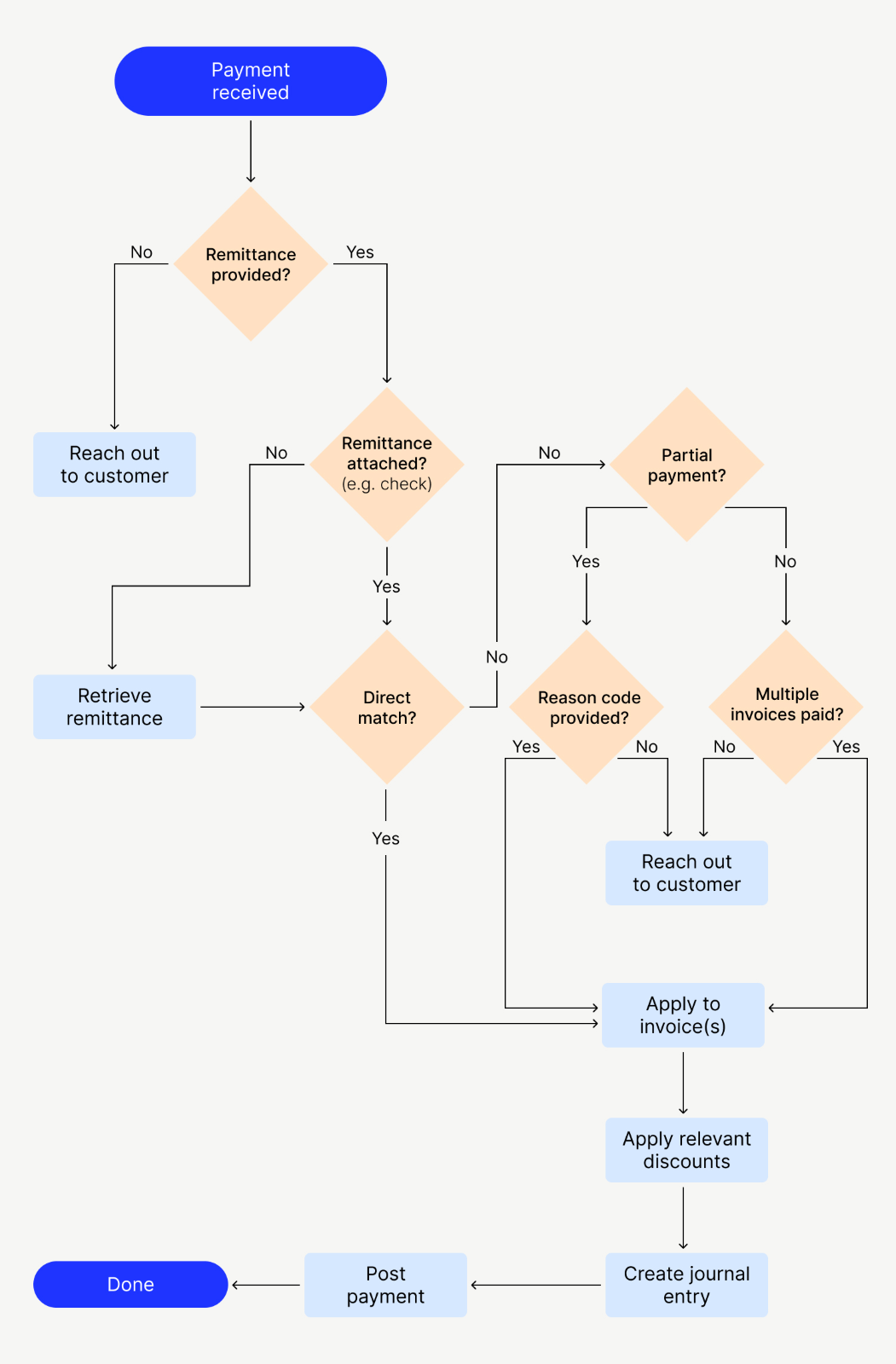

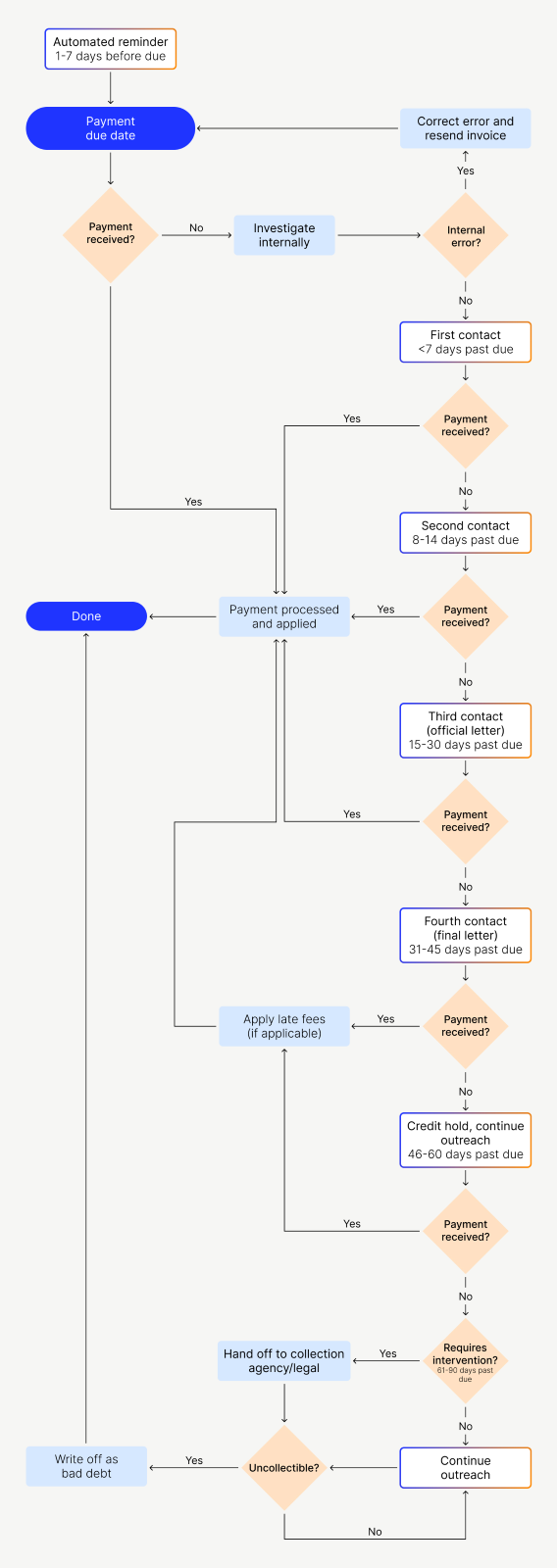

8. You post the payment to the corresponding invoice(s)

After you receive a payment, then comes the process of cash application, where you’ll record that revenue in your accounting software. When a payment comes in, you’ll record the transaction in your accounts receivable ledger as a credit, deducting the amount from your remaining unpaid receivables.

To do this, you need to be able to match payment information to the right invoice(s) and record any relevant credits or discounts before closing out the receivable in your ERP. There are several factors that can complicate this step, such as:

- A payment arriving without any associated remittance advice

- Remittance advice provided separately from its payment (as is the case with ACH and wire transfers, in contrast to checks)

- Remittance information not matching any open invoices

In these cases, AR staff have to reach out to the customer to get clarity on how they should apply their payment, as you’ll see in the flow chart below.

The cash application process

9. You report on the status of your AR (ongoing)

During the month end close process, your finance team will check that they’ve recorded all transactions and put the closing balance of all general ledger accounts into a report (a trial balance). This allows you to put together financial statements for that period to report to the rest of the company.

Reviewing the status of your AR is also something you can do on an ongoing basis. How frequently you report on collections might depend on the size of your company and your AR team’s bandwidth. For updating AR aging reports, once a month (or more often if you can) is a good time frame to aim for.

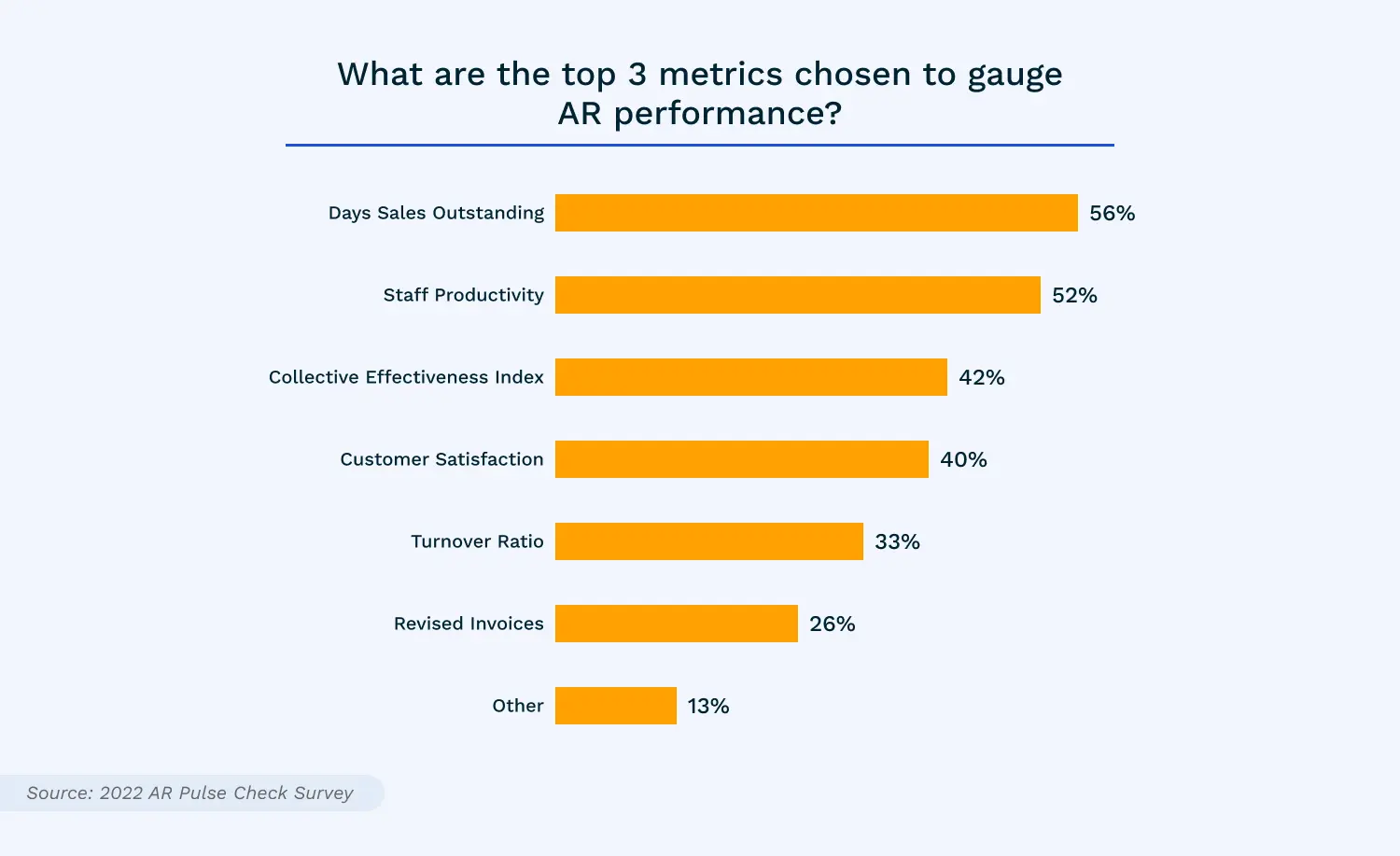

There’s a variety of metrics you can use to assess the health of your AR. In a recent survey we conducted with SSON, we found that the metrics most frequently used by businesses to gauge AR performance are DSO, staff productivity, and collections effectiveness index.

Every business will have unique challenges and priorities, so we advise you to come up with your own set of key performance indicators (KPIs) to track on an ongoing basis. (If you need help mapping those out, check out our AR Performance Toolkit)

The 5 most common challenges in the accounts receivable process

The traditional AR process is one that leaves much to be desired.

In the workflows we’ve described above, AR teams are carrying out tasks without any help from automation. When your business sends out upwards of tens of thousands of invoices every month, this makes keeping tabs on everything the company is owed nearly impossible.

At the heart of the issues with the typical accounts receivable process flow are:

1. Manual invoice creation and delivery

Many accounting departments still send invoices by snail mail. That means some poor soul is spending hours every month printing paper invoices and stuffing them into envelopes.

Not only does sending invoices this way take time and effort on behalf of your staff (which, compounded by mail delays, slows down customers’ receipt of their invoices), but it also gives customers limited visibility into the status of their account. Until they receive their monthly statement in the mail, they may have no idea how much they owe.

Now, let’s say you’re emailing customers their invoices as a PDF. This still tends to be a highly manual process for your team due to the effort it takes to email each individual invoice or upload it to a customer’s accounts payable (AP) portal.

2. Ad hoc collections outreach

The collections process is one of the most time-consuming (and dreaded) parts of the accounts receivable cycle. Without any kind of automation system in place, it usually involves sending emails, making phone calls, and crossing your fingers for a response.

Some AR departments have such a lengthy backlog of outstanding invoices that they simply don’t have time to address all of them. When time is a constraint, you might only be able to go after big-ticket invoices, leaving plenty of “small dollar” receivables on the table.

3. Patchwork payment processing

For businesses to be able to accept payments from their customers online, it takes several moving parts: a payment processor, a payment gateway, a merchant account, and a platform that can support ecommerce sales or accept payments for credit sales on demand.

In many cases, companies use different technology providers for all or some of these needs. This can significantly slow down your ability to process payments because all these systems must communicate with each other. Without a high degree of integration between these multiple systems, there will be gaps in your payment processing that you’ll have to fill with manual work like data entry.

Without an online portal where customers can input their own payment details, AR teams can spend hours collecting card information over the phone and running transactions themselves. This isn’t great for cash flow, nor is it for PCI compliance.

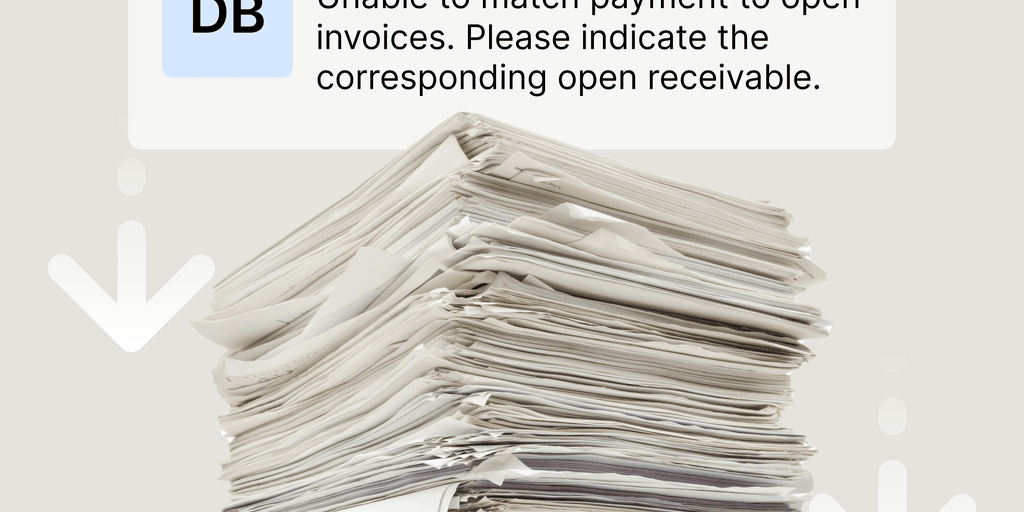

4. Tedious cash application

Even though B2B buyers are embracing digital payments at record highs (in fact B2B is the fastest-growing segment on the ACH network, having grown by 33% in just the last two years), the reality is checks aren’t going away any time soon. This means AR departments have a broad mix of payments to process and match to invoices, each with their own remittance formats.

There is no universal format or requirement for remittance advice, so it can vary greatly depending on the customer—or not arrive at all. Even when remittance advice is straightforward, the cash application process can be tedious as AR specialists have to find matches and record the transactions as journal entries in their ERP one by one.

5. Frequent need for clarification with customers

Although accounts receivable has the reputation of being a back-office and behind-the-scenes process, it requires a lot of direct interaction with customers.

When customers have an invoice question or dispute, they'll need to get in touch with your AR team. Likewise, when your AR team has a question about where to correctly apply a payment, they’ll need to reach out to your customer’s AP team.

These interactions typically happen over email. As a result, progress moves slowly because threads get buried in peoples' inboxes and messages neglect to include recipients who could address the issue if only they had visibility.

How automation streamlines the accounts receivable process

In the flow charts below, we’ve visualized how automation takes much of the labor out of the accounts receivable process.

The boxes outlined in blue and orange gradients represent tasks technology can automate.

Common tasks AR automation software can handle include:

- Delivering electronic invoices as soon as they’re created in your ERP

- Sending automated reminders before and after invoices are due, on a regular cadence

- Processing payments

- Matching payments to invoices

- Posting payments to your ERP automatically

The accounts receivable process with support from automation

The accounts receivable collections process with support from automation

Collecting payments from customers via an online payment portal expedites the cash application process significantly (as you’ll see in the flow chart below), because customers can clearly identify which invoice(s) they’re paying, by themselves. And when your payment portal integrates directly with your ERP, you can post the transaction to your ledger automatically.

For payments that come in outside of your owned channels—like ACH, wire transfers, and paper checks—artificial intelligence (AI) is especially useful. A cash application solution equipped with AI can capture remittance data from multiple sources, see past issues like unstructured formats and missing information, and look for a matching invoice in your accounting system.

In cases where the system can’t find a match, it can notify your customers right away and make it easy for them to apply the payment themselves.

The cash application process with support from automation

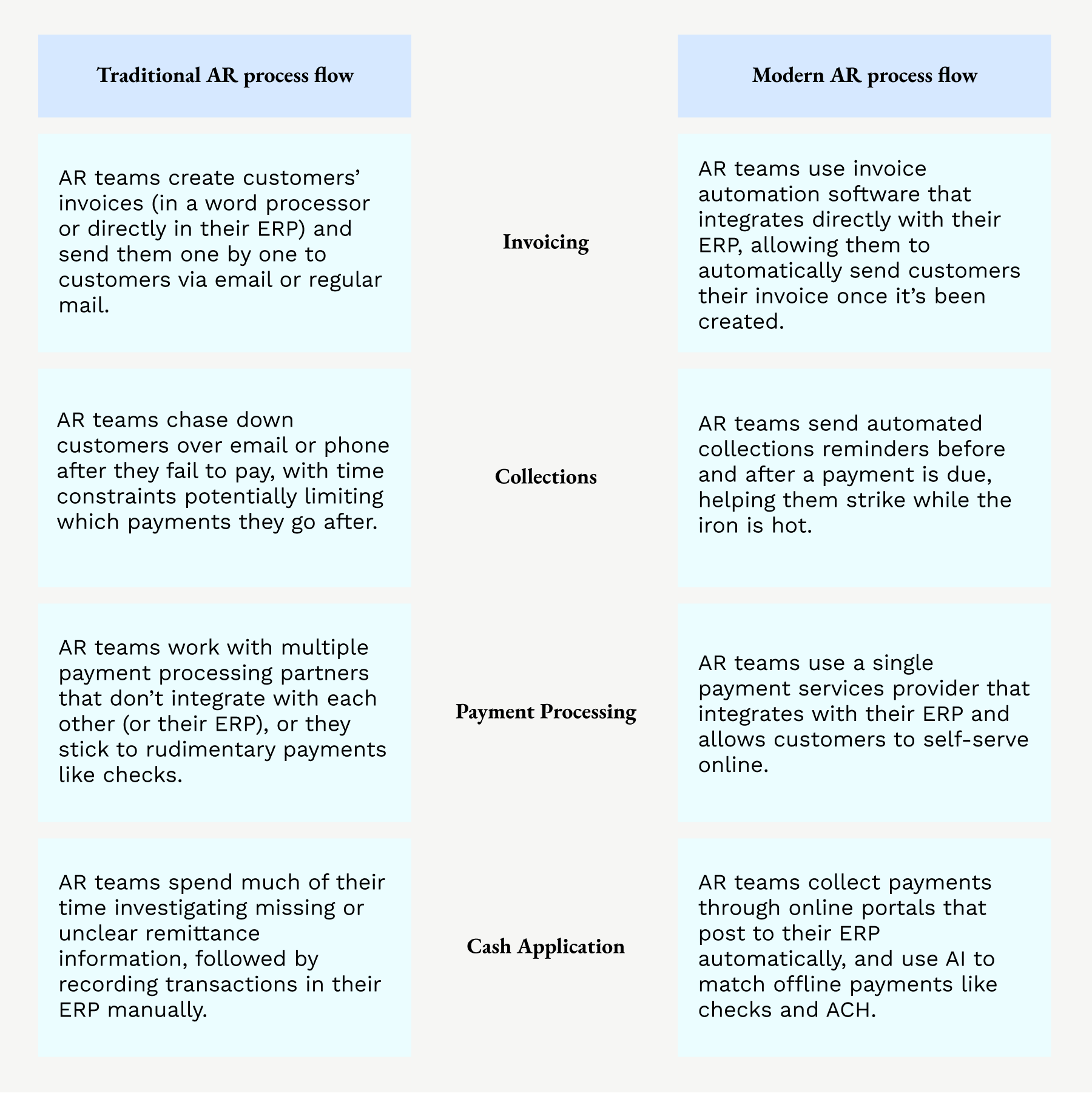

The traditional vs. modern accounts receivable process flow

Automation has the potential to simplify every aspect of the accounts receivable workflow for finance teams. A modern AR process minimizes manual work as much as possible, helping your receivables department speed up cash flow and focus employees’ time on more value-adding work. Here’s how a traditional approach to the accounts receivable process compares to a fully modernized one:

Transform your accounts receivable process flow with Versapay

Every day you shave off from your DSO has a significant downstream effect on your business. This is especially true in a recession (which some economists say we are headed toward), where rising material and production costs put significant pressure on your profit margins.

In this kind of environment, if you haven’t already, tightening up your accounts receivable processes is non-negotiable.

Versapay can help you simplify every aspect of the AR lifecycle with tools like:

- Automated invoice delivery and tracking

- Automated collections outreach and payment reminders

- Online payment processing integrated directly with your ERP

- AI-powered cash application

Best of all, we cut out all the back-and-forth over email it takes to answer questions and resolve customer disputes. Customers can view invoices, make payments, and leave comments for your team all in one shared cloud-based platform.

Learn more about how you can transform your AR processes and speed up cash flow with the first collaborative AR network.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.